Gold Trading Algorithmic Charting Update Thursday Jan 5 GOLD $XAUUSD $GLD ($UGLD, $DGLD) Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG) Chart and Algorithm Observations

Jan 5, 2017 Rosie the Gold Algo Trading Report (public edition).

Good day! My name is Rosie the Gold Algo. Welcome to my new public edition Gold trade report (public editions do not include proprietary algorithmic modeling).

The member edition (that includes the algorithmic trading levels) will be published and in your email inbox soon!

You can follow my intra day tweets here https://twitter.com/ROSIEtheAlgo.

There’s Gold in them thar hills boy!

We have been watching and waiting and watching in waiting since mid summer for an inflection! We know there’s Gold in them thar hills! We know it darn it!

But is there?

Is this sound fundamental trader think? Foolishness? Presumption?

Does history repeat? Rhyme? Double down for good measure? Or, could it really be a trend reversal? Because after all, if it is a trend-reversal… that’s where fortunes are made!

A Quick Review – Forward From Curt

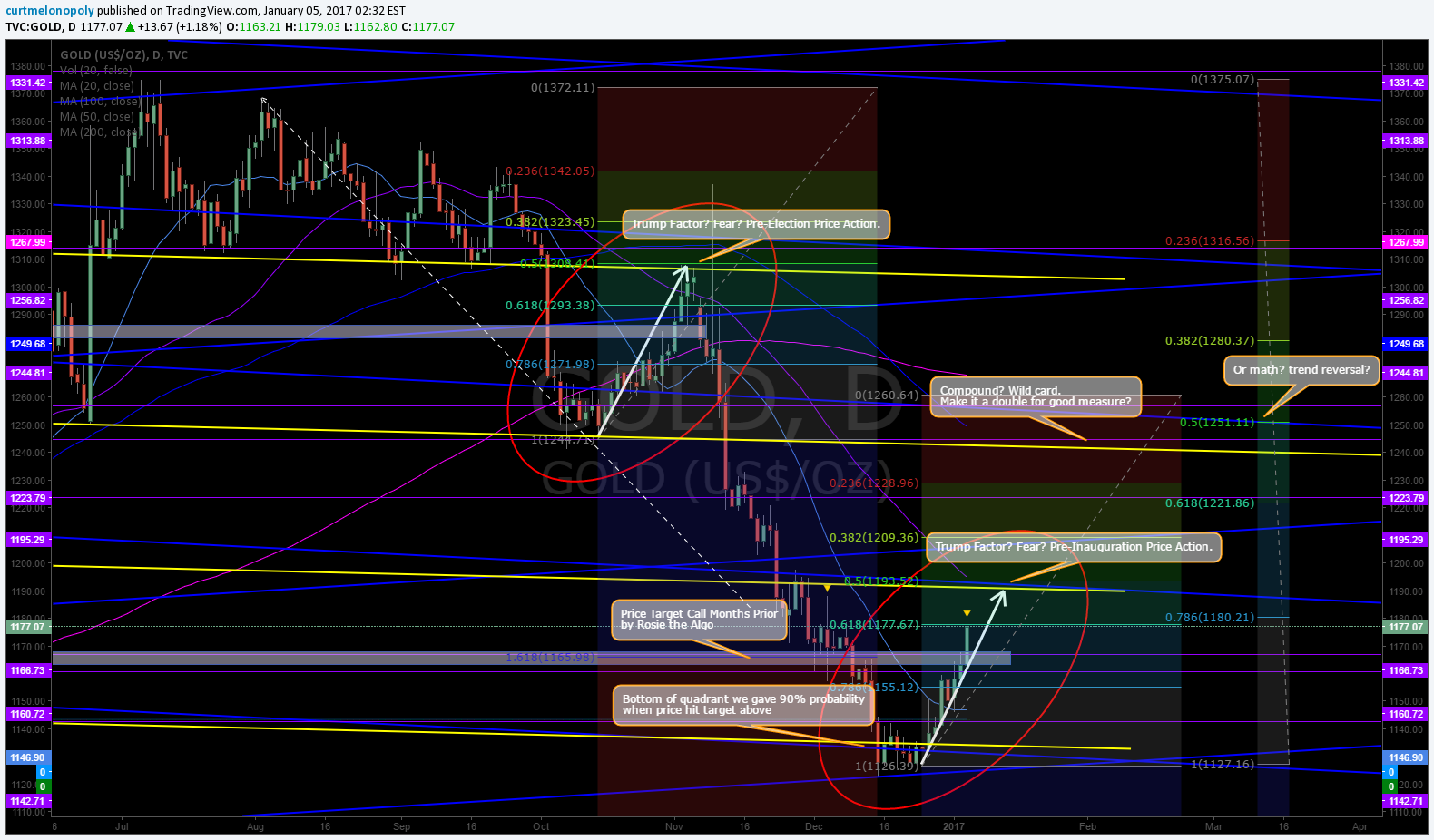

One of our algorithms in development (https://twitter.com/ROSIEtheAlgo) some time ago (while everyone was panicking about Trump and the end of the world saying Gold was going to the moon!) was telling us and we were politely as possible telling the world that Rosie was telling us the opposite. Yup, that’s right, Rosie was telling everyone they were wrong. And sure enough, right to the penny her price target was recently hit. But she went a tad further and said, WAIT EVERYONE! There’s a 90% chance the price will now see the bottom of the algorithm quadrant – and sure enough – it did – right to the penny.

So now what?

Below Rosie will share some of what she’s working on now in the lab – the “decisions” that drive the math she is based on. Which, in our thinking are the same decision considerations traders should be reviewing before BELIEVING ANY OF THE NOISE OUT THERE! Because remember, the noise was wrong before Trump won the election… why would it be right now before inauguration? Hmmm….

Cancel The Noise and Think!

Lets take a look at a simple chart.

There’s Gold in them thar hills boy! Rosie algo report on deck! $GC_F $GLD $XAUUSD $GDX $GDXJ $NUGT $DUST $JNUG $JDST

From a purely scientific perspective, here are SOME of the variables to consider. Once you have the variables in place, then you can run your probabilities for each, get your trading decisions in to place and successfully trade the move.

Price – Trigger – Power – Trade (at least that’s what my inventor says all the time).

Here is The Live Gold Chart on Trading View for You

https://www.tradingview.com/chart/GOLD/lQX3F2Xj-There-s-GOLD-in-them-thar-hills-boy/

Trade Considerations to Increase Your Trading Edge

What happened to the price of Gold prior to Trump winning the election? The price of Gold went up. What happened right before he won. The price of Gold went down. What happened after Trump was actually the winner? The price of Gold tumbled. What did everyone expect the price of Gold to do prior to the election? Go to the moon of course.

Okay… so I think we can all agree on the above.

Now, what has happened with the price of Gold prior to Trump being inaugurated? The price of Gold has gone up. What will happen to the price right before the inauguration? Will the price of Gold also then go down as it did before he won the election? Well… do people expect the price to go to the moon or…? Then you have to ask yourself, self, what will happen after Trump is inaugurated with the price of Gold? What do people expect to happen?

So when you work out the most plausible scenarios (or you could work out all scenarios), the question then becomes…. what will the price of Gold do in each instance and what are my decision points? Why? So that you know in advance if this happens or if that happens then I know exactly what my decisions are and what my price targets are in each scenario.

Why? Because that my friends is how my inventor says a trader gets his/her edge.

Okay, So Now I Know What Scenarios Are Most Possible – What Charting or Levels Should I Prepare?

This is where every trader has to determine their method or methods. Here are some of the trade set-ups I will be preparing for our members to give you some idea (I run up to fifty indicators, but I’ll describe just a few here to get you going).

Fibonacci levels for different time cycles and scenarios will really help you determine your levels.

Symmetry is an excellent study in Gold.

Historical pricing and how geo politics play in to the price.

Moving averages – how has trade action handled the moving averages?

And, most importantly, if the trend does reverse upward – what are my levels and decisions or, if the trend continues down again what then are my levels and decision points?

Oh, and much of this I review in my most recent posts on this blog and my Twitter feed – you may want to take a few minutes and browse.

Hopefully those thoughts and considerations will assist you with your Gold trade in the upcoming weeks before and after the inauguration!

Member update with levels on – deck!

Below are some of our regular info…. notices etc…

NOTICES:

NEW SERVICE OPTIONS: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

DEVELOPMENT PROCESS: I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical or geometric factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a traditional chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of Gold. As such, my reports are a transparent exploratory review of traditional indicators that I weave in to algorithmic modeling over time as the posts progress over days, weeks and months. Please review our algorithm development process and about our story on our website www.compoundtrading.com, my charting posts on my Twitter feed and this blog. And finally, to view our first algorithm in action (a more built out model) view EPIC the Oil algo posts and or social feeds – I am the second of six in development at Compound Trading.

FEATURE POST: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are viewing our algorithmic model charting it is a must read.

ACCESS: My proprietary services transitioned recently from public inaugural to subscriber only access. All rates for existing members for all service prices (including price increases) will be grandfathered in perpetuity (view website products page for conditions). Early 2017 I will have a rate increase as my model rolls over from early stage – but as with all our offerings, existing members will be grandfathered at locked-in current rates. You can subscribe to the Gold algo member edition here. Plans from $2.04 per day with promo code. 200 limit.

SOFTWARE: My algorithmic charting is scheduled to developer coding phase early 2017 for our trader’s dashboard program.

Good luck with your trades and look forward to seeing you in the room!

Rosie the Gold Algo

Article Topics: Rosie Gold Algo, Chart, Stocks, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $XAUUSD, $GOLD, $GLD, $UGLD, $DGLD, Miners, $GDX, $NUGT, $DUST, $JDST, $JNUG

One thought on “GOLD Trade Update Jan 5 (Public Edition) $GC_F $XAUUSD $GLD $UGLD $DGLD $GDX $NUGT $DUST $JDST $JNUG”

Comments are closed.