S&P 500 $SPY Trade Update Friday Feb 13, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Current Trade in $SPY S & P 500.

Thursday and Friday last week were promising and in overnight futures it appears the market will continue to be active at minimum in the short term. The chart indicators we are working with (backtesting sixty months) are starting to play out, so this is good as it allows for our charting to become more and more predictable as market continues to be active.

Most Recent Simple Charting Updates from Last Monday – Be Sure You Have These:

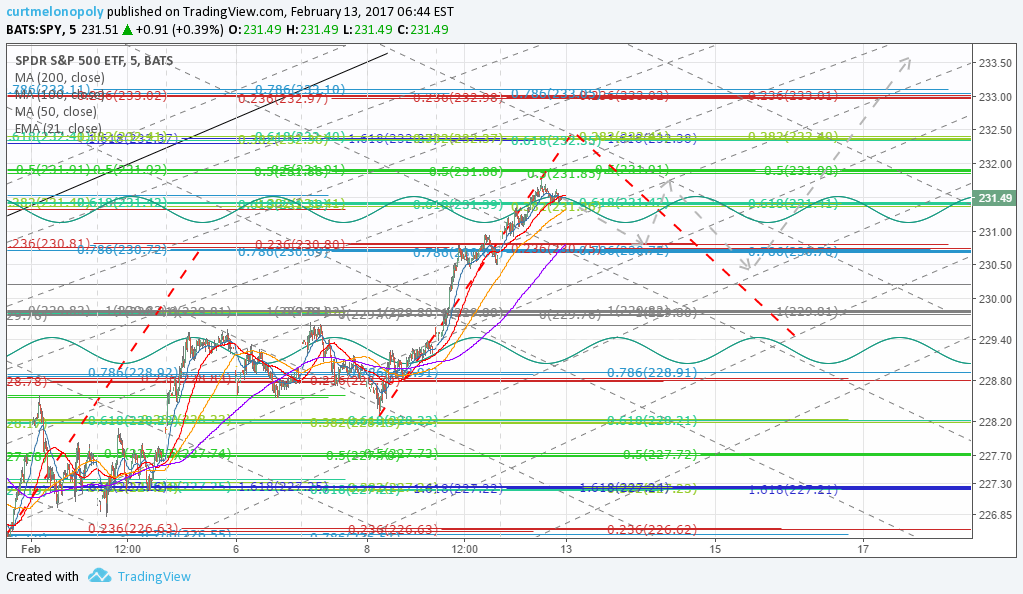

Intra-day trading ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Mon Feb 13 624 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Monday. The Fibonacci indicator settings have proven to be very precis in recent trade.

$SPY Intra-day Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/nCSO58xX-Intra-day-trading-ranges-with-Fibonacci-MAs-VWAP-Cloud-AO-T/

Symmetry extension, trading quadrants, Fibonacci. S&P 500 $SPY Trade Charting Fri Feb10 700 AM $ES_F $SPXL, $SPXS

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants for the time frame are also predictable, not perfect, but predictable.

Symmetry Extension – The new chart below provides you with the new intra-day upside symmetrical extension price target.

Time / Price Cycles – There are time / price cycles coming due between Friday 12:00 EST and Tuesday 4:00 EST – during time / price cycle terminations we advise our traders to use caution.

Trading Bias – Our trading bias is to the upside again with the possibility of an interim / moderate pull back.

$SPY Live Trading Chart with Symmetry Extensions, Fibonacci, and Trading Quadrants:

Symmetry price target extensions, trade quadrants, Fibonacci. S&P 500 $SPY Trade Charting Mon Feb 13 639 AM $ES_F $SPXL, $SPXS

Upside extension possible approx 232.38

Downside extension possible approx 229.42

Previous upside extension hit target at approx 230.72

Red dotted simply gives extension targets to upside and downside – not trade path.

Grey arrows give possible trade path.

Below we have copied the applicable charting that is not being update today from the previous report for your reference and as trade plays out over next few days and we can get a better read we will update the below.

$SPY Bullish however MACD negative divergence look to 200 MA – S&P 500 $SPY Trade Charting Feb 6 708 AM $ES_F $SPXL, $SPXS

In the event our bullish bias does not play out, consider / monitor the MACD divergence (down trend) and watch the 200 MA for support.

$SPY Live Chart: https://www.tradingview.com/chart/SPY/g5LKVW0h-SPY-Bullish-however-MACD-negative-divergence-look-to-200-MA/

Ascending Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 653 AM $ES_F, $SPXL, $SPXS

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/1ou53bUE-Ascending-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-6/

Price action in this model is intact. Per previous the 200 MA is support. More importantly the implied resistance is similar to the historical data above at 230.53.

Sideways Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 658 AM $ES_F $SPXL, $SPXS

This scenario is also intact. If price ascends above resistance look to it for support.

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/oWsddcg8-Sideways-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-65/

The descending model below has a very low probability of remaining intact so there will be no update to it at this point.

Per previous…

Descending with Fib, Symmetry and Time Price Cycle Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 615 AM $ES_F $SPXL, $SPXS

Live $SPY Trading Chart: https://www.tradingview.com/chart/SPY/dIJqIFq8-Descending-with-Fib-Symmetry-and-Time-Price-Cycle-Trade-Scenari/

This chart model is also intact. The important parts are not the general trade direction red dotted lines or that prospective black downward trendline – the downward channel and its associated trading width is the important indicator to watch on this chart.

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $SPY, $ES_F, $SPXL, $SPXS