How We Are Trading The Impending Tesla Stock Move

Tesla stock has been a wild ride lately and with earnings scheduled after market May 2, 2018 this should be an excellent trade (either way).

Below is a trading plan for trading Tesla up or down with price targets, support and resistance levels, buy sell triggers and time cycle peaks. But first… a few announcements on what’s new at Compound Trading!

What’s New!

April Sale On Now! 10 Promo Codes Per Select Items Only – 30% Off. Sale items end April 30, 2018 or if the Promo Code limit for the specific item has been reached (10). If there is no sale price beside the item listed the maximum promo codes have been used. Click here for available Promo Codes.

Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

Information about our next trade coaching event May 4, 5, 6 can be found here Trade Coaching Boot Camp.

Now available for serious traders – Legacy All Access Membership.

24 Hour Crypto Trading Desk opens May 2018 along with our Coding Algorithm Models for Machine Trading. Formal announcements to follow.

Tesla Trading Plan

I have been posting this trade set-up for some time, and we have done well with the trades since. But here forward it could get even better. Here’s a post from April 4, 2108 on Trading View that details the Tesla trading chart structure.

Earnings catalyst:

Here’s the Nasdaq website link for Tesla earnings: Tesla, Inc. is expected* to report earnings on 05/02/2018 after market close. The report will be for the fiscal Quarter ending Mar 2018.

About Tesla:

For those that need to know a little about the company Tesla, here is the Wikipedia Tesla page link: Tesla, Inc. (formerly Tesla Motors) is an American company that specializes in electric vehicles, energy storage and solar panel manufacturing based in Palo Alto, California.

And Here is Why Tesla Could Be A Historic Trade Opportunity.

Tesla is bar none the most hated stock on Wall Street.

Tesla has the highest short interest of any major company. As I write, more than 30% of Tesla’s float is being shorted – up significantly in the last two weeks. That’s an utterly massive level of shorting for a stock with a $47 billion market capitalization. Simply put, being short Tesla is a very crowded trade right now.

And shorts are making a very big mistake.

That is a quote from this article; The Biggest Mistake Tesla Short Sellers Are Making Right Now.

And the writer could be right!

And there is a never ending array of news coverage on the Tesla story as we lead up to earnings…

Musk’s ‘no new capital’ promise faces scrutiny when Tesla reports results

Either way, our job as traders is to trade price action, so below is your technical chart set-up to trade Tesla either way for massive profit!

Here’s your technical chart set-up for trading Tesla $TSLA.

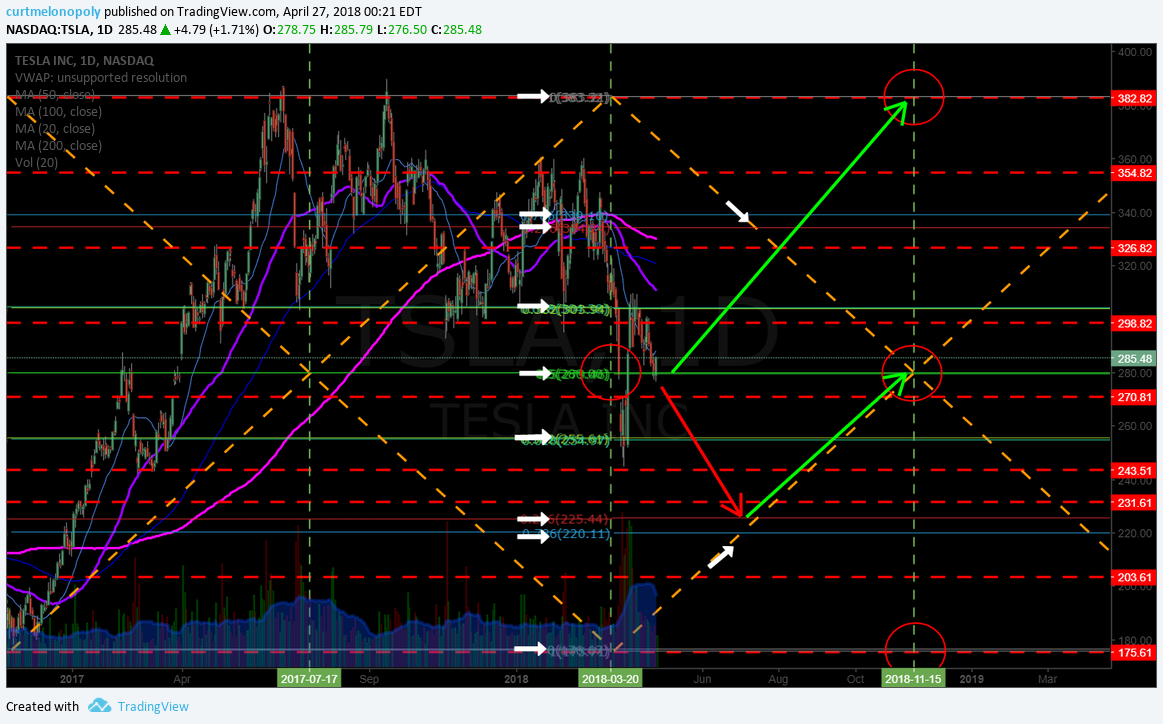

$TSLA closed April 26 at 285.48.

This set-up is a long over 280.00.

Your next major resistance is at 303.90 so be sure to trim longs in advance of that and then if resistance is breached add over that to the next resistance and then rinse and repeat. The horizontal fib lines on the chart show you support and resistance points. Also of note are the red dotted horizontal lines, they are also support and resistance lines, they represent historical support and resistance levels that can affect trade – pay some note to them also.

If 280.00 support (which is the main pivot in this trading range… mid trading quad support) then look to support at 255.60. If you’re short you will want to start covering in advance of trade getting to 255.60. If that is breached to the downside then add to your short and trim in advance of the next support on the chart.

I’ve made the chart easy to manage visually by adding white arrows to each major support and resistance level. The white arrows are your primary buy sell triggers. Note also the white arrows at the “trading quad walls”. These are Fibonacci based trend-lines that form a trading structure “quadrants”. They also act as support and resistance.

The red circles are price targets. The price targets for Nov 15, 2018 are 383.00 (bullish), 280.00 (moderate), 175.00 (bearish). Trade in accordance to price action toward the appropriate target. It is paint by numbers trading – just follow the rules and if your trade fails be sure to cut losses quickly and be ready to turn with price as needed. Trust the plan.

Here’s your technical chart set-up for trading Tesla $TSLA.

Here’s your technical chart set-up for trading Tesla $TSLA. by curtmelonopoly on TradingView.com

Good luck with your Tesla trade and if you need any help message me anytime!

Best and Peace.

Curt

Recent Trading Set-Up Review Webinars and Blog Posts

Oil Member Trade Alert Blog Post. Password “LONG” – Protected: Overnight Oil Trade | Trading Plan in Detail | EPIC Oil Algorithm $USOIL $WTI $CL_F #OIL $USO #Alerts

Swing Email Subscriber Blog Post – Trade Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trade Set-ups $SPY, $NFLX, OIL, $WTI, $ESPR, $GOOGL, Bitcoin, $BTC, $FEYE, $AAPL and more.

Trading Set-Ups $SPY, Gold, $GC_F, $GDX, Bitcoin, $GOOGL, $EVLV, $HEAR, $CHEK, $MARA, $PRTA, $ZDGE

Trading Set-Ups $NETE, $TSG, $ETH Ethereum, $BTC Bitcoin, $TAN, $HEAR, $AMMJ, $SNAP, $VLRX

Trade Set-Ups OIL, $WTI, $SPY, $GOOGL, $FSLR, $AXP, $GREK, $CELG, $AAOI, $SDRL, $WFT

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.