In this Special Earnings Season Swing Trading Report: $HCLP, $HIIQ, $LITE, $GTHX, $ITCI, $IBB, $PSTG, $ARRY, $AGN, $EDIT, $AXP, $FB, $GOOGL, $AMZN, $VFC, $FIT, $EXP, $XRT, $ARWR, $AMD and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video did not work on the monitor that was recording the video (the audio did work however, so I included it for those that wish to listen to further detail). In lieu of the video charting I have included charting below for all the tickers discussed and more in this special earnings report.

Mid Day Member Webinar Chart Swing Trading Set-ups Summary (from July 26 mid day, published July 29):

Swing Trading Special Earnings Season Report (member version) that will become the premise for our next major entries.

Stocks reviewed in this series for earnings: $HCLP, $FB, $HIIQ, $LITE, $GTHX, $ITCI, $IBB, $PSTG, $ARRY, $AGN, $EDIT, $AXP, $GOOGL, $AMZN, $VFC, $FIT, $EXP, $XRT, $ARWR, $AMD.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Members can refer to the previous swing trading report for charting to reference in the video (if not included below).

4 days in to 10 days of covering the 100 equities we cover regularly in our swing trading platform to be sure we’re on top of earnings.

$SPY – over 282.52 targets 284.96, 288.75 Aug 2 bullish price target with bearish target below per chart.

Oil – video explains recent oil trades.

$FB Facebook earnings wash-out trade. Refer to special reports published.

US Dollar $DXY – refer to chart structure and algorithmic reports.

American Express AXP – All time highs, 103.11, threatening break-out. See chart report below. Will be daytrading it Monday in hopes of getting a swing trade established.

$HCLP – Hi Crush Partners Testing 200 MA on weekly with Stochastic RSI turn up, MACD turn on weekly. Looking for big trade. #swingtrade #daytrade

$HIIQ – testing key support end of last week, earnings trade setting up here. 31.15 support, 33.20 resistance, 26.60 main support below, also a channel on chart with 35.55 main resistance and even 40.10 most bullish possible Nov1, 2018 (pending earnings action).

$LITE – under main structure resistance 53.95 trading 53.90 but stoch RSI is starting to turn up, earnings in 15 days,

$EDIT – see chart for explanation and video audio for trade plan.

$GTHX – expecting a good swing trade I’m in, 58,25 is first target Aug 27, trading 49.50 with earnings in 17 days.

