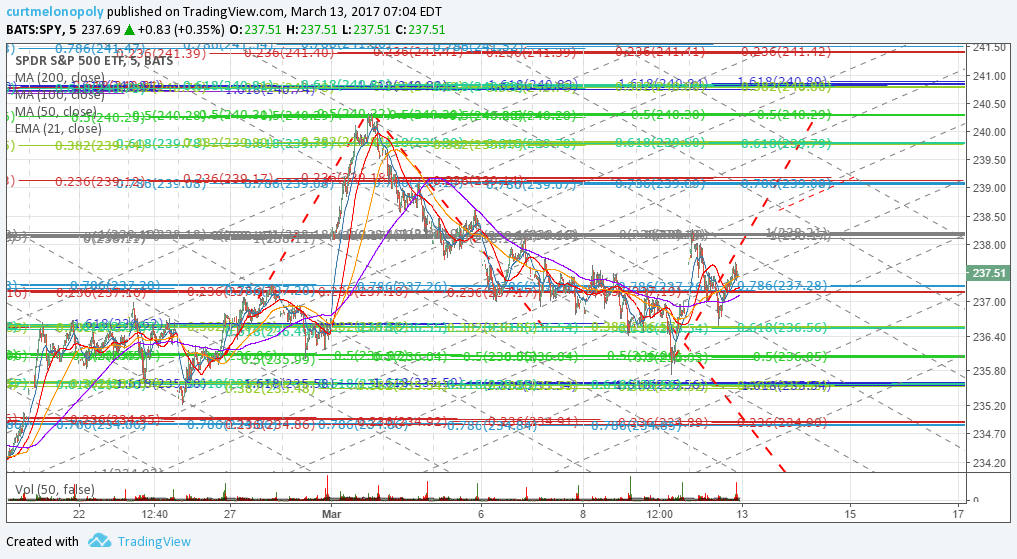

S&P 500 $SPY Trade Update Monday Mar 13, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Current Trade in $SPY S&P 500.

$SPY Live Price Extension Targets Chart https://www.tradingview.com/chart/SPY/XUnrpfDo-S-P-500-SPY-Symmetry-price-target-extensions-trade-quadrants/

S&P 500 $SPY Symmetry price target extensions, trade quadrants, Fibonacci. Trade Charting Mon Mar 13 705 AM $ES_F $SPXL, $SPXS

Notes with respect to $SPY Price Extensions and Targets

Recent Trade – $SPY price action has been hitting our upside price targets for a number of weeks now. The chart above includes the price extension targets for upward and downward trade.

The recent trading appears to be undecided and as such our trader’s will be using the Fib’s until a trend upward or downward to either the upper or lower target is established.

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants have been moderately predictable – we are leaving them as they are for now.

Symmetry Extension Targets – Most probable revised upside if trade is in uptrend is now 240.29 before a decision – which would make it a double top.

Most probable downside price target if trade is in a downtrend is between 233.12 and 232.75 before a decision.

Time / Price Cycles – There are currently no significant cycles in the charting. There is however a significant time / price cycle terminating in $VIX sometime between now and end of day March 10, 2017 (could extend in to Monday the 13th).

Trading Bias – Current bias is undecided. There is a divergence in that the upward trade extension makes the target a double, which is divergent from recent trade, which does cause us to pause.

This chart (below) I am not updating in this report as the levels are still in play.

30 Min Chart Trading Ranges with Fibonacci, MAs, VWAP , Cloud, AO, TSI , Stoch RSI . S&P 500 -0.21% $SPY Trade Charting Mon Mar 6 710 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade. The Fibonacci indicator settings have proven to be very precise in recent trade. The upside extension in this chart model is very similar to the chart above.

Trade action is following the upper alpha algo line closely (white dotted). In downward trade watch the diagonal trendline support closely (blue).

$SPY 30 Min Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/oad7PuED-30-Min-Chart-Trading-Ranges-with-Fibonacci-MAs-VWAP-Cloud-AO/

$SPY MACD Pinching on 15 Min Chart

The MACD on the 15 min is now pinching and undecided! Click on link and refresh chart to view.

Live Chart: https://www.tradingview.com/chart/SPY/FelQwwWV-SPY-MACD-is-currently-bullish/

$SPY MACD on 1 Hour Chart is Bearish

The one hour $SPY chart is on a sell!

Live Chart: https://www.tradingview.com/chart/SPY/GLjaQZZZ-SPY-S-P-500-KISS-Keep-it-Simple-MACD-Winning-Swing-Trading/

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS