Welcome to the Compound Trading Swing Trading Stocks Report with Buy Sell Signals on Chart Set-Ups for Sunday December 3, 2017. $SNAP, $ARRY, $ARWR, $CDNA, $XXII, $NAK, $SHOP, $SSW, $ITCI, $SENS, $HCN, $GTHX, $EXTR, $EDIT, $IPI, $XOMO, $MBRX, $SOHN, $PDLI, $LPSN, $LTRX

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Good morning!

This swing trading report is one in five in rotation.

This is Part A of this report – Part B is to follow.

The reports are in the process of upgrades to included buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be programmed in to our charting for attendees to the live trading room and alerts will flash on screen in the trading room. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you formulate.

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

Visit our You Tube channel for other recent videos.

Swing Trade Set Ups Nov 20 $TWTR, $KR, $BTC, $WTI, $SRAX, $ACST …

Swing Trade Set Ups Nov 17; Oil, $WTI, $JJC, Copper, Bitcoin, $BTC, $OSTK, $AMBA, $HMNY, $AAOI…

Swing Trade Set Ups Nov 15 $XIV, $SPY, $OSTK, $HMNY, GOLD, OIL, $SQ, $SORL, $WPRT….

BEST Trade Set-ups in a while! Nov 10 (starts 4:42): OIL, GOLD, $VIX, $VRX, $ROKU, $AAOI, $HTZ …

Wed Nov 8 Trade Set-Ups Review: $SPI, $BTC, $VRX, $AAOI, $KBSF, $LEU, $ONCS, $DEPO, $SNAP…

Nov 7 Trade Set-Ups Review: $DVN, $GOOGL, $TSLA, $HMNY, $VRX, $AAOI, $MYO, $TOPS, $BTC…

Nov 6 Trade Set-Ups Review: GOLD, $GLD, $HMNY, $RCL, $BTC, $WTI, $USOIL, $FB, $TOPS, $SPPI, $BAS…

Nov 2 Trade Set-Ups Review: $TSLA, $USOIL, $GPRO, $DRNA, $GSIT, $W …

Nov 1 Trade Set-Ups Review: $MDXG, $OSTK, OIL, $WTI, $AMBA, $TRIL, $AAOI, $UAA, $LBIX, $DWT…

Oct 31 SwingTrade Set-Ups Review: $UAA, $TAN, $SPPI, $SHOP, $SNGX, $AKS, $HMNU, OIL, $BTC, $VRX…

Email us at [email protected] anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Profit and Loss Statements:

Q3 2017 Will be released soon.

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month).

https://twitter.com/CompoundTrading/status/896897288798392320

July 2017 Trading Challenge P/L Report $NFLX, $XIV, $AAOI, $AKCA, $BWA, $SRG, $MCRB, $UGLD, $IPXL, $HIIQ and more

https://twitter.com/CompoundTrading/status/895889454212108289

Stock Pick Coverage

$SNAP Inc.

Dec 3 – $SNAP trading 14.23 under important resistance 14.62 with Stoch RSI high, MACD trend up, SQZMOM trend up on daily chart. CEO recently sold 10.1M in shares. This may be turning from a potential long to a potential short at 14.62 trigger. Will wait for a trigger and decide. Current Stoch RSI is too high for a long.

Watch as we near Dec 12 mid quad time/ price cycle as we near there for up or down bias.

Last quad we hit upper apex and previous to that lower inverted apex of quad price – if pattern continues it will be lower price next. But that is tenuis at best.

Buy sell triggers:

21.62

19.29

16.95

14.62

12.28

9.95

7.61

$SNAP Snap Inc (SNAP) CEO Evan Spiegel Sold $10.1 million of Shares https://finance.yahoo.com/news/snap-inc-snap-ceo-evan-041501770.html?.tsrc=rss

Oct 25 – Trading 14.62 sitting on 50 ma with earnings in 15 days. We closed positions on most accts long as it was rising to its recent high at 16.89. Waiting for earnings likely before making a decision.

Sept 11 – $SNAP Trading 15.10 premarket above 50 MA all indicators on daily bullish. Long from Friday session. Holding position.

$ARRY – ARRY Biopharma

Dec 3 – Trading 11.15 with indicators indecisive. Watching the price action as SQZMOM may drop in to red here. Trigger alarmed for that area. Still above its 200 MA but struggling with 20 and 50 MA. Very indecisive with a lower high also.

Oct 25 – $ARRY trading 10.45 and we closed the long position near recent highs. All indicator pointing down with earnings in 13 days. Will very likely wait for earnings to consider a position.

Sept 11 – $ARRY Trading 10.90 premarket with all indicators bullish. Long Swing trade Fri.

$ARWR – Arrowhead Pharmaceuticals

Dec 3 – $ARWR trading 3.65 filled gap Stoch RSI trend down price needs to test MA and bounce for possible long. Indecisive. Alert set for trade set-up review at price meeting 100 MA or over 50 MA.

Oct 25 $ARWR Trading 3.82 with all indicators pointing down, price lost 20 MA on daily and earnings in 49 days. Watching for an indicator rerversal.

Sept 11 – Trading 3.11 and expect pull back for an MA bounce at 20 or otherwise. Watching for that set-up.

Sept 5 – Trading 2.86. Good follow-through since last report. Over 200 MA with all MA’s in bull form, post ER, MACD SQZMOM up against resistance soon at just above 3.00. Will watch how it handles resistance or catch a long on a pull back prior.

Aug 28 – Trading 2.58. $ARWR Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up. #swingtrading

https://www.tradingview.com/chart/ARWR/7GYmLwsD-ARWR-Over-200-MA-watching-for-follow-through-MACD-SQZMOM-and-S/

$CDNA – Caradex

Dec 3 – $CDNA Trading 7.12 post earnings surprise well above MA’s with Stoch RSI high. Waiting on MA test for possible long. Earnings surprise -.015 vs. -.017.

Oct 25 – Trading 5.69 with earnings in 15 days. Many of our traders contacted me with thanks on this one and I didn’t execute on it. But good our traders got it. For now I am watching consolidation.

Sept 11 – $CDNA 50 MA about to breach 200 MA. Watching for price action confirmation for long.

Sept 5 – $CDNA Trading 2.80 after 20 MA thru 200 MA with price above and pullback on watch. #swingtrading

Aug 28 – Trading 2.98. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$NAK – Northern Dynasty Minerals

Dec 3 – $NAK trading 2.08 at diagonal Fibonacci trend line decision on daily chart and indicators are indecisive.

Buy / sell triggers: If it holds 1.87 and breaches diagonal Fib trendline upward then your targets are 2.25, 2.71, 3.49. If not your first target to downside is 1.50.

Alarms set at various triggers to assess for a trade.

Oct 25 – Trading 1.91 and up over all its ma’s except the 20 ma. Watching and studying this one some.

Sept 11 – Trading 1.82. 20 MA approaching underside test of 200 MA with price above. Watching for possible entry.

Sept 5 – Trading 1.81 May be a decent long over recent highs and confirmation of indicators with tight stop.

Aug 28 – Trading 1.78. Regained and over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$XXII – 22nd Century Group

Dec 3 – $XXII post earnings working through moving averages above 200 MA. Waiting on Stoch RSI to turn up for decision. Will chart buy sell trigger signals when swing trade sets up.

Oct 25 – Trading 2.62 with indicators pointing down. Watching for a turn of indicators for a long

Sept 11 – Bounced off 20 MA test – watch for follow thru – it may be extended. We will see.

Sept 5 – $XXII Trading 2.29 trending well above 200 MA and up against natural resistance. On watch.

Aug 28 – Trading 2.23 over 200 MA watching for follow through. Waiting for MACD to curl back up.

$SHOP – Shopify

Dec 3 – We have traded this successfully in the main wash-outs. $SHOP trading 103.27 with price mixed in MA’s. Will chart buy sell swing trade trigger signals when chart sets-up. Wait for a test of MA’s with bounce and MACD and SQZMOM trending up for a long and preferably enter long when Stoch RSI is near bottom and turned up.

Oct 25 – Trading 106.51 MACD on daily is up, earnings in 7 days. Since last report it washed out and we bought near bottom and it has since turned up. We are holding 70% of our position currently.

Sept 11 – Trading 113.61. Waiting on a Stoch RSI pull back to possibly long it (or a pull back to MA’s)

Sept 5 – $SHOP trading 110.86 trending with all indicators bullish and continued break out. Wait for pull back.

Aug 28 – Trading 103.74 This is a break out – over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up. Watching for break out follow-through.

$SSW – Seaspan

Dec 3 – $SSW Seaspan trading 5.93 daily chart has downside bias Stoch RSI rise post ER and price didn’t follow against 20 MA. Watch near Dec 20 timing cycle.

This could easily go short for another floor down to 5.16 and then even 3.74 area without a lot of effort evern though price action “appears” to be forming a bottom formation. The bullish argument would see 5.16 as an excellent buy trigger – use extreme caution in that scenario (triggering long).

Buy / sell triggers for swing trading signals on $SSW:

8.53

6.76

5.16

3.74

Oct 25 – Trading 7.12 testing 200 MA support with earnings in five days. All indicators are rolling over to bearish. Will watch earnings.

Sept 11 – Trading 6.85. Failed 200 MA upside breach. On watch.

Sept 5 – Trading 7.00 in premarket and is still testing underside resistance of 200 MA. On watch for break.

Aug 28 – Trading 7.34 Test the 200 MA watching for a break. MACD SQZMOM and Stoch RSI trending up.

$ITCI – Intra Cellular Therapies

Dec 3 – Trading 15.35 it does have its 200 MA but indicators are indecisive / weak and 50 MA is overhead. When this changes I will chart the buy / sell signals and distribute.

Oct 25 – Trading 15.77 over 200 ma but under 20 and 50 ma’s. A break to upside of MA’s may be a long. Watching.

Sept 11 – Trading 21.39 against natural resistance with MA’s and indicators in bullish formation. Watching for res break.

Sept 5 – $ITCI Significant upside since last report – trading 18.67 in to gap over 200 MA – wait for intra-day pull back timing for entry long – on high alert and will likely trade early this week.

Aug 28 – Trading 15.02. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$SENS – Senseonics Holdings

Dec 3 – $SENS trading 2.85 w Stoch RSI turn down and test of important support 2.50 area near time price cycle termination. Big decision on-deck. #swingtrading https://www.tradingview.com/chart/SENS/G3xY86kE-SENS-trading-2-85-w-Stoch-RSI-turn-down-and-test-of-important-s/ …

$SENS Buy sell signals / triggers:

As Dec 4 time cycle approached price sold off to “hard” support pivot in 2.50 range to bottom of quad (previous quad hit top of range in 3.68 area). If 2.48 range is breached to downside near Dec 4 it is an obvious sell in to at least 2.20. There is however a possible 3.68 target potential nearing Feb 5, 2018 time / price cycle termination. My bias is to down near 2.20 or 200 MA that is just above (pink line).

Oct 25 – Trading 2.76 with earnings in 8 days. Popping off 20 ma support test with 20 and 50 ma’s above. On high watch here.

Sept 11 – Trading 3.18 against natural resistance with MA’s and indicators in bullish formation. Watching for res break.

Sept 5 – $SENS trading 3.11 with continued follow through since last report – above 200 MA w SQZMOM Stoch RSI MACD truned up. On Watch.

Aug 28 – Trading 2.70. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$HCN – Welltower

Dec 3 – Trading 67.96 under 200 MA with indicators indecisive. I will continue watching for more conclusive signals either way.

Oct 25 – Trading 66.85 with all indicators down and price under all MA’s. May see considerable downside still before a bounce.

Sept 11 – Trading 74.50 against natural resistance with MA’s and indicators in bullish formation. Watching for res break.

Sept 5 – $HCN Trading 73.67 with all indicators trending up. Watching 20 MA possible breach to upside with price above.

Aug 28 – Trading 71.92. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up but under 50 and 100 Ma’s – on watch.

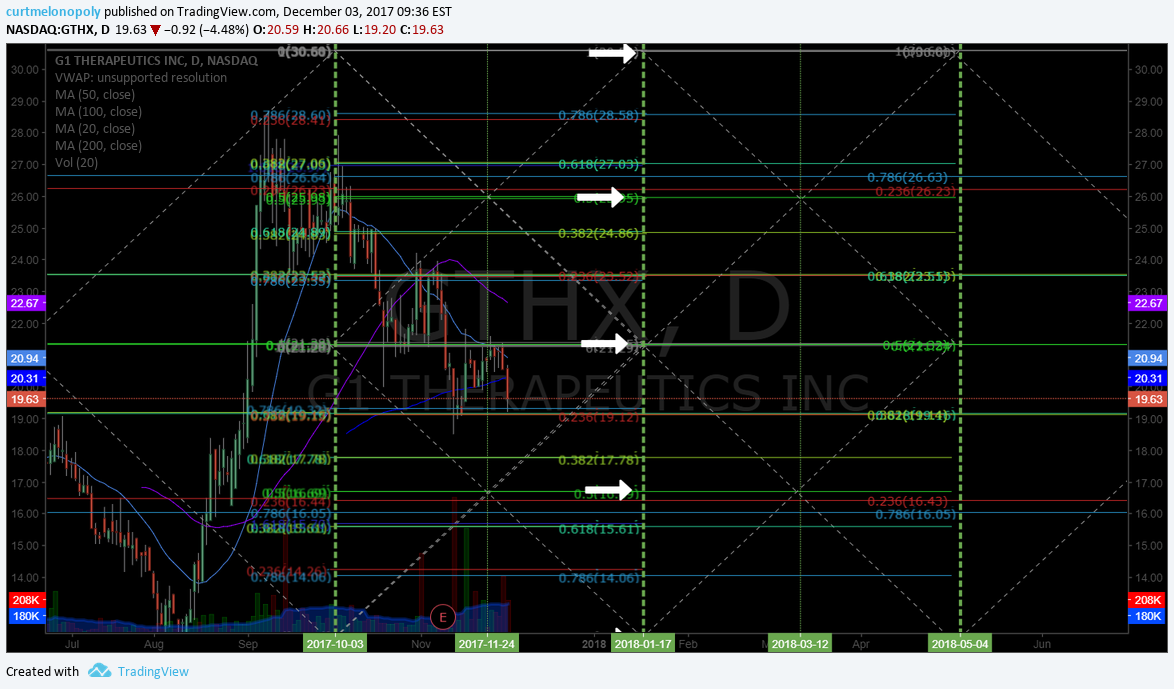

$GTHX – GT1 Therapuetics

Dec 3 – $GTHX leading up to Jan 17, 2018 time cycle should provide decent trading range / volatility… and trend decisions going forward #swingtrading

* There are elements of “black box” charting on these $GTHX charts so be sure to use levels with a degree of caution until they prove out over time.

Important buy sell trigger points on $GTHX chart:

30.65

25.85

21.32

16.67

12.08

Important time price cycle termination dates to watch (price will tend to trend toward important buy sell triggers toward the time cycle expiry dates):

May 4, 2018

Mar 12, 2018

Jan 17, 2018

Nov 24, 2017

Oct 3, 2017

Oct 25 – Trading 21.40 with earnings in 14 days and all indicators bearish. Will wait for earnings.

Sept 11 – Trading 26.51, up considerably since last report and on continued break out. High probability of continued break-out.

Sept 5 – $GTHX A close over 20.63 previous high may get a sustained break out over. On watch.

Aug 28 – Trading Over what would be 200 MA and a relative new issue (IPO) watching for follow through. MACD SQZMOM and Stoch RSI trending up.

$EXTR – Extreme Networks

Oct 25 – Trading 11.68 with earnings in 23 days and MA’s and indicators indecisive. Will watch earnings.

Sept 11 – Trading 11.48 threatening previous highs – on watch for the break.

Sept 5 – $EXTR After a 30% Aug run it is still in break – out. Watching very close.

Aug 28 – Trading 10.87 in premarket. This is a break out – over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up. Watching for break out follow-through.

$EDIT – EDITAS

Oct 25 – Trading 23.33 with earnings in 12 days and MA’s and indicators indecisive. Will watch earnings.

Sept 11 – Trading 20.09 – watching price action over 200 MA per below.

Sept 5 – $EDIT Trading 20.59 trading through MA’s on Daily – on watch.

Aug 28 – Trading 19.30 premarket. Waiting for MACD and SQZMOM to turn back up and run.

$IPI – Intrepid Potash

Oct 25 – Trading 3.92 with earnings in 7 days. All indicators and MA’s indecisive. Will watch earnings.

Sept 11 – Trading 3.66 – same indications as previous.

Sept 5 – Trading 3.72 threatening a break out of 52 week high of 3.93 – on watch.

Aug 28 – Trading 3.54. This is a trending stock over 200 MA retesting 20 MA on pull back. Watching bounce and indicators like MACD for a turn.

$MBRX – Moleculin Biotech

Oct 25 – Trading 1.93 and about to test 200 MA support on daily. Will watch 200 MA test.

Sept 11 – Trading 2.68 – same indications as below.

Sept 5 – $MBRX Over 200 MA set up and on pullback watch 100 MA breach for long.

Aug 28 – Trading 2.36. Over 200 MA on pull back waiting for MACD and SQZMOM to turn back up.

$SOHU – SOHU.COM

Sept 11 – Trading 54.22 – same indications as below – watching for MACD.

Sept 5 – Trading 53.93 – pulled back since last report. Watching.

Aug 28 – Trading 54.66. This is a trending stock over 200 MA and on pull back to 20 MA. Watching MACD and SQZMOM to turn back up.

$PDLI – PDL BIO Pharma

Sept 11 – Trading 3.17 same indications as below. On close watch now.

Sept 5 – Trading 3.07 and against chart resistance. Watching.

Aug 28 – Trading 3.00. Over 200 MA with all indicators trending and filling a gap with natural resistance on deck. Watching for follow through.

$ESPR – Esperion Therapeutics

Sept 11 – Trading 49.46 with same indications as below. On watch.

Sept 5 – Trading 52.80 premarket with all indicators bullish – on high watch here.

Aug 28 – Trading 48.27. Over 200 MA trending and waiting for MACD and SQZMOM to curl up.

$LPSN – LivePerson

Sept 11 – Trading 13.00 with same indications as below. Watching.

Sept 5 – Trading 13.60 premarket and MACD turned down. Watching when MACD turns back up for long.

Aug 28 – Trading 12.65. Over 200 MA trending and on pull back waiting for MACD and SQZMOM to curl up. Recently hit natural resistance so it is on test.

$XOMA – XOMA Corp

Sept 11 – Trading 18.10 with considerable upside since last report. On watch.

Sept 5 – Trading 11.50 premarket with good follow through since last report. Over 11.73 on watch for long.

Aug 28 – Trading 10.71. Had a large pop last week. Over 200 MA watching for follow through. MACD SQZMOM and Stoch RSI trending up. Daily volume is the main issue. Watching.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Compound Trading, Swing, Trading, Stock, Picks, Signals, Buy, Sell, Triggers $SNAP, $ARRY, $ARWR, $CDNA, $XXII, $NAK, $SHOP, $SSW, $ITCI, $SENS, $HCN, $GTHX, $EXTR, $EDIT, $IPI, $XOMO, $MBRX, $SOHN, $PDLI, $LPSN