Good Morning Swing Traders and Welcome to the Compound Trading Weekly Swing Trading updates (1 of 3 this week) for the Week of July 17, 2017. $AAPL, $WMT, $AMD, $EWZ, $FEYE, $NVO, $JKS, $LTBR and more …

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Good morning!

Twitter alert service at @SwingAlerts_CT. I know many have expressed interest in the email only, but the Twitter option is available going forward for those that prefer that. Please bear with us as we integrate and orientate ourselves to this new function in our daily routines.

This report (1 of 3) focuses on the more recent stocks we have added to our swing trading set-up coverage. They include; $TSLA, $SNAP, $VGX, $AAU, $AMMJ, $AGN, $CTSH, $IBB, $FEYE, $LACDF, $PCRX, $PBR, $EWZ , $JKS. $RCL, $LTBR and newer yet $WMT Wallmart, $AMD Advanced Micro, $SRNE Sorrento Therapeutics and $AAPL Apple coverage.

We are going to categorize our coverage soon because we are following more than we expected when we first started the service..

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

Our Q1 2017 Swing Trading Results are available here:

https://twitter.com/swingtrading_ct/status/841079400485478400

July 18 Mid Day Trade Set-Ups $NFLX, $GOLD, $GDX, $SPWR, $CAPR, $WTI, $USOIL, $MBRX, $EDUC, $IMGN, $DXY …

https://twitter.com/CompoundTrading/status/888116914341289985

July 17 Trade Set-Ups $SRG, $DUST, $AAOI, $HIIQ, $LITE, $IPXL, $IMGN, $QBAK, $SGMO, $ADOM, $BDSI and more.

https://twitter.com/CompoundTrading/status/887623442895392769

$AAPL – Apple

July 21 – Trading 153.37 earnings in 11 days and it did get its pop. All indicators are on a buy. May take a trade. Alert set for when 20 MA breached 50 MA (sidewinder set-up possible).

July 12 – Trading 145.53. MACD just crossed up. Will watch close now.

$AAPL signalling a possible buy here. Posted live charting with indicators in free chat room https://discordapp.com/invite/2HRTk6n #swingtrading

June 29 – Trading 145.57. Same.

June 23 – $AAPL Trading $145.62 Waiting on MACD on daily to turn up for possible long. Holding 100 ma.

$AMD Advanced Micro

July 21 – Trading 13.78. Earnings in 4 days. Indicators indecisive (MACD flat for example) Watching.

July 12 – Trading 13.89. MACD crossing up. Watching close here now.

June 29 – Trading 13.23. Same.

June 23 – $AMD Trading 14.28. Primary indicator I am watching for long is MACD on weekly to cross up.

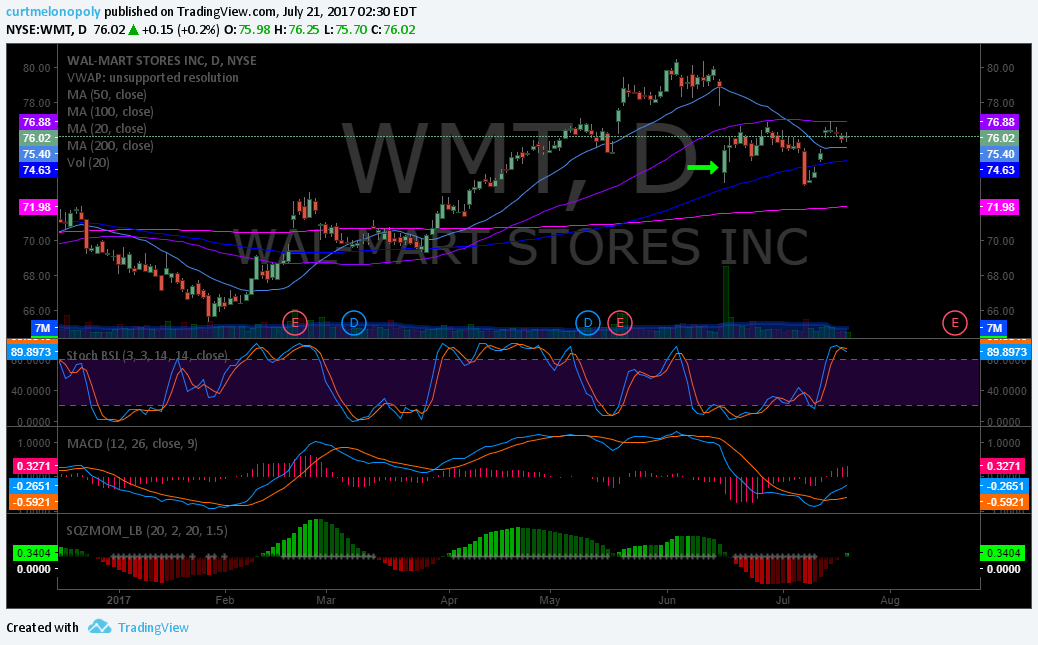

$WMT – Wallmart

July 21 – $WMT Wallmart Bought the dip at 74.81 trading 76.02 earnings 25 days and SQZMOM just turned green. MACD trend up. #swingtrading

$WMT Wallmart Bought the dip at 74.81 trading 76.02 earnings 25 days and SQZMOM just turned green. MACD trend up. #swingtrading pic.twitter.com/AFVUEK873v

— Melonopoly (@curtmelonopoly) July 21, 2017

June 26 – Trading 73.47. Holding still. It could visit the 200 MA for a bit lower but I’m confident. If / when it gets upside I will add.

$WMT Long 74.81 trading 76.50 about to test 50 MA to upside. #swingtrading #rulesdbasedprocess

$WMT Long 74.81 trading 76.50 about to test 50 MA to upside. #swingtrading #rulesdbasedprocess pic.twitter.com/W2HVb0FcYD

— Melonopoly (@curtmelonopoly) June 29, 2017

June 23 – Trading 75.60. Long from 74.81 for possible gap fill swing trade (was in daytrade room as an entry and moving it to swing side). Held its 200 MA on weekly and if MACD crosses up I will likely add significantly to the trade long. Stop now at entry and if I have to close and re-enter I will.

$SRNE – Sorrento Therapeutics

July 21 – Trading 2.05. Indicators are indecisive – flat. Watching.

July 11 – Trading 1.85. Indicators are poor. Set Stoch RSI on daily to alert when it crossed up to then assess.

June 29 – Closed flat. Watching.

https://twitter.com/SwingAlerts_CT/status/879372628884062208

$SRNE Trading 1.95 long from 2.07 wash out snap back gap fill play.

$LTBR – Lightbridge Corp.

July 21 – Trading 1.20. Watching.Very small position so I will hold through the downdraft.

July 12 – Trading 1.68. Watching. Holding. Still above 200 MA and in the bowl. Waiting for indicators to improve and will add considerably at that point.

June 29 – Trading 1.68. Watching. Holding.

June 23 – Trading 1.73 Price bounced off 200 ma so I am holding but MACD is trending down so we’ll see.100 ma about to breach 200 ma. If it does I may add long to 2.26 position.

June 12 – Trading 1,86 entering bowl phase (lost 20 MA has 200 MA trade as it should be). Holding 2.26 long will add as it proceeds through bowl. Likely bounce when 100 MA breaches 200 MA or when price hits 50 MA.

June 5 – $LTBR Daily 50 MA about to breach 200 MA with MACD SQZMOM and Stoch RSI up. Long 2.26 premarket.

https://twitter.com/SwingAlerts_CT/status/871663903012409344

$LTBR 100 MA resistance on weekly at 2.70. SQZMOM MACD Stoch RSI all up.

$RCL – Royal Caribbean

July 21 – Trading 115.26. MACD turned up. Earnings 11 days. Trading near 52 week highs. On very close watch now for break out.

July 12 – Trading 109.26. Same. Waiting on that MACD to cross up so I can assess.

June 26 – Trading 110.31. Same.

June 23 – Trading 112.15. Looking for MACD to cross up for long.

June 12 – Trading 112.07. MACD on its way down will look at long when MACD crosses up.

June 5 – Trading 113.38 and up significantly since last report with 50 MA breach of 100 MA on weekly. On Daily all indicators are a go also. Main reason we are not entering here is extension. Too risky and extended for now.

May 30 – Royal Caribbean Weekly 50 MA about to breach 100 MA and 52 week high near. Break out trade possible very soon.

$JKS – Jinko Solar

July 21 – Trading 27.15. MACD did turn up and price got a pop out of the bowl and now watching for a return to an MA (likely 20) and possible pop. I didn’t take the trade because I had many other trades but members have reported excellent trades between last report and now. 20 MA is about to breach 100 MA on the weekly.

July 11 – Trading 20.90. Still above 200 MA and in the bowl for continuation set-up. Waiting on MACD to cross up for possible long.

June 26 – Trading 20.63. Same watching.

June 23 – Trading 20.26. $JKS Solar. Resistance on deck with 200 MA on weekly overhead. However, 20 MA breaches 100 with price above pow. #swingtrading

June 12 – Trading 17.78. MACD down and waiting on it to cross up for long in continuation bowl over 200 MA.

June 5 – Closing trade flat – earnings on deck. Should have closed last week when it hit 22.00 range for a decent swing.

May 30 – $JKS Long hold 18.65 hit 23.14 last Thurs and I almost closed and likely should have (I know some of you did notify me of closing positions) and currently trading 19.03. Earnings in six days stop set at entry.

May 22 – $JKS MACD turned up on daily, unusual volume, SQZMOM turned green and earnings on deck. Short term swing between now and earnings. 500 Long 18.65 in premarket. Small starter.

$PCRX – PacIra Pharma

July 21 – Trading 49.15. Earnings in 23 days testing 20 MA above 200 MA MACD and SToch RSI trending down. Watching.

July 12 – Trading 49.70. Above 200 MA in the bowl Stoch RSI on daily turned down. Set alarm for Stoch RSI turn for assessing possible long.

June 26 – Trading 47.20. Same.

June 23 – $PCRX Indicators on daily good but on weekly mixed with price against 100 MA. Watching close for MACD cross up on weekly.

June 12 – $PCRX 43.75 Has 200 MA is moving through bowl process. MACD on daily about to curl up ans Stoch RSI on weekly about to cross up. If they do I will assess ma’s and likely long.

June 5 – Getting a small pop in premarket because they are presenting at a conference but indicators are still poor. Waiting.

May 30 – Trading 45.15. All indicators trending down. Watching.

May 22 – Trading 48.30 Chart indicators are indecisive. Will watch.

May 15 – $PCRX SQZMOM up MACD trending up, if price above 52.00 with indicators on side likely long with tight stop.

$PBR – PetroLeo

July 21 – Trading 8.70. Bounced per below and now waiting to see how it handles the 200 MA test from underside.

July 11 – Trading 8.04 and getting bounce off historical support. Will watch to see if it proves out. Long ways to its 200 MA.

June 29 – Trading 7.87. Same.

June 12 – Trading 8.15. Same.

June 5 – Trading 8.44. Same. Watching.

May 30 – Trading 8.95 same – watching.

May 22 – Trading 8.83. Weekly MACD down and failed 200 MA. Daily price under all MA’s. Failed upside break. Will watch.

May 15 – $PBR Trading 10.40. Regained 200 MA, MACD bullish, SQZMOM turned green. On 20 MA breach of 50 MA likely go long.

$EWZ – I Shares Brazil ETF

July 21 – Trading 37.35. with all indicators up and 20 MA about to breach 50 MA with price above. On high watch now.

July 11 – Trading 35.24. Getting very close to underside of 200 MA. Testing 50 MA now. On high watch here.

June 29 – Trading 33.96. Same

June 23 – Trading 33.10. Same.

June 12 – Trading 33.96. Daily chart is poor. Weekly Stoch RSI may cross up. Will wait for MACD and Stoch RSI cross up on weekly before considering a long.

June 5 – Trading 34.93. Indicators still poor. Watching.

May 30 – Trading 35.50. Got some trade lift but indicators are still poor. Watching.

May 22 – Trading 34.71. Weekly failed 200 MA test. Daily under all MA’s. Failed upside move. Will watch.

$EWZ Watching this one on the weekly. Looking for MACD to turn up and price above 41 ish for long.

$FEYE – Fire Eye Inc.

July 21 – Trading 15.84 holding from 14.40. Indicators are flatish. Watching.

July 12 – Trading 15.36 long 14.40. Watching close for adds.

June 29 – $FEYE Trading 15.90, long 14.40 with 100 MA near breach of 200 MA and MACD cross on deck. #swingtrading

Will likely add if price confirms over previous high and 100 ma breaches 200 ma.

June 23 – Trading 15.59. Holding from 14.40. Likely adding in premarket today.

https://twitter.com/SwingAlerts_CT/status/878151849177755649

June 12 – Trading 14.99. Daily not looking great with MACD down but Stoch RSI about to curl up. But on weekly it has MACD trend up, Stoch RSI trend up and SQZMOM up. Jury is out. Holding 14.40 entry.

June 5 – Trading 14.70. Holding MACD on weekly still up and daily not but it’s 50/50 here and I have a stop at entry.

May 30 – Trading 14.80. Holding 14.40 entry. Stop set at entry now. Did hit 16.26 and should have closed there – or when MACD turned down. Here again a few members notified they closed so congrats on that swing! It does have 50 MA crossing / breaching 200 MA currently on daily so that is actually bullish. So it is indecisive.

May 22 – Trading 14.95. Holding from 14.40. Weekly SQZMOM green and trending up, MACD trending up, 100 MA resistance at 19.58 intra. Daily not as good – MACD possibly turning down, SQZMOM green but turning down but on positive side 50 MA may breach 200 MA to upside. Holding for now.

May 15 – Trading 14.97. May 11 Long 14.40 when 20 MA breached 50 MA (per set-up May 8 below). Stop 13.99. 500 shares. Stoch RSI is on its way down and we’re watching closely. Did not get the pop we wanted – a tad concerned. Caution warranted.

May 8 – $FEYE In break-out. Waiting for 20 MA to breach 200 MA to upside for long with price above and time indicators right – MACD, Stoch RSI, SQZMOM and volume.

Live $FEYE charting https://www.tradingview.com/chart/FEYE/PZMX2RzI-FEYE-In-break-out-Waiting-for-20-MA-to-breach-200-MA-to-upside/

$LACDF – Lithium Amers Corp OTC

July 11 – Trading .725 Watching.

June 26 – Trading .676 Watching.

June 23 – Trading .685 Watching

June 12 – Trading .7315 It still has 200 MA on daily and it seems to be in indecision so I am waiting on MACD on daily and weekly to give me signal to look closer.

June 5 – Trading .6799 and indicators are still poor to indecision.

May 30 – Trading .708 Chart is still full of indecision.

May 22 – Trading .73. Indecision.

May 15 – Trading .7273 20 MA did not breach and we did not trade. Waiting on set up to complete.

May 8 – Trading .74 $LACDF 20 MA is about to breach 50 MA and 100 MA to upside with price above. If so it is long set-up if indicators confirm. This one is brought to us as a whisper by Hedge Hog Trader.

$LACDF Live Chart https://www.tradingview.com/chart/LACDF/IECwvASr-LACDF-20-MA-is-about-to-breach-50-MA-and-100-MA-to-upside-with/

$IBB – BioTechnology Index Fund

July 21 – Trading 323.58. Watching for break out of 52 week.

July 12 – Trading 312.01. Watching.

June 26 – Trading 317.89. Watching. It came of a bit so watching a back test possibility.

June 23 – Trading 320.11. On weekly it bounced off 200 ma and all indicators are up on weekly and daily, however, I am going to watch. The time to enter was four days ago and I just didn’t trust it.

June 12 – Trading 293.80. MACD on daily flat and hasn’t crossed up. Indecision.

June 5 – Trading 296.23. MACD on daily about to breach up and would likely be a decent trade but I will wait.

May 30 – Trading Trading 288.22. Here also, all kinds of indecision.

May 22 – Trading 289.92. Indecision.

May 15 – Trading 293.88. Price is now below the 20 MA and 50 MA, waiting for price to be above to assess set-up.

