My Stock Trading Plan for Tuesday Jan 3, 2017 in Trading Chat room. $DGAZ $LEI $ALJ $DEPO $ORIG $GLD $GDX $NUGT $JNUG $USLV $SLV $UWT, $DWT, $USOIL, $WTI, $GOLD, $USD/JPY, $SPY, $SILVER, $SI_F, $VIX, $UVXY $TVIX $NG_F… more.

Welcome to the morning Wall Street trading day session!

Notices:

Feature Post: “Why our Stock Algorithms are Different than Most“. If you are using our algorithmic model charting it is a must read.

Review: If you are not reviewing the post market trading results along with this please do so. We assume our trading room subscribers review it everyday. There is often information applicable to and not included in this premarket report. You will find the post market trading result reports on our blog daily.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

New Service Options: EPIC the Oil Algo now has an Oil Report only option vs. bundle w/ 24 hr trading room. Plans from $4.10 per day w/promo code.

New Service Options: Entry-Level trader one-on-one trade coaching and entry-level trade academy options now available in addition to intermediate / advanced trading academy and coaching.

Current Holds:

$CBMX, $JUNO, $DUST (looking for a way out on $DUST – was expecting one final significant spike in USDJPY before drop). $CBMX and $JUNO are holds till spring if necessary (you would have to do your own DD on the companies and make your own determination).

Market Outlook:

Early in 2017 I will be watching very closely bonds, $USDJPY, markets in general for direction (of course there are hundreds of variables).

Generally speaking I am looking for some volatility between now and late January. My instinct tells me that even if there is some downdraft in the markets that the Trump train will sweep them up in positive momentum at some point.

Metals, energy and financials are three areas I am looking to for 2017 for trading margin – with bio in fourth place on my list. And per previous we’re expecting some action in bonds to the upside a high probability.

As a trader, it is the margin / volatility I am focused toward and getting on the right side of a market / sector turn and scaling in to that.

As mentioned previous;

All algos (Oil, SPY, Gold, Silver, Dollar, VIX) have hit their targets now (long term since July and short term) so we are running calculation targets for all six algos for all time charting time-frames and expect these reports to start rolling out first week of January 2017.

Morning Momo / News Bits:

Momo Stocks: $DGAZ, $LEI, $ALJ, $DEPO, $ORIG

$SRPT upgraded to Buy from Neutral at Janney. PT $65

$MRNS Marinus Pharmaceuticals Receives FDA Orphan Drug Designation for Ganaxolone to Treat Fragile X Syndrome

$CLVS $175M offering.

Trump Tweets $GM Crushed premarket.

Shares of Nike (NYSE:NKE) are on watch after the stock is named the best new idea for 2017 at Jefferies.

NKE +2.07% premarket to $51.88 vs. a 52-week trading range of $49.01 to $65.44.

First NBC +15% on asset sale http://seekingalpha.com/news/3233032-first-nbc-plus-15-percent-asset-sale?source=twitter_sa_factset … #premarket $HBHC $FNBC

Nomura selects Starbucks (NASDAQ:SBUX) as its top restaurant pick for 2017.

Stocks gear up for fresh run at Dow 20K http://seekingalpha.com/news/3233030-stocks-gear-fresh-run-dow-20k?source=twitter_sa_factset … #premarket $SPY $QQQ $DIA $SH

2017 starts with a bang; Oil spikes; Techies flock to CES http://money.cnn.com/2017/01/03/investing/premarket-stocks-trading/index.html?section=money_markets&utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+rss%2Fmoney_markets+%28CNNMoney%3A+Markets%29

If you are new to our trading service you should review recent blog posts and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). . Our lead trader Twitter feed is here @curtmelonopoly, lead developer @hundalSHS, and newest trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: Gainers: $DGAZ 22%, $LEI 20%, $ALJ 10%, $DEPO 9%, $ORIG 9% $SDRL $IMGN $GGB $MRNS $UWT $SOHU $FCAU $PLX $XIV $ATW $CS $SVXY I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: As time allows I will update before market open or refer to chat room notices.

(6) Downgrades: As time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Regular Trades:

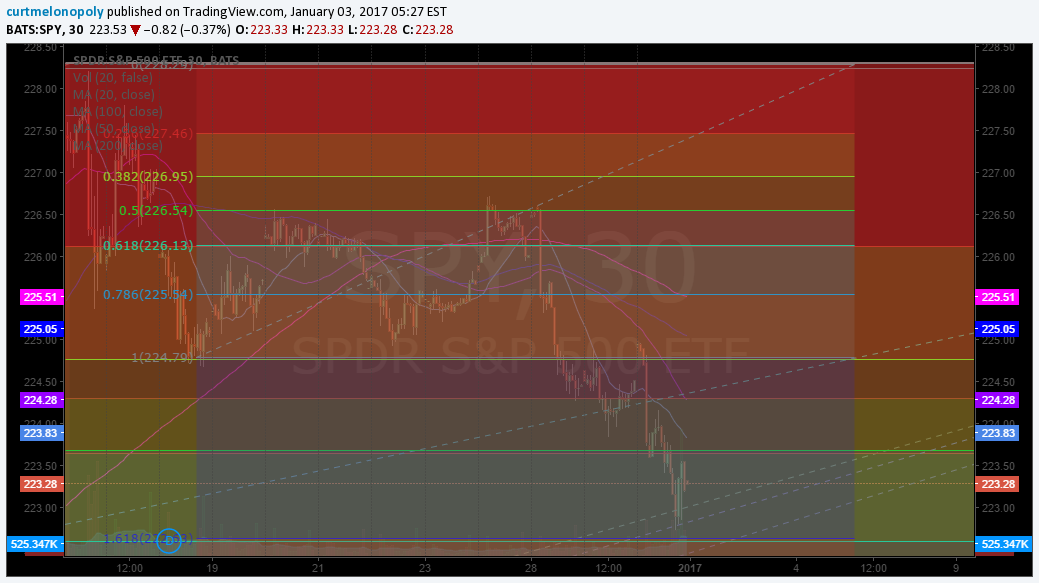

S & P 500: $SPY $ES_F ($SPXL, $SPXS)

The S&P did exactly what we thought it would last year.

We thought Trump would win and that would cause a rally and that did occur. We also expected some rest before EOY and our algorithm called that to the day and almost penny.

Here forward is more difficult to predict – we are going to assess price action as the year turns over and the Trump era unfolds.

I wouldn’t rule out a sell off and I wouldn’t rule out a rally. I think they are both likely in 2017. We just want to catch the inflection right.

My Trading Plan for $SPY:

Per previous;

Right now I am trading $XIV instead of $SPXL or $SPXS. I do this because we are in a trend of crushed volatility. Now, when that changes and volatility starts to rise again (even if $SPY is rising at the same time) then I’ll flip over to trading $SPXL and $SPXS instead of $XIV.

Volatility: $VIX ($TVIX, $UVXY, $XIV)

Outlook:

As noted above, we expect volatility.

CNN Fear and Greed Index: http://money.cnn.com/data/fear-and-greed/

My Trading Plan for Volatility: I will likely follow that trend with $TVIX $UVXY $XIV buys at range pivots / pending price action, volume and other geo events. SHORT $VIX SPIKES!

Currencies and Other Global Markets: $DXY US Dollar Index ($UUP US Dollar Bull, $UDN British Pound, $USD/JPY, $FXY Japanese Yen Trust, $CNY China, $TZA, $SMK / $EWW Mexico Capped ETF)

We are watching $USD/JPY close of course. We are also watching the Mexico Peso and the Russian markets – both could see significant lift early 2017.

https://twitter.com/CompoundTrading/status/816250593215848448

Per previous:

Watching $USDJPY now close for a top. Symmetry is in play on the chart, there is some divergence (although not broke) and metals are starting to front-run.

Per previous:

BE VERY CAREFUL LISTENING TO THE $USD/JPY bears – they have been feeding misery to followers for many weeks – the chart is not broke – price is currently at support and there could easily be another leg up – nobody knows but the trend is your friend!

My Trading Plan for Currencies / Global Markets:

Per previous;

Waiting, waiting, waiting. $USDJPY CHART IS NOT BROKEN! IT IS A BULL UNTIL IT IS NOT…

Gold: $GLD ($UGLD, $DGLD). Miners: $GDX ($NUGT, $DUST, $JDST, $JNUG)

As you may know, we called the bottom (if it is) almost to the penny (months in advance) and recently Gold and miners did get lift (which we expected / called). Between now and Jan 20 anything is possible.

It would be most logical that miners would rally and Gold may also.

But you need to remember that Trump has surprised everyone since he started campaigning and a significant Trump rally in the markets cannot be ruled out. If that happens, Gold will obviously most likely see new lows to between 800 – 1000.

So be ready, and lets catch the inflection. I was expecting on last run in USDJPY so be cautious.

https://twitter.com/CompoundTrading/status/816251457020182528

Per recent posts:

So we have started to see some action in Gold and Miners so it these are on high watch with me right now.

I am waiting for the trend reversal. We are very close to the price target at the bottom of that quadrant at 1133.00 ish. The initial wide frame target Rosie the algo nailed but there has been a wait and see for a reversal because of one more possible leg down. Getting very close IMO.

I haven’t started to take trades yet because I am waiting for “price – trigger – trade” set-ups. I will start chewing around the edges of stocks like $NUGT and $GLD likely. The idea is to get on the right side of the trade and trend.

WE SHOULD BE ALMOST THERE! GET READY! LIKELY BETWEEN CHRISTMAS AND TRUMP POWER TRANSFER! CHARTS COMING!

Other equities I like for Gold, Miners, Silver Trade: $IAG, $AUY, $AUMN, $ASM, $GRL, $VGZ, $NAK – building more complete list now.

Silver $SI_F: $SLV ($USLV, $DSLV, $SILJ $SLX $EPU $EWZ)

Outlook:

Per previous;

Same with Gold and miners – on high watch.

Same as Gold – we’re waiting for a decision from market so we can get algo targets.

My Plan for Trading Silver:

Per previous;

Same as Gold, I’m waiting for the “price – trigger – trade” set-ups… I am going to start chewing around the edges of stocks when set-up confirms like $USLV and $SLV attempting to get on right side of trend trade.

Other equities I like for Gold, Miners, Silver Trade: $IAG, $AUY, $AUMN, $ASM, $GRL, $VGZ, $NAK – building more complete list now.

Crude Oil FX : $USOIL $WTI ($UWTI, $DWTI, $GUSH, $ERX, $DRIP, $ERY, $USO, $UCO, $SCO, $UWT, $DWT, $CL_F)

Outlook:

At time of writing crude oil has rallied above resistance and is now trading in the next quadrant. Watch for a back test at support.

https://twitter.com/CompoundTrading/status/816249888908267521

Trading Plan:

Watching.

Other Equities I like for Oil or Energy Trade: Tape / Chart – $ETE, $RIG. High Short Interest – $CRC, $EPE, $WLL, $RES, $JONE, $AREX, $REN, $CLR, $HP, $ATW, $SGY. Fundamentals: $EOG, Pipelines – $XLE: $HEP, $SXE, $KMI, $DPM, $TGS, $ENB, $EEP, $PTRC, $HGT

Natural Gas $NG_F $NATGAS ($UGAZ, $DGAZ):

Outlook: NA

My Trading Plan for Natural Gas: Watching for confirmation (same as above – new year and Trump phenom make it difficult to future cast).

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $DGAZ, $LEI, $ALJ, $DEPO, $ORIG Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $CBMX, $JUNO, $GLD, $GDX, $NUGT, $JNUG, $USLV, $DUST, $UWT, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGAS, $DWT, $SLV, $GLD, $DXY