S&P 500 SPY Trading Algorithm Update Tuesday July 10, 2018.

$SPY $ES_F ($SPXL, $SPXS) Chart Observations

My name is Freedom the SPY Algo ($SPY). Welcome to my S&P 500 trade report for Compound Trading Group.

Below you will find algorithmic model charting based on Fibonacci extensions, timing and various other principles. This is a very early stage development model (generation 2 – 5 modeling rolls out in 2018 and as a result the reporting frequency increase significantly – our more advanced algorithm chart models are 4th and 5th generation, such as EPIC the Oil Algo that is graduating to #IA coding).

Notices:

NA

How to use this charting model:

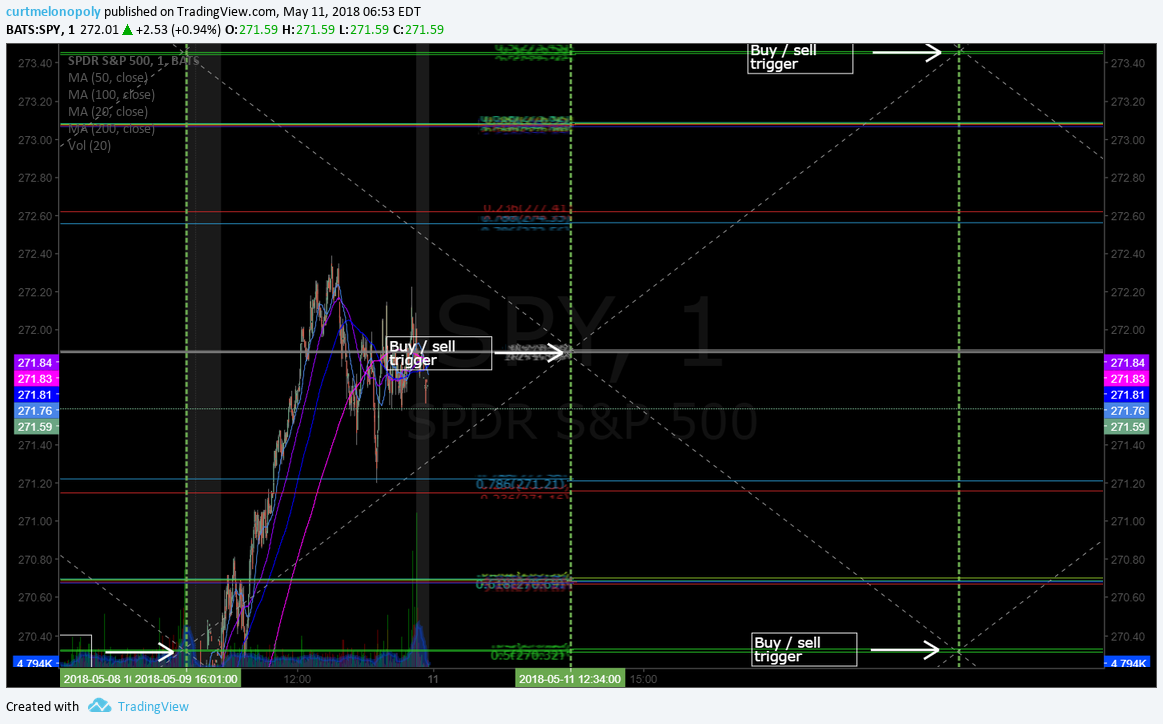

This S&P 500 (SPY) algorithm report includes a 1 minute model and a 60 minute model with buy sell triggers and reports in near future will include other time-frames for different styles / time-frames of trade.

The simplest way to use the charting is to consider all lines support and resistance decisions with the horizontal grey lines (marked with grey arrows) to be significant trading ranges in the model. The thicker the line the more important. And please consider that all support and resistance lines are approximate as this is a working chart model (a work-sheet). Horizontal and diagonal dotted lines are consider support and resistance.

This chart model is best weighed against conventional charting and used in conjunction with a conventional chart.

If you have questions about the best use of the chart model or private coaching options email our developers anytime at info@compoundtrading.com.

