Tag: Stock

Weekly Swing Trading Stocks Thurs June 9 $TAN, $GSIT, $AXP, $WYNN, $DXY, $UUP, $NFLX, $LIT, $BABA …

Welcome to the Compound Trading Weekly Swing Trading Stocks for the Week of June 5, 2017. $TAN, $GSIT, $AXP, $WYNN, $DXY, $UUP, $NFLX, $LIT, $BABA … and more.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Important Service Upgrade Notice: To receive alerts be sure we have your email and you have followed our Twitter alert service at @SwingAlerts_CT. I know many have expressed interest in the email only, but the Twitter option is available going forward for those that prefer that. Please bear with us for a few days as we integrate and orientate ourselves to this new function in our daily routines.

This report is 2 of 3 reports weekly. Picked up where we left off below.

You can expect the third report within in 48 hours of this report.

We will categorize our coverage soon as we are following more than we expected when we first started the service..

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

Stock Pick Coverage

$DXY US Dollar Index $UUP

June 8 – Long $UUP legging in 1/5 size 500 shares 25.07 from main account possible downside 95.55 DXY and it is trading 96.99 so its a managed trade

https://twitter.com/SwingAlerts_CT/status/872898660861857792

$DXY US Dollar Index MACD just turned up on daily. $UUP #swingtrading pic.twitter.com/itEfwfyeXd

— Melonopoly (@curtmelonopoly) June 9, 2017

$XAUUSD #Gold $GLD

June 6 – On a break of $XAUUSD GOLD 1303.87 area I will be long $UGLD or $GLD.

https://twitter.com/SwingAlerts_CT/status/872015624041504768

$XAUUSD Some follow thru on yesterdays post 100 MA breach 200 MA Daily. SQZMOM green MACD trending. #GOLD $GLD pic.twitter.com/DWnJNpAxZx

— Melonopoly (@curtmelonopoly) June 6, 2017

$MXIM – MAXIM Integrated Products

June 6 – Closing $MXIM 48.50

https://twitter.com/SwingAlerts_CT/status/872178801580494848

June 6 – $MXIM Trading 48.51. Holding from 46.94 BUT will likely be rolling out of this and closing it because Stoch RSI and MACD are near peak on weekly and we will be looking at rolling out of many long positions over next two weeks for end of quarter reassessment.

May 31 – Trading 47.70 holding.

$MXIM This swing trade going better now – took some pain in beginning on my break-out #powertrade thesis. #swingtrading

May 23 – Trading 46.69 Holding. All indicators are still a go.

Long $MXIM 46.94 range premarket 5:14 AM MAy 17, 2107. MACD crossed up, 20 MA thru 50 MA with price above. Confirmed break-out. Will hold likely until MACD turns down.

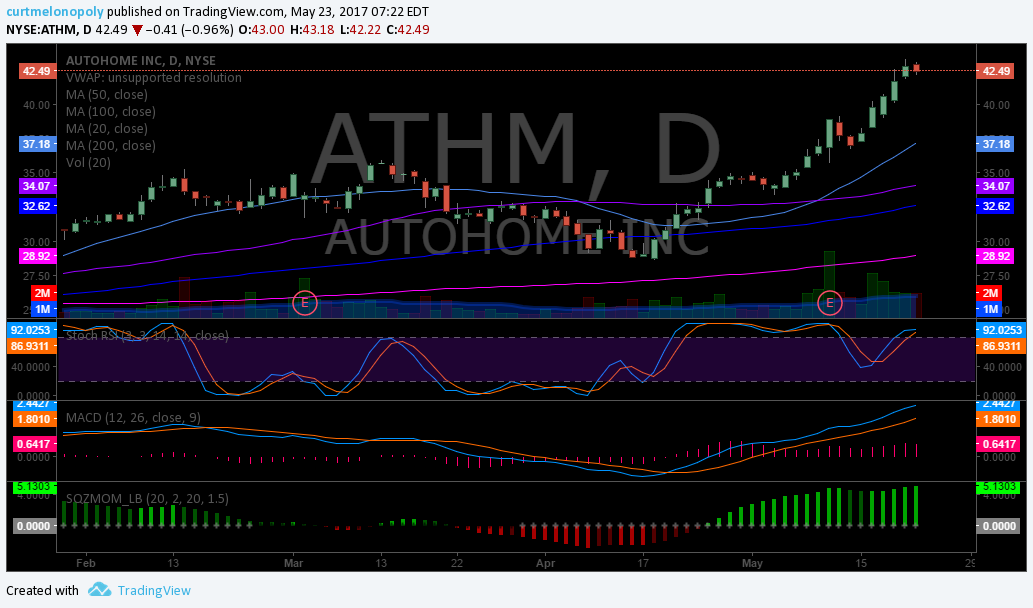

$ATHM – AutoHome

June 6 – Trading 40.86. Looks like we picked a decent exit. BUT the 50 MA is close to breaching the 100 MA on weekly so it is on high watch.

May 30 – Closing $ATHM swing trade in 42.11 range premarket from 40.22 entry.

https://twitter.com/SwingAlerts_CT/status/869828281817645056

Closing $ATHM swing t42.11 range premarket from 40.22 entry. Under 5% not the best on that one but it works – quick. #breakout #swingtrade

Closing $ATHM swing t42.11 range premarket from 40.22 entry. Under 5% not the best on that one but it works – quick. #breakout #swingtrade pic.twitter.com/6FUEIZFfD0

— Melonopoly (@curtmelonopoly) May 31, 2017

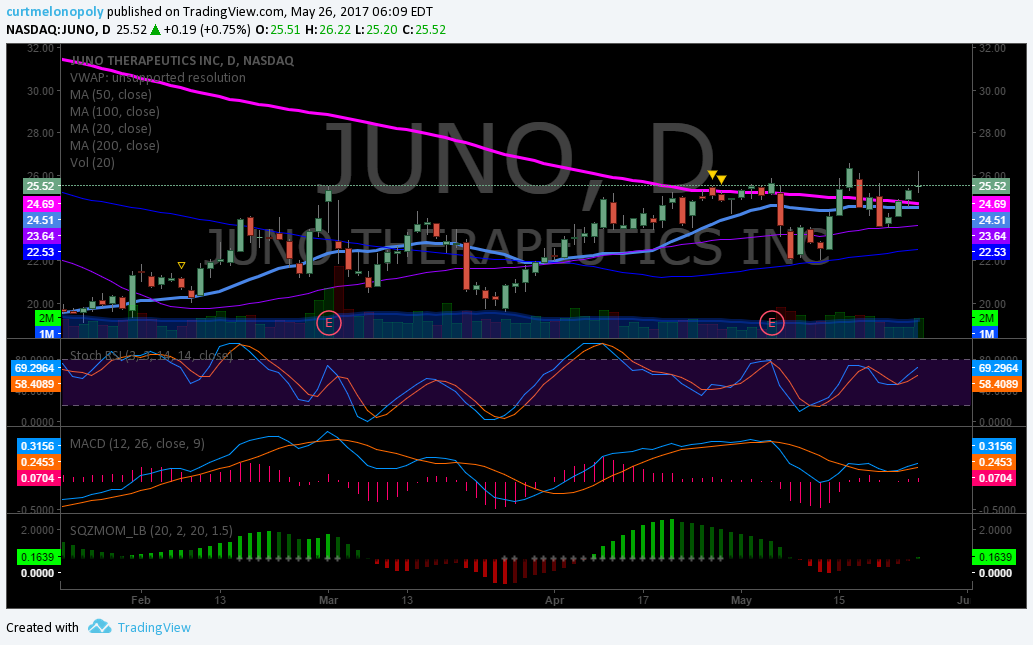

May 23 – Trading 42.49. Went long 40.22 500 shares per below triggers – Stoch RSI turn up (prior to alerts service). Holding. Stop at entry. Tight stop.

May 17 – Trading 39.88. $ATHM Weekly Stoch RSI turn up near top, MACD turn up, SQZMOM up, Vol up, Post earnings, 50 MA near 100 MA breach. See daily notes below.

May 17 – $ATHM Even though on weekly it looks like a buy, on daily we are waiting for Stoch RSI to turn up at minimum.

May 9 – Every indicator is flashing a buy, except earnings are on deck and 20 MA has to breach 50 MA and we’re long.

$BWA – BorgWarner

June 6 – $BWA Trading 44.31. Got its pop. Price above MA’s on Daily. Stoch RSI near top, MACD trending up and SQZMOM green. Looks good but will likely wait for the 50 MA to breach 100 MA to upside on Weekly. But it is set up. WARNING to 200 MA resistance at 48.11 on weekly if you do enter.

May 30 – Trading 42.19. Still indecisive indicators. Watching.

May 23 – Trading 41.37. Price under 20 MA. Under pressure. Watching.

May 17 – Trading 42.21. Resistance on weekly 48.10 (200 MA above) and 50 MA near crossing 100 MA. On daily indecision on MA’s – we’re watching.

May 9 – Waiting for 20 MA to breach the 100 ma (blue) and 50 ma (purple) with price above and MACD confirm.

$LIT – Global Lithium

June 6 – Trading 29.92 Holding but be aware it could come of a bit soon before running again as Stoch RSI turned down on daily and its high on weekly.

May 31 – MACD crossed up on 24th and went long 29.44 500 per alert notes below (before we integrated live alerts), will add when 60 min MACD at bottom and turns back up (will live alert it also).

May 23 – Trading 29.31. Waiting for MACD to turn up.

May 17 – Trading 29.43. MACD turned up last Friday and all indicators on weekly and daily are flashing a buy. Very likely will enter long May 17 premarket.

May 9 – Trading 28.55. Same.

May 3 – Trading 28.79. Watching for MACD and SQZMOM to turn up.

April 24 – Watching. Stoch RSI turned up at bottom and MACD trending down.

April 19 – MACD crossed down April 13. Closed 28.30 all shares.

April 10 – Trading 28.87 Holding.

April 5 – $LIT Alerted on March 27 report and went long 27.32 March 30 – long entry still intact as MACD is up, SQZMOM green or wait for pull back then enter. We expect this sector to stay hot – but if not in you may want to wait for STOCH RSI to cool and turn back up and go long.

$BA – Boeing

June 6 – Trading 188.47. Per last report it was an okay long. SQZMOM green MACD trending up but Stoch RSI on daily trending down on daily and on weekly the MACD may turn down and SQZMOM Green but trending down. Watching for now.

May 31 – Trading 187.09. MACD on daily turned up. Likely a good long here but waiting.

May 23 – Trading 183.40. Waiting MACD on daily to turn up.

May 17 – $BA Trading 182.70. Closed 183.82 when MACD turned down on daily May 11 from 180.06 entry 500 shares.

May 8 – $BA Boring Swing trade going well. Trading 186.13. Long 180.06. Holding. MACD, Stoch RSI, SQZMOM all trending. #swingtrading

$BA Live Chart https://www.tradingview.com/chart/BA/ba7cjyIj-May-8-BA-Boring-Swing-trade-going-well-Trading-186-13-Long/

May 3 – Trading 183.13. Holding. MACD still trending up. Stoch RSI trending down so it is a tad overbought and likely to come off a bit so watching close.

April 24 – Long 180.06 500 share test April 21 because MACD turned up and SQZMOM turned green. Earnings on deck so very careful. May close before earnings and re-enter after.

April 19 – Watching. Waiting for MACD to cross up.

Apr 10, 2017 – Watching

April 5, 2017 – $BA Boeing – It’s early but increasing volume, Stoch RSI turn up, MACD turn up pinch, SQZMOM wait for it to turn green and POW

$BA Boeing live chart – https://www.tradingview.com/chart/BA/9oB2G2vk-BA-Boeing-It-s-early-but-increasing-volume-Stoch-RSI-turn-up/

$EXK – EXK Silver Mining

June 6 – Trading 2.92. Holding.

May 31 – Trading 2.92. Yes still holding.

May 23 – Trading 3.13, Holding. MACD still turned up. High RR.

May 17 – Trading 3.31 holding long 3.49 entry. MACD turned up again on 12th and Stoch RSI is at top and resistance at 3.64 ish on daily 100 MA. Waiting now for 20 MA to breach 50 MA on daily for possible add.

May 8 – Trading 2.88. Holding per below.

May 3 – Trading 2.92. Holding long 3.49 3000 shares. It isn’t like us to hold through a down draft, however it is trading at a recent low equivalent so we are watching closely.

Apr 24 – Trading 3.12. Holding long 3.49 3000 shares.

Apr 19 – Holding long 3.49. Trading 3.20. Stoch RSI almost at bottom and will watch close when Stoch RSI turns back up.

Apr 10 – Holding trading 3.45

Apr 5 – $EXK Silver Mining SQZMOM turned green today, increasing volume, MACD up – may want to let it cool a bit before long. We are long at 3.49 average cost basis April 4 3000 shares.

$BABA – Alibaba

June 6 – Trading 125.20. Didn’t get our pull back and we’re paying. BUT SQZMOM just slightly turned down on weekly now so maybe we’ll get that pullback yet.

May 31 – Trading 123.60. Watching for a pull back.

May 23 – Trading 125.10. Well we got the pullback around earnings and missed it. Hopefully some members got it. It’s trading at near ATH’s right now in premarket.

May 17 – Trading 124.00. Every indicator on hourly, daily and weekly are still flashing buy, however, there has been no pullback to get an entry long. Watching.

May 8 – Trading 117.20. Same as below. Earnings nine days away also.

May 3 – Watching for it to cool off. Unfortunately we did miss some of the move. Waiting for MACD to trend down and catch it on its next turn up.

April 24 – Watching.

April 19 – Closed 111.40 at target from 104.64 cost avg 500 shares. Will allow MACD to return to bottom for re-entry.

April 10 – Hit 110.45, very near our 111.40 target. Holding, trading 109.34. Long 104.64.

April 4 – Holding long 500 shares from 104.64 now trading 108.17. It is testing all time highs and we may add on a break of all time highs. If it pulls back we may cut for a small profit. First price target is 111.40 (see below)

$BABA Live chart with indicators including that SQZMOM indicator – sweeet tool! https://www.tradingview.com/chart/BABA/Lbao9BVu-BABA-Swing-Trade-going-well-Our-Swing-Trading-side-is-in-at-10/

$BABA Swing Trade going well. Our Swing Trading side is in at 104.64 trading at 108.17. #swingtrading pic.twitter.com/x2zOezrBQ3

— Melonopoly (@curtmelonopoly) April 4, 2017

March 27 – We’re long 104.64 500 shares March 22 at test of 20 MA. Stop is at our entry and we are looking for a fresh break-out. However, the market sentiment is not great right now so we are unsure. There is an upside pivot at 111.38 we are watching for resistance should price continue up. Also watching MACD close.

March 20 – Wait for MACD to turn up and confirm and stay long until MACD turns down. The Stoch RSI seems to be frontrunning the MACD fyi. $BABA is one of my favorites right now and I see a long entry early in the week.

$BABA Live Trading Chart – https://www.tradingview.com/chart/SPY/GsGBi5f2-BABA-Daily-100-MA-50-MA-Cross-MACD-Pinch-SQZMOM-up-Stoch-RSI/

$BABA Daily 100 MA 50 MA Cross, MACD Pinch, SQZMOM up, Stoch RSI up. Wait for MACD for long. #swingtrading

$NFLX

June 8 – $NFLX Opened long 148.40 closing in premarket 165.88 range #swingtrading

June 6 – Trading 165.06 from 148.40 entry. All indicators pointing up on weekly and daily but we will likely roll out of this long soon.

May 31 – Trading 163.20. 148.40 entry. Stop set at 158.00 now. If price tests 20 MA on daily but doesn’t take out stop I will add and alert live.

$NFLX swing trade going wll. Trading 163.20 premarket from 148.40 entry. #swingtrading

May 23 – Trading 157.32. Stop set at 153.10 to protect equity. Holding otherwise. MACD turned down on daily and may add if it turns up.

May 17 – $NFLX Swing trade going well. Trading 158.50 from 148.40 entry. SQZMOM may turn down as with MACD and Stoch RSI truned down may exit soon and re-enter when indicators turn back up.

May 9 – $NFLX Swing trade going well. Long at 148.40 trading 156.08. SQZMOM and MACD trending but Stoch RSI may cool soon, vol decent. Will add per below.

$NFLX Live Chart https://www.tradingview.com/chart/NFLX/rjcjiVBz-NFLX-Swing-trade-going-well-Long-at-148-40-trading-156-08-SQ/

May 3 – April 25 148.40 Long 500 shares April 25 when MACD turned up per below. Trading 156.28. MACD trending up, SQZMOM trending up and Stoch RSI at top and may come off short term – so a short term turn down is possible here. Will likely re-add when STOCH RSI comes off and turns back up as long as MACD is trending up still and has room to top.

April 24 – Trading 142.87. Watching.

April 19 – Trading 143.75 – waiting for MACD to turn up.

April 10 – We closed flat 145.50. Trading 142.80. Waiting for MACD, Stoch RSI, SQZMOM to turn green for entry long.

April 4 – March 29 we entered 145.50 500 shares when MACD turned up per watch trigger below. Stop is at flat at entry and we will re-enter if we have to. Will look at adding pending triggers – will advise.

$NFLX Live chart with indicators https://www.tradingview.com/chart/NFLX/ozKJQ8t4-NFLX-March-29-we-entered-swing-trade-145-50-when-MACD-turned-t/

$NFLX March 29 we entered swing trade 145.50 when MACD turned, trading 146.82, stop at flat and re-enter if we have to. #swingtrading pic.twitter.com/DI8fiL6nsv

— Melonopoly (@curtmelonopoly) April 4, 2017

March 27 – MACD has been flat or turned down since last post. Looking close at MACD turn up and entry this week.

March 20 – The only thing that concerns me is the price staying above approximately 145.05 as a low on any given day. I may also look for that in addition to indicators lists below. Same thing with this one, exit when MACD turning down. Chances are high I will enter long early week.

Live $NFLX Chart – https://www.tradingview.com/chart/NFLX/4RQP5P9P-NFLX-Daily-abover-20-MA-Stoch-RSI-Revved-MACD-turning-up-SQZMOM/

$NFLX Daily abover 20 MA Stoch RSI Revved MACD turning up SQZMOM watch close for green. Long on MACD and QZMOM confirmation.

$GSIT

June 9 – Trading 8.68. All indicators turned up daily. On high watch. The issue with this trade is that we are along now a number of legs since price breached the 200 MA on the daily.

$GSIT All indicators turned up on daily. 20 MA thru 50 MACD trending SQZMOM trending Stoch RSI tad high.

$GSIT Live Chart Trade Set-Up With Indicators https://www.tradingview.com/chart/GSIT/wrOpbJRu-GSIT-All-indicators-turned-up-on-daily-20-MA-thru-50-MACD-tren/

June 6 – Trading 8.38. All indicators turning up on daily but waiting and watching.

May 31 – Trading 7.59. Same.

May 23 – Trading 7.99. Watching per below.

May 17 – Trading 7.91. All the indicators are indecisive. Waiting.

May 9 – Trading 7.40. See below.

May 3 – Trading 8.03. MACD pinching. Will enter long when MACD turns up AND be sure price is above moving averages and 20 MA is in fact over 50 MA. 20 50 100 200 all in order with price above in other words. Should be soon.

$GSIT Live chart https://www.tradingview.com/chart/GSIT/MLQDlG9S-GSIT-MACD-pinch-Enter-long-when-MACD-turns-be-sure-price-above/

April 24 – Trading 7.96. Watching.

April 19 – Trading 7.63. MACD still trending down. Waiting for it to turn up.

April 10 – Trading 8.18, Stoch RSI curling up, waiting on MACD to cross up and SQZMOM to turn green for long.

April 4 – $GSIT finally cooling off and coming back to earth. Watching that MACD very close for a turn up (after it returns to bottom hopefully).

Mar 27 – Sure enough, it was on its way to the 20 MA this past week and stopped short and got some lift and closed Friday sitting on 8 ema. Will wait for it to line up.

Mar 20 – The reason I have this on the list is because as a break-out stock it is about as clean as they come, however, break out stocks come with risk. So you have two options (and shorting right now isn’t one), you can either wait for it to get near a 20 MA test and go long when other indicators line up or open a short time-frame chart and trade it. I will be waiting for the 20 MA test.

GSI Technology, Inc. to Present at the Global Predictive Analytics Conference http://finance.yahoo.com/news/gsi-technology-inc-present-global-173705866.html

$GSIT in break-out. Daily Stoch RSI peaking, MACD near peak, SQZMOM near peak. Wait for 20 MA retest and MACD confirm for long.

$AXP

June 9 – $AXP SQZMOM green MACD up Stoch RSI high Waiting on MA’s to sort out with price above. Vol up. On High Watch.

May 31 – Trading 77.05. Same.

May 23 – Watching. Indicators indecisive.

May 17 – Trading 78. Sitting on 200 MA on weekly. On daily price is under 20 and 50 MA with MACD turned down. Watching.

May 9 – Trading 78.27. Closed 78.74 May 4 when MACD crossed down from 78.01 long. We still like this stock so we are watching close for indicators to turn back up.

May 3 – Trading 79.54. Holding long while MACD trends up and price above entry and 20 MA is above 50 MA. Stoch RSI is coming off so we expect some downward pressure short term.

April 24 – Trading 79.63. Long 78.01 500 shares April 20 when MACD turned up. Watching for MACD, Stoch RSI to remain, and SQZMOM to turn green for possible add.

April 19 – Trading 75.50. MACD getting close to bottom. On watch for MACD cross up.

April 10 – Trading 77.77. Waiting on Stoch RSI to curl up, MACD to cross up and SQZMOM to turn green for long.

April 4 – $AXP American Express. So close. SQZMOM about to turn, MACD cross on deck just need PTPTRR to line up. Need volume & power. #swingtrading $AXP Price Trigger Power Trade Risk Reward – PTPTRR #trading Over the Wall!

March 27 – MACD has turned down and SQZMOM is red and negative but Stoch RSI is starting to curl – waiting for that MACD to take an entry.

March 20 – This is a trend play. The only thing you have to do is manage your entry point and risk. Wait for indicators to confirm next leg up about to start and take long entry. When MACD turns down on daily that is your exit. I really like this one, especially because MA’s are all on right side (aligned) and trend reversal is in place.

$AXP Setting up for next possible leg up. Wait for MACD SQZMOM Stoch RSI to turn up. Will likely test near 100 MA at min 50MA.

$ABX – Barrick Gold

June 9 – Trading 16.64 Same.

May 31 – Trading 16.41. Same.

May 23 – Trading 16.95. Watching.

May 17 – Trading 17.14. On daily MACD is turned up, waiting on results of 20 MA test (happening now). On weekly MACD is turned down and would like to see that crossed up.

May 9 – Trading 16.26. See below.

May 3 – Trading 16.37. Watching. All indicators pointing down.

April 24 – Trading 19.25 watching. Earnings on deck.

April 19 – Trading 19.46. Indicator indecision. Waiting on clarity.

April 10 – Waiting on MACD and Stoch RSI to cross and turn up for long. SQZMOM is green now. Trading 19.09.

April 4 – $ABX Setting up nicely. Above 200 MA, wait for Stoch RSI to return to bottom and turn if possible, be sure SQZMOM green and MACD turns up and kapow. Some volume and power would help too.

March 27 – Very close now. SQZMOM just turned green, MA’s are starting to line up but not all yet, Stoch RSI is turned down at top of range so I would like to see it at bottom when we enter and the MACD is turned up. So we’re waiting for the MA’s to line up and the Stoch RSI to be near or at bottom curling up (ideally).

March 20 – I will enter a long when price above 20 50 100 200 MA’s and will likely wait for the 200 MA to cross 100 MA (although not absolute). Like with all others I will exit when MACD turns down.

Freeport a better buy? https://www.fool.com/investing/2017/03/18/better-buy-freeport-mcmoran-inc-vs-barrick-gold.aspx

Inflation may send Gold higher. http://ir.baystreet.ca/article.aspx?id=528&1489764218

$ABX Daily MACD turning up, Stoch RSI way up, price on 20 MA, SQZMOM needs to confirm, 200 MA 100 MA cross would help with price above.

$TAN

June 9 – $TAN Daily 200 MA popped, 20 MA to breach 200 MA and 50 MA about to breach 100 MA MACD trend up SQZMOM Green on high watch #swingtrading

May 31 – Trading 18.57. Will let this play through a bit before a long – but its getting very close now.

$TAN MACD Turned up on daily and price popped off 50 MA testing 200 MA now. #trading #premarket

May 17 – Trading 18.20. MACD on daily is just barely crossed up and other indicators are still indecisive. Going to let it play out some.

May 23 – Trading 18.18. Watching.

May 17 – Trading 18.20. MACD on daily is just barely crossed up and other indicators are still indecisive. Going to let it play out some.

May 9 – Trading 17.84. Waiting for 20 MA to breach 50 MA now – CLOSE!

May 3 – Trading 17.67. $TAN Watching MACD turned up price over 20 MA SQZMOM green. Need price over 50 MA with 20 MA breach 50 MA.

$TAN Live Chart Link: https://www.tradingview.com/chart/TAN/7JpW1gSP-TAN-Watching-MACD-turned-up-price-over-20-MA-SQZMOM-green-Need/

This is one of those where we are early. In other words the price isn’t above all MA’s yet. So one could take the trade as long as MACD is up and preferably long entry timed when 20 MA is about to breach 50 MA and price is above. But watch out for the 200 MA above.

April 24 – Trading 17.04. Watching.

April 19 – Trading 17.39. This one is getting close. Stoch RSI has to come off and then turn up. SQZMOM is almost green and MACD cross up. When those line up we will take a long position.

April 10 – Trading 17.20, Stoch RSI pinch, MACD pinch. Waiting on Stoch RSI to curl up, MACD to cross up and SQZMOM to confirm green for long.

April 4 – NA

Mar 27 – $TAN chart is now “broken” and price is on its way to the lower pivot around 16.44. All indicators are pointing to down. It closed Friday at 17.29. So we will keenly watch it as it nears the lower pivot and see if the indicators line up for a long trade. If it lost lower pivot we may even consider a short side entry pending indicators.

Mar 20 – Nice reversal play if it turns out. In addition to below watch the 200 MA as resistance if you go long.

$TAN Reversal Play. Daily MACD needs to turn up, Stoch RSI is up, SQZMOM needs to turn up. 100 MA about to cross 50 MA – bullish.

$VRX

June 9 – Trading 13.26 but chart says its not ready.

May 31 – Trading 12.29 Watching.

May 23 – Trading 13.41. Watching.

May 17 – $VRX Early stages of possible bottom bounce. SQMOM green, 20 MA about to breach 50 MA price still under 200 MA, MACD up. We may trade this more as a daytrade . swingtrade until it firms above 200 MA.

May 9 – Trading 9.77. See below.

May 3 – Trading 10.50. MACD is turned up and the SQZMOM has not confirmed green. Earnings in six days so watch for that. The MA’s are exactly like the $TAN scenario above so the same rules apply. We are not entering yet but may at any second. Again it is an early trade because you want price above the 200 MA and 20 MA to breach 20 MA that is perfect timing (with MACD trending up). But many people take these early at this point. Refer to considerations noted above with $TAN also. Same set-up.

April 24 – Trading 8.51 Watching.

April 19 – Trading 8.95. Not ready.

Apr 10 – Waiting on Stoch RSI to curl up, MACD to cross up and SQZMOM to confirm green for long.

April 4 – I thought I’d run a poll on my Twitter feed to help us with this one.

$VRX Premarket is up 1% – Could this be the bottom?

— Melonopoly (@curtmelonopoly) April 4, 2017

$VRX Premarket up 1%. MACD cross flat… is this the bottom?

$VRX Premarket live chart https://www.tradingview.com/chart/VRX/F7bVqHl7-VRX-Premarket-up-1-MACD-cross-flat-could-this-be-bottom/

March 27 – $VRX continues stepping down on the chart… per below, really important to wait for all the indicators to line up. So we remain patient and watch.

March 20 – This was looking like it was going to curl up last week and bounce but it failed. A great example of carefully watching a falling knife indicators before taking a long position. Use patience and when all indicators in play take a long.

$VRX Bottom Play. Daily MACD needs to turn, Stoch RSI turning up, SQZMOM needs to turn then as MA cross-overs occur it will strengthen.

$TWLO

June 9 – Trading 25.49 The indicators on the 60 min say you could go long with a decently strong thesis (not enough hart history for Daily or Weekly chart), however, considering the short history price action I will wait – I think it is accumulating and the chart possibly repairing.

May 31 – Trading 24.48. Watching.

