Introduction.

Hello everyone! Reed here again. This post is a one week update of my first guest post, “Finding Setups.” Here is the link for those who missed it – https://compoundtrading.com/guest-post-1-finding-setups/

This update will cover my progress with the screening technique, as well as one week progress of the 12 equities covered in my last post and a couple of new charts I found this week.

It Really Works.

So, it’s been a week since I first used tradingview’s scanner to look for chart setups. The first part of this update is simple: It works. It really works. In fact, it has completely changed the way I study – and trade – in just a week. Instead of spending hours and hours looking for charts, I’ve been able to find new setups easily and spend more time studying them (marking natural resistance, setting up fibonacci retracements, setting strict entry points and targets). If anything I’ve had too many charts and not enough time!

Adjustments.

So far the only parameter I have adjusted is volume. Instead of looking for average volume > 200K, I’ve been looking for average volume > 500K. This has eliminated all the low liquidity stocks from my screens and further simplified the screening process for me. There are tons of other parameters I plan to play with, but for now I’m just keeping it simple.

Results.

After one week, 7 of the 12 equities covered in my first post are green. $WEAT (a.k.a. Curt’s Old Man Play) is leading the pack, up 15.89% since last Monday. $NNVC is the biggest loser at -7.80%, but it’s testing the 200 and I’d be surprised to see it down for much longer. Below are my notes on those 12 charts as well as a few new charts to watch. Note: The price under the company name is the price on the date of the most recent update, percentage is percent change since my first post.

$SMSI—Smith Micro Software Inc.

1.49 (-7.41%)

July 3—Trading 1.49. Retesting the 200 but has held it for 3 days now. 50 MA just breached the 100 and the 20 is curling up toward the 200. Stoch RSI trending down but starting to curl, MACD still up and SQZMOM still bright green. Pretty low volume the last few days but watching for volume to pick up as the 20 approaches the 200.

June 27—Decent chart, lots of history, respects its 200. Pretty low liquidity but volume up recently. Trading 1.62. Price just breached 200 MA on the daily, 20 MA came through the 100 MA providing lift. MACD trending up, stoch RSI near the top, SQZMOM bright green trending up. Trading between the MA’s on the weekly – price just got over the 20 MA and tested the 50 MA. 100 and 200 MA’s in order above. Stoch RSI near top but trending up, MACD crossed up with tons of room, SQZMOM dark red about to turn green. Past earnings.

$NG—Novagold Resources

4.41 (-8.30%)

July 3—Trading 4.41. Lost the 200 MA. Will probably pull back to the 20 MA then try for the 200 again. Note: Discontinuing blog coverage of $NG after this week because it trades off of gold more than its MA’s.

June 27—Decent chart, lots of history but doesn’t always respect its 200. High liquidity. Trading 4.81. Not the best setup but just got over the 200 on the daily and the 20 just crossed the 50. Stoch RSI near the top, MACD crossed up with plenty of room and SQZMOM just turned bright green. On the weekly, 50 and 100 MA’s acting as resistance but stoch RSI straight up, MACD just crossed up and SQZMOM just turned dark red, trending up. Watching to see if this one holds the 200 MA.

$PFSW—PFS Web, Inc.

8.35 (+5.03%)

July 3—Trading 8.35. Low volume but 20 about to cross the 200 and stoch RSI has turned up. MACD up and SQMZOM bright green. Looking for some volume on this one.

June 27—Good chart with history. Decent liquidity. Respects its 200 MA. Trading 7.95, just over the 200 today. 20 and 50 MA both breached the 100 and are just below the 200. May ride the 20 MA up over the 200 once it crosses. Stoch RSI, MACD and SQZMOM all trending up. Watching for the 20 MA to cross the 200. Natural resistance and the 100/200 MA’s on the weekly at 10.16 area. Could see up to 16.00 area if it gets through that.

$DRRX—Durect Corp.

1.58 (+2.59%)

July 3—Trading 1.58. 50 crossed the 200 but not much movement with holiday low volume. Stoch RSI has turned up, SQZMOM still good but MACD looks like it could cross down. Just held the 200 on the weekly chart and the 20 is turning up toward the 50 as well. Huge upside in this chart with the daily and weekly setting up simultaneously. Ran fibs on it and it trades the model almost perfectly. Safe entry is over strong resistance at 1.70 with volume. Targets on the model at 2.00 and 3.26 both on August 17th, so we’ll see how it handles that decision.

June 27—Interesting chart. Not a ton of history but lots of symmetry and respects the 200. Good liquidity. Currently trading 1.54. Rode the 20 MA over the 200 and the 50 is approaching the 200. Stoch RSI at the top, MACD trending up but near the top and SQZMOM bright green. On the weekly it just broke through the 200 MA with the 100, 50 and 20 in line below. Indicators the same as daily but MACD has more room. Natural resistance at 1.88 area. Watching for 50 MA breach of 200 MA on the daily chart/over 1.88. Could see 3.00-3.50 range.

$PCO—Pendrell Corp.

7.47 (+3.61%)

July 3—Generally low volume but the setup is there. 20 came through the 200 today and price reacted well. Stoch RSI near top, MACD up and SQZMOM bright green. Looking for some volume before an entry.

June 27—Not the best chart. Decent liquidity and the tendency to gap (up and down) but respects the 200 and generally reacts well to price breaching the 200. Trading 7.21. This one got through the 200, came back and tested twice before losing the 200 and now regaining it. MA’s in line below the 200 with the 20 about to breach the 100. Stoch RSI near the top, MACD crossed up with plenty of room and SQZMOM bright green. Completed bowl could see it up around 15.00 if it plays out.

$WETF—Wisdomtree Investments, Inc.

10.31 (-0.002%)

July 3—Got some lift today from the 20 crossing up the 200. Stoch RSI turned down, MACD neutral but SQZMOM bright green. Looking for that MACD to come alive before I make an entry.

June 30—Came off a bit, trading 10.17. May come back to test the 200 before getting a pop but the 20 is coming through the 200 and could provide some lift. Stoch RSI trending up, MACD neutral and SQZMOM bright green but barely. Watching that 200 test closely.

June 27—Good chart with history, high liquidity. Trading 10.33. Just got over 200 MA on the daily, 50 just breached the 100 and the 20 is testing the 200. Has used the 20 MA as support on its way over the 200. Stoch RSI trending up, MACD neutral and SQZMOM just turned bright green. Resistance from the weekly 100 MA above at 12.28 and 200 MA at 13.85. Completed bowl would take it to the mid-20’s. Watching.

$THC—Tenet Healthcare Corp.

19.22 (+0.68%)

July 3—Trading 19.22. 20 through the 200 now but looks to be coming back to test the 200. Watching for the bounce after 200 test. Key resistance at 20.46, would look to enter over that with the 50 crossing the 100 and 200.

June 27—Decent chart with history, tons of liquidity and respects the 200. Trading 19.09 just over the 200 MA. 20 MA is crossing the 100 MA and the 200 is swooping down pretty steep from overhead. Stoch RSI trending up, MACD neutral and SQZMOM bright green. Resistance above at 19.55, 25.91 and 37.33 in the form of the weekly 50, 100 and 200 MA’s. I’d like to see the 20 MA breach the 200 on the daily with price above resistance at 19.55. Completed bowl could see anywhere from 30.00-60.00.

