CitiGroup ( C) Swing and Day Trade Chart Set-Up with Buy / Sell Triggers for Traders

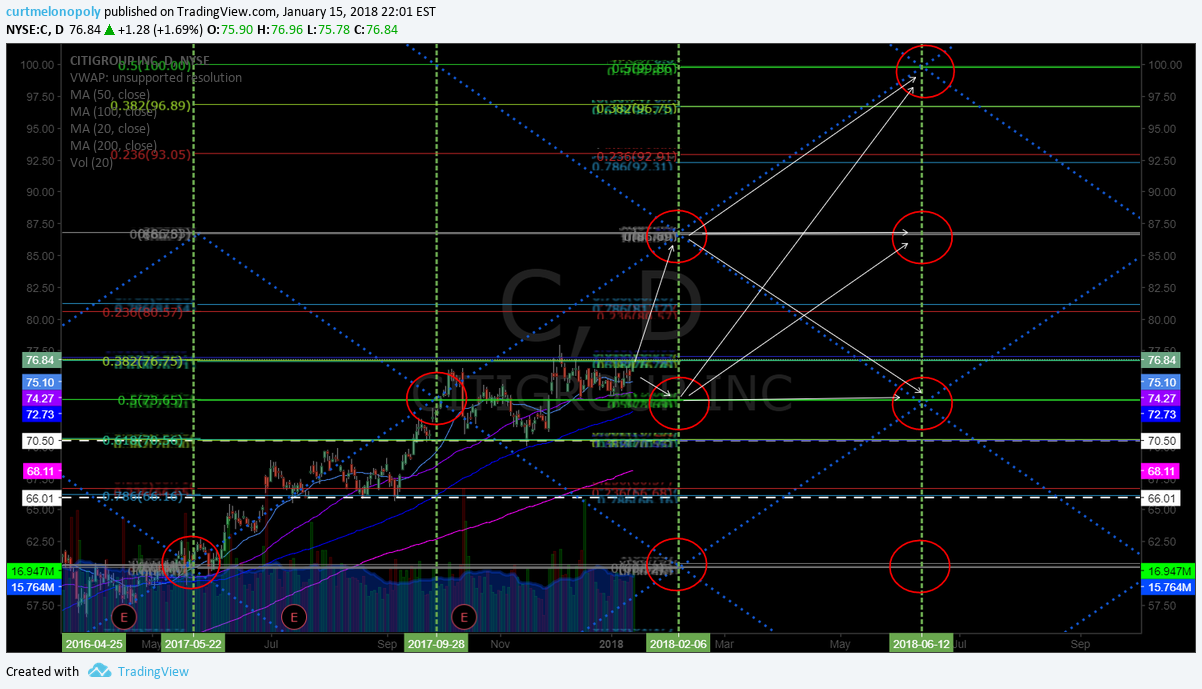

Below is the technical set-up of a simple algorithm model based on Fibonacci structure that specifically identifies trading signals for trade in CitiGroup to the upside and downside for earnings report on January 16, 2018.

Financial giant Citigroup ( C ) will announce fourth-quarter results on January 16. Analysts expect earnings of $1.18 per share. During the same period last year the company earned $1.14, and the stock has gained 13.0% since the end of June.

The chart structure for CitiGroup has been very consistent for the past six reporting quarters, so I have this particular chart on my watch list for daytrading tomorrow morning. And if trade continues to be predictable I will swing trade in accordance to the set-up below based on how trade plays out when earnings for Citi are released.

My invite to the public to receive a free copy of this trading set-up on social media. To receive future earnings trade set-ups, free webinars and videos and other trading information register to our email mailing list (click here).

Citi (CitiGroup) has been trading in a predictable chart structure for six quarters. Nice set-up for earnings. For a complete free report on how to trade earnings action with buy and sell triggers register to email mailing list here #swingtrading #ER $C https://www.tradingview.com/chart/C/ZYwtorum-Citi-has-been-trading-in-a-predictable-chart-structure-for-six-q/ …

Citi (CitiGroup) has been trading in a predictable chart structure for six quarters. Nice set-up for earnings. For a complete free report on how to trade earnings action with buy and sell triggers register to email mailing list here #swingtrading #ER $C https://t.co/z6YPIGzGg2 pic.twitter.com/XcVoLwuk0s

— Melonopoly (@curtmelonopoly) January 16, 2018

CitiGroup $C Earnings Chart Set-up for Swing Trading – Daily Chart. #swingtrading

Live chart link:

The chart below shows price targets for trade through to Feb 6, 2018 (red circles). The white arrows show possible trading scenarios based on the price targets and specific time cycles. As trade progress through the Fibonacci horizontal support and resistance lines (buy / sell triggers) and diagonal support and resistance lines (blue dotted lines forming quadrants) on its way to (trending toward) a spcific price target you can trade accordingly in your swing trade.

Your most important support / resistance buy / sell triggers are as follows:

Currently trading at: 76.84

Buy Sell triggers for upside price trend swing trade: 80.60, 81.60, 86.74, 92.24, 93.01, 96.64, 99.63 (most bullish target for June 12, 2018 – unlikely but it is).

Buy Sell triggers for downside price trend swing trade: 73.60, 70.54, 66.65, 66.06, 60.64

Here is the link to the live chart. Click on share button bottom right to open live chart (past initial viewer) and then “make it mine” to open. When chart is open double click on chart field to remove indicators at bottom of chart (the Stochastic RSI, MACD, SQZMOM) and double click to return indicators to chart.

Daytrading the Citi Earnings Report – Buy Sell Triggers

Below is the chart with additional horizontal Fibonacci buy / sell triggers if you choose to daytrade the market action in the morning.

Click the link below for the real-time chart:

Summary for Trade Set-Up

The charts above allow you to trade the earnings report price action as it happens when earnings are released. Once trade establishes a trend then a complete swing trading plan can be established. I will follow-up the CITI earnings report with members on the swing trading members report with a complete swing trading plan when the trend is established.

Trade Coaching

Important to new traders and/or users of our algorithm model charting can be the opportunity for private one-on-one coaching with our lead trader and / or an experienced trader that has worked under our lead trader (our lead trader maintains a trading win rate well in excess of 80% – recorded, verified, and alerted real-time for transparency).

On our website there are standard one-on-one online coaching packages (coaching via Skype) or you can request a customized package (reflecting the time you are wanting to invest in your learning). Keep in mind there is often a waiting list, but as students will attest, well worth the wait (if so).

To request a custom package most suited to your needs email us at info@compoundtrading.com or click here for a standard private trade coaching package. Other options for coaching include online webinars for members (from time to time), private on location and in-person coaching sessions at our new trading location(s) and organized trading conference events starting early 2018.

To learn more about our trade coaching email us or click here.

If you need assistance with the CitiGroup trade outlined above contact our lead trader on social or email us info@compoundtrading.com.

Thank-you.