May 23 – Trading 25.00. Watching for bottom bounce to form. MACD up on daily right now.

May 17 – Trading 24.53. Waiting on MACD turn cross up on daily before anything.

May 9 – Trading 23.50. See below. Not ready.

May 3 – Trading 23.70. Closed 33.57 1000 shares before earnings on a 29.60 buy. Never hold through earnings unless you are unusually confident (yes we did recently with $GOOGL and $AMZN but very unusual for us to do that). Anyway, watching now. Downdraft was intense from forward guidance.

April 24 – Trading 30.82. Holding 1000 shares 29.60.

April 19 – Trading 30.51. April 12 MACD turned up opened long 29.60 1000 shares.

April 10 – Trading 28.40. Stoch RSI curling up, waiting on MACD cross and SQZMOM to turn green for long.

April 4 – No change.

March 27 – Price failed when it had to poke through 100 MA and continue – it failed and is on its way (possibly) to the previous low. So here, as with $VRX we employ patience – but get ready because the long in this one will be decent. Use the indicators noted below.

March 20 – Looks like bottom may be in. It is trending up. Looking for 100 MA to cross down under 20 MA (pinching now) and price to trade above 20 MA for long. Be sure to wait for MACD to confirm also first.

$TWLO Bottom Play on Watch. 100 MA needs to cross 20 MA with price over them. Stoch RSI pinch, MACD pinch, SQMOM turning up not green.

$WYNN

June 9 – Trading 134.73. MACD turned up on 7th and it got the pop we were thinking would come. Watching for follow through and possible long today. On high watch also.

May 31 – Trading 126.30 Watching for MACD to turn up.

May 23 – Trading 125.11. Watching for set up.

May 17 – Trading 126.91 coming up on underside of 200 MA test on weekly. MACD on daily is about to cross up. Will wait for MACD on daily and assess.

May 9 – Stopped flat on May 5, 2017. Watching SQZMOM, Stoch RSI, MACD, volume indicators now for a turn.

May 3 – Trading 125.55. Long 122.56 April 25 when MACD turned up (per below) and watching for continuation in MACD and price. Will exit if MACD turns down or price hits our entry. We may even add. It looks good.

April 24 – Trading 114.89. Watching.

April 19 – Trading 115.95. MACD trending down. Waiting for bottom and turn up. It has a ways to go.

April 10 – Closed 500 shares Friday 117.20. Trading 116.50. Watching MACD, Stoch RSI, SQZMOM for reset at bottom and turn for re-entry.

April 4 – We triggered a stop at flat March 27 and had a re-entry at 111.04 when we looked at it again for 500 shares. Currently trading at 116.00 and we are watching MACD. Which is currently at top. We may exit as MACD turns down and re-enter when MACD turns back up. Alternatively we may ride the MACD turn down as long as our original entry isn’t triggered as stop and when MACD turns back up add to position. Both are valid and we are undecided.

March 26 – We took a long position at 110.93 for 500 share start on March 21. HOWEVER, we have a stop at our entry price (due to current market sentiment) and it is currently trading at 111.92. Careful with this one.

March 20 – This isn’t easy to swing but is so hot it would be foolish to ignore, so discipline like with so many other plays in the current market is required. Seeing it hold 110.00 for a full day with indicators in line would put me in a long position.

$WYNN 200 MA needs to cross 100 MA, trade over 110 full day. Stoch RSI peaking, MACD up, SQMOM up.

$XME

June 9 – Trading 30.20. Interesting – all indicators are a go except ma’s yet – so its on watch here now.

May 30 – Trading 29.25. Watching.

May 23 – Trading 29.23. Watching.

May 17 – Trading 29.32 MACD on weekly is down and price on Daily is under MA’s. Waiting on 20 MA to cross up and price to be above.

May 9 – Trading 28.73. See below.

May 3 – Trading 29.71. Watching for MACD to turn up. Currently pinched.

April 24 – Trading 29.79. Watching.

April 19 – Trading 29.48. Close flat 30.59 on the 12th. Testing 200 MA now. Watching for Stoch RSI to turn up, MACD to turn up and SQZMOM to turn green for long.

April 10 – Trading 30.84 holding. Long at 30.59. Tight stop.

April 5 – We opened a tight long position (so stop will be tight because you can always re-enter and metals charts still have to confirm so we are a tad early here) long 30.59 500 shares will add if it confirms and will cut bait if it comes off at most 2% and re-enter. Indicators look good BUT we are early. Use caution until metals etc confirm.

$XME Live trading chart with indicators listed. https://www.tradingview.com/chart/XME/lkPWMXSp-XME-Metals-and-Mining-ETF-Above-21-ema-8-ema-20-MA-200-MA-MACD/ #swingtrading

March 27 – Price action has been poor since last report, the 200 MA is just below price now so we are going to see if the indicators line up for a bounce long position.

March 20 – MACD is pinching and about to turn up, also waiting for price above 20 MA. This is a great looking chart and an argument could be made that a long position before everything lines up as I noted is sound. It’s a great looking chart because MACD is bottom (for clarity), so when it turns if all other indicators look good there should be room for a decent trade. Caution should be noted that now after having gone through a number of charts this evening the market is at a decision so any swing trades should be considered at length and stops should be tight IMO.

$XME Daily MACD pinching, SQZMOM starting to turn, Stoch RSI peaking, Price needs 20 MA

$URRE

June 9 – Trading 1.55 Watching.

Mar 23 – Trading 1.50 Watching.

May 17 – Trading 1.56. Watching.

May 9 – Trading 1.57. Waiting on MACD, SQZMOM to turn up, price to be above 20 MA and 20 MA to breach 50 MA. It is a ways away.

May 3 – Trading 1.68. Watching.

April 24 – Trading 1.84. Watching.

April 19 – Trading 1.94. Watching. Indicator indecision.

Apr 10 – No change.

April 5 – $URRE isn’t as close to a buy as $XME above, HOWEVER, the SQZMOM did signal green today and the MACD is slightly turning up! So it is on HIGH WATCH now!

March 27 – Almost a replay from last week (the indicators), so we remain patient and watch.

March 20 – Like so many of the charts this week, there is indecision. However, if the indicators line up this has excellent upside potential. The MACD pinching at the bottom is key IMO.

$URRE Daily MACD pinching at bottom, Stoch RSI turn up, SQZMOM needs green, price needs 20 MA.

Others on watch but not ready to report charting:

$RIG

June 9 – Trading 8.42 Watching.

May 23 – Trading 10.51 Watching.

May 17 – Trading 10.69. Watching.

May 9 – Trading 11.14 – SQZMOM trending up but red, MACD about to cross up, volume is up all after earnings. Waiting on price to be above 20 MA and breach 50 MA. Interesting action now (moderately positive) since earnings.

May 3 – Trading 10.60. Watching.

April 24 – Trading 11.24. Watching.

April 19 – Watching.

Apr 10 – No Change. Trading 12.50.

April 5, 2017 – $RIG Sooo close. MACD up, SQZMOM about to turn GR, wedged, needs increasing volume and break-out confirmation for a long.

March 27 – It is holding its 200 MA like a trooper, but I want to see it at least be over 20 MA and other indicators to line up.

March 20 – MACD pinching, watching for it to turn up, Above 200 day but needs to trade above 20 MA for long.

$XLE

June 9 – Trading 64.86 Watching.

May 23 – Trading 67.93 Watching.

May 17 – Watching.

May 9 – Trading 67.79. Similar action to $RIG above. Watching.

May 3 – Trading 67.31. Watching.

April 24 – Trading 67.79. Watching.

April 19 – Watching

April 10 – No change.

April 5 – $XLE chart is very similar to $RIG and others in this space, HOWEVER, it is still under 200 MA. On watch for break of 200 MA.

March 27 – The 50 has crossed the 100 and the 20 the 200 to downside – this is very bearish in the near term. Watching. It does qualify as a short and best when MACD at top turning down and Stoch RSI at top turning down with confirmation of price action and MA’s.

March 20 – MACD pinching, watching for it to turn up, Needs 200 day and to trade above 20 MA for long or it becomes a short.

$SLX – Vaneck Vectors Steel

June 9 – Trading 37.25. Testing 200 MA resistance. Will watch.

May 23 – Trading 36.74. Watching.

May 17 – Just regained its 200 MA, MACD crossed up Stoch RSI trending up. Waiting on 20 MA to breach 50 MA with price above.

May 9 – trading 36.16. All indicators are indecisive. Watching.

May 3 – Trading 38.16. Sitting on 200 MA. MACD is turned up but all moving averages above price and SQZMOM not green so we are waiting.

April 24 – Trading 37.55. On close watch.

April 19 – At 200 MA support test now. Watching indicators closely.

April 10 – No change. Trading 39.90.

April 5 – $SLX On watch for SQZMOM to turn green and MACD to turn up. Close.

March 27 – As with $XLE above this also qualifies as a short (pending short term indicators lining up when you take the position). Price lost the 100 MA and the indicators are negative – very bearish. Watching.

March 20 – MACD is pinching on the turn back up – waiting for it to turn up and 45.50 to hold for one day to confirm break out. Or, on downdraft I would look at a 100 MA long entry also.

$X – United States Steel Corp.

June 9 – Trading 21.77 watching

May 23 – Same

May 17 – Watching as with above.

May 9 – Trading 21.32. As below watching. Indicators are not flashing long at all.

May 3 – Trading 21.92 Watching.

April 24 – Trading 30.10. On close watch. Earnings on deck. MACD needs to turn up.

April 19 – Trading 28.65. At 200 MA support test. As above watching indicators closely.

April 10 – Trading 34.40 premarket Monday. ON HIGH WATCH MACD about to cross up.

April 5 – Same as $SLX indicators above. Very close now.

March 27 – The $X trade is almost identical to $SLX above. Waiting.

March 20 – This one is riskier than most on this list, however, I am watching the MACD for a turn up for a possible long.

$AKS – Iron Steel Mills Foundry

May 31 – Trading 6.21 Watching.

May 23 – Same

May 17 – Watching.

May 9 – As with $X above.

May 4 – Trading 6.21 Watching.

April 24 – Trading 6.72. On close watch. MACD pinching up.

April 19 – Trading 6.40. Closed 6.97 fr loss April 11 when it lost 200 MA. On watch again.

April 10 – Long 7.30 April 7 1000 shares. MACD just turned up but SQZMOM is not green yet. 1/3 size entry with other 2/3 entry when SQZMOM turns green with other indicators confirming.

$AKS Live Chart – https://www.tradingview.com/chart/AKS/BbzvqPhJ-AKS-Swing-trade-position-long-April-7-swingtrading-stock-pic/

April 5 – Sitting right on 200 MA now. Watching for 200 MA to hold, MACD to turn up, SQZMOM to green.

March 27 – AKS is coming in on the 200 MA test. Watching.

March 20 – MACD is turning up now, watching for price to trade above 20, 50, 100 that are clustered together. It is well over 200 MA.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; $TAN, $GSIT, $AXP, $WYNN, $DXY, $UUP, $NFLX, $LIT, $BABA, Compound Trading, Swing, Trading, Stock, Picks

Weekly Swing Trading Stocks Tues June 6 $Gold, $MXIM, $BWA, $ATHM, $LIT, $BABA, $NFLX, $TAN, $BA, $WYNN …

Welcome to the Compound Trading Weekly Swing Trading Stocks for the Week of June 5, 2017. $Gold, $XAUUSD, $MXIM, $LIT, $ATHM, $NFLX, $TAN, $BA, $BWA, $BABA, $WYNN … and more.

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Important Service Upgrade Notice: To receive alerts be sure we have your email and you have followed our Twitter alert service at @SwingAlerts_CT. I know many have expressed interest in the email only, but the Twitter option is available going forward for those that prefer that. Please bear with us for a few days as we integrate and orientate ourselves to this new function in our daily routines.

This report is 2 of 3 reports weekly. It is not complete – the incomplete entries below will be done in next 48 hours at most.

You can expect the third report within in 48 hours of this report.

We will categorize our coverage soon as we are following more than we expected when we first started the service..

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

Stock Pick Coverage

$XAUUSD #Gold $GLD

June 6 – On a break of $XAUUSD GOLD 1303.87 area I will be long $UGLD or $GLD.

https://twitter.com/SwingAlerts_CT/status/872015624041504768

$XAUUSD Some follow thru on yesterdays post 100 MA breach 200 MA Daily. SQZMOM green MACD trending. #GOLD $GLD pic.twitter.com/DWnJNpAxZx

— Melonopoly (@curtmelonopoly) June 6, 2017

$MXIM – MAXIM Integrated Products

June 6 – $MXIM Trading 48.51. Holding from 46.94 BUT will likely be rolling out of this and closing it because Stoch RSI and MACD are near peak on weekly and we will be looking at rolling out of many long positions over next two weeks for end of quarter reassessment.

May 31 – Trading 47.70 holding.

$MXIM This swing trade going better now – took some pain in beginning on my break-out #powertrade thesis. #swingtrading

May 23 – Trading 46.69 Holding. All indicators are still a go.

Long $MXIM 46.94 range premarket 5:14 AM MAy 17, 2107. MACD crossed up, 20 MA thru 50 MA with price above. Confirmed break-out. Will hold likely until MACD turns down.

$ATHM – AutoHome

June 6 – Trading 40.86. Looks like we picked a decent exit. BUT the 50 MA is close to breaching the 100 MA on weekly so it is on high watch.

May 30 – Closing $ATHM swing trade in 42.11 range premarket from 40.22 entry.

https://twitter.com/SwingAlerts_CT/status/869828281817645056

Closing $ATHM swing t42.11 range premarket from 40.22 entry. Under 5% not the best on that one but it works – quick. #breakout #swingtrade

Closing $ATHM swing t42.11 range premarket from 40.22 entry. Under 5% not the best on that one but it works – quick. #breakout #swingtrade pic.twitter.com/6FUEIZFfD0

— Melonopoly (@curtmelonopoly) May 31, 2017

May 23 – Trading 42.49. Went long 40.22 500 shares per below triggers – Stoch RSI turn up (prior to alerts service). Holding. Stop at entry. Tight stop.

May 17 – Trading 39.88. $ATHM Weekly Stoch RSI turn up near top, MACD turn up, SQZMOM up, Vol up, Post earnings, 50 MA near 100 MA breach. See daily notes below.

May 17 – $ATHM Even though on weekly it looks like a buy, on daily we are waiting for Stoch RSI to turn up at minimum.

May 9 – Every indicator is flashing a buy, except earnings are on deck and 20 MA has to breach 50 MA and we’re long.

$BWA – BorgWarner

June 6 – $BWA Trading 44.31. Got its pop. Price above MA’s on Daily. Stoch RSI near top, MACD trending up and SQZMOM green. Looks good but will likely wait for the 50 MA to breach 100 MA to upside on Weekly. But it is set up. WARNING to 200 MA resistance at 48.11 on weekly if you do enter.

May 30 – Trading 42.19. Still indecisive indicators. Watching.

May 23 – Trading 41.37. Price under 20 MA. Under pressure. Watching.

May 17 – Trading 42.21. Resistance on weekly 48.10 (200 MA above) and 50 MA near crossing 100 MA. On daily indecision on MA’s – we’re watching.

May 9 – Waiting for 20 MA to breach the 100 ma (blue) and 50 ma (purple) with price above and MACD confirm.

$LIT – Global Lithium

June 6 – Trading 29.92 Holding but be aware it could come of a bit soon before running again as Stoch RSI turned down on daily and its high on weekly.

May 31 – MACD crossed up on 24th and went long 29.44 500 per alert notes below (before we integrated live alerts), will add when 60 min MACD at bottom and turns back up (will live alert it also).

May 23 – Trading 29.31. Waiting for MACD to turn up.

May 17 – Trading 29.43. MACD turned up last Friday and all indicators on weekly and daily are flashing a buy. Very likely will enter long May 17 premarket.

May 9 – Trading 28.55. Same.

May 3 – Trading 28.79. Watching for MACD and SQZMOM to turn up.

April 24 – Watching. Stoch RSI turned up at bottom and MACD trending down.

April 19 – MACD crossed down April 13. Closed 28.30 all shares.

April 10 – Trading 28.87 Holding.

April 5 – $LIT Alerted on March 27 report and went long 27.32 March 30 – long entry still intact as MACD is up, SQZMOM green or wait for pull back then enter. We expect this sector to stay hot – but if not in you may want to wait for STOCH RSI to cool and turn back up and go long.

$BA – Boeing

June 6 – Trading 188.47. Per last report it was an okay long. SQZMOM green MACD trending up but Stoch RSI on daily trending down on daily and on weekly the MACD may turn down and SQZMOM Green but trending down. Watching for now.

May 31 – Trading 187.09. MACD on daily turned up. Likely a good long here but waiting.

May 23 – Trading 183.40. Waiting MACD on daily to turn up.

May 17 – $BA Trading 182.70. Closed 183.82 when MACD turned down on daily May 11 from 180.06 entry 500 shares.

May 8 – $BA Boring Swing trade going well. Trading 186.13. Long 180.06. Holding. MACD, Stoch RSI, SQZMOM all trending. #swingtrading

$BA Live Chart https://www.tradingview.com/chart/BA/ba7cjyIj-May-8-BA-Boring-Swing-trade-going-well-Trading-186-13-Long/

May 3 – Trading 183.13. Holding. MACD still trending up. Stoch RSI trending down so it is a tad overbought and likely to come off a bit so watching close.

April 24 – Long 180.06 500 share test April 21 because MACD turned up and SQZMOM turned green. Earnings on deck so very careful. May close before earnings and re-enter after.

April 19 – Watching. Waiting for MACD to cross up.

Apr 10, 2017 – Watching

April 5, 2017 – $BA Boeing – It’s early but increasing volume, Stoch RSI turn up, MACD turn up pinch, SQZMOM wait for it to turn green and POW

$BA Boeing live chart – https://www.tradingview.com/chart/BA/9oB2G2vk-BA-Boeing-It-s-early-but-increasing-volume-Stoch-RSI-turn-up/

$EXK – EXK Silver Mining

June 6 – Trading 2.92. Holding.

May 31 – Trading 2.92. Yes still holding.

May 23 – Trading 3.13, Holding. MACD still turned up. High RR.

May 17 – Trading 3.31 holding long 3.49 entry. MACD turned up again on 12th and Stoch RSI is at top and resistance at 3.64 ish on daily 100 MA. Waiting now for 20 MA to breach 50 MA on daily for possible add.

May 8 – Trading 2.88. Holding per below.

May 3 – Trading 2.92. Holding long 3.49 3000 shares. It isn’t like us to hold through a down draft, however it is trading at a recent low equivalent so we are watching closely.

Apr 24 – Trading 3.12. Holding long 3.49 3000 shares.

Apr 19 – Holding long 3.49. Trading 3.20. Stoch RSI almost at bottom and will watch close when Stoch RSI turns back up.

Apr 10 – Holding trading 3.45

Apr 5 – $EXK Silver Mining SQZMOM turned green today, increasing volume, MACD up – may want to let it cool a bit before long. We are long at 3.49 average cost basis April 4 3000 shares.

$BABA – Alibaba

June 6 – Trading 125.20. Didn’t get our pull back and we’re paying. BUT SQZMOM just slightly turned down on weekly now so maybe we’ll get that pullback yet.

May 31 – Trading 123.60. Watching for a pull back.

May 23 – Trading 125.10. Well we got the pullback around earnings and missed it. Hopefully some members got it. It’s trading at near ATH’s right now in premarket.

May 17 – Trading 124.00. Every indicator on hourly, daily and weekly are still flashing buy, however, there has been no pullback to get an entry long. Watching.

May 8 – Trading 117.20. Same as below. Earnings nine days away also.

May 3 – Watching for it to cool off. Unfortunately we did miss some of the move. Waiting for MACD to trend down and catch it on its next turn up.

April 24 – Watching.

April 19 – Closed 111.40 at target from 104.64 cost avg 500 shares. Will allow MACD to return to bottom for re-entry.

April 10 – Hit 110.45, very near our 111.40 target. Holding, trading 109.34. Long 104.64.

April 4 – Holding long 500 shares from 104.64 now trading 108.17. It is testing all time highs and we may add on a break of all time highs. If it pulls back we may cut for a small profit. First price target is 111.40 (see below)

$BABA Live chart with indicators including that SQZMOM indicator – sweeet tool! https://www.tradingview.com/chart/BABA/Lbao9BVu-BABA-Swing-Trade-going-well-Our-Swing-Trading-side-is-in-at-10/

$BABA Swing Trade going well. Our Swing Trading side is in at 104.64 trading at 108.17. #swingtrading pic.twitter.com/x2zOezrBQ3

— Melonopoly (@curtmelonopoly) April 4, 2017

March 27 – We’re long 104.64 500 shares March 22 at test of 20 MA. Stop is at our entry and we are looking for a fresh break-out. However, the market sentiment is not great right now so we are unsure. There is an upside pivot at 111.38 we are watching for resistance should price continue up. Also watching MACD close.

March 20 – Wait for MACD to turn up and confirm and stay long until MACD turns down. The Stoch RSI seems to be frontrunning the MACD fyi. $BABA is one of my favorites right now and I see a long entry early in the week.

$BABA Live Trading Chart – https://www.tradingview.com/chart/SPY/GsGBi5f2-BABA-Daily-100-MA-50-MA-Cross-MACD-Pinch-SQZMOM-up-Stoch-RSI/

$BABA Daily 100 MA 50 MA Cross, MACD Pinch, SQZMOM up, Stoch RSI up. Wait for MACD for long. #swingtrading

$NFLX

June 6 – Trading 165.06 from 148.40 entry. All indicators pointing up on weekly and daily but we will likely roll out of this long soon.

May 31 – Trading 163.20. 148.40 entry. Stop set at 158.00 now. If price tests 20 MA on daily but doesn’t take out stop I will add and alert live.

$NFLX swing trade going wll. Trading 163.20 premarket from 148.40 entry. #swingtrading

May 23 – Trading 157.32. Stop set at 153.10 to protect equity. Holding otherwise. MACD turned down on daily and may add if it turns up.

May 17 – $NFLX Swing trade going well. Trading 158.50 from 148.40 entry. SQZMOM may turn down as with MACD and Stoch RSI truned down may exit soon and re-enter when indicators turn back up.

May 9 – $NFLX Swing trade going well. Long at 148.40 trading 156.08. SQZMOM and MACD trending but Stoch RSI may cool soon, vol decent. Will add per below.

$NFLX Live Chart https://www.tradingview.com/chart/NFLX/rjcjiVBz-NFLX-Swing-trade-going-well-Long-at-148-40-trading-156-08-SQ/

May 3 – April 25 148.40 Long 500 shares April 25 when MACD turned up per below. Trading 156.28. MACD trending up, SQZMOM trending up and Stoch RSI at top and may come off short term – so a short term turn down is possible here. Will likely re-add when STOCH RSI comes off and turns back up as long as MACD is trending up still and has room to top.

April 24 – Trading 142.87. Watching.

April 19 – Trading 143.75 – waiting for MACD to turn up.

April 10 – We closed flat 145.50. Trading 142.80. Waiting for MACD, Stoch RSI, SQZMOM to turn green for entry long.

April 4 – March 29 we entered 145.50 500 shares when MACD turned up per watch trigger below. Stop is at flat at entry and we will re-enter if we have to. Will look at adding pending triggers – will advise.

$NFLX Live chart with indicators https://www.tradingview.com/chart/NFLX/ozKJQ8t4-NFLX-March-29-we-entered-swing-trade-145-50-when-MACD-turned-t/

$NFLX March 29 we entered swing trade 145.50 when MACD turned, trading 146.82, stop at flat and re-enter if we have to. #swingtrading pic.twitter.com/DI8fiL6nsv

— Melonopoly (@curtmelonopoly) April 4, 2017

March 27 – MACD has been flat or turned down since last post. Looking close at MACD turn up and entry this week.

March 20 – The only thing that concerns me is the price staying above approximately 145.05 as a low on any given day. I may also look for that in addition to indicators lists below. Same thing with this one, exit when MACD turning down. Chances are high I will enter long early week.

Live $NFLX Chart – https://www.tradingview.com/chart/NFLX/4RQP5P9P-NFLX-Daily-abover-20-MA-Stoch-RSI-Revved-MACD-turning-up-SQZMOM/

$NFLX Daily abover 20 MA Stoch RSI Revved MACD turning up SQZMOM watch close for green. Long on MACD and QZMOM confirmation.

$GSIT

June 6 – Trading 8.38. All indicators turning up on daily but waiting and watching.

May 31 – Trading 7.59. Same.

May 23 – Trading 7.99. Watching per below.

May 17 – Trading 7.91. All the indicators are indecisive. Waiting.

May 9 – Trading 7.40. See below.

May 3 – Trading 8.03. MACD pinching. Will enter long when MACD turns up AND be sure price is above moving averages and 20 MA is in fact over 50 MA. 20 50 100 200 all in order with price above in other words. Should be soon.

$GSIT Live chart https://www.tradingview.com/chart/GSIT/MLQDlG9S-GSIT-MACD-pinch-Enter-long-when-MACD-turns-be-sure-price-above/

April 24 – Trading 7.96. Watching.

April 19 – Trading 7.63. MACD still trending down. Waiting for it to turn up.

April 10 – Trading 8.18, Stoch RSI curling up, waiting on MACD to cross up and SQZMOM to turn green for long.

April 4 – $GSIT finally cooling off and coming back to earth. Watching that MACD very close for a turn up (after it returns to bottom hopefully).

Mar 27 – Sure enough, it was on its way to the 20 MA this past week and stopped short and got some lift and closed Friday sitting on 8 ema. Will wait for it to line up.

Mar 20 – The reason I have this on the list is because as a break-out stock it is about as clean as they come, however, break out stocks come with risk. So you have two options (and shorting right now isn’t one), you can either wait for it to get near a 20 MA test and go long when other indicators line up or open a short time-frame chart and trade it. I will be waiting for the 20 MA test.

GSI Technology, Inc. to Present at the Global Predictive Analytics Conference http://finance.yahoo.com/news/gsi-technology-inc-present-global-173705866.html

$GSIT in break-out. Daily Stoch RSI peaking, MACD near peak, SQZMOM near peak. Wait for 20 MA retest and MACD confirm for long.

$AXP

May 31 – Trading 77.05. Same.

May 23 – Watching. Indicators indecisive.

May 17 – Trading 78. Sitting on 200 MA on weekly. On daily price is under 20 and 50 MA with MACD turned down. Watching.

May 9 – Trading 78.27. Closed 78.74 May 4 when MACD crossed down from 78.01 long. We still like this stock so we are watching close for indicators to turn back up.

May 3 – Trading 79.54. Holding long while MACD trends up and price above entry and 20 MA is above 50 MA. Stoch RSI is coming off so we expect some downward pressure short term.

April 24 – Trading 79.63. Long 78.01 500 shares April 20 when MACD turned up. Watching for MACD, Stoch RSI to remain, and SQZMOM to turn green for possible add.

April 19 – Trading 75.50. MACD getting close to bottom. On watch for MACD cross up.

April 10 – Trading 77.77. Waiting on Stoch RSI to curl up, MACD to cross up and SQZMOM to turn green for long.

April 4 – $AXP American Express. So close. SQZMOM about to turn, MACD cross on deck just need PTPTRR to line up. Need volume & power. #swingtrading $AXP Price Trigger Power Trade Risk Reward – PTPTRR #trading Over the Wall!

March 27 – MACD has turned down and SQZMOM is red and negative but Stoch RSI is starting to curl – waiting for that MACD to take an entry.

March 20 – This is a trend play. The only thing you have to do is manage your entry point and risk. Wait for indicators to confirm next leg up about to start and take long entry. When MACD turns down on daily that is your exit. I really like this one, especially because MA’s are all on right side (aligned) and trend reversal is in place.

$AXP Setting up for next possible leg up. Wait for MACD SQZMOM Stoch RSI to turn up. Will likely test near 100 MA at min 50MA.

$ABX – Barrick Gold

May 31 – Trading 16.41. Same.

May 23 – Trading 16.95. Watching.

May 17 – Trading 17.14. On daily MACD is turned up, waiting on results of 20 MA test (happening now). On weekly MACD is turned down and would like to see that crossed up.

May 9 – Trading 16.26. See below.

May 3 – Trading 16.37. Watching. All indicators pointing down.

April 24 – Trading 19.25 watching. Earnings on deck.

April 19 – Trading 19.46. Indicator indecision. Waiting on clarity.

April 10 – Waiting on MACD and Stoch RSI to cross and turn up for long. SQZMOM is green now. Trading 19.09.

April 4 – $ABX Setting up nicely. Above 200 MA, wait for Stoch RSI to return to bottom and turn if possible, be sure SQZMOM green and MACD turns up and kapow. Some volume and power would help too.

March 27 – Very close now. SQZMOM just turned green, MA’s are starting to line up but not all yet, Stoch RSI is turned down at top of range so I would like to see it at bottom when we enter and the MACD is turned up. So we’re waiting for the MA’s to line up and the Stoch RSI to be near or at bottom curling up (ideally).

March 20 – I will enter a long when price above 20 50 100 200 MA’s and will likely wait for the 200 MA to cross 100 MA (although not absolute). Like with all others I will exit when MACD turns down.

Freeport a better buy? https://www.fool.com/investing/2017/03/18/better-buy-freeport-mcmoran-inc-vs-barrick-gold.aspx

Inflation may send Gold higher. http://ir.baystreet.ca/article.aspx?id=528&1489764218

$ABX Daily MACD turning up, Stoch RSI way up, price on 20 MA, SQZMOM needs to confirm, 200 MA 100 MA cross would help with price above.

$TAN

May 31 – Trading 18.57. Will let this play through a bit before a long – but its getting very close now.

$TAN MACD Turned up on daily and price popped off 50 MA testing 200 MA now. #trading #premarket

May 17 – Trading 18.20. MACD on daily is just barely crossed up and other indicators are still indecisive. Going to let it play out some.

May 23 – Trading 18.18. Watching.

May 17 – Trading 18.20. MACD on daily is just barely crossed up and other indicators are still indecisive. Going to let it play out some.

May 9 – Trading 17.84. Waiting for 20 MA to breach 50 MA now – CLOSE!

May 3 – Trading 17.67. $TAN Watching MACD turned up price over 20 MA SQZMOM green. Need price over 50 MA with 20 MA breach 50 MA.

$TAN Live Chart Link: https://www.tradingview.com/chart/TAN/7JpW1gSP-TAN-Watching-MACD-turned-up-price-over-20-MA-SQZMOM-green-Need/

This is one of those where we are early. In other words the price isn’t above all MA’s yet. So one could take the trade as long as MACD is up and preferably long entry timed when 20 MA is about to breach 50 MA and price is above. But watch out for the 200 MA above.

April 24 – Trading 17.04. Watching.

April 19 – Trading 17.39. This one is getting close. Stoch RSI has to come off and then turn up. SQZMOM is almost green and MACD cross up. When those line up we will take a long position.

April 10 – Trading 17.20, Stoch RSI pinch, MACD pinch. Waiting on Stoch RSI to curl up, MACD to cross up and SQZMOM to confirm green for long.

April 4 – NA

Mar 27 – $TAN chart is now “broken” and price is on its way to the lower pivot around 16.44. All indicators are pointing to down. It closed Friday at 17.29. So we will keenly watch it as it nears the lower pivot and see if the indicators line up for a long trade. If it lost lower pivot we may even consider a short side entry pending indicators.

Mar 20 – Nice reversal play if it turns out. In addition to below watch the 200 MA as resistance if you go long.

$TAN Reversal Play. Daily MACD needs to turn up, Stoch RSI is up, SQZMOM needs to turn up. 100 MA about to cross 50 MA – bullish.

$VRX

May 31 – Trading 12.29 Watching.

May 23 – Trading 13.41. Watching.

May 17 – $VRX Early stages of possible bottom bounce. SQMOM green, 20 MA about to breach 50 MA price still under 200 MA, MACD up. We may trade this more as a daytrade . swingtrade until it firms above 200 MA.

May 9 – Trading 9.77. See below.

May 3 – Trading 10.50. MACD is turned up and the SQZMOM has not confirmed green. Earnings in six days so watch for that. The MA’s are exactly like the $TAN scenario above so the same rules apply. We are not entering yet but may at any second. Again it is an early trade because you want price above the 200 MA and 20 MA to breach 20 MA that is perfect timing (with MACD trending up). But many people take these early at this point. Refer to considerations noted above with $TAN also. Same set-up.

April 24 – Trading 8.51 Watching.

April 19 – Trading 8.95. Not ready.

Apr 10 – Waiting on Stoch RSI to curl up, MACD to cross up and SQZMOM to confirm green for long.

April 4 – I thought I’d run a poll on my Twitter feed to help us with this one.

$VRX Premarket is up 1% – Could this be the bottom?

— Melonopoly (@curtmelonopoly) April 4, 2017

$VRX Premarket up 1%. MACD cross flat… is this the bottom?

$VRX Premarket live chart https://www.tradingview.com/chart/VRX/F7bVqHl7-VRX-Premarket-up-1-MACD-cross-flat-could-this-be-bottom/

March 27 – $VRX continues stepping down on the chart… per below, really important to wait for all the indicators to line up. So we remain patient and watch.

March 20 – This was looking like it was going to curl up last week and bounce but it failed. A great example of carefully watching a falling knife indicators before taking a long position. Use patience and when all indicators in play take a long.

$VRX Bottom Play. Daily MACD needs to turn, Stoch RSI turning up, SQZMOM needs to turn then as MA cross-overs occur it will strengthen.

$TWLO

May 31 – Trading 24.48. Watching.

May 23 – Trading 25.00. Watching for bottom bounce to form. MACD up on daily right now.

May 17 – Trading 24.53. Waiting on MACD turn cross up on daily before anything.

May 9 – Trading 23.50. See below. Not ready.

May 3 – Trading 23.70. Closed 33.57 1000 shares before earnings on a 29.60 buy. Never hold through earnings unless you are unusually confident (yes we did recently with $GOOGL and $AMZN but very unusual for us to do that). Anyway, watching now. Downdraft was intense from forward guidance.

April 24 – Trading 30.82. Holding 1000 shares 29.60.

April 19 – Trading 30.51. April 12 MACD turned up opened long 29.60 1000 shares.

April 10 – Trading 28.40. Stoch RSI curling up, waiting on MACD cross and SQZMOM to turn green for long.

April 4 – No change.

March 27 – Price failed when it had to poke through 100 MA and continue – it failed and is on its way (possibly) to the previous low. So here, as with $VRX we employ patience – but get ready because the long in this one will be decent. Use the indicators noted below.

March 20 – Looks like bottom may be in. It is trending up. Looking for 100 MA to cross down under 20 MA (pinching now) and price to trade above 20 MA for long. Be sure to wait for MACD to confirm also first.

$TWLO Bottom Play on Watch. 100 MA needs to cross 20 MA with price over them. Stoch RSI pinch, MACD pinch, SQMOM turning up not green.

$WYNN

May 31 – Trading 126.30 Watching for MACD to turn up.

May 23 – Trading 125.11. Watching for set up.

May 17 – Trading 126.91 coming up on underside of 200 MA test on weekly. MACD on daily is about to cross up. Will wait for MACD on daily and assess.

May 9 – Stopped flat on May 5, 2017. Watching SQZMOM, Stoch RSI, MACD, volume indicators now for a turn.

May 3 – Trading 125.55. Long 122.56 April 25 when MACD turned up (per below) and watching for continuation in MACD and price. Will exit if MACD turns down or price hits our entry. We may even add. It looks good.

April 24 – Trading 114.89. Watching.

April 19 – Trading 115.95. MACD trending down. Waiting for bottom and turn up. It has a ways to go.

April 10 – Closed 500 shares Friday 117.20. Trading 116.50. Watching MACD, Stoch RSI, SQZMOM for reset at bottom and turn for re-entry.

April 4 – We triggered a stop at flat March 27 and had a re-entry at 111.04 when we looked at it again for 500 shares. Currently trading at 116.00 and we are watching MACD. Which is currently at top. We may exit as MACD turns down and re-enter when MACD turns back up. Alternatively we may ride the MACD turn down as long as our original entry isn’t triggered as stop and when MACD turns back up add to position. Both are valid and we are undecided.

March 26 – We took a long position at 110.93 for 500 share start on March 21. HOWEVER, we have a stop at our entry price (due to current market sentiment) and it is currently trading at 111.92. Careful with this one.

March 20 – This isn’t easy to swing but is so hot it would be foolish to ignore, so discipline like with so many other plays in the current market is required. Seeing it hold 110.00 for a full day with indicators in line would put me in a long position.

$WYNN 200 MA needs to cross 100 MA, trade over 110 full day. Stoch RSI peaking, MACD up, SQMOM up.

$XME

May 30 – Trading 29.25. Watching.

May 23 – Trading 29.23. Watching.

May 17 – Trading 29.32 MACD on weekly is down and price on Daily is under MA’s. Waiting on 20 MA to cross up and price to be above.

May 9 – Trading 28.73. See below.

May 3 – Trading 29.71. Watching for MACD to turn up. Currently pinched.

April 24 – Trading 29.79. Watching.

April 19 – Trading 29.48. Close flat 30.59 on the 12th. Testing 200 MA now. Watching for Stoch RSI to turn up, MACD to turn up and SQZMOM to turn green for long.

April 10 – Trading 30.84 holding. Long at 30.59. Tight stop.

April 5 – We opened a tight long position (so stop will be tight because you can always re-enter and metals charts still have to confirm so we are a tad early here) long 30.59 500 shares will add if it confirms and will cut bait if it comes off at most 2% and re-enter. Indicators look good BUT we are early. Use caution until metals etc confirm.

$XME Live trading chart with indicators listed. https://www.tradingview.com/chart/XME/lkPWMXSp-XME-Metals-and-Mining-ETF-Above-21-ema-8-ema-20-MA-200-MA-MACD/ #swingtrading

March 27 – Price action has been poor since last report, the 200 MA is just below price now so we are going to see if the indicators line up for a bounce long position.

March 20 – MACD is pinching and about to turn up, also waiting for price above 20 MA. This is a great looking chart and an argument could be made that a long position before everything lines up as I noted is sound. It’s a great looking chart because MACD is bottom (for clarity), so when it turns if all other indicators look good there should be room for a decent trade. Caution should be noted that now after having gone through a number of charts this evening the market is at a decision so any swing trades should be considered at length and stops should be tight IMO.

$XME Daily MACD pinching, SQZMOM starting to turn, Stoch RSI peaking, Price needs 20 MA

$URRE

Mar 23 – Trading 1.50 Watching.

May 17 – Trading 1.56. Watching.

May 9 – Trading 1.57. Waiting on MACD, SQZMOM to turn up, price to be above 20 MA and 20 MA to breach 50 MA. It is a ways away.

May 3 – Trading 1.68. Watching.

April 24 – Trading 1.84. Watching.

April 19 – Trading 1.94. Watching. Indicator indecision.

Apr 10 – No change.

April 5 – $URRE isn’t as close to a buy as $XME above, HOWEVER, the SQZMOM did signal green today and the MACD is slightly turning up! So it is on HIGH WATCH now!

March 27 – Almost a replay from last week (the indicators), so we remain patient and watch.

March 20 – Like so many of the charts this week, there is indecision. However, if the indicators line up this has excellent upside potential. The MACD pinching at the bottom is key IMO.

$URRE Daily MACD pinching at bottom, Stoch RSI turn up, SQZMOM needs green, price needs 20 MA.

Others on watch but not ready to report charting:

$RIG

May 23 – Trading 10.51 Watching.

May 17 – Trading 10.69. Watching.

May 9 – Trading 11.14 – SQZMOM trending up but red, MACD about to cross up, volume is up all after earnings. Waiting on price to be above 20 MA and breach 50 MA. Interesting action now (moderately positive) since earnings.

May 3 – Trading 10.60. Watching.

April 24 – Trading 11.24. Watching.

April 19 – Watching.

Apr 10 – No Change. Trading 12.50.

April 5, 2017 – $RIG Sooo close. MACD up, SQZMOM about to turn GR, wedged, needs increasing volume and break-out confirmation for a long.

March 27 – It is holding its 200 MA like a trooper, but I want to see it at least be over 20 MA and other indicators to line up.

March 20 – MACD pinching, watching for it to turn up, Above 200 day but needs to trade above 20 MA for long.

$XLE

May 23 – Trading 67.93 Watching.

May 17 – Watching.

May 9 – Trading 67.79. Similar action to $RIG above. Watching.

May 3 – Trading 67.31. Watching.

April 24 – Trading 67.79. Watching.

April 19 – Watching

April 10 – No change.

April 5 – $XLE chart is very similar to $RIG and others in this space, HOWEVER, it is still under 200 MA. On watch for break of 200 MA.

March 27 – The 50 has crossed the 100 and the 20 the 200 to downside – this is very bearish in the near term. Watching. It does qualify as a short and best when MACD at top turning down and Stoch RSI at top turning down with confirmation of price action and MA’s.

March 20 – MACD pinching, watching for it to turn up, Needs 200 day and to trade above 20 MA for long or it becomes a short.

$SLX – Vaneck Vectors Steel

May 23 – Trading 36.74. Watching.

May 17 – Just regained its 200 MA, MACD crossed up Stoch RSI trending up. Waiting on 20 MA to breach 50 MA with price above.

May 9 – trading 36.16. All indicators are indecisive. Watching.

May 3 – Trading 38.16. Sitting on 200 MA. MACD is turned up but all moving averages above price and SQZMOM not green so we are waiting.

April 24 – Trading 37.55. On close watch.

April 19 – At 200 MA support test now. Watching indicators closely.

April 10 – No change. Trading 39.90.

April 5 – $SLX On watch for SQZMOM to turn green and MACD to turn up. Close.

March 27 – As with $XLE above this also qualifies as a short (pending short term indicators lining up when you take the position). Price lost the 100 MA and the indicators are negative – very bearish. Watching.

March 20 – MACD is pinching on the turn back up – waiting for it to turn up and 45.50 to hold for one day to confirm break out. Or, on downdraft I would look at a 100 MA long entry also.

$X – United States Steel Corp.

May 23 – Same

May 17 – Watching as with above.

May 9 – Trading 21.32. As below watching. Indicators are not flashing long at all.

May 3 – Trading 21.92 Watching.

April 24 – Trading 30.10. On close watch. Earnings on deck. MACD needs to turn up.

April 19 – Trading 28.65. At 200 MA support test. As above watching indicators closely.

April 10 – Trading 34.40 premarket Monday. ON HIGH WATCH MACD about to cross up.

April 5 – Same as $SLX indicators above. Very close now.

March 27 – The $X trade is almost identical to $SLX above. Waiting.

March 20 – This one is riskier than most on this list, however, I am watching the MACD for a turn up for a possible long.

$AKS – Iron Steel Mills Foundry

May 31 – Trading 6.21 Watching.

May 23 – Same

May 17 – Watching.

May 9 – As with $X above.

May 4 – Trading 6.21 Watching.

April 24 – Trading 6.72. On close watch. MACD pinching up.

April 19 – Trading 6.40. Closed 6.97 fr loss April 11 when it lost 200 MA. On watch again.

April 10 – Long 7.30 April 7 1000 shares. MACD just turned up but SQZMOM is not green yet. 1/3 size entry with other 2/3 entry when SQZMOM turns green with other indicators confirming.

$AKS Live Chart – https://www.tradingview.com/chart/AKS/BbzvqPhJ-AKS-Swing-trade-position-long-April-7-swingtrading-stock-pic/

April 5 – Sitting right on 200 MA now. Watching for 200 MA to hold, MACD to turn up, SQZMOM to green.

March 27 – AKS is coming in on the 200 MA test. Watching.

March 20 – MACD is turning up now, watching for price to trade above 20, 50, 100 that are clustered together. It is well over 200 MA.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; Gold, $XAUUSD, $GLD, $MXIM, $LIT, $ATHM, $NFLX, $TAN, $BA, $BWA, $BABA, $WYNN, Compound Trading, Swing, Trading, Stock, Picks

Weekly Swing Trading Updates Mon June 5 $LTBR, $RCL, $JKS, $CTSH, $TSLA, $NVO, $FEYE, $PCRX, $AGN, $IBB …

Good Morning Swing Traders and Welcome to the Compound Trading Weekly Swing Trading updates (1 of 3 this week) for the Week of June 5, 2017. $LTBR, $RCL, $JKS, $CTSH, $TSLA, $FEYE, $PCRX, $PBR, $NVO, $EWZ, $AGN, $IBB and more …

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Notices:

Good morning!

Twitter alert service at @SwingAlerts_CT. I know many have expressed interest in the email only, but the Twitter option is available going forward for those that prefer that. Please bear with us as we integrate and orientate ourselves to this new function in our daily routines.

This report (1 of 3) focuses on the more recent stocks we have added to our swing trading set-up coverage. They include; $TSLA, $SNAP, $VGX, $AAU, $AMMJ, $AGN, $CTSH, $IBB, $FEYE, $LACDF, $PCRX, $PBR, $EWZ , $JKS. $RCL and new on coverage is $LTBR.

We are going to categorize our coverage soon because we are following more than we expected when we first started the service..

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

Also, as live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Newer updates below in red for ease.

Our Q1 2017 Swing Trading Results are available here:

https://twitter.com/swingtrading_ct/status/841079400485478400

$LTBR – Lightbridge Corp.

June 5 – $LTBR Daily 50 MA about to breach 200 MA with MACD SQZMOM and Stoch RSI up. Long 2.26 premarket.

https://twitter.com/SwingAlerts_CT/status/871663903012409344

$LTBR 100 MA resistance on weekly at 2.70. SQZMOM MACD Stoch RSI all up.

$RCL – Royal Caribbean

June 5 – Trading 113.38 and up significantly since last report with 50 MA breach of 100 MA on weekly. On Daily all indicators are a go also. Main reason we are not entering here is extension. Too risky and extended for now.

May 30 – Royal Caribbean Weekly 50 MA about to breach 100 MA and 52 week high near. Break out trade possible very soon.

$JKS – Jinko Solar

June 5 – Closing trade flat – earnings on deck. Should have closed last week when it hit 22.00 range for a decent swing.

May 30 – $JKS Long hold 18.65 hit 23.14 last Thurs and I almost closed and likely should have (I know some of you did notify me of closing positions) and currently trading 19.03. Earnings in six days stop set at entry.

May 22 – $JKS MACD turned up on daily, unusual volume, SQZMOM turned green and earnings on deck. Short term swing between now and earnings. 500 Long 18.65 in premarket. Small starter.

$PCRX – PacIra Pharma

June 5 – Getting a small pop in premarket because they are presenting at a conference but indicators are still poor. Waiting.

May 30 – Trading 45.15. All indicators trending down. Watching.

May 22 – Trading 48.30 Chart indicators are indecisive. Will watch.

May 15 – $PCRX SQZMOM up MACD trending up, if price above 52.00 with indicators on side likely long with tight stop.

$PBR – PetroLeo

June 5 – Trading 8.44. Same. Watching.

May 30 – Trading 8.95 same – watching.

May 22 – Trading 8.83. Weekly MACD down and failed 200 MA. Daily price under all MA’s. Failed upside break. Will watch.

May 15 – $PBR Trading 10.40. Regained 200 MA, MACD bullish, SQZMOM turned green. On 20 MA breach of 50 MA likely go long.

$EWZ – I Shares Brazil ETF

June 5 – Trading 34.93. Indicators still poor. Watching.