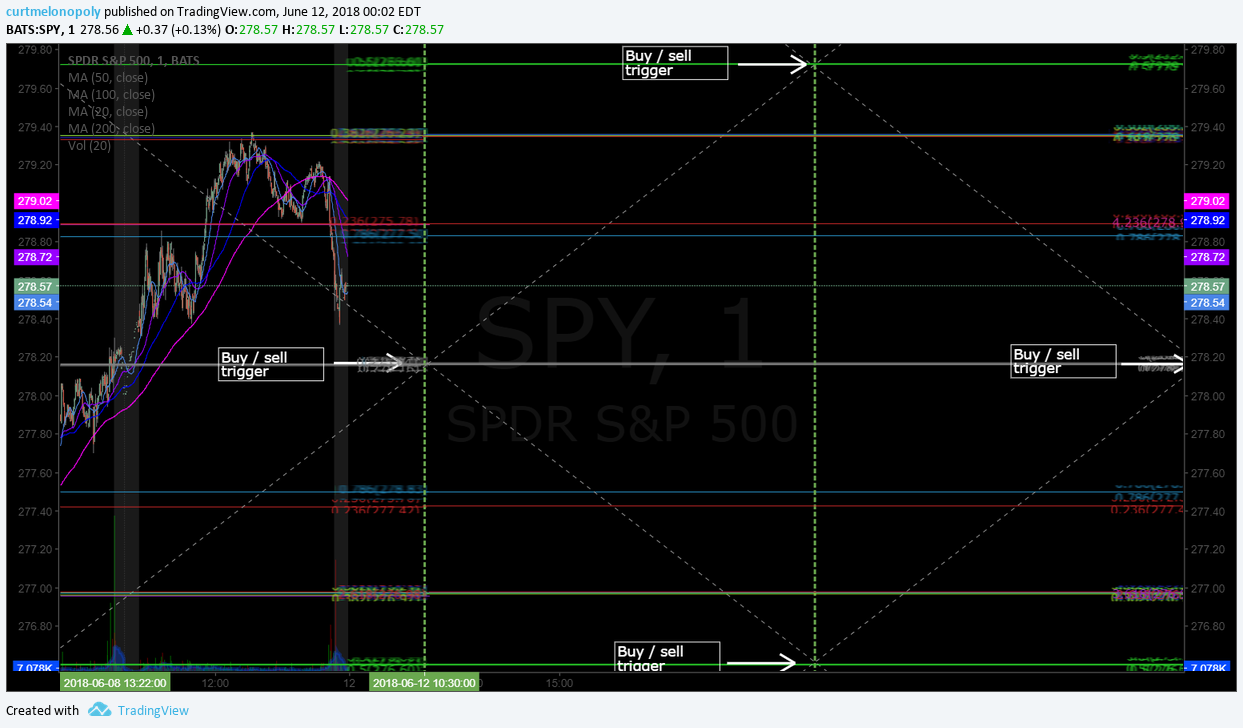

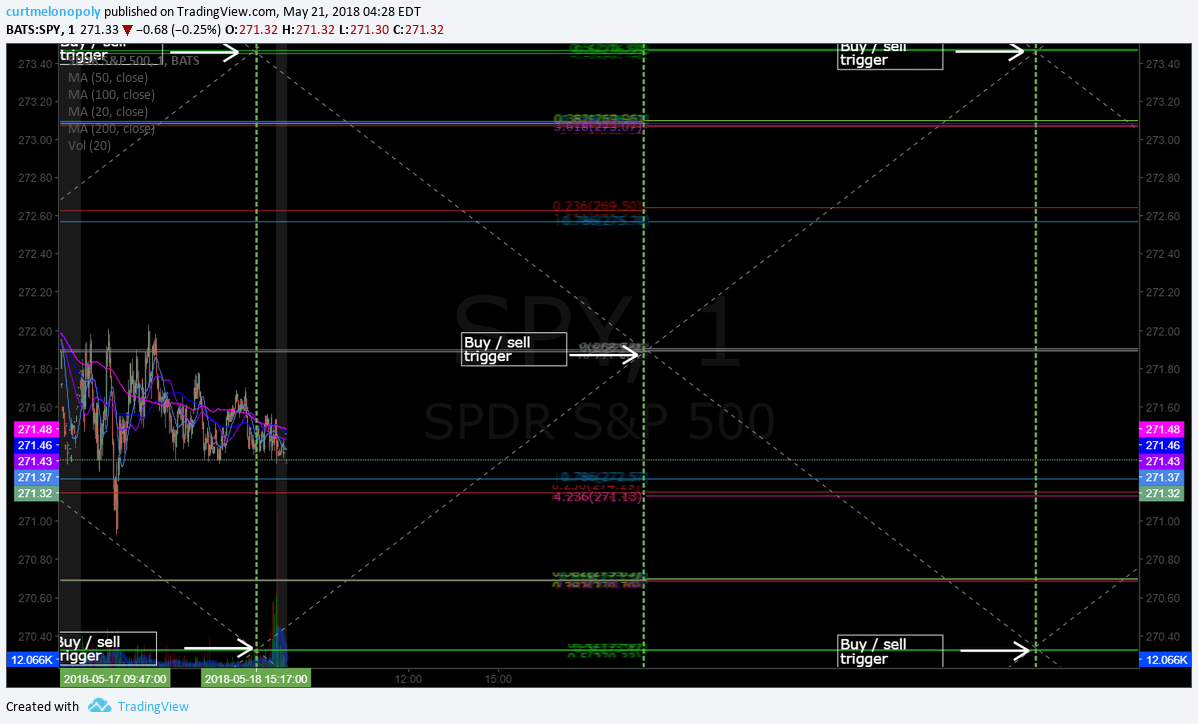

SP500 Algorithm (SPY). 1 Min Chart (Intra-Day Trading) $SPY.

Current Buy / Sell Triggers for $SPY SP500:

292.29

290.70

289.15

287.58

286.00

284.45

282.88

281.30

279.74

278.17

276.61

275.02

273.46

271.89

270.33

268.75

267.20

265.62

264.04

262.47

260.92

When you open the live chart below in “viewer” mode you can then click on the share button at bottom right and then click on “make it mine” to open real-time chart. Double click the body of the chart to remove or institute indicators at bottom of chart (MACD, Stoch RSI, SQZMOM).

SP500 Algorithm (SPY). 1 Min chart. Current trade. Buy sell triggers, fibs, quads, MA’s. July 11 115 AM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

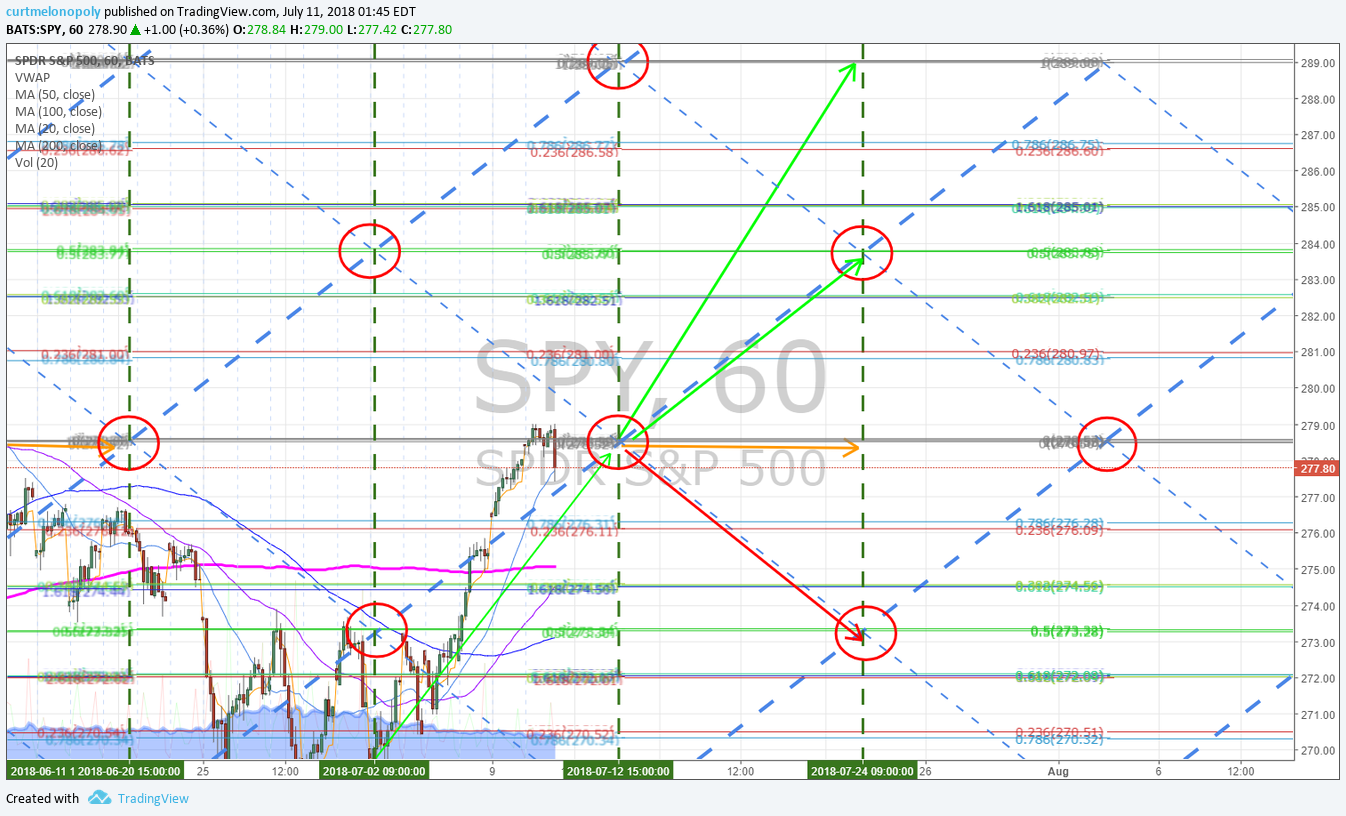

SP500 Algorithm (SPY). 60 Minute Chart (Swing Trading) $SPY:

SP500 Algorithm (SPY). 60 Min Gen 1. Current trade. Buy sell triggers, fibs, quads, MA’s. July 11 147 AM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

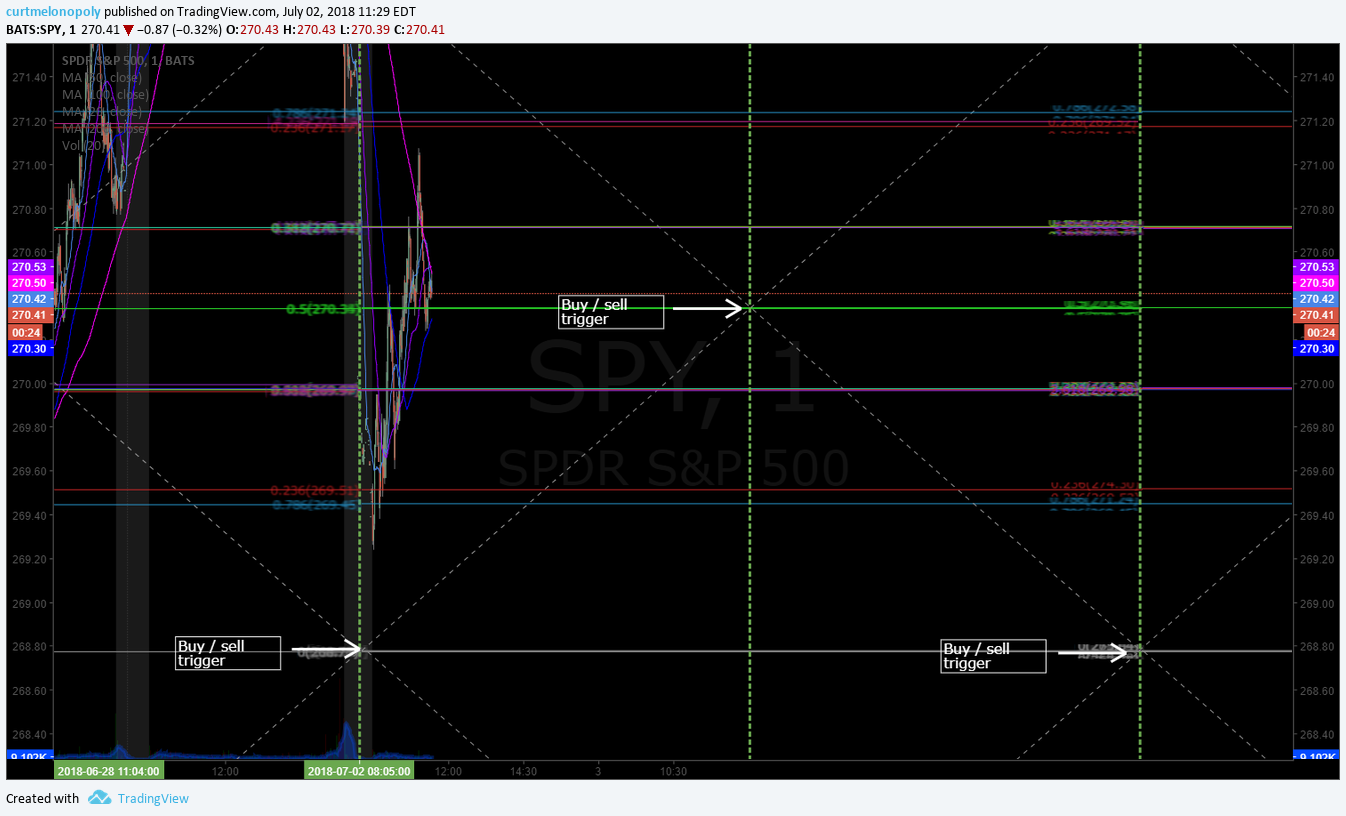

Per recent;

SP500 Algorithm (SPY). 60 Min Gen 1. Current trade. Buy sell triggers, fibs, quads, MA’s. July 2 1139 AM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

Per recent;

SP500 Algorithm (SPY). 60 Min chart. Market pressure here now. June 18 644 AM. $SPY $ES_F $SPXL $SPXS #Algorithm #SPY

SP500 (SPY) Conventional Charting Considerations $SPY:

July 11, 2018 – Structure from previous still intact.

SP500 (SPY) Chart – MACD still turned down, messy structure. $SPY $ES_F $SPXL $SPXS #SPY #Chart

SPY chart with bearish (or at best indecisive) overtones in its structure.

SP500 (SPY) Chart with trendlines to watch – MACD to likely turn down today. June 18 649 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

Per recent;

SP500 (SPY) Chart – Trade above moving averages MACD is turned up on daily. June 12 1213 AM $SPY $ES_F $SPXL $SPXS #SPY #Chart

Recent Real-Time Alerts, Trading, Model Price Target hits etc.

July 11 – Alert and price target examples will be updated soon.

Per recent;

9:56 AM – 19 Apr 2018 $SPY Divergent trade returning to target area it tried to pass in the fast lane. See previous recent posts.

$SPY Divergent trade returning to target area it tried to pass in the fast lane. See previous recent posts. pic.twitter.com/3vo4sgNXKH

— Melonopoly (@curtmelonopoly) April 19, 2018

5:18 AM – 18 Apr 2018 That 273.20 mark that comes due in a time cycle peak for $SPY at around 2:00 EST today…. that’s the start of a double extension getting really stretched on the models – corresponds with everything that moved. There ain’t much room available above that short term. Rest on deck.

That 273.20 mark that comes due in a time cycle peak for $SPY at around 2:00 EST today…. that's the start of a double extension getting really stretched on the models – corresponds with everything that moved. There ain't much room available above that short term. Rest on deck. pic.twitter.com/wKfBQ9njDc

— Melonopoly (@curtmelonopoly) April 18, 2018

4:48 AM – 18 Apr 2018 $SPY long side trade cleared mid quad and quad wall. Closed 270.19, next res trims 270.22, 270.45, 271.99, 273.25

https://twitter.com/SwingAlerts_CT/status/986526884790927360

3:37 PM – 13 Apr 2018 The resistance dump after the alert and the 50 MA support may become your buy area Mon morning. $SPY #swingtrading https://www.tradingview.com/chart/SPY/H375XWXb-The-resistance-dump-after-the-alert-and-the-50-MA-support-may-be/ …

https://twitter.com/SwingAlerts_CT/status/984878380284858369

11:05 AM – 13 Apr 2018 $SPY trim quad resistance alert worked well.

https://twitter.com/SwingAlerts_CT/status/984809783768346624

9:31 AM – 13 Apr 2018 $SPY upside resistance trim alert to long side as it approaches 268.00 mid quad res

https://twitter.com/SwingAlerts_CT/status/984786277189988352

$SPY at upside resistance pivot and structured trade worked out. Trim longs add above.

$SPY building structure near the buy trigger and channel bottom we expected. It’s long while it holds area. Trading 261.23 intra day.

https://twitter.com/SwingAlerts_CT/status/981571557771350018

$SPY Time cycle peak on this simple model is now. If its going to follow channel up it will be soon that it starts. If not, it could be another channel down yet.

https://twitter.com/DayAlerts_CT/status/978990333278253056/photo/1pic.twitter.com/50zcoPctuv

Best with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: SP500, Algorithm, SPY, $SPY, Chart, Model, $ES_F, $SPXL, $SPXS