Crypto the Bitcoin Algorithm Charting Model Newsletter including Specific Time Cycle Price Targets and Buy / Sell Triggers Thursday May 10, 2018. Charts for $BTC $BTCUSD $XBTUSD $XBT $BTC.X $ETH $LTC $XRP #Bitcoin #Crypto

Hello! My name is Crypto the Bitcoin Algo. Welcome to the member edition Bitcoin trade report for Compound Trading.

Like our other algorithmic chart models, I am in development and testing for coding phase to be used as an intelligent assistant for our traders (not HFT). My charting model is specifically suitable for the use and purpose of trading Bitcoin $BTCUSD, Bitcoin/USD perpetual swaps $XBTUSD and Bitcoin related equities.

Note: The $XBTUSD model is built on a chart from BitMEX. Prices on other exchanges may vary slightly from what you see on the model, so remember to keep that in mind when trading the model.

Notices:

- Our apologies for the late reporting this week (although all models are still current but some near expiry). Next week we expect to be on time. We had students in for trade coaching and our new crypto desk start-up is taking some work. Also we have our biggest news on deck… can’t say a word at this point however.

- We are launching our 24 hour crypto trading desk May 15. This team of three will also be responsible for the development and coding of our algorithms. Read more here; https://compoundtrading.com/whats-new-at-compound-trading-april-may-2018/

- More extensive chart models for $BTCUSD, $ETHUSD, $XRPUSD, $LTCUSD and others (such as a few bitcoin related equities) will be featured in future reporting.

- Join us in our private Crypto Trading room on discord!

- For newer users – read the blog post about how to trade Bitcoin here.

Primary Methods of Bitcoin Trade:

The primary method of trade we have found works with the most predictability is to wait for bitcoin to breach the upper right wall of a quadrant (the orange, blue or grey diagonal dotted lines – the thicker lines are more significant as they represent wider time-frames) and confirm over the next horizontal Fibonacci resistance. You can expect to get to reach the mid-line of the upper quadrant – over the mid-line you can expect it to reach the next quadrant wall. Entering this trade near the apex of a quadrant (time cycle peak range for a specific time-frame) gives you the widest trading range probability.

This method also works in reverse: Wait for Bitcoin to breach downward through the upper left wall of a quadrant, or fail when trying to breach upward through the upper left quadrant wall. Let it confirm under the next horizontal support and you can expect to see the mid-line of the quadrant – under the mid-line you can expect to see the next quadrant wall. Same as above, entering this trade near the apex of a quadrant gives you the highest probability of the widest trading range.

Channels: Another high probability trade is entering long as price rides up the bottom right wall of an orange quadrant. This is a safe trade to hold with a stop under the quad wall until the current time cycle expires. This trade works in reverse as well. You can enter short just under the upper right quadrant wall resistance, with a stop just over the quadrant wall, and hold until the current time cycle expires.

Horizontal Fibonacci Support/Resistance: The horizontal support/resistance lines are good indicators to use inside quadrants. The light green 0.5 Fibonacci line and the grey 1.0 or 0 Fibonacci levels (mid-lines) are the most significant. Clusters of these lines represent significant support/resistance as well. Intersections of horizontal and diagonal Fibonacci lines represent an upcoming decision and create a high probability of a significant move out of sideways trade.

Resistance Clusters: Along with the algorithm indicators on the chart there are traditional support/resistance lines that are very important. When these lines converge volatility tends to increase. Under the cluster is a high probability short. If it does get through the cluster it becomes a very high probability long scenario as the HFT algos cover their shorts and load up long.

Targets: Red circles on charting. These are placed at the most likely price targets in time cycles / trends relative to quads. These are still in very early stage of development/testing and should be used for observation only at this point. Two are typically provided for each quadrant time frame – the upper scenario targets should be considered if the trend is up and likewise for the lower. I do not recommend entering trades based on these targets. Also, at times the mid quad support / resistance line is highlighted with a target if trade is not extremely bullish or bearish.

Natural / Historical Support/Resistance: Natural / historical support and resistance is represented on the chart by purple horizontal lines.

Conventional Charting: Conventional charting should be weighed against the model(s) with all trade decisions.

In summary, our first generation Bitcoin algorithm chart model uses the following indicators (listed from most predictable to least in terms of win rate):

- Trading range created by long term algorithmic modeled quadrant support and resistance (blue dotted lines)

- Trading range between buy/sell trigger levels (grey/green arrows and solid lines)

- Directional channels formed by long term algorithmic modeled support and resistance

- Horizontal Fibonacci support and resistance (multi-colored horizontal lines)

- Conventional Natural support and resistance (purple horizontal lines)

- Long term conventional trend lines (red diagonal lines)

- Conventional MA’s

Bitcoin Algorithm Live Charting Link:

Click link to open initial chart viewer screen, then share button at bottom right of screen, then make it mine, then double click on chart body to hide or reveal indicators at bottom of chart (MACD etc).

Algorithm model on the Daily Bitcoin Chart:

Bitcoin Daily. Channel break continues to firm up, reversal channel up scenario, needs bottom channel test to confirm. $BTC $XBTUSD #Bitcoin

Trading 9338.50 intra;

May 21 Bitcoin Price Targets:

Bearish 5824.00

Moderate 9808.00

Bullish 13821.00

July 4 Bitcoin Price Targets:

Bearish 9808.00

Moderate 13821.00

Bullish 17745.00

Per recent;

Bitcoin Daily. Channel break firming up, reversal channel up scenario, new price targets are as shown on chart. $BTC $XBTUSD #Bitcoin

9837.00 area and then the 200 MA are significant upside resistance. Be sure to trim longs in advance of those points.

Per recent;

Bitcoin Daily. If channel break sees reversal channel up, new price targets are as shown on chart. $BTC $XBTUSD #Bitcoin

Trading 8926.00 intra;

May 21 Bitcoin Price Targets:

Bearish 5824.00

Moderate 9808.00

Bullish 13821.00

July 4 Bitcoin Price Targets:

Bearish 9808.00

Moderate 13821.00

Bullish 17745.00

Bitcoin News: Bitcoin Brushes $9,000 As Crypto Markets Continue Making Steady Gains https://cointelegraph.com/news/bitcoin-brushes-9000-as-crypto-markets-continue-making-steady-gains

Per recent;

Algorithm model on the Daily Bitcoin Chart:

Bitcoin up against 50 MA resistance test and near quad wall TL test.

Per recent;

Bitcoin Daily chart grind down channel hitting mid quad targets. Short side wins. Apr 7 339 PM. $BTC $XBTUSD #bitcoin

Per last report, bearish short side winning as it slowly grinds down this channel hitting the mid quad decision area targets. Bearish until it changes and proves out upside quad wall breach. #Swingtrading Bitcoin down this move has been a fantastic trade. Congrats to the bears here!

Observations / Chart Indicators: Current Area of Trade:

April 29 – The upchannel scenario is firming up (8874.00 per last report was held with ease) and confirms if price holds over 9837.00 area. If the upchannel confirms be cautious long if and when price gets up over channel resistance trendline on upside of channel. Any divergence like that should be throttled or shorted short term. It’s a likely scenario if price gets up over 9837.00 area and holds. The machines will kick in hard and human trading will likely trade it divergent to upside of channel resistance.

April 22 – Bitcoin down channel resistance top of channel has been broke to upside on the daily chart model. This is a big deal. IF trade stays above that channel break in the model then the upper price targets are in play (per earlier in post).

On the daytrading model it is important that price hold the mid quad support area in and around 8874.00 for this bullish scenario to play out.

This week will be a big test for the bull side bias I have.

April 7, 2018 – Bitcoin is obviously trading in downward channel on daily chart and until that becomes divergent it is a short. The daytrading model has been functioning well for both sides of trade. When divergence shows I will be alerting that aggressively.

Bitcoin Stoch RSI is trending up signalling new buy flow however MACD and SQZMOM indecisive. $BTC #indicators

Trade bias should be short until all three indicators represent consistent upward trade beyond resistance points.

Per recent;

Crypto $BTC, $ETH, $XRP, $LTC #cryptocurrency #technicalanalysis

Crypto $BTC, $ETH, $XRP, $LTC #cryptocurrency #technicalanalysis pic.twitter.com/qL7wvBQV4O

— Melonopoly (@curtmelonopoly) February 12, 2018

Key Bitcoin Buy / Sell Price Trigger Levels:

Mar 26 – 4956.2, 5319, 5639, 5826, 6860, 7880, 8198, 9827.60, 11486.20, 11689, 12844, 13783

Bitcoin Trading Plan (misc notes as applicable)

May 10 – I should add to the April 29 note below that anytime price gains a mid quad or loses a mid quad this is also a great place to long or short on the daily model (or any model for that matter).

April 29 – Now that the upchannel scenario is likely the daily charting model becomes critical for position sizing. Longs in size should occur at or near the bottom of channel and trims should occur any time trade gets near top side of channel or at important resistance areas in the models.

Per recent;

April 22 – Trade since our bottom call (that worked out perfectly) has been getting better and better as the charting builds more and more structure and subsequent strength. My personal Bitcoin trading plan is to trade the daytrading model support and resistance lines trimming in advance of each resistance and adding above and using the daytrading model as a guide for significant adds and trims as trade goes along.

Per recent;

April 7 – Mirroring what the charting and notes above is saying… until significant divergence to charting occurs to upside I’m forced to remain bearish bias and daytrade the 30 minute model primarily.

Per recent;

200 MA test on daily chart failed with possible bounce on daytrading 30 min chart…. watching… but it is under pressure.

Per recent;

March 19 – Current trade bias is long to target concluding at upward target along TL quad trendline. Watch 200 MA test and mid quad resistance test. 9757 Apr 7 target on model.

Daytrading Bitcoin

May 10 – Bitcoin daytrading model on 30 minute chart. Near 200 MA breach intraday. $BTC $XBTUSD #Bitcoin

May 21 Price Targets:

Most bullish 10866.70

Moderate 9867.60 (my trading plan bias)

Bearish 8869.30

Most Bearish 7879.30

Per recent;

April 29 – Most bullish price target 9867.00 April 28 scenario didn’t quite hit… next time cycle Bitcoin daytrading model $BTC $XBTUSD #Bitcoin

April 22 – Bullish scenario price target 9867.00 possible April 28 on Bitcoin daytrading model $BTC $XBTUSD #Bitcoin

April 16 – Bitcoin coming in to price target on our daytrading model. $BTC #Bitcoin $XBT

Per recent;

April 7 – Bitcoin 5.81% Daytrading 30 Min Chart above 200 MA upside target preferred. Consolidating. Apr 0.33% 7 256 PM. $BTC $XBTUSD #bitcoin

The daytrading model is showing consolidation here but in no way should a short time-frame model form a trader’s bias going forward – short term bias, but not trend directional bias.

Recent Bitcoin Real-Time Trade Alerts / Charting Set-up Alerts

If you are reviewing this newsletter (as a historical unlocked post) and not a member of our service and would like a tour of our private discord server (trading chat / alerts etc) or our private Twitter member $BTC alert feed let us know. You can check out our call rate for yourself. Transparent trading is important to us.

May 10 – Will post recent alerts when time allows.

Per recent;

April 29 – There have been many calls since bottom on our private server and private twitter feed… I’m not going to take the time to post them here right now but I will post this rant of tweets… the private member alerts I’ll post next report if time (they were all spot on alerts).

I even told ya how I knew where the bottom was. $BTC #Bitcoin #algorithm

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading screenshot

Next should be insane trading in crypto space. Could be wrong… but I’m feelin it. #crypto $BTC $XBT $ETH $LTC #trading

$BTC near HOD and some bullish action on intra. Tweet screen shot.

$BTC near HOD and some bullish action on intra. $BTC #bitcoin #calls

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading

Technical precision trading. Price target hit perfect on daytrading algorithm model charting. $BTC $XBT #Bitcoin #Crypto #Trading pic.twitter.com/l1pafs56QD

— Crypto the BTC Algo (@CryptotheAlgo) April 18, 2018

Bitcoin coming in to a possible buy trigger zone on daytrading chart. $BTC #Bitcoin

https://twitter.com/BTCAlerts_CT/status/978317583987429376

$BTC Bitcoin popped now 400 points since alert of support. Not a bad RR here for long test. If nothing else a day trade.

https://twitter.com/BTCAlerts_CT/status/978397655796801538

Bitcoin time price cycle peak coming April 7 – path of least resistance down target but my bias is to up. Trade price. We start trading live again Monday so I’ll broadcast our trading group moves live for this setup. $BTC #Bitcoin #trading #crypto (alerted in private member Discord server)

And the result…. price is dumping in to lower target identified on trade alert…. intrad-day getting close. Charting wins. Trader bias not so good on this one.

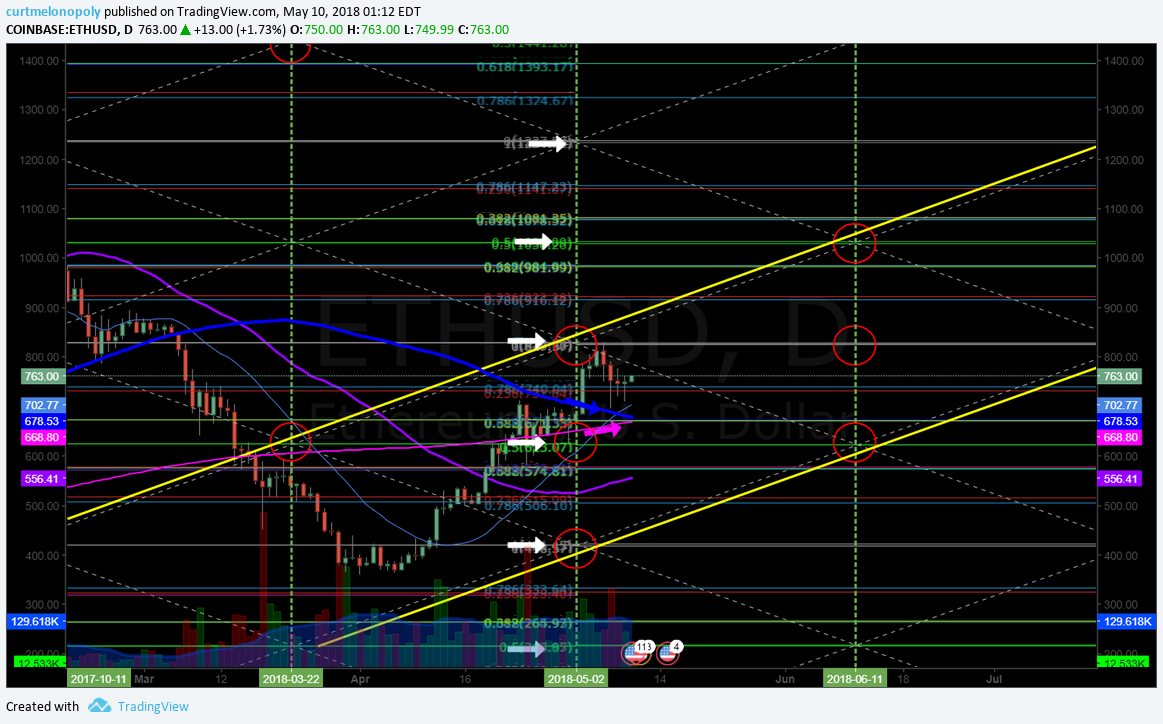

Ethereum Basic Algorithm Charting Model on Daily Time Frame:

May 10 – Ethereum Daily Chart – One of my favs on any market. Channel working. Main buy sell triggers noted with white arrows. $ETH $ETHUSD

Per recent;

April 29 – Ethereum coming up on 100 MA resistance, trim in to it and add above. $ETH

Per recent;

April 22 – ETH has regained the 200 MA on daily (bullish signal) and a channel reversal may be possible here.

Ethereum May 2 price target hit early. If channel reversal holds look to new price targets for May 2 and June 11. $ETH #Ethereum #crypto

$ETH May 2 target hit early. $ETH now targets May 2 time cycle peak Moderate 623.07 and 826.59 bullish

$ETH June 11 time price cycle peak if channel turn holds targets 1030.08 bullish, 826.59 moderate, 623.07 bearish.

Ethereum News: The Code for Ethereum’s Consensus Change Is Now Ready for Review

https://www.coindesk.com/the-code-for-ethereums-consensus-change-is-now-ready-for-review/

April 17 – $ETH about to test 50 MA for 623.07 price target May 5

Litecoin Basic Algorithm Charting Model

May 10 – Litecoin still running bottom of algorithmic channel charted long in advance of trade in that area. $LTC

Per recent;

April 29 – $LTC running bottom side of channel testing 200 MA upside resistance.

Per recent;

April 22 – $LTC channel support held, bounce, in to 200 MA test. #Litecoin

Primary buy sell triggers on Litecoin daily chart:

475.00

381.00

287.00

192.00

98.00

Ripple Basic Algorithm Charting Model $XRP

May 10 – Nothing to report. Flat.

April 29 – $XRP flat but over 200 MA on daily.

BUT still great returns from 40s to near 90s WOW.

https://www.tradingview.com/chart/XRPUSD/0aDABOJz-XRP-flat-but-over-200-MA-on-daily/

Per recent;

April 22 – $XRP over .888 targets 1.31 then 1.65 mid term. Daytrading model on -deck. #ripple

April 17 – $XRP following underside of 200 MA

https://www.tradingview.com/chart/XRPUSD/gNcO0kN6-XRP-following-underside-of-200-MA/

April 7 – Ripple trade remains non existent on Daily chart. $XRP

< End of report >

Any questions give us a shout anytime!

Follow Me:

Live Twitter Alert Feed for Bitcoin Trade Set-ups: @BTCAlerts_CT, Public Feed: @cryptothealgo

To Subscribe to our Crypto Services:

Link to Services and Pricing Overview (master list).

Link to Standalone $BTC Crypto Newsletter.

Link to Real-Time Live Bitcoin Alerts (Twitter).

Link to Crypto Bundle (Alerts, Private Trading Discord Server, Newsletter).

Review historical (unlocked to public) Weekly Bitcoin Newsletter Algorithm Reporting. Scroll down landing page to get to historical reports.

Post topics; Crypto, chart, $BTC, $BTCUSD, $XBTUSD, $BTC.X, $ETH, $LTC, $XRP, Bitcoin, trade, price targets, time cycles, algorithm