Review of my Chat Room Stock Day Trades, Algorithm Charting Calls and Alerts for Friday Jan 27, 2017 $GOOGL, $DUST, $JUNO, $CBMX, $ROKA, $TRCH, $LGCY – $SPY, $GLD, $GDX, $SLV, $USDJPY, $DXY, $USOIL, $WTIC, $VIX, $NG_F…

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Per Recent;

Promo Code Discounts are Ending: The 38.2% inaugural opening discounts end Jan 31, 2017 and we won’t be a promo driven type room – so if you’re thinking of jumping do it now. Also, the promo codes are technically all used up (we were only going to offer discount for first 200) so if you get an error message when typing in your promo code that’s on the website then let us know and a tech will sort it for you.

https://twitter.com/CompoundTrading/status/823791504602710016

New Service Option: We now also offer a stand-alone trading room option (vs. bundle w/ trading room, premarket newsletter and alerts) at 59.00 /mth and w/ promo code is 1.22 per day (until end of Jan, 2017).

Overview Perspective & Review of Chat Room, Algo Calls, Trades and Alerts:

I am holding $GOOGL, $DUST, $JUNO, $CBMX, $ROKA, $TRCH, $LGCY after coming off those aftermarket earning scalps. All except $GOOGL are 1/5 – 1/10 size and $GOOGL is 1/4 size.

I didn’t trade today because market was off some and there were a number of inflections with Gold, Silver, SPY, VIX was trampled, USD/JPY etc…. and no setups in momentum stocks. The momo stocks have been more like wack a moe the past week or so and really risky to catch moves – or they had major part of move in premarket or after close with earnings (which is how I ended up trading earnings this week). Many traders getting chopped up in morning gap and go plays.

Momentum / Noteable Stocks Today:

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Holding:

$GOOGL, $DUST, $JUNO, $CBMX, $ROKA, $TRCH, $LGCY

Looking Forward:

Our algorithmic charting has been really on, so as with previous, that helps. $VIX and $SPY we’re locking down more and more.

The market itself has a number of potential $VIX catalysts (as does big oil) this week so I will be watching closely.

#Oil #Earnings https://t.co/F6rAH0HPVF

— Melonopoly (@curtmelonopoly) January 30, 2017

$VIX Volatility finally… maybe this week? Trump, Fed, BOJ, BOE, ISM Global Manufacturing, Jan Jobs Report, Amazon, Apple Earnings…

— Melonopoly (@curtmelonopoly) January 29, 2017

The algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Announcements in Trading Room:

09:54 am Curtis M : $SPY on descending algo path watching for reversal. $USOIL atching rigs at 1, GOLD watching resistance. No momos today yet.

11:52 am Curtis M : Algos turned off in Oil … watching main support around 51.65, $USOIL, SILVER over 17.35 small long and over 17.86 I will hammer down, Gold main resistance at 1201.82, $GDX see post on Rosie Twitter feed re top of algo quad, $SPY 3 Decisions yet to play out

Stock Chat-room Trading Transcript:

Miscellaneous chatter may be removed.

09:23 am Mathew Waterfall : Woke up expecting weakness in the miners as I had an alert for 1180 gold on my phone. Looks like they may actually open up for a chance. Would be looking to go $JNUG or $NUGT around 22.9 $GDX level. Everything else Im holding

09:26 am Curtis M : Not excited about any momos

09:26 am Mathew Waterfall : Nope me neither. The whole week it seems like if you miss the gaps you miss the moves with a few exceptions

09:31 am Carol B : $MYOS

09:32 am Mathew Waterfall : $TLT Mar 17 126c’s for .4 this AM. Up and over my levels in a gap. Would be out if it slips past 119 on the downside on a closing basis

09:34 am Mathew Waterfall : $PULM rockings

09:37 am Sandra Q : In some $USO

09:39 am Lepki N : $PULM over 3 maybe or pullback

09:40 am Curtis M : yup

09:41 am Curtis M : Careful with $USO Sandra – getting tight

09:43 am Carol B : $HTBX action

09:44 am andrew l : Selling $BMY swing here

09:47 am Steve U : $HTBX start

09:48 am Flash G : $CAT decent actually here and $GOOGL likely off for a whle now but holding

09:49 am Curtis M : .

09:49 am Curtis M : Watching Gold resistance area today

09:49 am Curtis M : Watching crude for rigs at 1

09:50 am Mathew Waterfall : looks like the market wants a sell off here. Bradth, TICks trending down a bit

09:52 am OILK K : Out $INTC thanks Curt! from last night pow

09:53 am OILK K : Glad I’m not in $IDVN

09:56 am Mathew Waterfall : Covering some $GPS short here. Trade is taking time and effort away from others. Small win cover at 23.5 from 23.85 but nothing at all to beexcited about. If it pops I will reshort around yesterdays highs

10:00 am Mathew Waterfall : $IWM not looking so hot. Leading to the downside

10:00 am Cara R : Long $IBB

10:14 am Curtis M : $SPY holds 229.03 it could get lift

10:15 am Curtis M : Crude getting very close to a decision. Up or down next few days. It could continue sideways but ulikely

10:16 am Curtis M : Last algo line terminates Feb 2 so thats a huge sign of pop or drop

10:23 am Curtis M : Starting to lock in $SPY math finally lol

10:23 am Curtis M : Will take some time yet

10:24 am Scott K : Watching tyat close Curt

10:25 am Steve S : $NOVN back on hahahaha

10:30 am Curtis M : no fear at all yet – wierd thought there would be some at least

10:31 am Mathew Waterfall : Euphoric market. I cant spell it but I can call it

10:31 am Curtis M : lol

10:32 am Curtis M : Waiting for that big straight up spike and then bear raid – but who knows but would be nice for bank acount

10:33 am Mathew Waterfall : On the mic

10:33 am Curtis M : k

10:33 am Scott K : hey mat

10:38 am Curtis M : good point mat

10:38 am Lui S : yip

10:39 am gurpreet s : silver moving good timing

10:41 am Curtis M : Thanks Mathew – wisdom in there

10:41 am Mathew Waterfall : Hopefully a couple nuggets in my ramblings

10:41 am Mathew Waterfall : I’m watching $HTBX. should get some momo over highs

10:42 am Curtis M : oh ya

10:42 am Curtis M : your nuggets i am refering to

10:42 am Curtis M : $HTBX I’ve trade lots in past – its not the easiest but up overall on it

10:43 am Mathew Waterfall : thanks. What’s great about a room like this is we all have insight and wisdom to offer. Great learning environment for me I’ll say that much

10:43 am Curtis M : Me too

10:44 am Scott K : yes sirs!!!