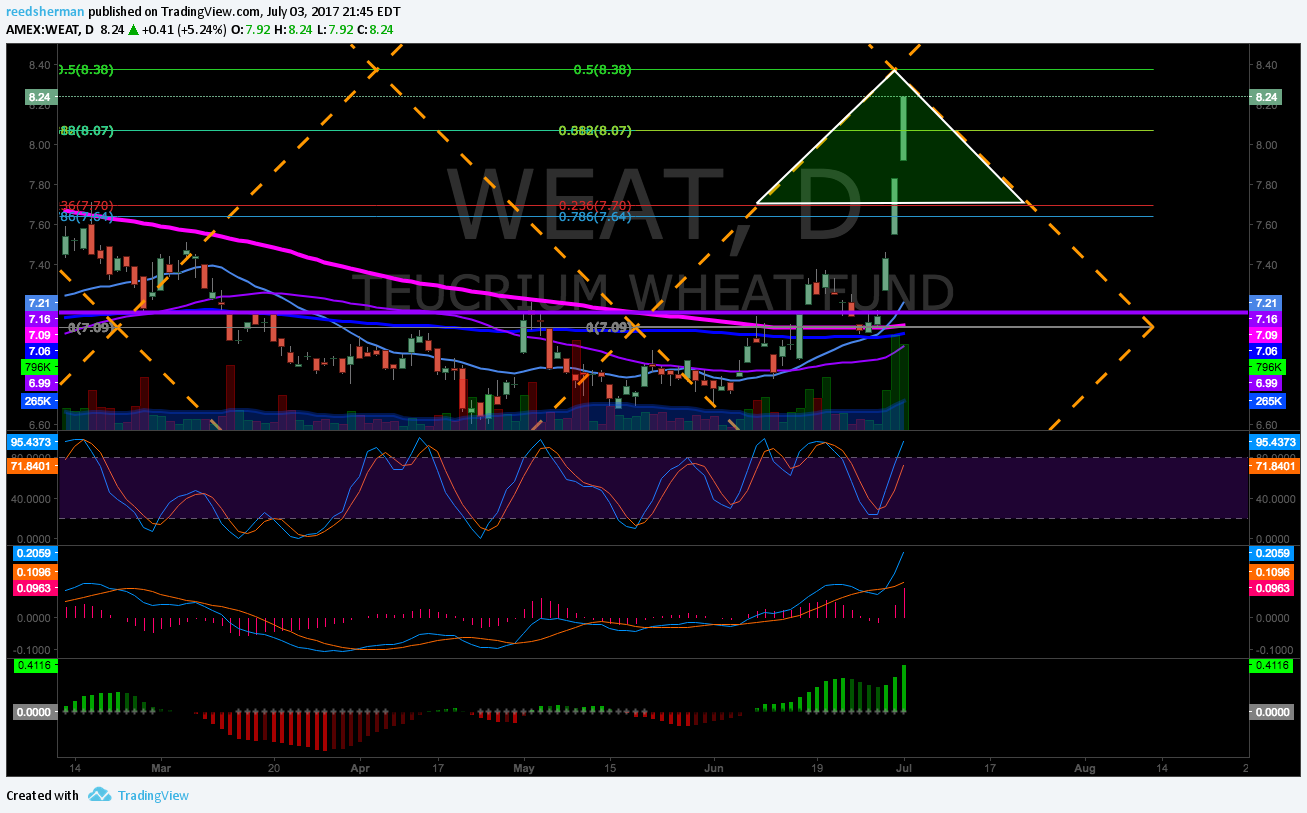

$WEAT—Teucrium Wheat Fund

8.24 (+15.89%)

July 3—Trading 8.24. Wishing I had gone long on this one the second I saw it. Perfect setup testing the 200 right as the 20 crossed then BOOM straight to the apex of the model. Stoch RSI and MACD almost completely vertical. Wow can’t believe I missed that one.

June 27—Not a ton of history here but generally respects the 200 MA and recently breached before coming back to test. 20 MA sitting just under the 100 and 200 MA’s. Stoch RSI trending down, MACD just crossed down and SQZMOM dark green. Watching for stoch RSI to turn up at the bottom, the 20 to breach the 100 and 200 and the MACD to cross up. Unsure about this one due to lack of history/volume. Good upside but a generally slow mover.

$NNVC—Nanoviricides Inc.

1.30 (-7.80%)

July 3—Trading 1.30. Looking like it will test the 200 MA. Stoch RSI coming down, MACD crossed down but SQZMOM still bright green. Hitting resistance on the down channel trend line – needs to push soon or it could end up in that 1.06 target on July 10. Upper target is around 2.20 on the same day. When this one goes, it goes. Watching closely.

June 27—Pretty good chart with history, but low liquidity. Respects its 200 MA and has gotten enormous lift when this setup has played out in the past. Trading 1.41, just above the 200 MA, riding the 20 MA for support. 50 MA is close to breaching the 200 MA. Stoch RSI is at the top, MACD is crossed up with room and SQZMOM just turned bright green. Jumped 130% last time this setup played out.

$RUN—Sunrun, Inc.

7.24 (+5.07%)

July 3—Trading 7.24. Still holding this one, it has failed between the fib resistances at 7.29 and 7.36 multiple times over the last few days. Looking for the 50 MA cross over the 200 to help push it through that level. Stoch RSI coming off the top but MACD still up and SQZMOM green. Critical level is that 7.36 fib, over that and it’ll see 8.00 imo.

July 1—Trading 7.12. I’m long on this one from 7.15 on Wednesday morning. Having a lot of trouble with the 0.236 fib level at 7.29 and came off to support at 7.12. Trading the model well though and 50 MA is crossing the 100 and should get the 200 soon. Stoch RSI coming off the top a little bit but MACD and SQZMOM still way up. Giving it some room. Will continue to move stop up along that diagonal trend line. Stop set at 6.78 for now. Target: 8.00.

June 27—Not much history but lots of liquidity and so far seems to respect it’s 200 MA. Trading 6.89 (+1.39 since breaching the 200 last week). 20 MA crossed up the 200 MA almost vertically and the 50 MA is starting to curl up toward the 100. Stoch RSI flat on top, MACD trending up fast and SQZMOM bright green but near the top. Trump solar wall play I believe. Really bullish chart, target at 8.00 by early August.

$RSO—Resource Capital

10.52 (+3.34%)

July 3—Trading 10.52. Got some lift from the 50 touching the 200, could be the start of a significant move. Stoch RSI turning up, MACD still neutral and SQZMOM starting to perk up bright green. Watching the MACD on this one for a possible entry point.

June 27—Pretty decent chart, respects its 200 MA, decent liquidity. Same play, trading 10.18 just over the 200 MA. 20 MA just breached with the 50 just below. Gap-fill potential as well. Stoch RSI trending up, MACD neutral and SQZMOM just turned bright green. Resistance above at 10.33, 11.18 and 16.12 from the weekly 50, 100 and 200 MA’s. Have to watch the weekly chart as you play this one. Side note: was trading over $70 pre-2008 and just announced pricing of $377 million mortgage backed CLO’s…Watching this one.

$IQI—Invesco Quality Municipal Income Trust

12.74 (-0.70%)

July 1—Trading 12.74. Removing $IQI from this list because I am unfamiliar with the way trusts trade.

June 27—Healthy looking chart, hugs its MA’s but no idea on liquidity. Looks to be traded mostly by computers. Trading 12.83, rode its 20 MA up through the 200 as it comes down on a pretty steep slope. The 50 should cross soon and the 100 after that. Stoch RSI and MACD neutral, SQZMOM dark green. Over the 200 on the weekly chart as well but hitting resistance at the 100. Stoch RSI at the top, MACD trending up and SQZMOM bright green on the weekly. Slow mover, not a ton of upside in this one.

A Few New Charts to Watch.

$SCHN—Schnitzer Steel

$ARNA—Arena Pharmaceuticals Inc.

$HIVE—Aerohive Networks Inc.

Conclusion.

The A+++ charts are out there. You just have to find a method of $STUDY that works best for you. With the help of Curt’s lessons and this screener, I’m finally starting to turn a corner with my trading and get on the road to freedom!

Thanks again to Curt for allowing me to share and to everyone for reading! Feel free to contact me on twitter @reedshermanator if you have any questions/comments concerns.

Happy Independence Day to those of you in the U.S. and happy Canada Day to our friends up north!

– Reed