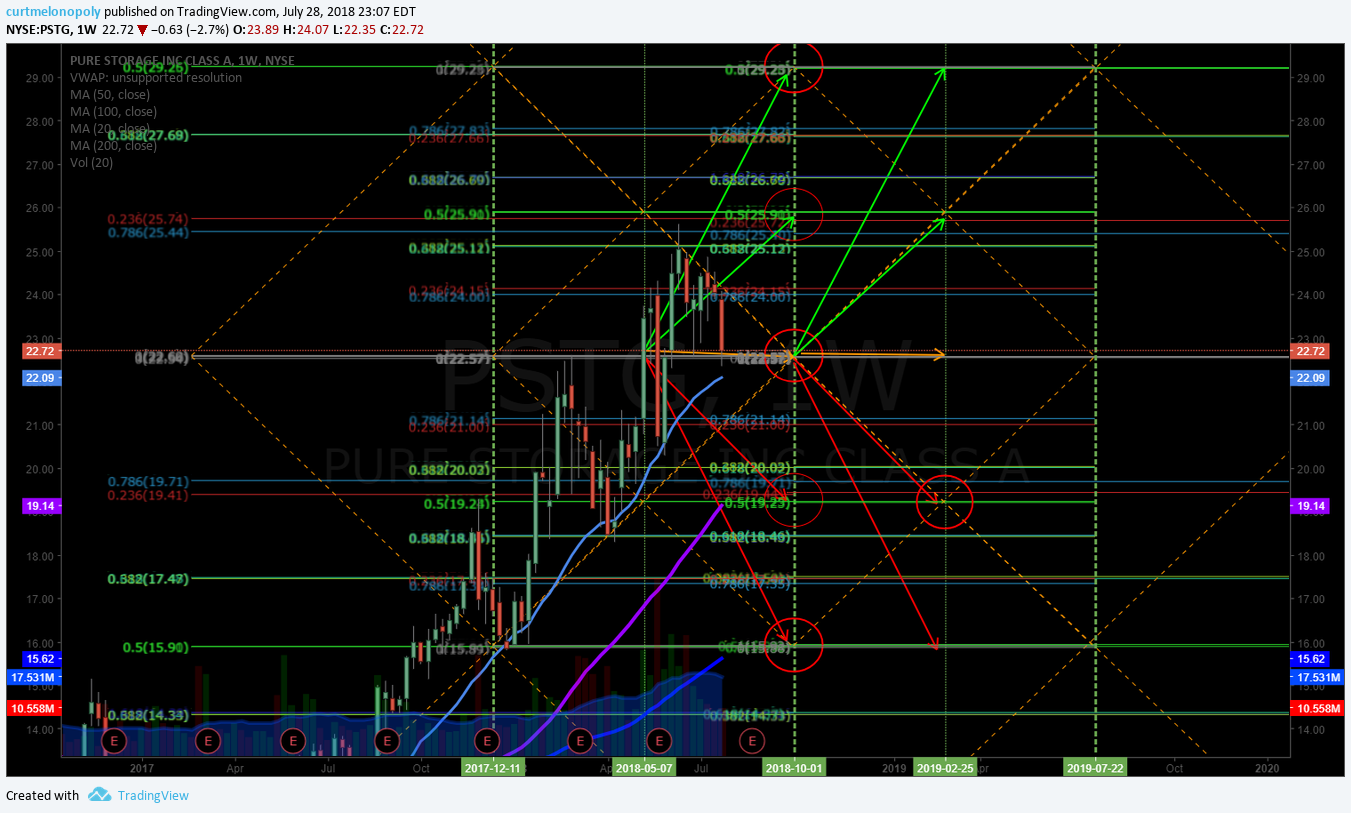

$PSTG – see video for swing trade set-up below and audio on video for all support and resistance descriptions on chart.

$AMD – 17.02 support, 19.34 resistance, 18.16 trading intra, Aug 15 PT 19.39. Most bullish scenario 24.10 on time cycle expiry Aug 15, 2018. 16.98 is support and bearish scenario. Trading plan explanation on video.

$ARWR – in swing 1.3 sizing, up on day, swing structured so far. 17.15 range alarmed for an add. 19.50 Aug 22 price target for swing trade.

$AGN – see chart in report. 191.00 Sept 6 price target on my swing trade. 198.69 main resistance, 165.46 main support. Trading 177.06 intra. Listen to audio on video for various trade plan indicators and levels to watch for.

Referencing the June 20 swing trading report:

$XRT – various levels explained on video for upside and downside trading the set-up.

$EXP – sideways action, refer to last swing trade report for it for chart, trading really technical, support 105.07 earnings 4 days. Bullish 117.71, bearish 95.63 and 73.81 in major sell off. Upside most bullish 139.86. Trading 105.24. Nov 2 2018 is target date for quoted levels at end of time cycle.

$FIT – refer to special report sent out to members, the trade was one of the best this year, 5.61 main structural support, main resistance 6.65, under 50 MA. Currently testing resistance. 7.72 Aug 14 most bullish target, 6.66 below that, 5.57 and 4.54 bearish targets same date. Most probable 5.57 based on trend.

$VFC – trading 93.43 testing previous highs, interested in its break out if it trades above in to Monday.

$GOOGL – trading 1277.88 well above it’s moving averages, it’s a buy and don’t look. 1320.00 resistance, 1211.50 support, 1425.00 Oct 23, 2018 price target, in a sell off 1211.56 and 996.16 in a sell-off to serious bearish side.

$AMZN – not interested in chasing anything that extended over its moving averages, will wait for pull backs for entries.

Stocks Reviewed Specifically on the Video Above:

Below is an excerpt from the Special ALPHABET (GOOGL) Trading Report found here (refer to report for more detail):

ALPHABET (GOOGL) The projected July 3 target area did hit (albeit a bit late), current trade structure on chart, price came off at Fibonacci resistance / quad wall (diagonal down slope Fib trend line). $GOOGL

1320.20 is key range resistance.

1294.89 Fibonacci resistance and quad wall area price came off.

1263.00 Fib resistance.

1257.80 Fib resistance.

1252.89 trading intra.

1211.80 key range support.

1102.74 key range support one leg down in a sell-off.

Keep in mind the diagonal up trend yellow lines that illustrate the algorithmic channel. Above the channel is considerably over bought, mid channel (dotted yellow) has been historical buy zone and below that (yellow bottom channel line) is the bottom of the channel. Price is not visiting the bottom of the channel, but in a sell-off scenario this will be a considerable buy zone to contemplate.

Current trading range is highlighted in the green triangle. For shorter time frame traders long near bottom of the triangle and short at the outter upper edge of trading structure (triangle) are key points for trimming longs and adding etc.

Upside is limited here for new entries unless price nears the mid channel (dotted yellow).

Also pay attention to those trajectory lines (green) from target to target, you will find trade will react to those areas. This should only be considered for short time frame trims and adds.

Most probable target is 1320.20 October 24, 2018 but the 1440.00 area at top of channel on October 24 is also possible.

In a sell-off 1211.80 area is likely and in considerable sell-off look to 1102.00 then 994.00 on same Oct 24, 2018 time cycle peak – unlikely but noted.

Our Google Trading Plan:

We have been long for some time (in accordance to alerts and swing trading member reports), we are trimming at top of this trading structure (triangle in green) and adding at bottom of structure until the structure is broke and then we will move to the next.

Below is the Google chart with live link:

$GOOGL Alphabet is looking even better after Facebook’s disappointing earnings #swingtrading #earnings $FB https://cnb.cx/2LZ6jRe

Google is laying the groundwork for life beyond advertising $GOOGL #swingtrading https://qz.com/1342305/google-is-laying-the-groundwork-for-life-beyond-advertising/?utm_source=YPL&yptr=yahoo

Facebook (FB) – Please refer to the Special Trading Report found at the link below.

FACEBOOK (FB) Closed Friday just above 50% Fibonacci retrace pivot in trading structure alerted to members $FB #swingtrade #daytrade

AMAZON (AMZN) Daily chart – watching for Stochastic RSI and MACD to turn back up for possible long trade. $AMZN #swingtrading

Per comments above and in video (audio) “$AMZN – not interested in chasing anything that extended over its moving averages, will wait for pull backs for entries.”

Hi Crush Partners Testing 200 MA on weekly with Stochastic RSI turn up, MACD turn on weekly. Looking for big trade. #swingtrade #daytrade $HCLP

3 Top Stocks to Buy Under $20 $HCLP $CYOU $GLUU https://finance.yahoo.com/news/3-top-stocks-buy-under-204600726.html?soc_src=social-sh&soc_trk=tw

Health Innovations (HIIQ) Testing key support with earnings in four days, will be looking for a trade post earnings $HIIQ chart. #swingtrade #earnings

LUMENTUM HOLDINGS INC (NASDAQ LITE) Coming in to earnings at key mid quad, looking for trade other side of ER $LITE #swingtrade #earnings

G1 THERAPEUTICS (GTHX) Over mid quad key support in swing trade long here. Targets on chart. $GTHX #swingtrade

Recent Charting Alarms / Trade Alerts that Triggered in the Live Trading Room:

INTRA CELLULAR (ITCI) Trading 20.16 above key mid quad Fib support 19.77, price targets 24.60 (preferred), 19.77, 14.66 Sept 6, 2018 $ITCI

The upper price target for Sept 6, 2018 at this point is still in play at 24.60 (follow green arrow trajectory). If mid quad support (Fibonacci support) at 19.77 is breached to downside then the mid price target (yellow arrow) or lower price target red arrow are in play. Notice the technical trade as trade has used the trajectory of the green arrow trending toward the upper price target has been used as resistance in trade and trade close Friday at the quad wall support (diagonal Fibonacci up trending trend line – orange dotted).

The white arrows on the chart are your main buy sell triggers. They represent important Fibonacci levels. When price breaches the buy sell trigger down then bias is to the short side to the next price buy sell trigger only if the trading trend is in that direction (trajectory). The opposite is true if price breaches to the upside. Each horizontal line or diagonal line and moving average then becomes a support or resistance test as price trends toward the next appropriate target.

The red horizontal lines are conventional historical support and resistance that can be used for timing intra day entries or trims as needed.

Also note that trade is still above the 200 MA on this daily chart structure (bullish at this juncture of trade). If trade turns back up it will be interesting to see if it turns before price gets to the downside and hits the 200 MA test. Note last time price did fall below the 200 MA on the daily BUT PRICE REVERSED AT THE QUAD WALL. This is important as it displays the importance over the quad wall support and resistance areas on the charts. And note, the 200 MA was used as support the time prior to that. The point being, all the lines on these charts are important and as a trader that does not like to lose and wants to receive the greatest ROI on each trade, I rely on entries and exits with the “lines” or indicators on these charts to ensure I see an addition 10, 20, 30% on every trade simply because I know where the machines will execute liquidity in to each decision of trade in the structure of the instrument being traded. This allows for precision trading – this is important for swing trading and investing, not only daytrading.

The last important observation on this chart structure is the symmetry. Symmetry is another word for Sesame Street in charting. Look at the price targets. The last two upper quadrant price targets were hit, the first had price over shoot some and the second the price under shot the price some. Nonetheless, there is symmetry and this will be weighted in my personal swing trading plan.

The charting observations above are representative of typical lesson points students receive in our trade coaching service.

The charting observations above are representative of typical lesson points students receive in our trade coaching service. Understanding the battle field layout (the charting or financial instrument structure) and the reasons to be long or short biased based on trade in the chart structure are key to your success as a trader – the importance of this are vital for daytrading, swingtrading and investing.

$ITCI Intra-Cellular Therapies to Host Second Quarter 2018 Financial Results Conference Call and Webcast #earnings https://finance.yahoo.com/news/intra-cellular-therapies-host-second-120000332.html?soc_src=social-sh&soc_trk=tw

Biotechnology Fund (IBB) Closed 115.41 just under key resistance 122.31. Bullish PT 142.21 Nov 30 bearish 102.57 $IBB #swingtrading

$AMGN Amgen Beats Estimates, Reports Growth in Q2 2018 $IBB https://marketrealist.com/2018/07/amgen-beats-estimates-reports-growth-in-q2-2018 #earnings

$CELG Celgene Raises Revenue Guidance after Solid Growth in Q2 2018 $IBB #earnings https://finance.yahoo.com/m/15d9d5cd-86e5-37e1-a2ee-782d9c8c7b0a/celgene-raises-revenue.html?soc_src=social-sh&soc_trk=tw

PURE STORAGE (PSTG) Closed Friday just above key support. Below targets 19.25 Oct 1 above 25.92. $PSTG #swingtrading

Not an easy stock to short, but if it loses key support a short may be okay if monitored closely. I would prefer a bounce here and a long in to the next price targets – preferably the 25.92 Oct 1 swing trade price target in a continued uptrend. Will monitor this one closely Monday.

May 16, 2018 $PSTG Special Trading Report we published is available here for $STUDY reference;

How to Trade Pure Storage (PSTG) Earnings in Six Days (Member Edition) $PSTG

$PSTG Pure Storage Positioned as a Leader in Gartner Magic Quadrant for Solid-State Arrays for Fifth Co… #swingtrading https://finance.yahoo.com/news/pure-storage-positioned-leader-gartner-200500009.html?soc_src=social-sh&soc_trk=tw

3 Tech Stocks for Growth Investors to Buy Now $MOMO $HEAR $PSTG #swingtrading https://finance.yahoo.com/news/3-tech-stocks-growth-investors-205308353.html?soc_src=social-sh&soc_trk=tw via

ARRAY BIOPHARMA (ARRY) At chart trading structure support test, targets 18.37 on reversal or 13.39 on pressure. $ARRY #swingtrading #chart

Another stock I will be watching closely Monday for a possible reversal is Array BioPharma. It closed the week on this weekly chart structure at the quad wall support. If it turns up on positive indicators I’ll take a trade for the upside target. Yet to be seen. On watch.

$ARRY BRAFTOVI™ (encorafenib) + MEKTOVI® (binimetinib) Receives Positive CHMP Opinion for Adv BRAF… #swingtrading https://yhoo.it/2OnDoIa

ALLERGAN (AGN) swing trade continues, 180.28 resistance hit, over then targets 184.62 main resistance Aug 16. $AGN #swingtrading

June 7 Special Trading Report for AGN. Protected: How to Trade Allergan (AGN) Stock Move (Exclusive) $AGN #swingtrading #daytrading #chart

$AGN I know it’s psychedelic but I think time cycle over soon. https://www.tradingview.com/chart/AGN/001O0j7h-ALLERGAN-AGN-Excellent-swing-trade-in-progress-trading-177s-t/

ALLERGAN $AGN 147s to 181.50 HOD on Friday #swingtrading #tradingedge #careertrade

https://twitter.com/curtmelonopoly/status/1005060263953993729

Pharma Favorites: 7 Healthy Picks in the Drug Sector #swingtrading $AGN $ABT $SNY $AZN $ABBV … http://www.investopedia.com/investing/pharma-favorites-7-healthy-picks-drug-sector?utm_source=twitter&utm_medium=social&utm_campaign=shareurlbuttons

EDITAS MEDICINE (EDIT) Sell-off nears key support 27.95 for an add to swing, trading 29.70 Friday $EDIT #swingtrade #alerts

3 Top Healthcare Stocks to Buy Right Now $CELG $EDIT $ABMD #swingtrading https://finance.yahoo.com/news/3-top-healthcare-stocks-buy-202000177.html?soc_src=social-sh&soc_trk=tw

AMERICAN EXPRESS (AXP) Closed Friday in clear break out post earnings. Will likely daytrade this Monday and maybe swing it if DT goes well. $AXP #daytrade #earnings

Charts and Chart Links for Member Version Only

(Mailing list versions that may be made available from time to time do not include charting or chart links).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me: