S&P 500 $SPY Trade Update Tuesday April 25, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

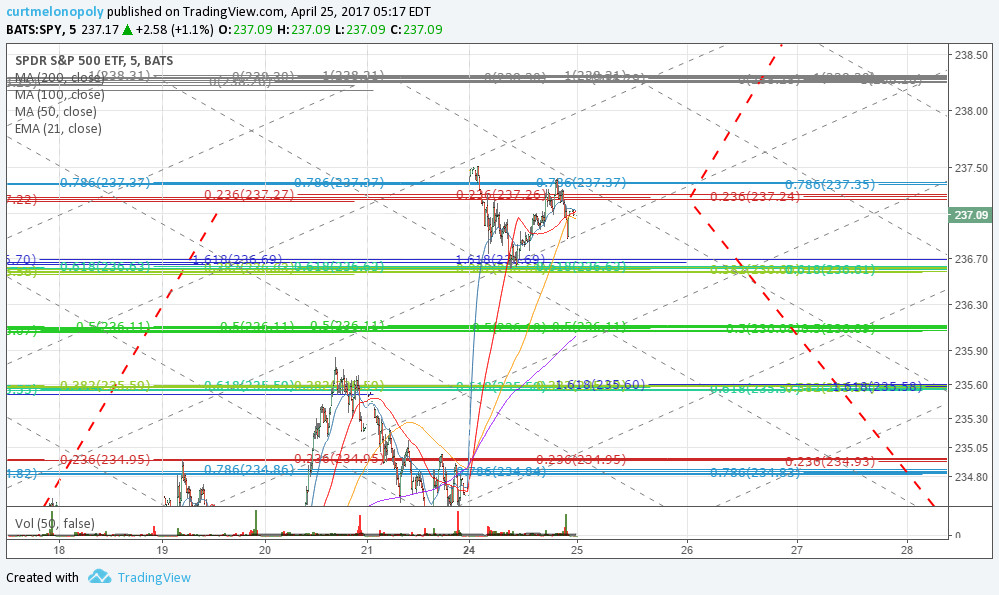

April 25, 2017 – The upside price extension predicted has now hit to near the penny! New extension price targets below.

Live $SPY Chart representing current extensions:

https://www.tradingview.com/chart/tO0JzCEP/

New upside and downside price extensions. S&P 500 $SPY Symmetry price target extensions, trade quadrants, Fibonacci. Trade Charting Tues April 25 518 AM $ES_F $SPXL, $SPXS

Notes with respect to $SPY Price Extensions and Targets

Recent Trade – $SPY price action has been hitting our upside price extension targets for months now. The chart above includes the price extension targets for upward and downward trade.

Trading just the price extension targets we have provided on the upside and downside has proven a very profitable signal.

Also of importance, in addition to trading the price extensions, our traders have found the Fib resistance and support on the chart and the algorithmic quadrants excellent signals intra-day for support and resistance.

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants have become predictable – we are leaving them as they are.

Symmetry Extension Targets – The extension price targets we have published the last number of months now have hit the price targets to upside and downside near perfect so they are becoming very predictable! Trade the outside ranges for optimum return and predictability.

Most probable downside price target if trade is in a downtrend is in 233.33 area before a decision.

Most probable upside price target if trade is in an uptrend is in 241.50 area before a decision.

Time / Price Cycles – There are currently no significant cycles in the charting.

Trading Bias – Although the warning below is still in place, our traders do have considerable high expectations that previous highs will be tested and / or taken out soon. Unless of course a geo political situation arises to derail the market. IN THE SHORT TERM HOWEVER price is expected to rest some after the recent break out.

Warning per recent reports;

This is a considerable warning because price has not traded above previous high since we alerted members to this divergence in the algorithm: Current bias is to the upside target, however, there is a divergence in the upward trade extension makes the target a double topped target, which is divergent from recent trade, which does cause us to pause.

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS