S&P 500 $SPY Algorithm Update Wednesday April 4, 2018 $ES_F ($SPXL, $SPXS) Chart Observations

My name is Freedom the $SPY Algo. Welcome to my new S&P 500 trade report for Compound Trading.

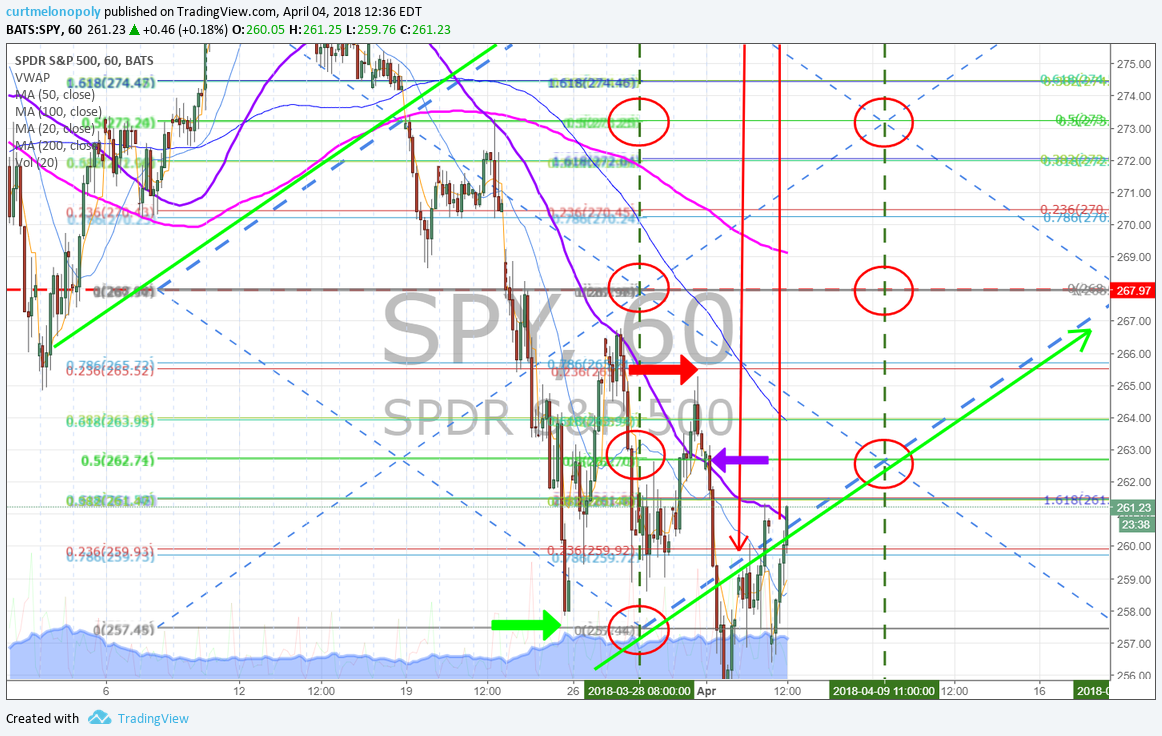

Below you will find algorithmic model charting based on Fibonacci extensions, timing and various other principles. This is a very early stage development model (generation 2 – 5 modeling rolls out in 2018 and as a result the reporting frequency increase significantly – our more advanced algorithm chart models are 4th and 5th generation, such as EPIC the Oil Algo that is graduating to #IA coding).

Notices:

This reporting week has brought two challenges:

- Charting Anomalies: The recent holiday has caused some models some issue as it relates to the geometric chart modeling (you will notice in some instances slight to significant geometric divergence – visually) and as such will cause some issue with many of the trading platforms and liquidity in some markets. Trade carefully until next report at each support and resistance. When these type of anomaly events are in play, it is prudent for your trade plan to refer also to the model / reports published prior to the holiday.

- Trading / Coaching Ctr Update: Our new trading / coaching center set-up has taken longer than expected (tech needed vs. Caribbean Island time). We have the fiber set-up now (the hard part it seems) but the ancillary components t make it all work for our equipment are in progress and expected to be complete soon. Downtime credits applied to members. Will advise.

How to use this charting model:

The S & P 500 model is different than others we have in development in that it functions on a number of time-cycles or time-frames, as such, you will see on some reporting a series of time-frames. This report includes a 1 minute model with buy sell triggers and reports in near future will include other time-frames for different styles / time-frames of trade.

The simplest way to use the charting is to consider all lines support and resistance decisions with the horizontal grey lines (marked with grey arrows) to be significant trading ranges in the model. The thicker the line the more important. And please consider that all support and resistance lines are approximate as this is a working chart model (a work-sheet). Horizontal and diagonal dotted lines are consider support and resistance.

This chart model is best weighed against conventional charting and used in conjunction with a conventional chart.

If you have questions about the best use of the chart model or private coaching options email our developers anytime at info@compoundtrading.com.

Current Algorithmic Model Charting

When you open the live chart below in “viewer” mode you can then click on the share button at bottom right and then click on “make it mine” to open real-time chart. Double click the body of the chart to remove or institute indicators at bottom of chart (MACD, Stoch RSI, SQZMOM).

Real-time $SPY chart link:

$SPY 1 Min model with current trading range buy sell triggers, fibs, quads, moving averages Apr 4 138 PM $SPXL $SPXS

Recent;

$SPY 1 Min model with current trading range buy sell triggers, fibs, quads, moving averages Mar 26 817 AM $SPXL $SPXS

Current swing trade buy / sell triggers for $SPY SP500 trade:

292.29

290.70

289.15

287.58

286.00

284.45

282.88

281.30

279.74

278.17

276.61

275.02

273.46

271.89

270.33

268.75

267.20

265.62

264.04

262.47

260.92

259.37

257.80

256.20

254.64

Conventional Charting Considerations:

Per recent;

$SPY key levels to watch in current chart structure. $SPXL $SPXS

Per recent;

$SPY simple charting new trade range scenario – upper trend-line and lower pivot support. #trading #SP500

Per recent;

$SPY My love note to bears. $SPXL $SPXS #jammin #MACD #holdon

Per recent;

$SPY MACD pinch – on watch here as MACD daily predictable directional swing trade indicator.. Mar 4 1046 PM $SPXL $SPXS

Per recent;

$SPY MACD turn, 200 MA bounce, over MAs, previous high test. Boomtown. MACD daily predictable directional swing trade indicator.. Feb 26 707 AM $SPXL $SPXS

Recent Real-Time Alerts, Trading, Model Price Target hits etc.

$SPY building structure near the buy trigger and channel bottom we expected. It’s long while it holds area. Trading 261.23 intra day.

https://twitter.com/SwingAlerts_CT/status/981571557771350018

$SPY Time cycle peak on this simple model is now. If its going to follow channel up it will be soon that it starts. If not, it could be another channel down yet.

https://twitter.com/DayAlerts_CT/status/978990333278253056/photo/1pic.twitter.com/50zcoPctuv

Best with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, Algorithm, Chart, Model, $SPY, $ES_F, $SPXL, $SPXS