Crypto the Bitcoin Algorithm Charting Model Newsletter Monday March 5, 2018. Charts for $BTCUSD $XBTUSD $BTC.X $ETH $LTC $XRP #Bitcoin

Hello! My name is Crypto the Bitcoin Algo. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders (not HFT). My charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD and Bitcoin related equities.

Note: The $XBTUSD model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices:

- More extensive chart models for $BTCUSD, $ETHUSD, $XRPUSD, $LTCUSD and others (such as a few bitcoin related equities) will be featured in future reporting.

- Join us in our private Crypto Trading room on discord!

- For newer users – read the blog post about how to trade Bitcoin here.

Primary Methods of Trade:

Live Twitter Alert Feed for Bitcoin Trades: @BTCAlerts_CT, Public Feed @cryptothealgo

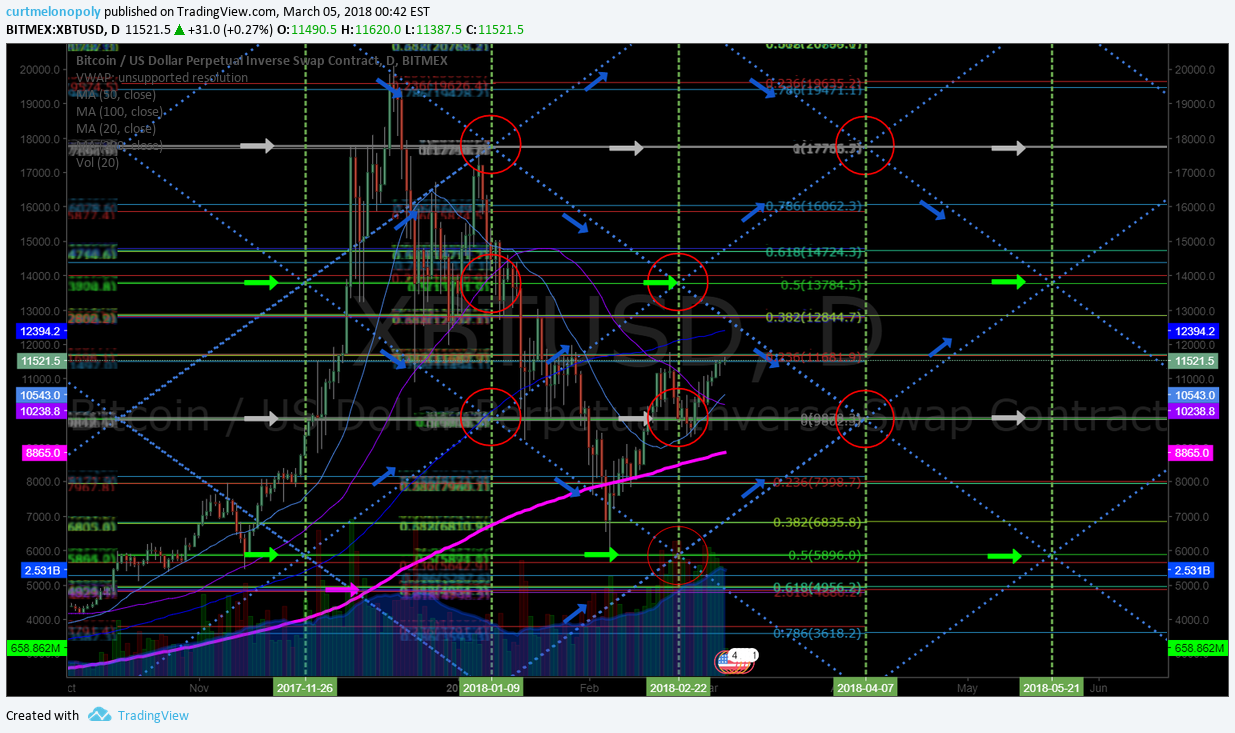

The primary method of trade we have found works with the most predictability is to wait for bitcoin to breach the upper right wall of a quadrant (the orange, blue or grey diagonal dotted lines – the thicker lines are more significant as they represent wider time-frames) and confirm over the next horizontal Fibonacci resistance. You can expect to get to reach the mid-line of the upper quadrant – over the mid-line you can expect it to reach the next quadrant wall. Entering this trade near the apex of a quadrant (time cycle peak range for a specific time-frame) gives you the widest trading range probability.

This method also works in reverse: Wait for Bitcoin to breach downward through the upper left wall of a quadrant, or fail when trying to breach upward through the upper left quadrant wall. Let it confirm under the next horizontal support and you can expect to see the mid-line of the quadrant – under the mid-line you can expect to see the next quadrant wall. Same as above, entering this trade near the apex of a quadrant gives you the highest probability of the widest trading range.

Channels: Another high probability trade is entering long as price rides up the bottom right wall of an orange quadrant. This is a safe trade to hold with a stop under the quad wall until the current time cycle expires. This trade works in reverse as well. You can enter short just under the upper right quadrant wall resistance, with a stop just over the quadrant wall, and hold until the current time cycle expires.

Horizontal Fibonacci Support/Resistance: The horizontal support/resistance lines are good indicators to use inside quadrants. The light green 0.5 Fibonacci line and the grey 1.0 or 0 Fibonacci levels (mid-lines) are the most significant. Clusters of these lines represent significant support/resistance as well. Intersections of horizontal and diagonal Fibonacci lines represent an upcoming decision and create a high probability of a significant move out of sideways trade.

Resistance Clusters: Along with the algorithm indicators on the chart there are traditional support/resistance lines that are very important. When these lines converge volatility tends to increase. Under the cluster is a high probability short. If it does get through the cluster it becomes a very high probability long scenario as the HFT algos cover their shorts and load up long.

Targets: Red circles on charting. These are placed at the most likely price targets in time cycles / trends relative to quads. These are still in very early stage of development/testing and should be used for observation only at this point. Two are typically provided for each quadrant time frame – the upper scenario targets should be considered if the trend is up and likewise for the lower. I do not recommend entering trades based on these targets. Also, at times the mid quad support / resistance line is highlighted with a target if trade is not extremely bullish or bearish.

Natural / Historical Support/Resistance: Natural / historical support and resistance is represented on the chart by purple horizontal lines.

Conventional Charting: Conventional charting should be weighed against the model(s) with all trade decisions.

Bitcoin Algorithm Live Charting Link:

Algorithm model on the Daily Bitcoin Chart: Click link to open initial chart viewer screen, then share button at bottom right of screen, then make it mine, then double click on chart body to hide or reveal indicators at bottom of chart (MACD etc).

Bitcoin Chart Model – Up over mid quad nearing quad wall resistance Mar 5. $BTC $XBTUSD #bitcoin

Per recent;

Bitcoin hit buy sell trigger support 5895 early (green arrow) then mid trigger early (gray) and 13790 in sight Feb 22. $BTC $XBTUSD

Per recent;

https://www.tradingview.com/chart/XBTUSD/u159Yjrc-Bitcoin-Charting-Algorithm-Model-Jan-28-2018-BTCUSD-XBTUSD/

Bitcoin holding 200 MA with peak time cycle on daily algorithm model chart Feb 22. Price targets per chart.

At this point lower trending channel on model (quads) is holding, but 200 MA price action may put in a bottom formation signalling a trend change.

Trading support and resistance for focused time-frame to Feb 22 time cycle peak.. #trading #bitcoin

Watch the diagonal quad lines (dotted diagonal lines) and horizontal support and resistance to upside target above 200 MA and downside target if 200 MA is lost.

https://www.tradingview.com/chart/XBTUSD/pSZG52Uz-Trading-support-and-resistance-for-focussed-time-frame-to-Feb-22/

Bitcoin holding 200 MA with peak time cycle on daily algorithm model chart Feb 22. Price targets per chart.

$BTC $XBTUSD April 7 Price Targets;

9875.00 bearish scenario with 5838.00 most bearish in a sell-off.

13816.00 mid quad most likely hit.

17227.00 most bullish scenario. Unlikely.

In summary, our first generation Bitcoin algorithm chart model uses the following indicators (listed from most predictable to least in terms of win rate):

- Trading range created by long term algorithmic modeled quadrant support and resistance (blue dotted lines)

- Trading range between buy/sell trigger levels (grey/green arrows and solid lines)

- Directional channels formed by long term algorithmic modeled support and resistance

- Horizontal Fibonacci support and resistance (multi-colored horizontal lines)

- Conventional Natural support and resistance (purple horizontal lines)

- Long term conventional trend lines (red diagonal lines)

- Conventional MA’s

Observations in the current area of trade:

Crypto $BTC, $ETH, $XRP, $LTC #cryptocurrency #technicalanalysis

Crypto $BTC, $ETH, $XRP, $LTC #cryptocurrency #technicalanalysis pic.twitter.com/qL7wvBQV4O

— Melonopoly (@curtmelonopoly) February 12, 2018

Bitcoin MACD trending bullish with Stochastic RSI nearing top of range. $BTC $XBTUSD #Bitcoin

Per recent;

The squeeze momentum indicator and MACD on daily chart are still trending up but the Stochastic RSI is high and looks ready to turn FYI.

Per recent;

The squeeze momentum indicator direction trend should be in consideration for direction IMO on daily chart. $BTC $XBTUSD Trade against its trend at your peril (historically speaking and specifically on daily).

Key buy / sell price trigger levels in the current area of trade are as follows:

See above.

Per previous;

9882, 13772, 17776, 21736, 25684.

Shorter time-frame indicators such as Fibonacci levels on chart can be used to trade against as support and resistance.

Price trading under 20 MA and 50 MA with 100 MA just below price (watch closely as price is pinched between 100 MA and 20 MA) with 200 MA nearing (pink line).

Bitcoin $XBTUSD conventional charting notes:

White arrows at bottom of chart represent conventional indicators. All indicators suggest (since recent lows) that price trend is up.

Also, upward trending channel in place (highlighted with thick yellow lines), two significant falling wedges played out technically (dotted yellow lines) and the general trend is in play.

Bitcoin Daily Charting – Conventional notes – MACD turning up, Stoch RSI trend up, SQZMOM up $BTCUSD $XBTUSD $BTC.X Jan 28 2018 1455 PM #Bitcoin

Bitcoin Trading Plan

From here to 13700 range it seems without significant resistance. Trading bias is bullish between moving averages on chart (horizontal lines).

Per Previous;

The 8854.20 support played out well – trading 11315.00 now with a time / price cycle peak coming in VERY SOON – Feb 22. Watch price direction really close coming out of Feb 22. Use the grey and green buy sell trigger arrows and quad walls as support and resistance decisions.

Daytrading charting on $BTC says careful with 11700.00 range resistance Feb 22.

Per recent;

Over 8854.20 and held, the upside price target on Bitcoin is highly probable. Daytrade supports noted. $BTC #Bitcoin $XBTUSD

Daytrader’s view of algorithm model charting on 60 minuter chart. $XBTUSD $BTC #Bitcoin

Daytrader’s GPS for tight trading – Current trade buy sell triggers in to Feb 22 time price cycle peak (green arrows) . $BTC $XBTUSD #Bitcoin

Per previous;

Bitcoin Daily Chart Trading Plan – price above Fib 11707.00 and 20 MA that holds channel support is long add and if that fails I would reconsider the current long position alerted on the Twitter member alert feed near recent bottom. $BTCUSD $XBTUSD $BTC.X Jan 28 2018 1505 PM #Bitcoin

Ethereum Basic Algorithm Charting Model on Daily Time Frame:

$ETH Indecisive trade. #Ethereum

Per recent;

It seems the buy sell triggers (green arrows) are best. Ethereum Daily Chart Algorithmic Model. $ETH #crypto

Per recent;

Ethereum Daily Chart Algorithmic Model suggests 1031.41 Mar 22 most probable price target. MACD on daily chart is near a turn up also. $ETH #crypto

Buy / sell triggers for $ETH are noted with green arrows on chart below.

$ETH Real-time chart link:

Per previous;

$ETHUSD real-time chart:

https://www.tradingview.com/chart/ETHUSD/meIvBmFK-Ethereum-Daily-Chart-Algorithmic-Model-Suggests-1240-00-Feb-10-m/

Ethereum Daily Chart Algorithmic Model Suggests 1240.00 Feb 10 most probable area of trade. $ETHUSD $ETH.X #crypto

Litecoin Basic Algorithm Charting Model

$LTC target 287.50 on bullish scenario. Trading in channel. #Litecoin

Per recent;

Litecoin $LTC basic algorithm chart model. Buy sell triggers (green and gray arrows) are best. Feb 20 636 PM $LTCUSD

Real-time $LTC chart link:

Per recent;

Litecoin $LTC basic algorithm chart model on daily time frame in play per previous. Feb 12 116 PM $LTCUSD

Primary buy sell triggers on Litecoin daily chart:

475.00

381.00

287.00

192.00

98.00

Per previous;

Litecoin $LTC basic algorithm chart model on daily time frame. Jan 28 1556 PM $LTCUSD

Thick yellow lines are prospective upward trending channel. Red circles prospective targets – trade in direction of targets. Buy sell triggers represented as well as trading quadrants, moving averages etc. If trade is indecisive it will tend to terminate at time cycle peak (green verticals) at mid quad horizontal line (green horizontal) at that specific time in chart and not reach an upper apex or lower inverse apex.

https://www.tradingview.com/chart/LTCUSD/yPMnzhEL-Litecoin-LTC-basic-algorithm-chart-model-on-daily-time-frame-J/

Ripple Basic Algorithm Charting Model

$XRP still indecisive.

Ripple has gone quiet – isn’t chasing time price peaks. $XRP basic algorithm chart model. Feb 20 642 PM $XRPUSD

Per recent;

Ripple $XRP basic algorithm chart model on daily time frame in play per previous. Feb 12 122 PM $XRPUSD

Ripple $XRP basic algorithm chart model on daily time frame. Jan 28 1556 PM $XRPUSD

Real-time Ripple $XRP chart link:

https://www.tradingview.com/chart/XRPUSD/1WptpUNA-Ripple-XRP-basic-algorithm-chart-model-on-daily-time-frame-Jan/

< End of report >

Any questions give us a shout anytime!

Post topics; Crypto, chart, $BTCUSD, $XBTUSD, $BTC.X, $ETH, $LTC, $XRP, Bitcoin, trade