Compound Trading Swing Trade Earnings Report Thursday January 17, 2019.

Swing Trading Signals and Stock Picks in this Issue: $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX … .

Email us at compoundtradingofficial@gmail.com anytime with any questions about any of the swing trades listed below. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Notices:

Welcome to a series of special reports during earnings season for our swing trading platform. There will be a significant number of these mini reports in advance of key earnings release dates.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week (on average) cycling the five reports (that include over one hundred equities) every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service rotation to also include reports for earnings season, special trade set-ups, themed reports and swing trade alerts direct to your email inbox.

After earnings season we will recommence the regular rotations.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Swing Trading Signals / Charts for Earnings Season.

Bloomberg Earnings Season Reporting Calendar List https://www.bloomberg.com/markets/earnings-calendar/us

MORGAN STANLEY (MS) Earnings Swing Trade Strategy.

Jan 17 –

Morgan Stanley’s stock jumps into bull-market territory ahead of earnings $MS #swingtrading #earnings https://on.mktw.net/2MdqifS

Morgan Stanley (MS) swing trade set-up couldn’t be better, long at lower trend short at upper trend line $MS #swingtrading #earnings

On the weekly the channel trade is it, long at support or momentum post earnings and short at top of the channel. MACD on the weekly is turned up, this is a bonus. This trade is on high watch.

AMERICAN EXPRESS (AXP) Earnings Swing Trade Strategy.

Jan 17 –

Should You Buy American Express Stock Before Earnings? #swingtrading $AXP https://finance.yahoo.com/news/buy-american-express-stock-earnings-185712628.html?soc_src=social-sh&soc_trk=tw

AMERICAN EXPRESS (AXP) earnings on tap. Over 99 targets 112, under 89.70 targets 76 Mar 23, 2020 #swingtrading #earnings

Over trading box to target, under trading box to lower target and in trading box long at trading box support short at resistance of the trading box. Really structured swing trade set up here.

Downside of the trade – MACD on the weekly is trending down.

CITIGROUP INC (C) Earnings Swing Trade Strategy.

Jan 17 –

Jim Cramer: Citigroup May Be the Metaphor for the Moment

Get a load of what CEO Michael Corbat said on his conference call: “we clearly see a disconnect between what we see in our business and what the markets are saying.” He goes on to say he sees no significant slowdown and that “we see the biggest risk in the global economy is one of talking ourselves into the next recession as oppose to the underlying fundamentals taking us there.” https://realmoney.thestreet.com/investing/jim-cramer-citigroup-may-be-the-metaphor-for-the-moment-14833403

CitiGroup (C) Bullish post earnings, over mid resistance 20 50 MA with 100 MA previous resistance test next #swingtrading #earnings $C

Trading way up from earnings at 62.38 CITIGROUP stock is a winner this earnings season.

Next resistance is the 100 MA overhead and then the most important resistance (previous support) at approx 65.94, the 200 MA just happens to be hovering in same area.

A trade from 62.38 to previous resistance seems to be a no thought needed long trade, not a huge reward but trade could squeeze in to top price target at 73.99.

I missed my entry (I was busy at the time) – wish I would have got this one for sure.

Your support is now the mid quad just under trade.

Jan 13 –

On Monday, Citigroup (C) kicks things off with earnings before the open. While the stock has beaten EPS estimates 74% of the time, it has averaged a one-day decline of 0.35% on its earnings reaction days. Per Bespoke here.

Citigroup is up first as big banks kick off fourth-quarter earnings season #swingtrading #earnings $C https://on.mktw.net/2H6XRBn

CITIGROUP INC (C) earnings swing trading targets on daily chart for bullish and bearish trend of trade post earnings #swingtrading $C #earnings

After earnings I will trade to the following price targets for Citi pending trade on daily chart below:

Bullish – 73.99

Moderate Bullish – 60.63

Bearish – 47.68

Intra-Day Trading – 56.69

Each horizontal Fibonacci line and diagonal Fibonacci diagonal trend line in chart model below are support and resistance decisions as trade trends toward up or down price target.

SHAW COMMUNICATIONS INC (SJR) Earnings Swing Trade Strategy.

Jan 17 –

SHAW (SJR) got a bump upside post earnings, over 20.81 is long under 19.48 short trading 19.88 #swingtrading $SJR #earnings

I like this trade set-up with SHAW. The MACD on weekly is crossed up and the chart structure is really clean.

Will be watching the levels noted above for triggering a swing trade to next decision (per chart horizontal fibs) either way.

I’m sure it will be a long swing trade that triggers.

Shaw Communications (SJR) Q1 Earnings Beat, Revenues Up Y/Y #swingtrading #earnings $SJR https://finance.yahoo.com/news/shaw-communications-sjr-q1-earnings-112211034.html?soc_src=social-sh&soc_trk=tw

Jan 13 –

Will Shaw (SJR) Beat Estimates Again in Its Next Earnings Report? #swingtrading $SJR #earnings https://finance.yahoo.com/news/shaw-sjr-beat-estimates-again-151003158.html?soc_src=social-sh&soc_trk=tw

SHAW (SJR) earnings swing trading targets on weekly chart for bullish and bearish trend of trade post earnings #swingtrading $SJR #earnings

After earnings I will trade to the following price targets for Shaw pending trade on daily chart below:

Bullish – 25.94

Moderate Bullish – 23.02

Indecisive – 20.17

Moderate Bearish – 17.28

Bearish – 14.41

Intra-Day Trading – 19.69

Each horizontal Fibonacci line, diagonal Fibonacci diagonal trend line and moving average in chart model below are support and resistance decisions as trade trends toward up or down price target.

BANK of AMERICA (BAC) Earnings Swing Trade Strategy.

Jan 17 –

Bank of America Earnings: BAC Stock Soars on Q4 Earnings Beat. BAC beat EPS and revenue estimates for Q4 https://investorplace.com/2019/01/bank-of-america-earnings-boost-bac-stock/.

BANK OF AMERICA (BAC) beautiful move on earnings up over 7% looking for my entry long #swingtrading $BAC #earnings

Jan 13 –

Big Banks’ Q4 Earnings Releases Next Week: C, JPM, WFC, BAC https://finance.yahoo.com/news/big-banks-q4-earnings-releases-132401161.html?.tsrc=rss

BANK OF AMERICA (BAC) earnings swing trading strategy on weekly chart for bullish and bearish trend of trade post earnings #swingtrading $BAC #earnings

After earnings I will trade to the following price targets for Bank of America pending trade on daily chart below:

Bullish – 36.49

Moderate Bullish – 30.54

Indecisive – 24.73

Moderate Bearish – 18.92

Bearish – 12.97

Intra-Day Trading – 26.03

Each horizontal Fibonacci line, diagonal Fibonacci diagonal trend line and moving average in chart model below are support and resistance decisions as trade trends toward up or down price target.

DELTA AIRLINES (DAL) Earnings Swing Trade Strategy.

Jan 17 –

Delta Air Lines Earnings: Weak Guidance Disappoints $DAL https://finance.yahoo.com/news/delta-air-lines-earnings-weak-230600156.html?soc_src=social-sh&soc_trk=tw

DELTA AIRLINES (DAL) earnings disappoint but it closed above trading box support today on weekly chart #swingtrading $DAL #earnings

I really like this set-up, price closed above the large structured weekly trading box support.

What I don’t like is that the MACD on the weekly is trending down – but on the daily it is crossed up.

I’ll be watching for trade to hold trading box support for a possible long swing trade.

Jan 13 –

Airline Outlook Darkens as Warnings Reveal Revenue Weakness #swingtrading $DAL #earnings https://finance.yahoo.com/news/airline-outlook-darkens-warnings-reveal-150701769.html?soc_src=social-sh&soc_trk=tw

Trading Strategy:

The recent sell-off looks extreme to me. The news flow from the airlines may be setting up for a bit of a short squeeze moving in to earnings.

DELTA (DAL) earnings swing trading strategy on weekly chart for bullish and bearish trend of trade post earnings #swingtrading $DAL #earnings

After earnings I will trade to the following price targets for Delta pending trade on daily chart below:

Bullish – 58.39

Moderate Bullish – 53.92

Indecisive – 49.41

Moderate Bearish – 44.71

Bearish – 40.22

Intra-Day Trading – 48.56

Each horizontal Fibonacci line, diagonal Fibonacci diagonal trend line and moving average in chart model below are support and resistance decisions as trade trends toward up or down price target.

NETFLIX (NFLX) Earnings Swing Trade Strategy.

Jan 17 –

Netflix reports Thursday.

Big Quarter Expected From Netflix https://finance.yahoo.com/video/big-quarter-expected-netflix-175317659.html?soc_src=social-sh&soc_trk=tw $NFLX #swingtrading #earnings

Netflix (NFLX) traded right up against key resistance going in to earnings. $NFLX #swingtrading #earnings

Jan 13 –

“Netflix (NFLX) will report Thursday after the close. NFLX is projected to earn 35 cents/share, and the stock has beaten EPS estimates 85% of the time throughout its history”. Per Bespoke – click here.

Netflix earnings: Can the streaming giant clear a high bar of investor expectations for a change? #swingtrading $NFLX #earnings https://on.mktw.net/2VOoFtx

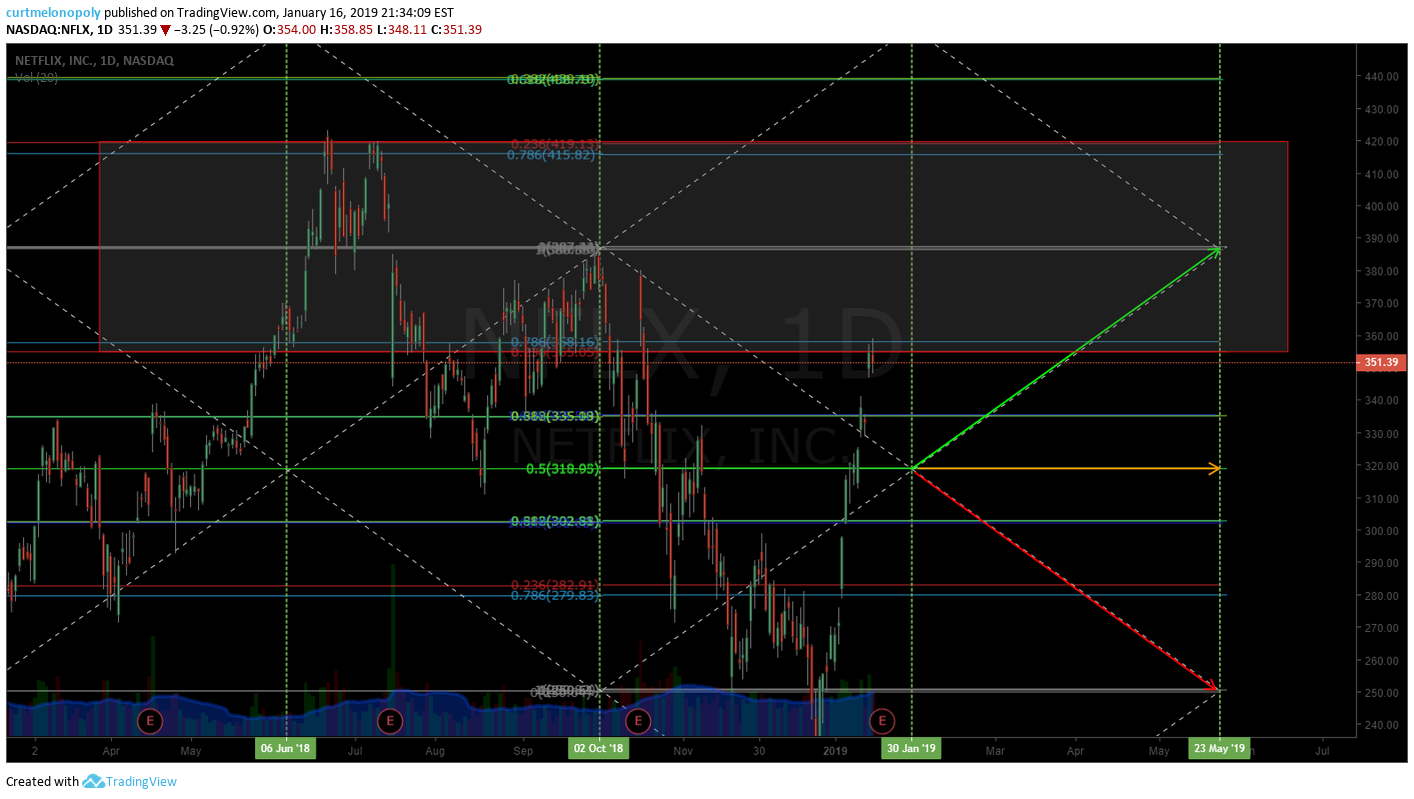

Netflix (NFLX) earnings swing trading targets for bullish and bearish trend of trade post earnings #swingtrading $NFLX #earnings

After earnings I will trade to the following price targets for Netflix pending trade on daily chart below:

Bullish – 387.24

Bearish – 251.08

Intra-Day Trading – 337.59

Each horizontal Fibonacci line and diagonal Fibonacci diagonal trend line in chart model below are support and resistance decisions as trade trends toward up or down price target.

Netflix (NFLX) 240 min chart I will use for entry timing for my swing trade post earnings $NFLX #swingtrading #earnings

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX