Category: SP500 (SPY) Algorithm

S&P 500 $SPY Member Trade Charting Thur Mar 2 $ES_F $SPXL, $SPXS

S&P 500 $SPY Trade Update Thursday Mar 2, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Current Trade in $SPY S&P 500.

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants have not been updated on this charting – there is some work to do here so we will update them soon.

Symmetry Extension Targets – As noted, the previous report upside target was hit again! The new chart includes an upside and downside trade target. Most probable upside if trade is in uptrend is 243.28 before a decision. Most probable downside if trade is in a downtrend is 236.47 before a decision.

Time / Price Cycles – There are currently no significant cycles in the charting.

Trading Bias – Bias is to the long side.

The charts below are still in play so I won’t update them yet, but I will mention that the diagonal trendlines that are white dotted you want to pay attention to as possible support and resistance anytime you see them.

30 Min Chart Trading Ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Tues Feb 21 351 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Tuesday. The Fibonacci indicator settings have proven to be very precise in recent trade. The upside extension in this chart model is very similar to the chart above. Also, price is about to enter under the bottom center of a price apex – this chart bias is toward downside target of at least 231.72.

$SPY 30 Min Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/oad7PuED-30-Min-Chart-Trading-Ranges-with-Fibonacci-MAs-VWAP-Cloud-AO/

$SPY MACD Bullish on 15 Min Chart

This chart is bullish – trade bias to upside to resistance noted in above charts and ratchet stops.

https://www.tradingview.com/chart/SPY/aoCCTSfU-SPY-MACD-Bullish-15-Min/

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS

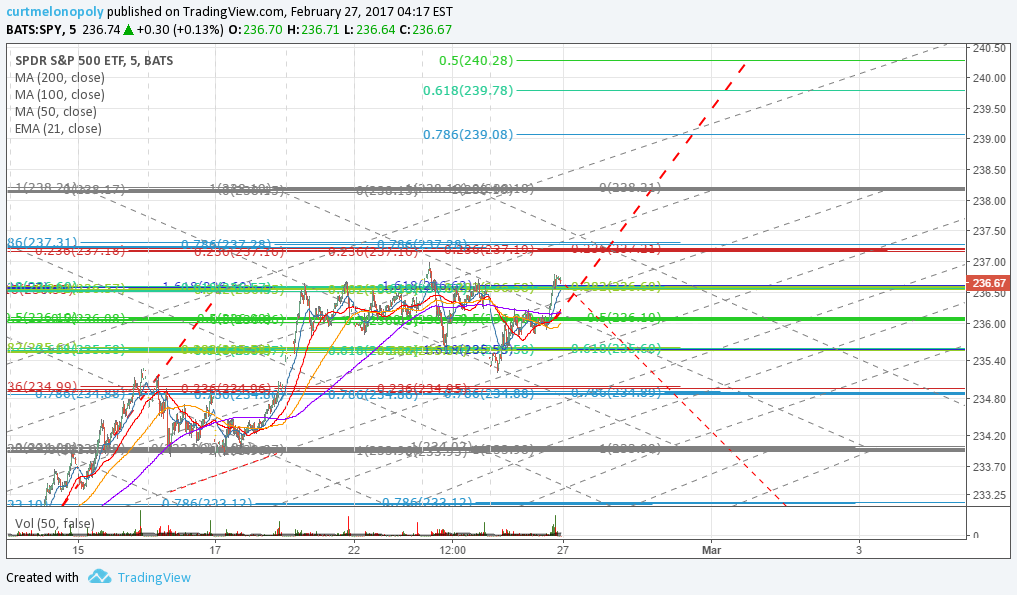

S&P 500 $SPY Member Trade Charting Mon Feb 27 $ES_F $SPXL, $SPXS

S&P 500 $SPY Trade Update Monday Feb 27, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Current Trade in $SPY S&P 500.

Recent trade is sideways so upside and downside targets remain the same as previous.

S&P 500 $SPY Symmetry price target extensions, trade quadrants, Fibonacci. Trade Charting Friday Feb 27 517 AM $ES_F $SPXL, $SPXS

Trading Quadrants – The trading quadrants have not been updated on this charting – there is some work to do here so we will update them soon.

Symmetry Extension Targets – As noted, the previous report upside target was hit! The new chart includes an upside and downside trade target. Most probable upside if trade is in uptrend is 240.28 before a decision. Most probable downside if trade is in a downtrend is 233.02 before a decision.

Time / Price Cycles – There are currently no significant cycles in the charting.

Trading Bias – Bias is to the long side.

The charts below are still in play so I won’t update them yet, but I will mention that the diagonal trendlines that are white dotted you want to pay attention to as possible support and resistance anytime you see them.

30 Min Chart Trading Ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Tues Feb 21 351 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Tuesday. The Fibonacci indicator settings have proven to be very precise in recent trade. The upside extension in this chart model is very similar to the chart above. Also, price is about to enter under the bottom center of a price apex – this chart bias is toward downside target of at least 231.72.

$SPY 30 Min Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/oad7PuED-30-Min-Chart-Trading-Ranges-with-Fibonacci-MAs-VWAP-Cloud-AO/

$SPY MACD Bullish on 15 Min Chart

This chart is bullish – trade bias to upside to resistance noted in above charts and ratchet stops.

https://www.tradingview.com/chart/SPY/aoCCTSfU-SPY-MACD-Bullish-15-Min/

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS

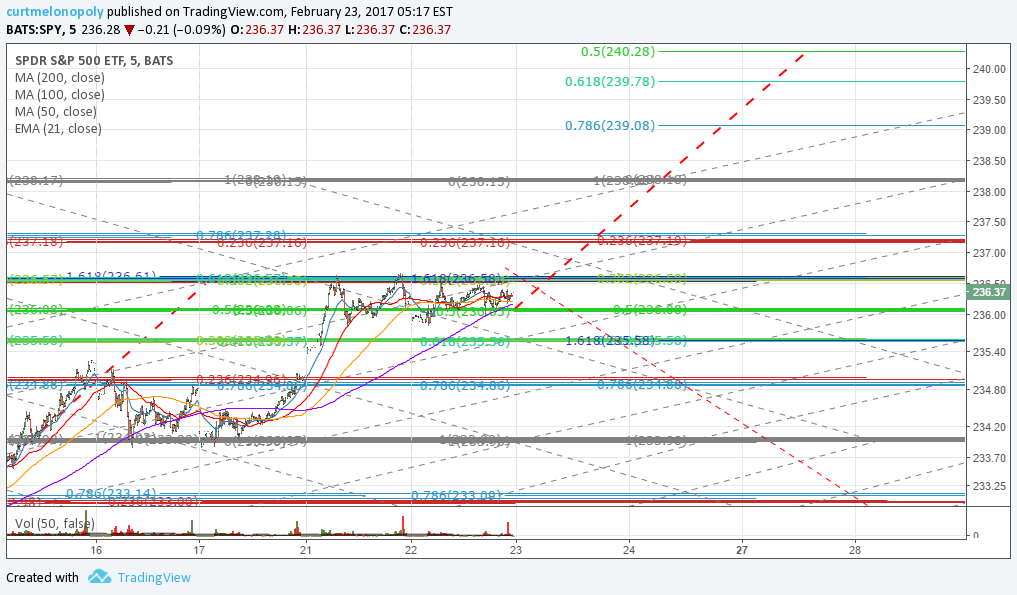

S&P 500 $SPY Member Trade Charting Thurs Feb 23 $ES_F $SPXL, $SPXS

S&P 500 $SPY Trade Update Thursday Feb 23, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Current Trade in $SPY S&P 500.

Well this is interesting, the upside targets have hit exactly as prescribed in the previous report – this is three time cycles in a row our calls have hit so this is getting more predictable.

S&P 500 $SPY Symmetry price target extensions, trade quadrants, Fibonacci. Trade Charting Thurs Feb 23 517 AM $ES_F $SPXL, $SPXS

Trading Quadrants – The trading quadrants have not been updated on this charting – there is some work to do here so we will update them on weekend.

Symmetry Extension Targets – As noted, the previous report upside target was hit! The new chart includes an upside and downside trade target. Most probable upside if trade is in uptrend is 240.28 before a decision. Most probable downside if trade is in a downtrend is 233.02 before a decision.

Time / Price Cycles – There are currently no significant cycles in the charting.

Trading Bias – Bias is to the long side.

The charts below are still in play so I won’t update them yet, but I will mention that the diagonal trendlines that are white dotted you want to pay attention to as possible support and resistance anytime you see them.

30 Min Chart Trading Ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Tues Feb 21 351 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Tuesday. The Fibonacci indicator settings have proven to be very precise in recent trade. The upside extension in this chart model is very similar to the chart above. Also, price is about to enter under the bottom center of a price apex – this chart bias is toward downside target of at least 231.72.

$SPY 30 Min Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/oad7PuED-30-Min-Chart-Trading-Ranges-with-Fibonacci-MAs-VWAP-Cloud-AO/

$SPY MACD Bullish on 15 Min Chart

This chart is bullish – trade bias to upside to resistance noted in above charts and ratchet stops.

https://www.tradingview.com/chart/SPY/aoCCTSfU-SPY-MACD-Bullish-15-Min/

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS

S&P 500 $SPY Member Trade Charting Tues Feb 21 $ES_F $SPXL, $SPXS

S&P 500 $SPY Trade Update Tuesday Feb 21, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Current Trade in $SPY S&P 500.

S&P 500 $SPY Symmetry price target extensions, trade quadrants, Fibonacci. Trade Charting Thurs Feb 21 323 AM $ES_F $SPXL, $SPXS

Trading Quadrants – The trading quadrants for the time frame are also predictable, not perfect, but predictable. We are going to reset these when trade moves out of current range.

Symmetry Extension – Most probable upside if trade is in uptrend is 236.56 before a decision. Most probable downside if trade is in a downtrend is 232.98 before a decision. Trade is currently in a fixed range 234.98 – 233.95.

Time / Price Cycles – There are currently no significant cycles in the charting.

Trading Bias – We have no bias at this time.

30 Min Chart Trading Ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Tues Feb 21 351 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Tuesday. The Fibonacci indicator settings have proven to be very precise in recent trade. The upside extension in this chart model is very similar to the chart above. Also, price is about to enter under the bottom center of a price apex – this chart bias is toward downside target of at least 231.72.

$SPY 30 Min Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/oad7PuED-30-Min-Chart-Trading-Ranges-with-Fibonacci-MAs-VWAP-Cloud-AO/

$SPY MACD Bullish on 15 Min Chart

This chart is bullish – trade bias to upside to resistance noted in above charts and ratchet stops.

https://www.tradingview.com/chart/SPY/aoCCTSfU-SPY-MACD-Bullish-15-Min/

In summary, it seems best to trade with trend toward upside resistance in 236.56 area or to downside of 232.98 area. Tighter support range is 234.98 – 233.95.

When decision is made for uptrend or downtrend we will post detailed targets.

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS

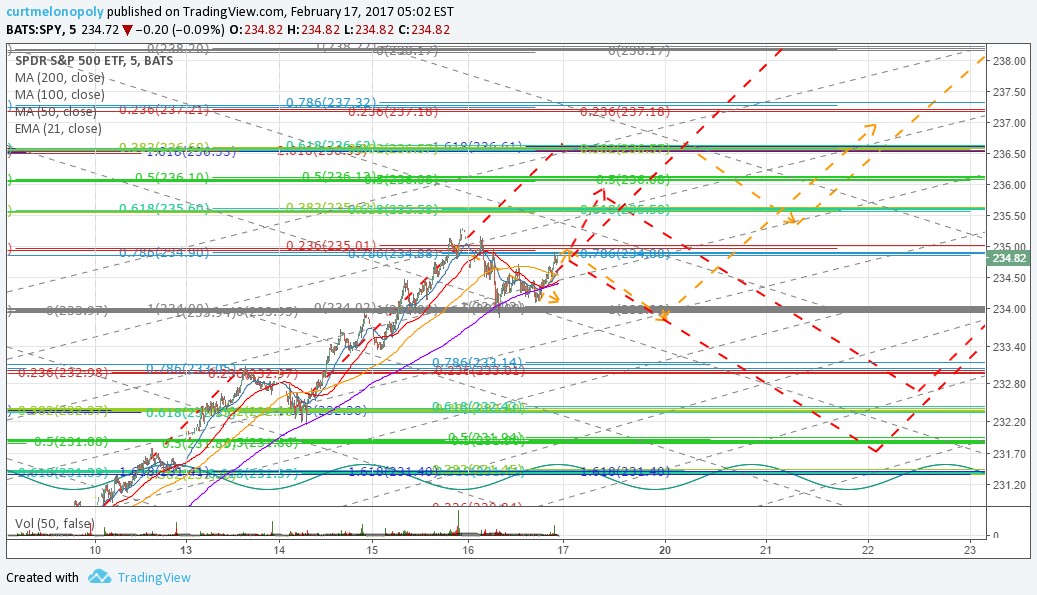

S&P 500 $SPY Member Trade Charting Fri Feb 17 $ES_F $SPXL, $SPXS

S&P 500 $SPY Trade Update Friday Feb 17, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Quick Mid-Week Update: Current Trade in $SPY S & P 500.

Yesterday we published two scenarios that both required a pull-back. We did in fact get a small pull-back but the actual trade followed the pattern of one of the two scenarios but not exactly at the location of trade on the chart.

Below is an updated chart with most probable scenarios. You may wonder, why even worry about trade scenarios… we do this because if the scenarios become predictable on the intra-day then our traders can take full advantage (beyond Fibonacci levels, trading quadrants and extension price targets).

This weekend we will do a complete update.

We have left the more recent charting in this post at the bottom for your reference.

S&P 500 $SPY Symmetry price target extensions, trade quadrants, Fibonacci. Trade Charting Thurs Feb 17 503 AM $ES_F $SPXL, $SPXS

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants for the time frame are also predictable, not perfect, but predictable. We have lots of work to do on this on the weekend.

Symmetry Extension – The new chart below provides you with the new intra-day upside symmetrical extension price target and pull-back scenarios.

Time / Price Cycles – There are currently no significant cycles in the charting.

Trading Bias – Our trading bias is the possibility of an interim / moderate pull back very soon – very likely at or before the end of the upside extension on the chart.

Below we have copied the applicable charting that is not being updated today from previous reports for your reference – all charting will be updated this weekend (as mentioned above).

Intra-day trading ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Mon Feb 13 624 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Monday. The Fibonacci indicator settings have proven to be very precis in recent trade.

$SPY Intra-day Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/nCSO58xX-Intra-day-trading-ranges-with-Fibonacci-MAs-VWAP-Cloud-AO-T/

$SPY Bullish however MACD negative divergence look to 200 MA – S&P 500 $SPY Trade Charting Feb 6 708 AM $ES_F $SPXL, $SPXS

In the event our bullish bias does not play out, consider / monitor the MACD divergence (down trend) and watch the 200 MA for support.

$SPY Live Chart: https://www.tradingview.com/chart/SPY/g5LKVW0h-SPY-Bullish-however-MACD-negative-divergence-look-to-200-MA/

Ascending Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 653 AM $ES_F, $SPXL, $SPXS

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/1ou53bUE-Ascending-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-6/

Price action in this model is intact. Per previous the 200 MA is support. More importantly the implied resistance is similar to the historical data above at 230.53.

Sideways Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 658 AM $ES_F $SPXL, $SPXS

This scenario is also intact. If price ascends above resistance look to it for support.

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/oWsddcg8-Sideways-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-65/

The descending model below has a very low probability of remaining intact so there will be no update to it at this point.

Per previous…

Descending with Fib, Symmetry and Time Price Cycle Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 615 AM $ES_F $SPXL, $SPXS

Live $SPY Trading Chart: https://www.tradingview.com/chart/SPY/dIJqIFq8-Descending-with-Fib-Symmetry-and-Time-Price-Cycle-Trade-Scenari/

This chart model is also intact. The important parts are not the general trade direction red dotted lines or that prospective black downward trendline – the downward channel and its associated trading width is the important indicator to watch on this chart.

Most Recent Simple Charting Updates from Last Monday – Be Sure You Have These:

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS

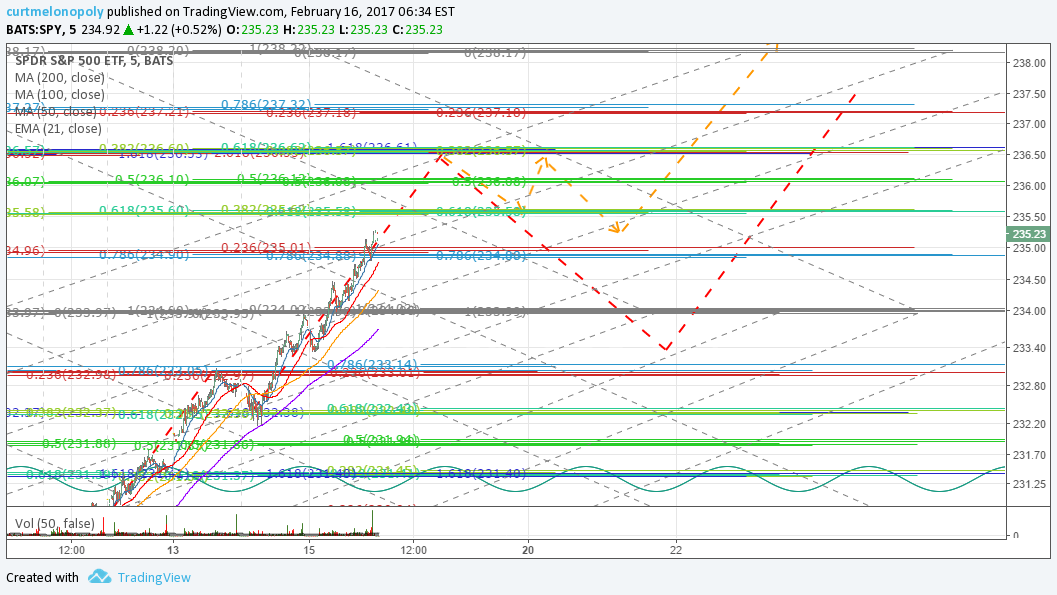

S&P 500 $SPY Member Trade Charting Thurs Feb 16 $ES_F $SPXL, $SPXS

S&P 500 $SPY Trade Update Thursday Feb 16, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Quick Mid-Week Update: Current Trade in $SPY S & P 500.

There are two scenarios on this chart (red dotted and orange dotted lines) for when an interim pull-back occurs. We expect a pull-back at the level noted, however, if it occurs prior to that mark or after that mark the two pull back scenarios are still the two most likely based on 60 months back-testing.

This weekend we will do a complete update.

We have left the more recent charting in this post at the bottom for your reference.

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants for the time frame are also predictable, not perfect, but predictable. We have lots of work to do on this on the weekend.

Symmetry Extension – The new chart below provides you with the new intra-day upside symmetrical extension price target and pull-back scenarios.

Time / Price Cycles – There are currently no significant cycles in the charting.

Trading Bias – Our trading bias is the possibility of an interim / moderate pull back very soon – very likely at or before the end of the upside extension on the chart.

$SPY Live Trading Chart with Symmetry Extensions, Fibonacci, and Trading Quadrants:

Below we have copied the applicable charting that is not being updated today from previous reports for your reference – all charting will be updated this weekend (as mentioned above).

Intra-day trading ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Mon Feb 13 624 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Monday. The Fibonacci indicator settings have proven to be very precis in recent trade.

$SPY Intra-day Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/nCSO58xX-Intra-day-trading-ranges-with-Fibonacci-MAs-VWAP-Cloud-AO-T/

$SPY Bullish however MACD negative divergence look to 200 MA – S&P 500 $SPY Trade Charting Feb 6 708 AM $ES_F $SPXL, $SPXS

In the event our bullish bias does not play out, consider / monitor the MACD divergence (down trend) and watch the 200 MA for support.

$SPY Live Chart: https://www.tradingview.com/chart/SPY/g5LKVW0h-SPY-Bullish-however-MACD-negative-divergence-look-to-200-MA/

Ascending Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 653 AM $ES_F, $SPXL, $SPXS

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/1ou53bUE-Ascending-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-6/

Price action in this model is intact. Per previous the 200 MA is support. More importantly the implied resistance is similar to the historical data above at 230.53.

Sideways Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 658 AM $ES_F $SPXL, $SPXS

This scenario is also intact. If price ascends above resistance look to it for support.

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/oWsddcg8-Sideways-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-65/

The descending model below has a very low probability of remaining intact so there will be no update to it at this point.

Per previous…

Descending with Fib, Symmetry and Time Price Cycle Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 615 AM $ES_F $SPXL, $SPXS

Live $SPY Trading Chart: https://www.tradingview.com/chart/SPY/dIJqIFq8-Descending-with-Fib-Symmetry-and-Time-Price-Cycle-Trade-Scenari/

This chart model is also intact. The important parts are not the general trade direction red dotted lines or that prospective black downward trendline – the downward channel and its associated trading width is the important indicator to watch on this chart.

Most Recent Simple Charting Updates from Last Monday – Be Sure You Have These:

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS

S&P 500 $SPY Member Trade Charting Tues Feb 14 $ES_F $SPXL, $SPXS

S&P 500 $SPY Trade Update Tuesday Feb 14, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Current Trade in $SPY S & P 500.

Thursday and Friday last week and yesterday (Monday) were promising and in overnight futures it appears the market is moderately off or flat and will continue to be active at minimum in the short term.

The chart indicators we are working with (backtesting sixty months) are starting to play out, so this is good as it allows for our charting to become more and more predictable as market continues to be active.

Nonetheless, it is moved now and where it should be.

Going forward we expect the market to either rest some here (sideways) or come off a bit before extending to upside. There are a few scenarios on the chart below.

Also, I have left the more recent charting in this post at the bottom for your reference.

My tweet from yesterday to members, I also emailed this;

https://twitter.com/FREEDOMtheAlgo/status/831207955366244353

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants for the time frame are also predictable, not perfect, but predictable.

Symmetry Extension – The new chart below provides you with the new intra-day upside symmetrical extension price target.

Time / Price Cycles – There are time / price cycles coming due between Friday 12:00 EST and Tuesday 4:00 EST – during time / price cycle terminations we advise our traders to use caution.

Trading Bias – Our trading bias is the possibility of an interim / moderate pull back.

$SPY Live Trading Chart with Symmetry Extensions, Fibonacci, and Trading Quadrants:

Below we have copied the applicable charting that is not being update today from the previous report for your reference and as trade plays out over next few days and we can get a better read we will update the below.

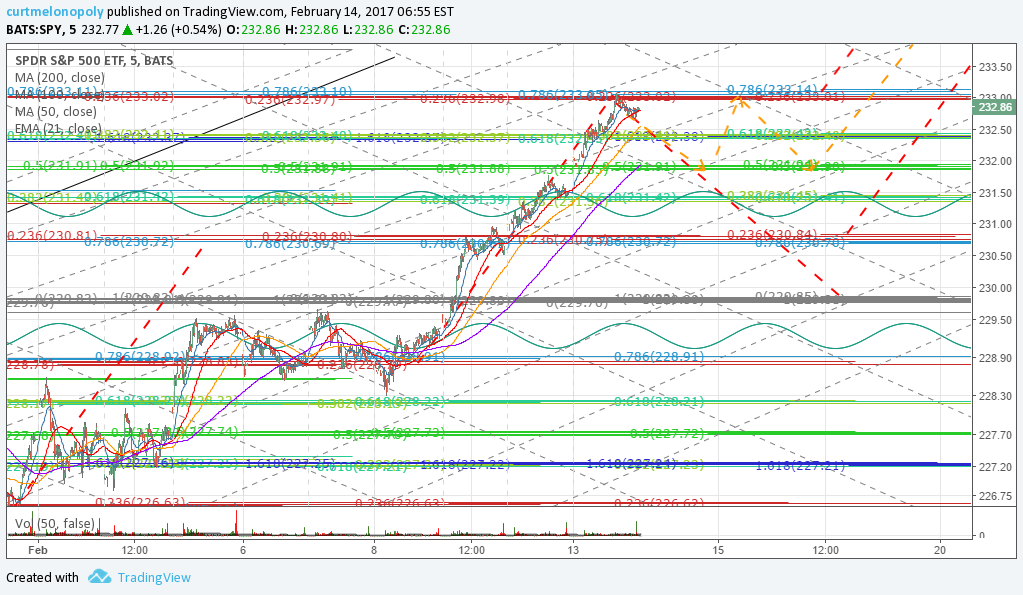

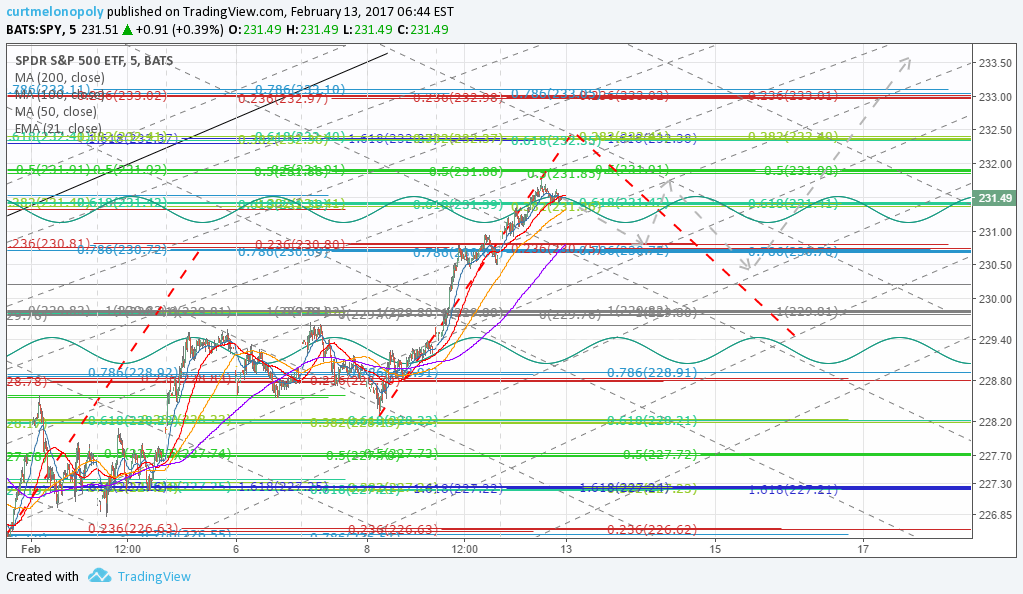

Intra-day trading ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Mon Feb 13 624 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Monday. The Fibonacci indicator settings have proven to be very precis in recent trade.

$SPY Intra-day Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/nCSO58xX-Intra-day-trading-ranges-with-Fibonacci-MAs-VWAP-Cloud-AO-T/

$SPY Bullish however MACD negative divergence look to 200 MA – S&P 500 $SPY Trade Charting Feb 6 708 AM $ES_F $SPXL, $SPXS

In the event our bullish bias does not play out, consider / monitor the MACD divergence (down trend) and watch the 200 MA for support.

$SPY Live Chart: https://www.tradingview.com/chart/SPY/g5LKVW0h-SPY-Bullish-however-MACD-negative-divergence-look-to-200-MA/

Ascending Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 653 AM $ES_F, $SPXL, $SPXS

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/1ou53bUE-Ascending-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-6/

Price action in this model is intact. Per previous the 200 MA is support. More importantly the implied resistance is similar to the historical data above at 230.53.

Sideways Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 658 AM $ES_F $SPXL, $SPXS

This scenario is also intact. If price ascends above resistance look to it for support.

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/oWsddcg8-Sideways-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-65/

The descending model below has a very low probability of remaining intact so there will be no update to it at this point.

Per previous…

Descending with Fib, Symmetry and Time Price Cycle Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 615 AM $ES_F $SPXL, $SPXS

Live $SPY Trading Chart: https://www.tradingview.com/chart/SPY/dIJqIFq8-Descending-with-Fib-Symmetry-and-Time-Price-Cycle-Trade-Scenari/

This chart model is also intact. The important parts are not the general trade direction red dotted lines or that prospective black downward trendline – the downward channel and its associated trading width is the important indicator to watch on this chart.

Most Recent Simple Charting Updates from Last Monday – Be Sure You Have These:

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS

S&P 500 $SPY Member Trade Charting Mon Feb 13 $ES_F $SPXL, $SPXS

S&P 500 $SPY Trade Update Friday Feb 13, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Current Trade in $SPY S & P 500.

Thursday and Friday last week were promising and in overnight futures it appears the market will continue to be active at minimum in the short term. The chart indicators we are working with (backtesting sixty months) are starting to play out, so this is good as it allows for our charting to become more and more predictable as market continues to be active.

Most Recent Simple Charting Updates from Last Monday – Be Sure You Have These:

Intra-day trading ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Mon Feb 13 624 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Monday. The Fibonacci indicator settings have proven to be very precis in recent trade.

$SPY Intra-day Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/nCSO58xX-Intra-day-trading-ranges-with-Fibonacci-MAs-VWAP-Cloud-AO-T/

Symmetry extension, trading quadrants, Fibonacci. S&P 500 $SPY Trade Charting Fri Feb10 700 AM $ES_F $SPXL, $SPXS

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants for the time frame are also predictable, not perfect, but predictable.

Symmetry Extension – The new chart below provides you with the new intra-day upside symmetrical extension price target.

Time / Price Cycles – There are time / price cycles coming due between Friday 12:00 EST and Tuesday 4:00 EST – during time / price cycle terminations we advise our traders to use caution.

Trading Bias – Our trading bias is to the upside again with the possibility of an interim / moderate pull back.

$SPY Live Trading Chart with Symmetry Extensions, Fibonacci, and Trading Quadrants:

Symmetry price target extensions, trade quadrants, Fibonacci. S&P 500 $SPY Trade Charting Mon Feb 13 639 AM $ES_F $SPXL, $SPXS

Upside extension possible approx 232.38

Downside extension possible approx 229.42

Previous upside extension hit target at approx 230.72

Red dotted simply gives extension targets to upside and downside – not trade path.

Grey arrows give possible trade path.

Below we have copied the applicable charting that is not being update today from the previous report for your reference and as trade plays out over next few days and we can get a better read we will update the below.

$SPY Bullish however MACD negative divergence look to 200 MA – S&P 500 $SPY Trade Charting Feb 6 708 AM $ES_F $SPXL, $SPXS

In the event our bullish bias does not play out, consider / monitor the MACD divergence (down trend) and watch the 200 MA for support.

$SPY Live Chart: https://www.tradingview.com/chart/SPY/g5LKVW0h-SPY-Bullish-however-MACD-negative-divergence-look-to-200-MA/

Ascending Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 653 AM $ES_F, $SPXL, $SPXS

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/1ou53bUE-Ascending-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-6/

Price action in this model is intact. Per previous the 200 MA is support. More importantly the implied resistance is similar to the historical data above at 230.53.

Sideways Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 658 AM $ES_F $SPXL, $SPXS

This scenario is also intact. If price ascends above resistance look to it for support.

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/oWsddcg8-Sideways-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-65/

The descending model below has a very low probability of remaining intact so there will be no update to it at this point.

Per previous…

Descending with Fib, Symmetry and Time Price Cycle Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 615 AM $ES_F $SPXL, $SPXS

Live $SPY Trading Chart: https://www.tradingview.com/chart/SPY/dIJqIFq8-Descending-with-Fib-Symmetry-and-Time-Price-Cycle-Trade-Scenari/

This chart model is also intact. The important parts are not the general trade direction red dotted lines or that prospective black downward trendline – the downward channel and its associated trading width is the important indicator to watch on this chart.

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $SPY, $ES_F, $SPXL, $SPXS

S&P 500 $SPY Member Trade Charting Fri Feb 10 $ES_F $SPXL, $SPXS

S&P 500 $SPY Trade Update Friday Feb 10, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Current Trade in $SPY S & P 500.

In Thursday’s market trade became active, and as such this will allow for considerable charting over the coming days. A complete update will be done prior to Saturday webinars that are scheduled (vs Sunday update) and for today a quick update so trader’s have levels intra-day for today’s trading.

Most Recent Simple Charting Updates From Monday – Be Sure You Have These:

Intra-day trading ranges with Fibonacci, MAs, VWAP, Cloud, Indicators. S&P 500 $SPY Trade Charting Mon Feb10 651 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Friday.

$SPY Intra-day Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/acfEactA-SPY-Intra-day-trading-ranges-with-Fibonacci-MAs-VWAP-Cloud/

Symmetry extension, trading quadrants, Fibonacci. S&P 500 $SPY Trade Charting Fri Feb10 700 AM $ES_F $SPXL, $SPXS

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants for the time frame are also predictable, not perfect, but predictable.

Symmetry Extension – If you refer to the most previous report, we included a red dotted line to provide you an upward trend extension for a price target of our upward trading bias. Trade did break out to the upside and the upward trading price target has been hit! The new chart below provides you with a new upward trending symmetrical extension.

Time / Price Cycles – There are time / price cycles coming due between Friday 12:00 EST and Tuesday 4:00 EST – during time / price cycle terminations we advise our traders to use caution.

Trading Bias – Our trading bias is to the upside again with the possibility of an interim / moderate pull back.

$SPY Live Trading Chart with Symmetry Extensions, Fibonacci, and Trading Quadrants:

Symmetry extension, trading quadrants, Fibonacci. S&P 500 $SPY Trade Charting Fri Feb10 700 AM $ES_F $SPXL, $SPXS

Below we have copied the applicable charting that is not being update today from the previous report for your reference. The weekend update will have all newly revised charting.

$SPY Bullish however MACD negative divergence look to 200 MA – S&P 500 $SPY Trade Charting Feb 6 708 AM $ES_F $SPXL, $SPXS

In the event our bullish bias does not play out, consider / monitor the MACD divergence (down trend) and watch the 200 MA for support.

$SPY Live Chart: https://www.tradingview.com/chart/SPY/g5LKVW0h-SPY-Bullish-however-MACD-negative-divergence-look-to-200-MA/

Ascending Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 653 AM $ES_F, $SPXL, $SPXS

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/1ou53bUE-Ascending-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-6/

Price action in this model is intact. Per previous the 200 MA is support. More importantly the implied resistance is similar to the historical data above at 230.53.

Sideways Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 658 AM $ES_F $SPXL, $SPXS

This scenario is also intact. If price ascends above resistance look to it for support.

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/oWsddcg8-Sideways-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-65/

The descending model below has a very low probability of remaining intact so there will be no update to it at this point.

Per previous…

Descending with Fib, Symmetry and Time Price Cycle Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 615 AM $ES_F $SPXL, $SPXS

Live $SPY Trading Chart: https://www.tradingview.com/chart/SPY/dIJqIFq8-Descending-with-Fib-Symmetry-and-Time-Price-Cycle-Trade-Scenari/

This chart model is also intact. The important parts are not the general trade direction red dotted lines or that prospective black downward trendline – the downward channel and its associated trading width is the important indicator to watch on this chart.

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $SPY, $ES_F, $SPXL, $SPXS