May 8 – Trading 295.43. Waiting on 20 MA (blue) to cross up 50 MA (purple) with price above.

May 1 – $IBB Daily. Waiting on 20 MA (blue) to cross up 50 MA (purple) with price above. MACD turned up and SQZMOM green.

Live Chart $IBB https://www.tradingview.com/chart/IBB/HZtJEsFe-IBB-Daily-Waiting-on-20-MA-blue-to-cross-up-50-MA-purple-w/

$AGN – Allergan

July 21 – Trading 249.07. Indicators are indecisive.

July 12 – Trading 242.12 Same.

June 26 – Trading 246.71 – Same.

June 23 – Trading 247.11. $AGN 20 MA on track to breach 50 MA on daily – on watch for long. $AGN Also, on weekly price has to get above 100 MA resistance on deck.

June 12 – Trading 234.74. $AGN Has 200 MA w 20 MA breach price above all but 100 MA. MACD up SQZMOM green Stoch RSI peaking.

Will wait for price over 100 MA and assess then for long.

June 5 – Trading 228.16. MACD just turned up on daily but other indicators indecisive. Waiting.

May 30 – Trading 223.12. Interesting chart. MACD pinching to upside trend, Stoch RSI starting to trend up and the SQZMOM might turn up. Price still under 200 MA however.

May 22 – Trading 219.13. Lost all MA’s on daily and MACD down. It will take time.

May 15 – Trading 230.88. Touching the top of 200 MA and under 20, 50, 100 MA’s. Watching.

May 8 – Trading 244.99. Earning is one day so we are waiting for that. 20 MA is about to breach to upside 50 MA so we expect to take a long if price action confirms after earnings.

May 1 – $AGN Daily. Trigger long when 20 MA (blue) 50 MA (purple). MACD turned up SQZMOM just green now. Careful with earnings in eight days.

$CTSH – Cognizant Technology

July 21 – Trading 69.96 MACD crossed and it got a pop. Waiting on earnings for this.

July 12 – Trading 67.70 MACD about to cross up – watching very close now.

June 29 – Trading 67.03 – same.

June 23 – Trading 67.12. Looking at long if 50 ma breaches 100 ma on weekly. Also watching the weekly Stoch RSI for a turn up.

June 12 – Trading 66.39. MACD trending down on daily. Waiting on it to cross up for signal to review other indicators for possible long.

June 5 – Trading 67.30. Closing position in 67.30 area from 61.78 entry. Out of both positions now (the other was on another report that was transferred over from a daytrade that became a swing trade).

https://twitter.com/SwingAlerts_CT/status/871647793672212480

May 30 – Trading 66.70 and stop set at 66.50 from 61.78 entry.

May 22 – $CTSH Swing Trade Going Well. Trading 65.42 from 61.78 entry. 20 MA may breach 100 MA on weekly and may add. MACD trending and SQZMOM trending on weekly also.

May 15 – $CTSH Swing trade is going well. Trading 64.39. Holding long from 61.78. Will watch MACD and other indicators to close or add.

Live Chart : https://www.tradingview.com/chart/CTSH/qwtL29oD-CTSH-Swing-trade-is-going-well-Trading-64-39-Holding-long-fro/

May 8 – Trading 63.22. Earnings price action went well and when that passed and 20 MA breached 50 MA (per trigger below) to upside with indicators confirming we went long 500 shares at 61.78.

May 1 – $CTSH SQMOM just went green, MACD turned up, Waiting on 20 MA to confirm thru 50 MA for long. #swingtrading Careful with earnings on deck.

$NVO – Novo – Nordisk

July 21 – Trading 43.85. Holding from 42.44 entry. Watching.

July 12 – Trading 42.10. Watching. Hold. In play with set-up sound.

June 26 – Trading 43.27. Holding long 42.44. Same as below.

June 23 – Trading 43.67. Holding long from 42.44. 200 MA overhead on weekly but MACD trending up still and 20 about to breach 50 ma with price above. Interesting scenario.

June 12 – Trading 42.59. 200 MA play still in order. 100 MA about to breach 200 MA on daily. We may get some downside but it is in play.

June 5 – Trading 43.99 Went long May 31 42.44 500 shares when 50 MA breached 200 MA. MACD trending up on daily.

https://twitter.com/SwingAlerts_CT/status/869913818343784448

May 30 – Trading 41.68. Interesting chart. MACD might turn up and 50 MA may breach soon – it may break out! On Watch!

May 22 – Trading 40 .85. Price action didn’t respond to 20 MA breach of 200 MA on daily (not good), however, on weekly MACD and SQZMOM trending up so will watch closely.

May 15 – $NVO Trading 40.60. 20 MA about to breach 200 MA. With price above and good price action will go long. Stoch RSI near bottom so hopefully on a curl up all indicators are right for long.

May 8 – Trading 40.87. Still waiting for 20 MA to breach 200 MA with price above for entry.

May 1 – $NVO Waiting for price above 200 MA and 20 MA to breach 200 MA to upside for long. #swingtrade

$TSLA – Tesla

July 12 – Trading 327.22. Waiting on MACD to assess.

June 26 – Trading 372.20. Pull back to 20 MA in progress. Waiting on MACD to turn back up on daily.

June 23 – Trading 382.61. Hasn’t stopped. Missed it for now.

June 5 – Trading 339.65 in premarket. In full break out with all indicators on daily turned up. Did not get our pullback.

May 30 – Trading 325.50 in premarket. Chart turning bullish. MACD about to turn up, Stoch RSI turned up, near 52 week high break out!

May 22 – Trading 310.57. MACD is still trending down on daily so we are confident we are getting our pullback and then we’ll consider a long at that point (that MACD curls up).

May 15 – Trading 317.58. Still looking for a better pull-back entry.

May 8 – Trading 311.75. MACD is trending down (cooling), Stoch RSI isn’t yet, and SQZMOM is trending down. Waiting for the indicators to bottom and turn up for long if MA’s confirm.

We decided to start covering Tesla because we feel it is out of the woods so to speak. There are many factors, but the bottom line is we are ready to trade this long term. It is revved right now, but it won’t be for long and we expect an entry sooner than later based on the simple charting below.

May 1 – Waiting. It is too heated. Stoch RSI at bottom turned up, MACD at top indecision however, SQZMOM green but trending down.

April 21 – Trading 302.80. Stoch RSI is at bottom likely to curl up, MACD at top crossed down, squeeze momentum indicator green but turning down, holding 8 ema. Waiting for indicators to line up.

April 13, 2017 – $TSLA Daily – Waiting on Stoch RSI to bottom, MACD down and turn up with MA’s on right side for a long position.

Live Tesla Chart https://www.tradingview.com/chart/TSLA/YlcqJMzy-TSLA-Daily-Waiting-on-Stoch-RSI-to-bottom-MACD-down-and-turn/

$SNAP – SNAP (60 Min Chart vs. Daily because it is a new issue)

July 12 – Trading 15.47. Same.

June 29 – Trading 17.85. Same.

June 23 – Trading 17.64 watching.

June 5 – Trading 20.84. Indecisive. Watching.

May 30 – Trading 21.21. All indicators turned up but watching.

May 22 – Trading 20.16. Daily under all MA’s. Watching.

May 15 – Trading 19.18. Stopped at entry per below. Watching.

May 8 – Trading 23.02. Trading 23.02. Holding at 22.20. Stop at entry. Watching indicators close for exit if needed.

May 1 – Trading 22.52. When Stoch RSI per below bottomed we entered April 28 22.20 Long 500 Shares. Will add when Stoch RSI returns to bottom unless price trends toward entry for possible stop. 60 Minute chart.

$SNAP Live Chart https://www.tradingview.com/chart/SNAP/KhbQSyJg-May-1-Trading-22-52-When-Stoch-RSI-per-below-bottomed-we-ente/

April 21 – $SNAP responding to cross-overs on hourly 20 50 100 & 20 thru 200 MA? Stoch RSI revved need at bottom preferrably to trigger long. #trading

MOST IMPORTANT PART IS THE 200 MA swooping down. That’s bulliish!

Live chart $SNAP : https://www.tradingview.com/x/MLMZNGXi/

$SNAP responding to cross-overs on hourly 20 50 100 & 20 thru 200 MA? Stoch RSI revved need at bottom preferrably to trigger long. #trading pic.twitter.com/3K9Yzfp3r5

— Melonopoly (@curtmelonopoly) April 21, 2017

April 13, 2017 – We decided to add $SNAP to our coverage because some of our clients have asked us to cover it, plain and simple. So the challenge is that it does not have the history we like, so we have charted it on hourly for now. This is considered a high risk trade.

Live $SNAP chart – https://www.tradingview.com/chart/SNAP/lLVhJfMz-SNAP-Hourly-Waiting-on-20-MA-to-cross-up-through-50-MA-and-pr/

$SNAP Hourly – Waiting on 20 MA to cross up through 50 MA and price to be above for a long entry.

$VGZ – Vista Gold

July 12 – Trading .83 same.

June 26 – Trading .86 same.

June 23 – Trading .83 watching.

June 5 – Trading .92. Indecisive on weekly and on daily price under all MA’s – watching.

May 30 – Trading .93 per below. Watching.

May 22 – Trading .92. Watching.

May 15 – Trading.98. Price is under all MA’s and needs to set up much better.

May 8 – Trading.96. Watching. All indicators trending down with MA’s over price.

May 1 – Trading 1.03 Watching.

April 21 – Indicators are still a mess. Watching.

April 13, 2017 – $VGZ – Has its 200 MA, waiting on 50 MA to cross up thru 200 MA and if price is over then long.

$AAU Almaden Minerals

July 21 – Trading 121. Same.

June 26 – Trading 1.32. Same.

June 23 – Trading 1.37. Watching.

June 5 – Trading 1.38. Holding 200 MA. Indecisive to bullish. Watching.

May 30 – Trading 1.45. MACD just turned up. Watching.

May 22 – Trading 1.29 Watching.

May 15 – Trading 1.42. Price under 20 MA on daily. Waiting and watching.

May 8 – Similar to $VGZ above – indicators trending down and indicators are a mess. Watching.

May 1 – Trading 1.47. Stoch RSI Bottom, MACD turned down, SQZMOM red trending down. Waiting on indicators to turn up and price to be above 20 ma at minimum.Price below 20 ma currently.

April 21 – Learning traders. Master this trade set-up. Change your life. #freedomtraders

Reviewing these trading set-ups in room all week at lunch. Here’s some raw footage. #trading #setups #freedomtraders https://www.youtube.com/watch?v=2_0PfnNiU-A&t=2704s

Reviewing these trading set-ups in room all week at lunch. Here's some raw footage. #trading #setups #freedomtraders https://t.co/6SqOEquC5J

— Melonopoly (@curtmelonopoly) April 21, 2017

#AAU Example of when 20 MA gets upside of 200 MA with price above. KAPOW! Waiting for Stoch RSI to return to bottom and curl up.

April 13, 2017 $AAU Has its 200 MA waiting on 20 MA to cross up thru 200 MA and take long when Stoch RSI at bottom and MACD turned up.

$AMMJ – American Cannabis

July 21 – Trading .6298. Testing underside of 200 MA watching.

July 12 – Same

June 26 – .Trading 049 watching. Recaptured the 20 MA and price now testing 50 MA and 200 MA above.

June 23 – Trading .045 watching.

June 5 – Trading .500. Under 200 MA and all other ma’s on daily. Watching.

May 30 – Trading .5149 as per below.

May 22 – Trading .50. Watching.

May 15 – Trading .51 watching. Price under all MA’s.

May 8 – Trading .60. All indicators trending down. Watching.

May 1 – Lost its 200 MA. Waiting for MA’s to sort out and indicators to get right.

April 21 – Watching.

$AMMJ Has its 200 MA, waiting for Stoch RSI to hit bottom and turn up, MACD to turn up, and price over 20 MA and 50 MA with 20 MA up through 50 MA for long.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, $AAPL, $WMT, $AMD, $TSLA, $FEYE, $NVO, $JKS, $LTBR