10:44 am gurpreet s : some dumbness on twitter and stocktwits

10:44 am gary y : agreed

10:44 am Curtis M : thanks guys

10:44 am Curtis M : gals lol

10:45 am Curtis M : some day i will remember to turn on that video

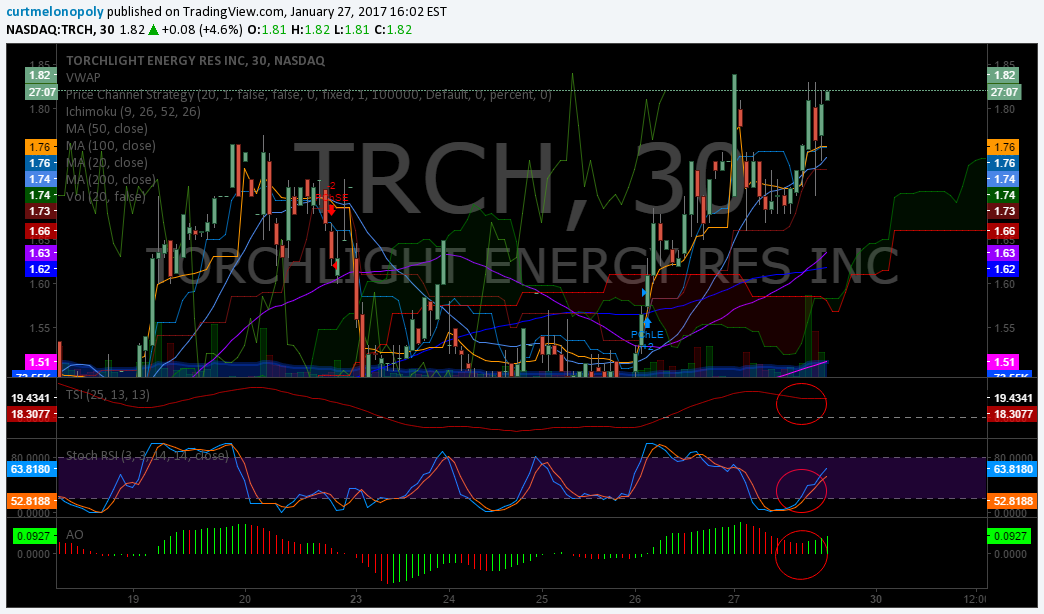

10:47 am Curtis M : interesting $TRCH

10:47 am Roger S : I have to say that Mathew and Curtis I like the no bullcrap straight out

10:48 am Roger S : And the algos are getting really spooky hahahaha precise!!! Right Wei?

10:48 am Roger S : spooky thats funny

10:48 am Curtis M : $TRCH may go today a bit… may

10:49 am Curtis M : here comes gold

10:52 am Curtis M : $GDX never did get to top of that Quadrant – wierd it may yet

10:52 am Mathew Waterfall : I would give me 2 cents on $GDX but you already know what I think lol

10:53 am Curtis M : It may hit it on Feb 1…. off chance… thats Wed I think

10:54 am Mathew Waterfall : That would be nice. FOMC next week I believe right?

10:54 am Curtis M : Feb 1 around 4 pm

10:55 am Mathew Waterfall : That would be hilarious, FOMC is 1/31-2/1 and they release at 2pmtypically

10:55 am Mathew Waterfall : Right before would be awesome

10:55 am Mathew Waterfall : Quick break for me. Back in a few. I would say IM gonna scan which I will but not expecting to find much

11:01 am Curtis M : $GDX FEb 1 4 PM 24.97, Feb 7 12:00 24.63, Feb 13 24.26 1:00 PM are the 3 upside probabilities most likely

11:01 am Curtis M : That is if it is ascending

11:02 am Curtis M : Price hits top of quad 9 out of 10 times tho fyi

11:22 am Mathew Waterfall : Whatever silver had for breakfast, I want so of that!

11:23 am Curtis M : ha ya

11:23 am Curtis M : it gets up over 17.35 and holds it could be interesting

11:24 am Mathew Waterfall : I’ve had 17.3 on my charts for a while as well. For me next stop would likely be 18

11:24 am Mathew Waterfall : I called $SLW a mid 20’s stock by next week so for my own sake I hope Im right

11:24 am Mathew Waterfall : $HTBX also making highs FYI. I took a small order at 1.05 for a tester

11:25 am Curtis M : up over that area held is an anomoly so it could go if it does just saying…. I’d likely go in heavy myself – but it would have to hold 17.35 ish

11:25 am Mathew Waterfall : Agreed

11:26 am Curtis M : algos are still in oil

11:27 am Curtis M : thought they may back off with action in gold silver and spy

11:31 am Mathew Waterfall : $VIX. Single digit close before the correction?

11:31 am Curtis M : lol

11:31 am Mathew Waterfall : Seems to be no fear in this market which makes me nervous. Lowest close back to 2014 was 10.28

11:31 am Mathew Waterfall : Could take that out today

11:33 am Curtis M : Actually 17.86 held is my hammer down long Silver point… 17.35 I’d likely only take a 1/10 size or 1/5 at most then hammer at 17..86

11:33 am Mathew Waterfall : Looks like thats actually the lowest close in the last 10 years basically with a couple 9 handles in 07

11:33 am Curtis M : y alol

11:34 am Curtis M : Trump factor

11:34 am Mathew Waterfall : I would expect some selling in the miners here but silver IMO is on its way

11:34 am Curtis M : Trump factor should work both ways through his time tho

11:35 am Curtis M : theres your tell on algos n oil

11:37 am Curtis M : Oil support at 51.62 $USOIL

11:37 am Curtis M : Main support that is

11:37 am Mathew Waterfall : I’ve been stearing clear of oil as of late. Tough to get a read there for me

11:38 am Curtis M : That ol support puts Silver at right near 17.83 FYI

11:39 am Curtis M : And it puts Gold near that main resistance red arrow at 1201.64

11:39 am Mathew Waterfall : And there’s our miners selling right on the back of a USD ramp

11:39 am Mathew Waterfall : I’m getting my timing down with those calls lol

11:41 am Curtis M : $SPY stalled at resistance

11:48 am Mathew Waterfall : $GV for a swing along with gold. I was wrong about this earlier in the week about buying the breakout so I have been looking for a pullback. Stop under todays LOD

11:49 am Mathew Waterfall : This is a small starter. Will be looking to add either direction most likely

11:52 am Mathew Waterfall : I expect the dollar to cool a bit here. Running into down trend and neckline. close under 100.49 preferable

11:54 am Curtis M : Distance between 1190.20 and 1201.64 in Gold tough area to trade

12:09 pm Curtis M : taking a break before 1pm rigs and afternoon session back at 12:40 EST at latest

12:09 pm Mathew Waterfall : 10-4. $HTBX still running nHOD

12:16 pm Curtis M : were crashing may have to reboot

12:29 pm Curtis M : Gonna make a pot of coffee back in 15

12:50 pm Mathew Waterfall : $VIX products tempting me here. Historically VIX doesn’t stay this low for long though the leveraged VIX stuff can wear you down in roll fees.

12:50 pm Roger S : me too

12:52 pm Curtis M : Rigs on deck

12:57 pm Curtis M : Breadth not the best on $SPY but be careful

12:58 pm Curtis M : Theres a bear on Twitter calling for lower oil to 38 through this whole uptrend and well ya its 53 ish

12:58 pm Mathew Waterfall : Very similar to yesterday so far. Not much moving the market here

12:59 pm Mathew Waterfall : lol I love those people. At least they stick to their guns albeit the wrong guns lol

12:59 pm Curtis M : lol

12:59 pm Curtis M : rather be right than make money

12:59 pm Mathew Waterfall : I like be right but my mortgage company doesn’t accept that every month which is weird…

01:00 pm Mathew Waterfall : *to be

01:00 pm Curtis M : haha

01:00 pm Mathew Waterfall : +15 rihs. not much movement

01:01 pm Mathew Waterfall : *rigs. Jesus I can’t type

01:01 pm Curtis M : ya Fris quiet with rigs wanted to watch just in case

01:01 pm Mathew Waterfall : Sitting right on the 10 day on the 5′ chart

01:02 pm Curtis M : we get past pit close and market could get lift fyi and Trump on TV soon I think?

01:02 pm Scott K : he was supposed to be yes

01:02 pm Mathew Waterfall : Probably to talk more about Mexico

01:02 pm Scott K : with Theresa May

01:03 pm Mathew Waterfall : Breaking down the $VIX chart. Looks like ref low of 10.28 and I have a downtrend right under 20. 3/4 recent pops have made it to the trendline

01:07 pm Curtis M : Bear going off on Twitter 1200 Gold – the number is 1202.42 don’t listen

01:08 pm Curtis M : Red arrow is the mark on Gold

01:10 pm Curtis M : Gold is in a downtrend. That can’t be argued. Simple price action charting. Until that red arrow breached and tested Gold is not in reverse trend.

01:11 pm Curtis M : And even then it has to prove out other resistance areas. Gold could hit that red arrow and vsit 900 easy.

01:11 pm Curtis M : Not saying it will o wont but you dont bank guesing.

01:12 pm Mathew Waterfall : I think we are reading this a bit different. I agree with you, but we did get a successful break and backtest of the 23.6 at 11.84 which tells me we go 1221 unless we break under 1184.1 again

01:12 pm Curtis M : Between the blue arrow and the red arow it is anybody’s guess.

01:13 pm Mathew Waterfall : That’s how I’m reading it and why I don’t mind playing this mid level because my stop is fairly close

01:15 pm Mathew Waterfall : That’s the thing about charts though, you can often twist them to say what you want which makes trading without a bias very hard. My Macro view of lower dollar is also leading me here. We’ll see if I’m right

01:15 pm Curtis M : Gold got a bounce but it hasn;t reversed trend – depends on timeframe I suppose – but I’m talking about wide frame trend. Sure, it bounced from lows but not a trend reversal. And yes all on timeframe bbut the young traders don’t get the frames they get chopped. And big money in trend reversal hammer time lol

01:16 pm Curtis M : I’ve had sooooo many conversations with newer traders in latest Gold trade that have been killed cause they listened to wrong stuff – Mat you can trade it – many peeps can’t they haven’t got the skillset yet

01:17 pm Curtis M : here comes its test lol

01:17 pm Mathew Waterfall : To me it goes back to trading your play and having discipline. If this thing folds on me I’m out and not going to be blinded by my hopes and dreams of 1300 gold right around the corner. You also have to be quick to take profits

01:18 pm Curtis M : ya many new traders just haven’t got the toolkit yet to do what you can do or see what you can see

01:19 pm Curtis M : you should see the questions I get

01:19 pm Mathew Waterfall : Which IMO is compounded when you’re using levered ETFs too frequently. I like them, but to load up on them like some newer traders do is very risky

01:19 pm Curtis M : yup

01:20 pm Curtis M : So here lol heres my timeframe for downtrend

01:21 pm Curtis M : lol

01:22 pm Curtis M : For a trend reversal I need 1220 plus

01:22 pm Mathew Waterfall : 1221 and 1223 bit levels for me. Obvious when we look back at this week and we couldn’t even crack 1219

01:22 pm Mathew Waterfall : Also FYI I chart using /GC so my levels are often a point or 2 higher than your GOLD chart

01:23 pm Curtis M : Ya

01:23 pm Curtis M : Other thing is at levels it got to it should have continued and didn’t whch was wierd

01:24 pm Curtis M : Above 1210 ish it should have held and didn’t

01:24 pm Curtis M : odd

01:24 pm Mathew Waterfall : Had more to do with the dollar there I think

01:25 pm Curtis M : ya that part the roaring bear has right

01:25 pm Curtis M : lol

01:25 pm Curtis M : talking about twitter

01:25 pm Mathew Waterfall : Seriously. Just like me he has some nuggets in there but also some crazy talk

01:25 pm Curtis M : haha

01:26 pm Curtis M : normally, over that blue lne on that chart the price would have held

01:26 pm Curtis M : just talking probabilities

01:26 pm Curtis M : based on backtesting 5 years

01:27 pm Mathew Waterfall : Huge up day for dollar yesterday. I still have the dollar in a H&S pattern though Im following that until it breaks

01:27 pm Curtis M : Its almost like Trump and Japan are n on it together to keep Gold down

01:28 pm Curtis M : its very odd

01:32 pm Steve S : way i see it guys is the bear haha is going off about gold and silver up this year but not up since summer last year way way lower and can always go lower too so ya my opinion

01:32 pm Steve S : so I trade price and trend

01:34 pm Caide X : Curtis – last fall you were saying lower and stayed with that and we’re lower and now if I understand you are saying let it decide – or prove a reversal or continuation correct?

01:35 pm Curtis M : good way to put it yes correct

01:35 pm Caide X : 🙂

01:36 pm Curtis M : This move today in Silver is an anomoly FYI but it needs 17.86 and higher held to be a reversal n our modeling

01:36 pm Caide X : Yes, I got that too thanks.

01:37 pm Curtis M : But Caide that means I will miss some of the start of every move too.

01:37 pm Caide X : Right.

01:38 pm Caide X : For example then, with Gold, when is the downtrend re-confirmed?

01:41 pm Mathew Waterfall : wow just saw a chart on bloomberg of SPX/VIX at the widest split ever. Crazy

01:41 pm Curtis M : yup

01:41 pm Mathew Waterfall : People say bull markets end on euphoria and people aren’t euphoric yet. I would say that might be changing if no one is worried about the downside

01:42 pm Curtis M : theres gong to be a lot of first 🙂

01:43 pm Curtis M : Caide you watchin?

01:44 pm Caide X : were all watching – ready

01:44 pm Curtis M : In our modeling heres a trend

01:45 pm Curtis M : And here is a reversal that failed

01:45 pm Curtis M : July 4 or so last year

01:46 pm Curtis M : So when we published targets at 1163 and possibility for lower we knew there was a revrsal coming because of anomolies in trade

01:47 pm Curtis M : In that red cricle there were things hapening in trading that didn’t happen before so we knew reversal was going to fail

01:48 pm Curtis M : Then wwhen it hit 1163 we said there was a 90% chance it would continue to bottom of quadrant and it did

01:49 pm Caide X : So where does it completely prove itself as an uptrend?

01:49 pm Curtis M : Its stages of decisions as it goes

01:51 pm Curtis M : wide view it needs approx 1215 then 1250 then and so on1374 and gone but chances are very slim until things change (but I’ve given more precise targets too you can look at in our notes etc but I think you get idea

01:51 pm Curtis M : So downtrend is…

01:52 pm Curtis M : Show me 1124 or lower first then…

01:52 pm Curtis M : then evry step down needs to be lower to kep a trend

01:52 pm Curtis M : basic lol I know

01:53 pm Caide X : I get it

01:53 pm Caide X : So make the decisions based on lower frames like in your newsletters and stay with trend while it confirms along the way, correct?

01:53 pm Curtis M : YES!

01:54 pm Curtis M : amen lol

01:54 pm Caide X : Thats what Fibonacci Queen always says. Decision to decision and confirm.

01:54 pm Mathew Waterfall : Winner winner on that caide

01:55 pm Curtis M : ya she’s awesome

01:55 pm Curtis M : Price Trigger Trade

01:55 pm Caide X : Thanks Mathew

01:56 pm Curtis M : The triggers are what I’ publishing and I’ll walk you along decision by decision in newsletters as trend moves

01:56 pm Curtis M : Like with oil, you know the very specific decisions.

01:56 pm Curtis M : Yellow line at top resistance and that blue trendline at bottom support per newsletter

01:56 pm Caide X : Right

01:57 pm Curtis M : So thats why Silver needs 17.86

01:57 pm Curtis M : Gold needs 1202.48

01:58 pm Curtis M : For longs… and when you enter if it fails you have stops

01:58 pm Caide X : Got it thanks

01:58 pm Curtis M : No Prob webinars coming

02:01 pm Curtis M : If you got a long on Gold at 1202 ish you could likely run it to 1300 without a worry just rathceting stops as you go

02:01 pm Curtis M : ish

02:01 pm Curtis M : decision to decision

02:01 pm Curtis M : here coms test again

02:09 pm Mathew Waterfall : $SSRI hit the volume scanner so silver miners seeing some nice flows here

02:09 pm Mathew Waterfall : They frontran the move a bit last week into this weeks pop and drop

02:10 pm Curtis M : getting jiggy

02:12 pm Jon R : $JUNO jiggy Curt

02:12 pm Curtis M : thx

02:14 pm Wie W : Bear on Twitter losing his mind in case you care.

02:15 pm Curtis M : haha I would be frustrated to

02:15 pm Curtis M : Gold looking bullish intra tho

02:15 pm Mathew Waterfall : I wonder how some of these guys make money. It sounds like some of them run funds and I believe they have something to do with managed money as they discuss in depth issues at times, but seeing P?L sheets would be funny

02:16 pm Curtis M : ya…. you and I will talk soon, we have insight

02:16 pm Curtis M : later date soon

02:17 pm Curtis M : could pop here tho lol

02:18 pm Deni T : $URRE guys pop

02:18 pm Mathew Waterfall : Seeing some nice QQQ call buying today. Only real big orders on the indexes overall

02:18 pm Curtis M : Qs have the big boys in now

02:18 pm Mathew Waterfall : yepp and rolling into more earnings next week

02:20 pm Mathew Waterfall : Bonds grinding nicely here to. Would love for $TLT to get going for me

02:25 pm Curtis M : $TRCH strong price considering indicators aren’t revving

02:25 pm Curtis M : Very bullish

02:28 pm Curtis M : OIl!

02:28 pm Curtis M : oily!

02:28 pm Curtis M : pit close

02:31 pm Curtis M : That was actually a positve pit close considering

02:32 pm Mathew Waterfall : Yepp kind of a surprise. Still seems stuck in that chop though. OIL that is

02:32 pm Mathew Waterfall : Well same could be said for most of the market

02:32 pm Curtis M : oh ya it is but time cycles coming to end soon so thought we may see panic…. interesting cause oil has a mjor major resistance overhead

02:33 pm Curtis M : interetsing times

02:33 pm Curtis M : but its in sideways till it isn’t lol

02:33 pm Curtis M : $TRCH may pop

02:33 pm Mathew Waterfall : Yepp let that one show its hand before I jump in

02:33 pm Curtis M : yup

02:34 pm Curtis M : good way to put it – I think I’ll steal that if I may lol

02:34 pm Mathew Waterfall : Sure thing

02:37 pm Curtis M : $TRCH jiggy

02:37 pm Curtis M : Gary you’ll have to look at chat logs when publishd lots of info – just notced you’ve been in and out today is all. Just a heads up. Lots of data n chat.

02:38 pm Curtis M : If you’re holding $TCH anyone you may want to consider selling

02:38 pm Curtis M : I’m not tho not right this minute

02:38 pm gary y : will do

02:39 pm Mathew Waterfall : Over that high looks decent to me, indicators are turning favorable

02:39 pm Mathew Waterfall : Thought Friday afternoon on a boring day might not lead to much volume here

02:39 pm Curtis M : It;s a permian play

02:39 pm Curtis M : I have a 2.80 target but u never know

02:39 pm Curtis M : 2.80 – 4.20

02:40 pm Mathew Waterfall : The Trump factor will have to cooperate

02:40 pm Curtis M : yup

02:49 pm Curtis M : Well this is interesting…. Silver at decision, Gold at decision, SPY well you know, Crude coming up on decison and market momos bla…. I have seen this before – I’m old – and my guess because end of month end of Tuesday we have a barn burner Mon and Tues up or down likely up bullish – just my guess.

02:50 pm Mathew Waterfall : Or as I would say: Them dice is hot!

02:51 pm Curtis M : lol gambler Mathew – like my wife the poker player

02:51 pm Mathew Waterfall : I actually hate gambling and casinos

02:51 pm Mathew Waterfall : Not for me

02:52 pm Curtis M : I quit I was a bacarrat guy… done

02:54 pm Mathew Waterfall : Seems like I hear that story often. I just don’t enjoy it and can understand both the entertainment and skill sides to the games just not my cup of tea

02:55 pm Curtis M : No skill in bacarrat just balls of steel and stupidity and drinking stuff like that at least poker has skill involved lol

02:56 pm Mathew Waterfall : haha I’ve never even played that game I know the basics and that’s about it

02:57 pm Curtis M : here it comes

02:58 pm Mathew Waterfall : Just like last friday except we were looking for 1210+. I’ll take 1200 lol

02:58 pm Curtis M : It may pop decet here

03:03 pm Steve S : Curt I don’t know what t o do $TRCH is my play this week!!! Sell?

03:04 pm Curtis M : Can’t tell you what to do

03:04 pm Curtis M : I’m holding but its a small play for my portfolio

03:05 pm Cara R : I’ll tell you what to do Steve!

03:05 pm Cara R : Curt always wins bahahaha

03:05 pm Curtis M : omg

03:07 pm Steve S : I have seen him loose but small. Always small. I think its a good story $TRCH and Mathew is right its all about Trump.

03:07 pm Curtis M : Of course I lose:)

03:08 pm Curtis M : Would like 1 play here

03:08 pm Curtis M : Buy momma a new dress

03:13 pm Curtis M : $LGCY strong too fyi

03:19 pm Mathew Waterfall : Daily volume on /ES is pitiful. I’m not playing anything this afternoon don’t want to get trapped

03:24 pm Curtis M : ya its beer timme but i’ll be here in office and close down at 4

03:24 pm Mathew Waterfall : interesting flows taken from twitter

03:24 pm Mathew Waterfall : This wk: -$5.7b outflow from domestic equity MF and ETFs. Last 7 wks = -$7.0b out+$2.8b inflow to taxable bond funds. Last 6 wks = +$0.9b

03:25 pm Mathew Waterfall : Seems to me smart money is moving into bonds a bit out out of equities

03:33 pm Curtis M : Well Mat – Gold up or down Sunday night?

03:34 pm Mathew Waterfall : Let me warm up the crystal ball one sec

03:34 pm Mathew Waterfall : Up on USD weakness

03:34 pm Curtis M : I need a good week next week or I will snap fyi – need some action and I know I’m not the only one lol so it’s gonna get jiggy.

03:34 pm Curtis M : I see horns on that $TRCH chart

03:34 pm Mathew Waterfall : Monday sees similar action today before more weakness overall thanks to a VIX spike that finally happens

03:35 pm Mathew Waterfall : Many things are looking week and or double toppy

03:35 pm Curtis M : interesting well give me up or down plz thanks Mat

03:35 pm Mathew Waterfall : Market needs a small correction to draw in new money. I say downside liquidation break into mid week with FOMC on deck

03:36 pm Mathew Waterfall : Gold up but not much. Holding anything now hoping for huge gap on Monday unlikely

03:37 pm Mathew Waterfall : Watching USD close into the close. Under 100.49 and I will get more bullish metals over the weekend. I do like VIX products here though

03:38 pm Mathew Waterfall : That’s my crystal ball. $TLT 121 by next friday, gold sees 1220 test, and silver gets to 17.5 before floating around. All of this is assuming no rate hike next week. Those are my calls

03:40 pm Curtis M : 🙂

03:40 pm Curtis M : Sound reasonable.

03:40 pm Mathew Waterfall : I echo your statement in needing a good week. This week was boring and hard to make much $$$

03:41 pm Curtis M : very tough

03:41 pm Curtis M : last 8 market days

03:41 pm Curtis M : maybe 7 lost track

03:42 pm Mathew Waterfall : Yepp chop city with no volume. That is what is making me very suspicious of what’s going on under the hood here. Kind of feels like some players are unloading quietly. I have seen some big dark pool prints and not a lot of conviction in the call buying as well. Clues possibly

03:42 pm Mathew Waterfall : Not that large money is always right, but they have the good info more often than not

03:43 pm Curtis M : ya

03:44 pm Curtis M : I’m being overly optomistic – my thesis is generally that guys like us are like wtf can we just get on wth some action lol

03:45 pm Mathew Waterfall : Exactly. I don’t care what direction we go, I just want to go somewhere. I have no interest in calling turns or tops/bottoms. I just want a trend to play

03:45 pm Mathew Waterfall : top calling is futile and will leave you broke more often than not

03:46 pm Curtis M : I see Silver bulls on Twitter

03:54 pm Mathew Waterfall : MOC useless today as well

03:55 pm Mathew Waterfall : Have a good weekend all. I’m out of here shortly. Basically a sideways week for me. Small gains but nothing to write home about. Hopefully we get some volatility sooner or later or I’m going to have to take up wood carving to have something to do

03:55 pm Curtis M : You too Mathew thanks enjoy!

03:55 pm Lui S : Ya thanks guys!

03:55 pm Deni T : Peace Mat!

03:56 pm Caide X : $RGSE guaranteed dead dog

03:59 pm Curtis M : $TRCH nice close

04:00 pm Curtis M : Cya guys and gals enjoy your time down!

04:01 pm Steve S : bye

04:01 pm Steve S : thanks curt

Be safe out there!

Follow our lead trader on Twitter:

https://twitter.com/curtmelonopoly

Article Topics: $GOOGL, $DUST, $JUNO, $CBMX, $ROKA, $TRCH, $LGCY, $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500