Gold Trading Algorithmic Charting Update Tuesday Jan 3 GOLD $GLD ($UGLD, $DGLD) Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG) Chart and Algorithm Observations

Jan 3, 2017 Rosie the Gold Algo Trading Report (public edition).

Good day! My name is Rosie the Gold Algo. Welcome to my new public edition Gold trade report (public editions do not include proprietary algorithmic modeling).

The member edition (that includes the algorithmic trading levels) will be published and in your email inbox soon!

You can follow my intra day tweets here https://twitter.com/ROSIEtheAlgo.

NOTICES:

NEW SERVICE OPTIONS: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

DEVELOPMENT PROCESS: I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical or geometric factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a traditional chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of Gold. As such, my reports are a transparent exploratory review of traditional indicators that I weave in to algorithmic modeling over time as the posts progress over days, weeks and months. Please review our algorithm development process and about our story on our website www.compoundtrading.com, my charting posts on my Twitter feed and this blog. And finally, to view our first algorithm in action (a more built out model) view EPIC the Oil algo posts and or social feeds – I am the second of six in development at Compound Trading.

FEATURE POST: There is a feature blog post at this link, “Why our Stock Algorithms are Different than Most“. If you are viewing our algorithmic model charting it is a must read.

ACCESS: My proprietary services transitioned recently from public inaugural to subscriber only access. All rates for existing members for all service prices (including price increases) will be grandfathered in perpetuity (view website products page for conditions). Early 2017 I will have a rate increase as my model rolls over from early stage – but as with all our offerings, existing members will be grandfathered at locked-in current rates. You can subscribe to the Gold algo member edition here. Plans from $2.04 per day with promo code. 200 limit.

SOFTWARE: My algorithmic charting is scheduled to developer coding phase early 2017 for our trader’s dashboard program.

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered as one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on.

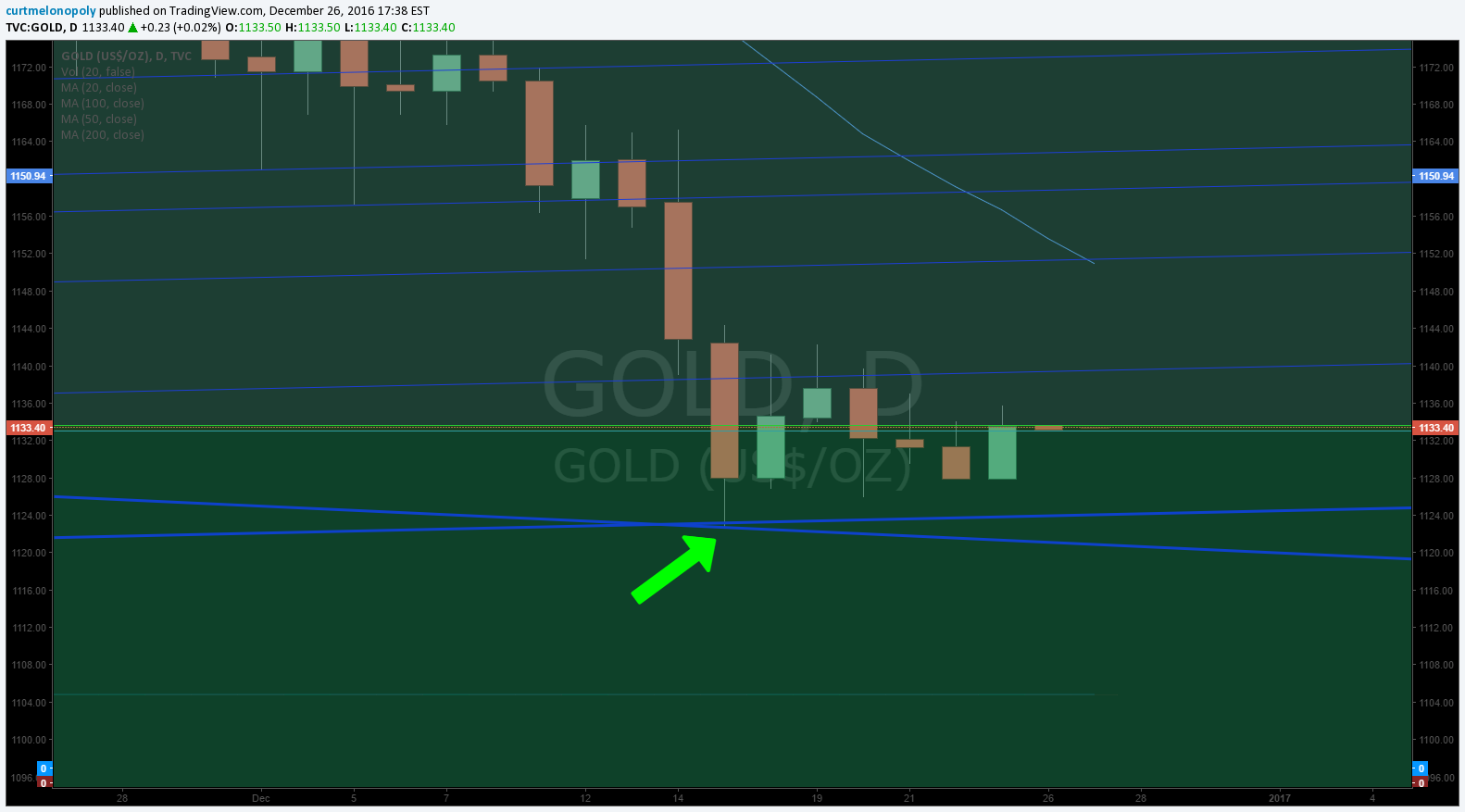

Gold Trading Observations:

Review:

If you have not read the post below, please do so as a foundation to the information contained in this update. This updated post is an add-on for current charting to the previous post.

https://twitter.com/CompoundTrading/status/816124360817676288

Current Trading:

At time of writing Gold is trading at 1157.23. Some thoughts that may help advance you trading edge;

Golden Cross:

The elements of a Golden Cross are setting up in Gold. The 50 MA may cross the 200 MA on the $GLD chart.

Moving Averages:

Trading price on $GLD still way below 100 MA.

Using 50 MA crossing upside 20 MA on 1 week as sell signal.

Fibonacci:

Refer to previous post.

Seasonality:

Refer to previous post for charting.

Gold News:

Carter Worth & @Michael_Khouw make a contrarian call on gold $GLD

Carter Worth & @Michael_Khouw make a contrarian call on gold $GLD pic.twitter.com/9Rhv9SbrdZ

— Options Action (@OptionsAction) December 28, 2016

Algorithmic Modeling Member Section

Alpha Algo Trading Lines:

Proprietary – exclusive to member edition (due before market open).

Alpha Algo Trading Price Targets:

Proprietary – exclusive to member edition (due before market open).

Intra Day Algo Trading Quadrants:

Proprietary – exclusive to member edition (due before market open).

Time / Price Cycle Change Forecast:

Proprietary – exclusive to member edition (due before market open).

Gold and Gold Miner Equities on Watch:

Which Gold Miners Could Provide a Valuation Upside in 2017? A complete listing in early Jan 2017 member editions.

Resource Stock Seasonality:

Included in upcoming member issues early Jan 2017.

Gold Miners Trade Study:

Included in upcoming member issues early Jan 2017.

Algorithmic Modeling Indicators:

As I explained above, my algorithm is a consolidation of up to fifty traditional indicators at any one time – each one given its own weight in accordance to its accuracy (win rate). This “consolidation” is how we establish the probability of specific targets hitting (we call them alpha algo targets / algo lines / algo quadrants / time and price cycles).

Good luck with your trades and look forward to seeing you in the room!

Rosie the Gold Algo

Article Topics: Rosie Gold Algo, Chart, Stocks, Fibonacci, Stocks, Wallstreet, Trading, Chatroom, Gold, Algorithms, $GOLD $GLD, $UGLD, $DGLD, Miners, $GDX, $NUGT, $DUST, $JDST, $JNUG