January 7, 2019 Main Trading Room With Lead Trader Video Footage of Market Open and Live Trades.

Voice broadcast for market open starts at 15:15 on video.

Voice broadcast for oil trade start at 1:09:48 on video and continues sporadically.

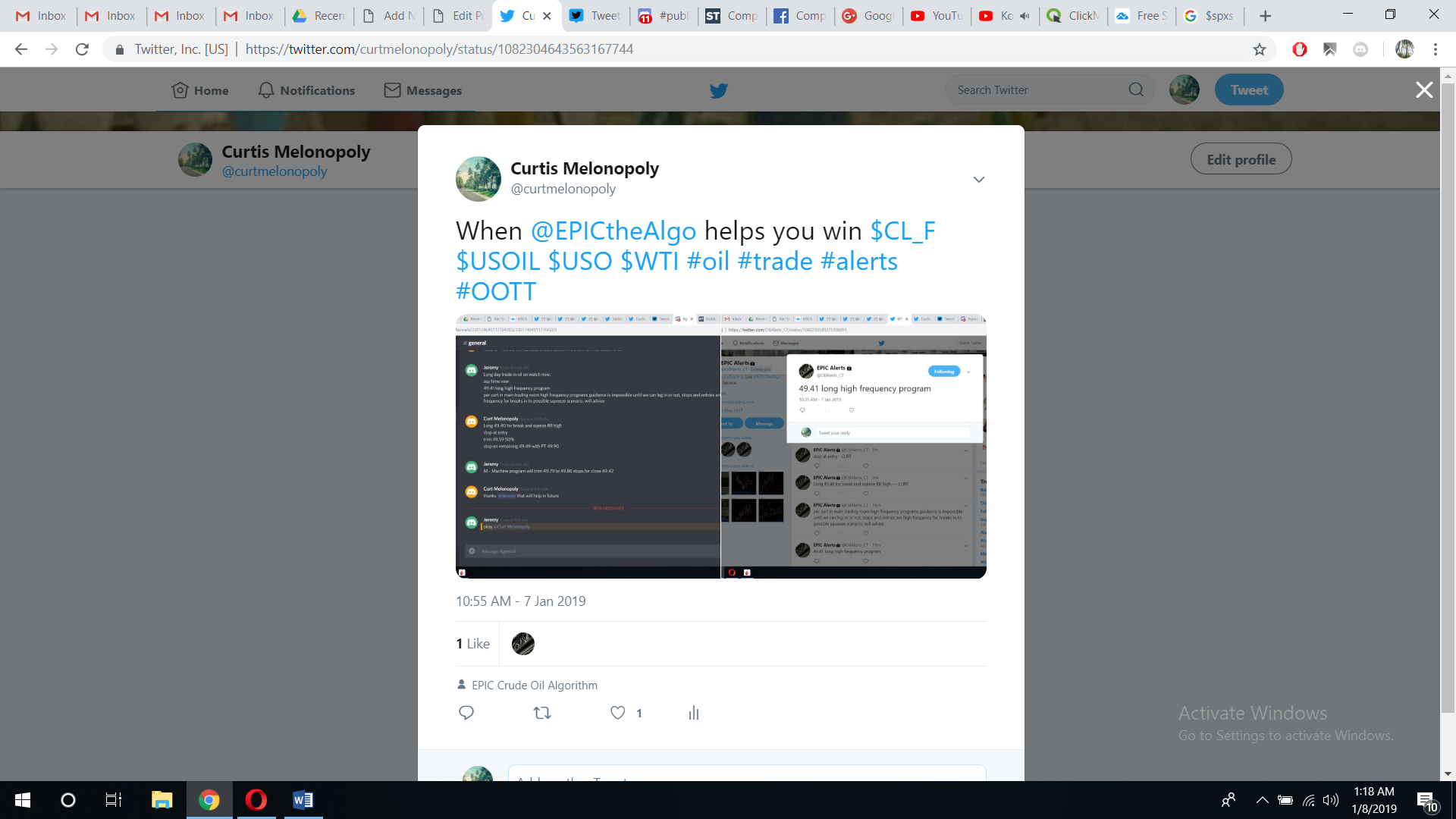

The chat room on Discord screen shot is below that shows the guidance from the machine trade tech and lead trader on the oil trade.

Chat Log Trading Signals For Those That Missed The Day in The Trading Room (Lead Trader and Pro Mods)

1/7/2019 5:28chrisgm

1/7/2019 5:28OilTrader3452xxmorn

1/7/2019 5:28Leannenice oil rally of lows

1/7/2019 5:28Surrindermorning

1/7/2019 5:29Surrinderhappy new year all

1/7/2019 5:29OilKmorning

1/7/2019 6:47curtProtected: PreMarket Trading Report Mon Jan 7: AXSM, LOXO, LXFT, LLY, AAPL, TSLA, AMZN, Oil, SPY, VIX, BTC, Gold, Silver, DXY …rrPassword: timerrLink: https://compoundtrading.com/premarket-trading-report-mon-jan-7-axsm-loxo-lxft-lly-aapl-tsla-amzn-oil-spy-vix-btc-gold-silver-dxy/

1/7/2019 6:47curtJan 7 – I am in session in main trading room today for market open, mid day review, during active trading.

1/7/2019 6:50curtmorn

1/7/2019 6:50curtMonday Jan 7 – Two days to let market structure settle and the report flow for the next six month time cycles starts. #patience #caution.

1/7/2019 7:00curtLooking to add to DWT short initial position on next oil pull back.

1/7/2019 7:08OilKROKU has block flows in premarket

1/7/2019 7:09OilKOil should see 50 then likely pull back some as curt points out

1/7/2019 7:09OilKSHOP also with flow\

1/7/2019 7:09MavenSHOP and ROKU high on my list today OilK

1/7/2019 7:11MavenDollar tree also may begood RR on swing here with activist

1/7/2019 7:11LennyMaven, sector issues but i agree

1/7/2019 7:12Lennystreaming hours up near 70% on ROKU – that seems key data point

1/7/2019 7:13AndersonAssoci started a position ROKU earlier starter only at this point, agree ith SHOP and possibly dollar tree

1/7/2019 7:14Surrinderpull back in oil would be healthy here

1/7/2019 7:14shafagreed

1/7/2019 7:16curtVIX on watch for near term bounce as it nears lower BB

1/7/2019 7:17curtWeekly US Dollar chart on watch for price to lose 200 MA – possible swing to 100 MA 94.70 area, trading 95.75 intra

1/7/2019 7:19curtSPY on watch for a near term pull back as it tackles 20 MA on daily.

1/7/2019 7:22curtJP Morgan says recent sell-off in global markets has a striking similarity to the one in late 2015, which may offer a glimmer of hope for 2019. In 2016 recession didn’t materialise. What stopped the rot were Fed, USD & China stimulus; all these could be inflecting again.

1/7/2019 7:22curthttps://twitter.com/Schuldensuehner/status/1082280294609231873

1/7/2019 7:25curtNext oil pull back should take us to near 20 MA on 240 (intra day at 45.90) oil trading 48.47 intra then bounce to 52 – 55 s. Scenario outlined in report last evening.

1/7/2019 7:26curtLook for a test of 50 area first however.

1/7/2019 7:27curt(possible test to 50 area in play)

1/7/2019 7:27curton mic shortly after open here, watching

1/7/2019 7:31curtLots of caution next 2 days, let it settle

1/7/2019 7:31curt$BBOX Halt – Additional Information Requested by NASDAQ. Halt time: 09:29:52.

1/7/2019 7:32curtIn Play: $QEP, $AXSM, $PCG, $CLVS, $ROKU, $DXC, $UWT, $UGAZ High Uncertainty: $TLRY, $DUST, $MU

1/7/2019 7:40curton mic in 1

1/7/2019 7:55curtIf oil does get the 50 mark (which may be too obvious) before a pull back, I will likely short term long NatGas UWT

1/7/2019 8:01curtNFLX NVDA strong order flows today

1/7/2019 8:02curt1030 or 1100 30 min candles should determine short term direction in oil

1/7/2019 8:05curtOn equities – the leaders have moved in to short term resistance areas, will watch but if oil pulls back like I think it will those equities will likely also, that would give opportunity for the select long entries in equities.

1/7/2019 8:07curt•New orders 62.7 vs 62.5 prior

1/7/2019 8:07curtUS December ISM non-manufacturing index 57.6 vs 59.0 expected

1/7/2019 9:02curtBack in an hour at lunch in main trading room for mid day trade review.

1/7/2019 9:58curton mic at 12:10, delayed with conference

1/7/2019 10:09curton mic 1 min