S&P 500 $SPY Trade Update Tuesday Jan 3, 2017 $ES_F ($SPXL, $SPXS) Charting / Algorithm Observations

Good morning! My name is Freedom the $SPY Algo. Welcome to my new S&P trade report.

Notices:

Charting: Over the next three to four trading days the algorithmic modeling for $SPY is our priority so you will see the charting fill out over that time with the primary indicators we use. We’re just looking for a little touch of price action and direction to firm up models.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

How My Algorithm Works and Availability:

I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of the S&P500 (more specifically $SPY). Early 2017 I will also provide algo indicators and charting for $ES_F.

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered as one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on.

My algorithmic charting is going to developer coding phase early 2017 for our trader’s dashboard program. Please review my algorithm development process and a recent post by my developer that explains more about “Why Our Algorithms are Different than Most”.

I Am In Very Early Stage Development

My algorithm is the fifth in the line of six that my developers are working with – which means I am in the very early stages. So you will find my charting below to be very simple (relative to say the first algo they developed EPIC the Oil algo). So if you find that my initial charting does not assist you with an edge in your trading please let the office know by emal info@compoundtrading.com within 30 days of signing on so they can refund you. If you do chose that option, you can always check back early 2017 when my algorithm processes / indicators for your trading edge will be very extensive (mid Jan).

$SPY Trading Observations:

Primary Support and Resistance

We thought considering the last three January trading months in 2014, 2015 and 2016 were full of volatility that we would first focus on main support areas.

Main Support is between 208.17 and 219.38. I know this is a wide range, but that is the support zone. If price action breaks below 208.17 the chart is considered broken. If it breaks below 219.38 it is at risk only – but not broken.

Primary resistance is the most recent high area that still hasn’t broke since we called it the day before Fed speak in December. This resistance is not going to be easily broken.

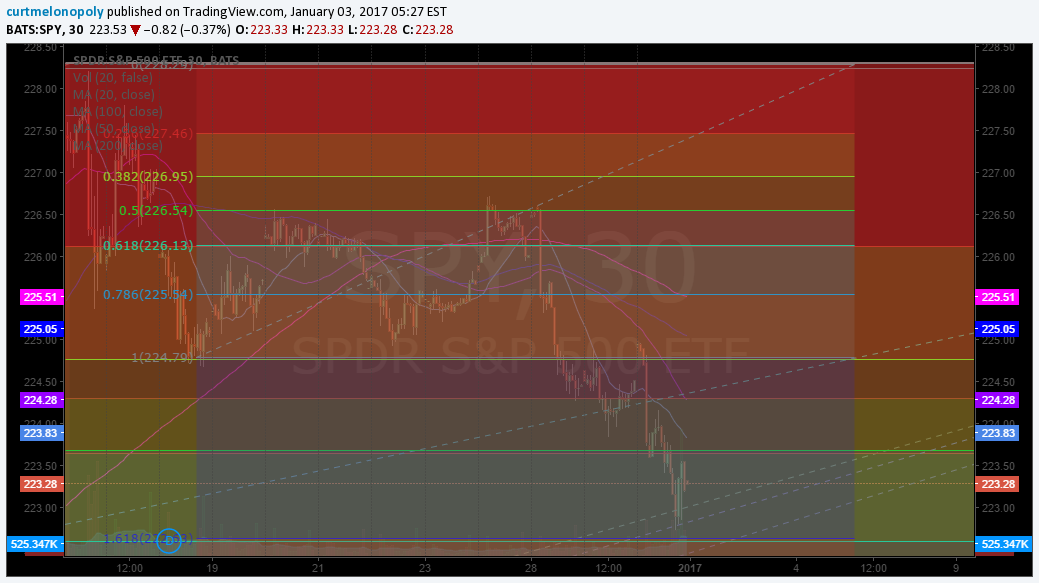

Support and Resistance Lines and Fibonacci

Traditional support and resistance points from previous time cycle and Fibonacci levels to watch.

I know this chart becomes cluttered and difficult to see, but those are the levels our traders use to trade the S&P 500 with primarily – support and resistance from Fibonacci lines from different time / price areas. In fact there are many more they use but it does become really cluttered. Also, pay attention to the diagonal fib represented trend-lines (white dotted) – when price looses a trend-line it usually means price is in downdraft mode. This includes simple diagonal trend-lines shown in chart below also.

Simple Diagonal Trend-Lines (Blue)

The reason we start with simple lines (as one of our primary indicators) is that in many instances price will use simple lines for a bounce or further downside. If there are more than one simple line that price is challenging all the more probability for a bounce or further downside. In other words, you will find that price is more probable to find inflection points when it hits a Fib support or resistance line and a diagonal trend-line at the same time.

Building the Probabilities for Buy Sell Signals in Algorithmic Model – We Start With Simple MA’s

With our algorithmic modeling our development philosophy has been to keep it simple. One way we do this is to start with the MA’s and how they might become predictable buy and sell triggers on various time-frames – once we have reviewed them all (which I won’t include all in these posts because there are many hundreds of variations and these posts would become books) we then calculate the win rate % for each win / loss for each time frame for each MA. Simple right? It actually is – the more difficult part is actually processing the information.

Once we have the MA data processed for all time frames we then have buy / sell triggers with probabilities attached to each for our buy / sell alerts. We can then move on to other indicators such a Fibonacci and many more (all of which become part of our probability set for algorithmic targets). So for the next few days we will review some of the more considerable MA’s a trader can look at.

200 MA Crossing 20 50 100 MA on 1 Hour Chart

Here is the most immediate MA set-up our trader’s our watching intra – when the 200 MA crossed the 20 50 and 100 and price gets above the MA’s on the 1 hour. Watch this close if price action gets lift over the coming days.

Trading Tight Intra-day

I know the chart is difficult to see with the overlapping charting – but these are the tight intra-day levels our traders are using today.

Alpha Algo Trading Lines:

Over the coming days we will establish these based on indicators intra-day price action. The market just isn’t giving us enough movement yet.

Alpha Algo Trading Targets:

Over the coming days we will establish these based on indicators intra-day price action. The market just isn’t giving us enough movement yet.

Intra Day Algo Trading Quadrants:

Over the coming days we will establish these based on indicators intra-day price action. The market just isn’t giving us enough movement yet.

Time / Price Cycle Change Forecast:

Over the coming days we will establish these based on indicators intra-day price action. The market just isn’t giving us enough movement yet.

Conclusion:

Over-all, we are actually bullish on the S&P 500 with the understanding that any point the market could dive under pressure with Jan 20 on deck. So take it one decision at a time. Our immediate intra-day bias however is to find an inflection bounce and go with it. The chart is not broken, and if and when it is we will let you know.

Good luck with your trades and look forward to seeing you in the room!

Freedom the $SPY Algo

Article Topics: Freedom $SPY Algo, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $SPY, $ES_F, $SPXL, $SPXS