S&P 500 $SPY Algorithm Update Tuesday Sept 5, 2017 $ES_F ($SPXL, $SPXS) Chart Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Below you will find algorithmic model charting based on Fibonacci extensions, timing and various other principles. This is a very early stage development model (generation 1 and generation 2 modeling commences sometime Sept 2017 and as a result the reporting frequency increase significantly – our more advanced algorithm chart models are 4th and 5th generation for reference – such as EPIC the Oil Algo that is now going to coding).

How to use this charting model:

The S & P 500 model is different than the others we have in development in that it functions on five time-cycles or time-frames.

The simplest way to use the charting is to consider all lines support and resistance decisions with the horizontal grey lines (marked with grey arrows) to be significant trading ranges in the model. The thicker the line the more important. And please consider that all support and resistance lines are approximate as this is a working chart model (a work-sheet). Horizontal and diagonal dotted lines are consider support and resistance.

This chart model is best weighed against conventional charting and used in conjunction too a conventional chart. The model will be more user-friendly when the next generation is launched sometime in September.

If you have questions about the best use of the chart model email our developers anytime at info@compoundtrading.com.

Current Algorithmic Model Charting

When you open the live chart below you can click on the share button at bottom right and then click on “make it mine” to open current chart.

Live Chart Link:

It is important to note that this chart is functioning on five time frames and we are endeavoring to simplify that through the month of Sept 2017 and also add targets. In the interim, the charting is simply a series of support and resistance lines.

Current Area of Trade $SPY S&P 500 Algorithmic Model Chart Sept 5 325 AM $ES_F, $SPXL, $SPXS

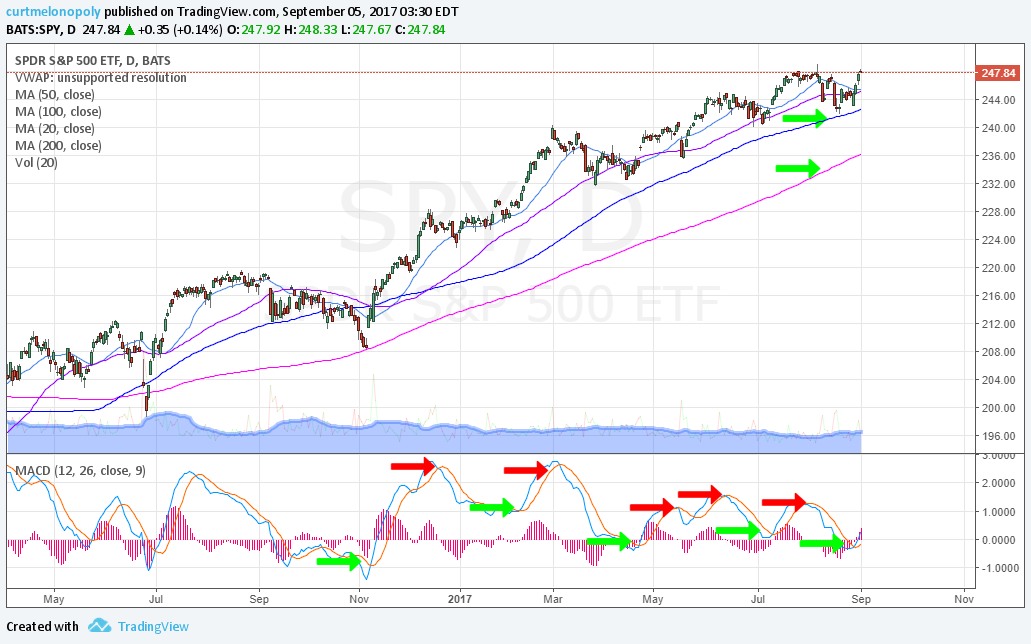

Conventional Charting Considerations:

Waiting for MACD buy and sell signals on Daily provides decent ROI $SPY S&P 500 Conventional Chart Sept 5 330 AM $ES_F, $SPXL, $SPXS

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Trading, Algorithm, Chart, Model, $SPY, $ES_F, $SPXL, $SPXS