Compound Trading Chat Room Stock Trading Plan and Watch List Thursday November 16, 2017 $HMNY, $AAOI, $MRDN, $CADC, $EVLV, $LEDS $CHFS, $NATGAS, $TSLA, $DIS, $MXIM, $AMBA, $VRX, $VERI, $HIIQ, $CELG, $ROKU, $HTZ, $SNAP, Bitcoin, $BTC, Oil, $WTI, Gold – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

The private capital fund will bring slight changes.

The financing of our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will increase also.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade in our private fund is not disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You may see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading a private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:

THESE ARE ON DECK THIS WEEKEND – $SPY, $VIX, $DXY models are currently in re-balance / re-do mode for upcoming coding in 2018. Crypto model is being re-done in light of recent volatility. All to be complete prior to Nov 26, 2017. $BTC Crypto re-do also and Silver shortly behind.

They are a huge upgrade as all algorithm models and swing trade set-ups will have specific buy and sell triggers.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Per recent; EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. Looks like a master class will happen in Columbia Jan 2018 – will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

Part 2 of Episode 4 Podcast – Data Scientist

Part 2 – Episode 4 Podcast : Data Scientist Fireside, https://t.co/r85TlxJ9a4

— Melonopoly (@curtmelonopoly) October 23, 2017

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

BEST Trade Set-ups in a while! Nov 10 (starts 4:42): OIL, GOLD, $VIX, $VRX, $ROKU, $AAOI, $HTZ …

Wed Nov 8 Trade Set-Ups Review: $SPI, $BTC, $VRX, $AAOI, $KBSF, $LEU, $ONCS, $DEPO, $SNAP…

Nov 7 Trade Set-Ups Review: $DVN, $GOOGL, $TSLA, $HMNY, $VRX, $AAOI, $MYO, $TOPS, $BTC…

Nov 6 Trade Set-Ups Review: GOLD, $GLD, $HMNY, $RCL, $BTC, $WTI, $USOIL, $FB, $TOPS, $SPPI, $BAS…

Nov 2 Trade Set-Ups Review: $TSLA, $USOIL, $GPRO, $DRNA, $GSIT, $W …

Nov 1 Trade Set-Ups Review: $MDXG, $OSTK, OIL, $WTI, $AMBA, $TRIL, $AAOI, $UAA, $LBIX, $DWT…

Oct 31 SwingTrade Set-Ups Review: $UAA, $TAN, $SPPI, $SHOP, $SNGX, $AKS, $HMNU, OIL, $BTC, $VRX…

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

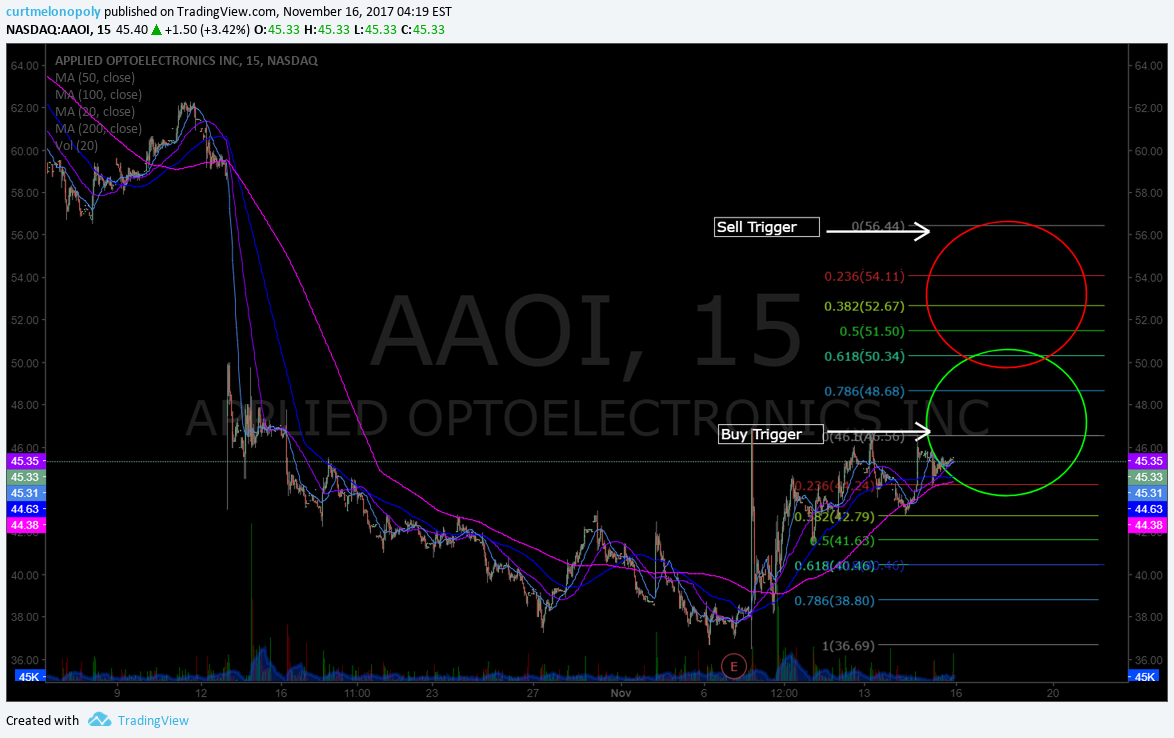

Trading Plan (Buy, Hold, Sell) and Watch Lists. I am in $HMNY premarket and Oil, closed $BTC trade overnight for win, watching $AAOI like a hawk. $TSLA Semi Day and Natural Gas EIA may be a huge report and turn in $NATGAS $NG_F

Morning Momentum / Gap / News / PR / IPO Stocks on Watch: MRDN, $CADC, $EVLV, $LEDS $CHFS

Recent IPO’s $FEDU $CBTX $IFRX $MCB

From recent: Starting to look at cyber crime stocks – $VEEV etc.

Also watching $VERI, $MXIM, $DIS, $AMBA, $VRX, $AAOI, $HIIQ, $CELG, $ROKU, $HTZ, $HMNY, $SNAP

Shippers list: $TOPS $DRYS $SHIP $ESEA $DCIX

Market observation / on watch:

US Dollar $DXY flat trading 93.89. Oil $USOIL $WTI has lift in recent weeks and testing support premarket, in multi month sideways action but near highs now, Gold / Silver in flat range intra day is trading at 1279.71. $SPY is moderate but does have a MACD turning down on daily, $BTCUSD $XBTUSD has retracement lift after sell off and $VIX trading at 12.4 – off from yesterday mid 13’s if I recall.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

Recent / Current Holds, Open and Closed Trades:

$BTC $XBTUSD win overnight, in oil long premarket and $HMNY premarket. Small win on $XIV yesterday.

Bitcoin win to start day $BTC $XBTUSD #Bitcoin #Crupto #Premarket pic.twitter.com/SVYbtnodCA

— Melonopoly (@curtmelonopoly) November 16, 2017

Outta here! Have a good one and GL!🍻 Back for overnight session 6pm $WTI Oil $GC_F Gold $BTC Bitcoin. Scalped $XIV $AAOI $SPPI up and algo models rockin🔥🎯👊 Peace. pic.twitter.com/aPnwr1Eg58

— Melonopoly (@curtmelonopoly) November 15, 2017

$WYNN was previously closed for a win, Gold trade ss went well and a win.

Closed Gold short 1270.40 #GOLD $GC_F $GLD $XAUUSD $NUGT $DUST #algorithm #rulesbasedtrading pic.twitter.com/e059wPE6bu

— Melonopoly (@curtmelonopoly) November 14, 2017

Previous recent trading position notes:

Live trade in $ROKU on video and how I knew exactly where to enter and exit on extensions here : https://twitter.com/curtmelonopoly/status/928605860074532864 … #trading

Recent trades in $ROKU and $VRX have gone well. Hold $WYNN swing trade going very well, Gold short going well from Friday, $SNAP very small position needs to be traded out of and $AAOI swing trade is improving. $SPPI swing trade I may have to cut at a small loss.

Back in Bitcoin and doing well obviously with overnight trade, holding $AAOI (survived ER), holding 1 small $SNAP position, $SPPI swing holding, $WYNN holding and going well as is $FB small position(s). Holding small oil play through EIA. Watching Gold here with weekly chart bullish slant.

Closed $DWT starter for a loss. $WYNN, $FB going well. $AAOI will see soon – ER on deck. $SPPI flattish swing.

Flipped to a small oil long premarket also.

Looking for Bitcoin chart to reconstruct for a long hammer down.

New position in $WYNN going well, we got out of $SHOP swing right before it tanked, $FB going we close (that was a decent swing ROI), $SPPI swing trade I am holding, $DWT small swing trade position holding for now – watching oil close and $AAOI (our toughest trade all year) we are unfortunately holding in to earnings.

New position in $WYNN going well, we got out of $SHOP swing right before it tanked, $BTC trades going well, $FB going well and $AAOI we shall see in to earnings here ugh.

No trades Tuesday other than $XTBUSD.

Hold small $SNAP (win), holding $SPPI (YTBD), hold some $FB (win), $XBTUSD many trades & all wins (only thing we can claim that – we don’t lose), $AAOI underwater and holding waiting for a bounce for a double down, $SHOP holding and trimmed some (winning), Gold closed my short for a win, and oil no new position as of yet.

Out 99% of $SNAP for win, new swing in $SPPI in to earnings. Hold most of $FB swing for winning exits, $XBTUSD Bitcoin we have been winning of course and especially with most recent downturn and spiking yesterday (we bought all the way down and sniped off some on bounces) and $AAOI holding, $SHOP holding. In a tight oil trade premarket long and a swing in Gold short.

Yesterday killed Bitcoin and an oil scalp. Holding $AAOI, $SNAP, $SHOP.

Holding everything still… trimmed some $SNAP and keep winning on Bitcoin 100 x leverage 24 hours a day 7 days a week.

Recent Chart Set-ups on Watch:

Algorithm models are rocking it:

Well that couldn't be any closer to nailing the oil target at 10:30 at exact time and price. @EPICtheAlgo on fire. Perfect hit from Sunday newsletter. #OIL #OOTT $USOIL $WTI $USO $UWT $DWT pic.twitter.com/sAdaPJ1Lt9

— Melonopoly (@curtmelonopoly) November 15, 2017

And check out @ROSIEtheAlgo algorithm model BOOM in to the target yesterday and BOOM comes right off resistance marked for members for a HUGE short. Wow fired up. #Gold $GC_F $GLD $NUGT $DUST pic.twitter.com/A8vpZfWnnK

— Melonopoly (@curtmelonopoly) November 15, 2017

Review You Tube posts. Most recent of interest are $DIS, $MXIM, $CELG, $HIIQ, $AMBA, $ROKU, $HTZ, $AAOI, $HMNY

Per recent;

$AMBA could rip in to earnings in 17 days – Stoch RSI close to bottom with a break above sees 61.00 fast 65.00 possible. #swingtrading

$AMBA could rip in to earnings in 17 days – Stoch RSI close to bottom with a break above sees 61.00 fast 65.00 possible. #swingtrading pic.twitter.com/1iqGppNGQF

— Melonopoly (@curtmelonopoly) November 13, 2017

As above, starting to look at cyber crime stocks – $VEEV etc – obvious catalyst with Bitcoin.

$OCN is added to my watchlist thanks to JDee in the room on mid day chart review and $SPPI which I am in.

From Monday in the room $LCI (thanks to Sean) and $HIIQ are on my watchlist.

I am adding $ONTX to my short term watch… it has its 200 MA and is in a bull formation. $BABA, $BBRY. $GBTC, $AAOI, $FIT, $FSLR, $JKS, $FEYE $LACDF, $CTSH, $NVO, $TSLA, and $AAMJ. $NLNK and $PI are recent chart set ups – $GPRO for possible break out on chart and recent new includes $SNAP and $ARRY – $ARWR, $CDNA, $XXII, $SHOP (wash-out), $SENS, $HCN, $GTHX, $EDIT, $IPI, $XOMO, $MBRX, $PDLI, $LPSN and more that can be reviewed on You Tube videos or on weekly Swing Trading reports.

See other mid day charting trade set-up reviews on You Tube. The set-ups are key to success if you’re swing trading (even daytrading).

We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day. Many of the mid day reviews are published “private” for members only so be sure to watch your email inbox for these among other member only videos.

Market Outlook:

Moderate – $SPY under some pressure of recent.

Stocks making the biggest moves #premarket: $WMT, $BBY, $VIAB, $SJM, $P, $CSCO & more –

Stocks making the biggest moves #premarket: $WMT, $BBY, $VIAB, $SJM, $P, $CSCO & more – https://t.co/ZnFlTCL2om

— Melonopoly (@curtmelonopoly) November 16, 2017

Per recent;

Credit Slips – SPX(inverted) vs. Credit

Credit Slips – SPX(inverted) vs. Credit pic.twitter.com/3vtKA4m04t

— MQTA (@Steen_Jakobsen) November 14, 2017

JNK Bonds – still the chart to watch – big week in the markets.

Moderate with a concern toward MACD on daily $SPY chart.

$SPY MACD remains decent buy sell trigger and is currently threatening lower. S&P 500 $SPY 525 AM Nov 13 $ES_F $SPXL, $SPXS https://t.co/xnVSgtdSzo pic.twitter.com/CmCoIFJvq3

— Melonopoly (@curtmelonopoly) November 13, 2017

Market News and Social Bits From Around the Internet:

Per previous;

Upcoming #earnings releases with the highest #volatility

$ANW $SORL $WPRT $SCVL $ASUR $WUBA $SFUN $DQ $YRD $ANF $SSYS $SITO $FL $IGT $BBY $MTSI $DKS $VBLT

upcoming #earnings releases with the highest #volatility$ANW $SORL $WPRT $SCVL $ASUR $WUBA $SFUN $DQ $YRD $ANF $SSYS $SITO $FL $IGT $BBY $MTSI $DKS $VBLThttps://t.co/lObOE0dgsr pic.twitter.com/BMWsZtM719

— Earnings Whispers (@eWhispers) November 13, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: MRDN, $CADC, $EVLV, $LEDS $CHFS $RH $TIME $ARGS $ROSG $QRHC $NTAP $ROKU $CSCO $P $ROK $CSTM $ACHN

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $DG $PDCO $PTCT $NTAP $DBD $CSTM $SCG $YY $RH $P $RF $BL $SYK $PDCO

(6) Recent Downgrades: $PAY $DPLO $SMI $CPTA $TCAP $ACOR $LHO $SHO $CHSP $MAR

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $DIS, $MXIM, $AMBA, $VRX, $AAOI, $HIIQ, $CELG, $ROKU, $HTZ, $HMNY, $SNAP, Bitcoin, $BTC, Oil, $WTI, Gold, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY