S&P 500 $SPY Trade Update Thursday Feb 16, 2017 $ES_F ($SPXL, $SPXS) Algorithmic Charting Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report for Compound Trading.

Quick Mid-Week Update: Current Trade in $SPY S & P 500.

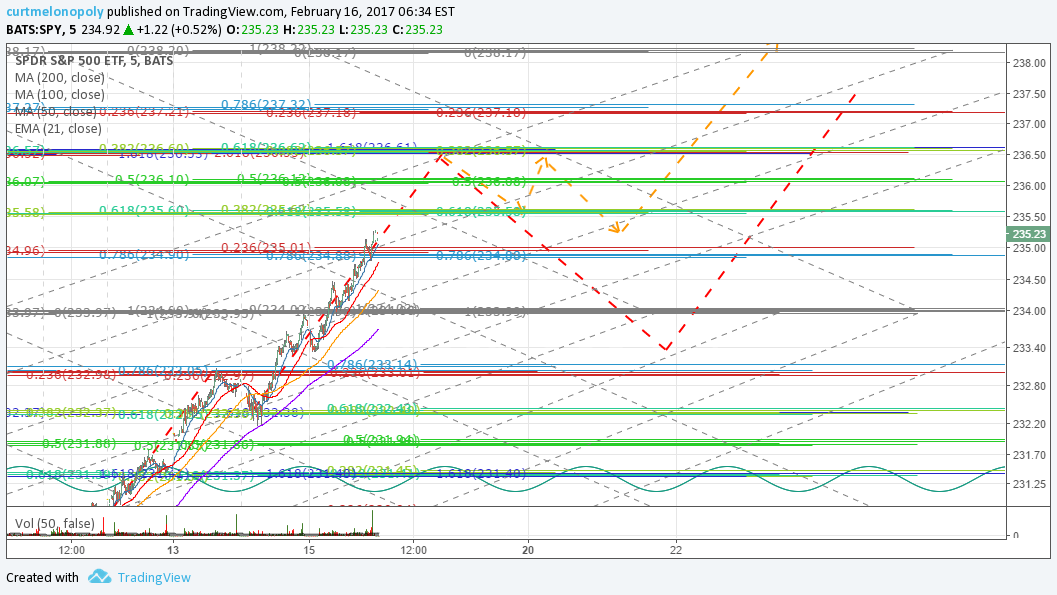

There are two scenarios on this chart (red dotted and orange dotted lines) for when an interim pull-back occurs. We expect a pull-back at the level noted, however, if it occurs prior to that mark or after that mark the two pull back scenarios are still the two most likely based on 60 months back-testing.

This weekend we will do a complete update.

We have left the more recent charting in this post at the bottom for your reference.

Fibonacci – The Fibonacci levels have been predictable so we are leaving them as they are.

Trading Quadrants – The trading quadrants for the time frame are also predictable, not perfect, but predictable. We have lots of work to do on this on the weekend.

Symmetry Extension – The new chart below provides you with the new intra-day upside symmetrical extension price target and pull-back scenarios.

Time / Price Cycles – There are currently no significant cycles in the charting.

Trading Bias – Our trading bias is the possibility of an interim / moderate pull back very soon – very likely at or before the end of the upside extension on the chart.

$SPY Live Trading Chart with Symmetry Extensions, Fibonacci, and Trading Quadrants:

Below we have copied the applicable charting that is not being updated today from previous reports for your reference – all charting will be updated this weekend (as mentioned above).

Intra-day trading ranges with Fibonacci, MAs, VWAP, Cloud, AO, TSI, Stoch RSI. S&P 500 $SPY Trade Charting Mon Feb 13 624 AM $ES_F $SPXL, $SPXS

Below are the levels our traders will be using for intra-day trade on Monday. The Fibonacci indicator settings have proven to be very precis in recent trade.

$SPY Intra-day Trading Levels Live Chart: https://www.tradingview.com/chart/SPY/nCSO58xX-Intra-day-trading-ranges-with-Fibonacci-MAs-VWAP-Cloud-AO-T/

$SPY Bullish however MACD negative divergence look to 200 MA – S&P 500 $SPY Trade Charting Feb 6 708 AM $ES_F $SPXL, $SPXS

In the event our bullish bias does not play out, consider / monitor the MACD divergence (down trend) and watch the 200 MA for support.

$SPY Live Chart: https://www.tradingview.com/chart/SPY/g5LKVW0h-SPY-Bullish-however-MACD-negative-divergence-look-to-200-MA/

Ascending Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 653 AM $ES_F, $SPXL, $SPXS

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/1ou53bUE-Ascending-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-6/

Price action in this model is intact. Per previous the 200 MA is support. More importantly the implied resistance is similar to the historical data above at 230.53.

Sideways Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 6 658 AM $ES_F $SPXL, $SPXS

This scenario is also intact. If price ascends above resistance look to it for support.

$SPY Live Trading Chart: https://www.tradingview.com/chart/SPY/oWsddcg8-Sideways-Trade-Scenario-1-S-P-500-SPY-Trade-Charting-Feb-6-65/

The descending model below has a very low probability of remaining intact so there will be no update to it at this point.

Per previous…

Descending with Fib, Symmetry and Time Price Cycle Trade Scenario 1 – S&P 500 $SPY Trade Charting Feb 2 615 AM $ES_F $SPXL, $SPXS

Live $SPY Trading Chart: https://www.tradingview.com/chart/SPY/dIJqIFq8-Descending-with-Fib-Symmetry-and-Time-Price-Cycle-Trade-Scenari/

This chart model is also intact. The important parts are not the general trade direction red dotted lines or that prospective black downward trendline – the downward channel and its associated trading width is the important indicator to watch on this chart.

Most Recent Simple Charting Updates from Last Monday – Be Sure You Have These:

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom, $SPY, Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $SPY, $ES_F, $SPXL, $SPXS