Compound Trading Chat Room Stock Trading Plan and Watch List Wednesday Feb 21, 2018 Fed, $AMZN, $NFLX, $ESPR, $TTPH, Raising Rates – $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY – $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL, $VIX , Gold Miners $GDX, Silver $SLV, $USOIL, US Dollar Index $USD/JPY, $DXY, S&P 500, Volatility … more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today (or recently important).

Curtis is on annual holiday from Feb 13 – 23.

Reporting and trading rooms run per normal. Mid day reviews will recommence when he returns. Curtis will be intermittently in trading rooms only during that time.

Service(s) Memo Follow-Up re: Compliance and Service Offerings Going Forward

https://twitter.com/CompoundTrading/status/963218112668631041

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Reporting and Next Gen Algorithms:.

BE SURE to get in to each private Discord server specific to your subscription as many of the updates as we go forward will be posted in there. This includes the SWING TRADING platform also.

IF YOU NEED A LINK / INVITE email or DM Sartaj!

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia, Brasil, and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. We are currently planning 2018 master class sessions and will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent Blog / Video / Social posts:

#BitcoinTrading 101: A Beginner’s Guide to Getting Started $BTCUSD $XBTUSD $BTC https://compoundtrading.com/bitcointrading-101-beginners-guide-getting-started-btcusd-xbtusd-btc/ …

https://twitter.com/CompoundTrading/status/927397024315662336

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Recent Educational Videos:

Want to learn how to trade stocks for a consistent profit? Raw trading footage video library. https://www.youtube.com/channel/UCxmgJ3CfWHRBFFMpoHumZ8w … … #freedomtraders

Visit the Trading Educational and Analysis Play List at this Link on our YouTube Channel

Trading Plan (Buy, Hold, Sell) Watch Lists. Morning Momentum / Gap / News / PR / IPO / SEC Filings / Earnings Stocks on Watch:

Stocks making the biggest moves premarket: GRMN, DISH, AAP, FL, LC, GM & more –

Stocks making the biggest moves premarket: GRMN, DISH, AAP, FL, LC, GM & more – https://t.co/CFWQmtRog5

— Melonopoly (@curtmelonopoly) February 21, 2018

$NFLX $AMZN $AAPL $NVDA are all up premarket.

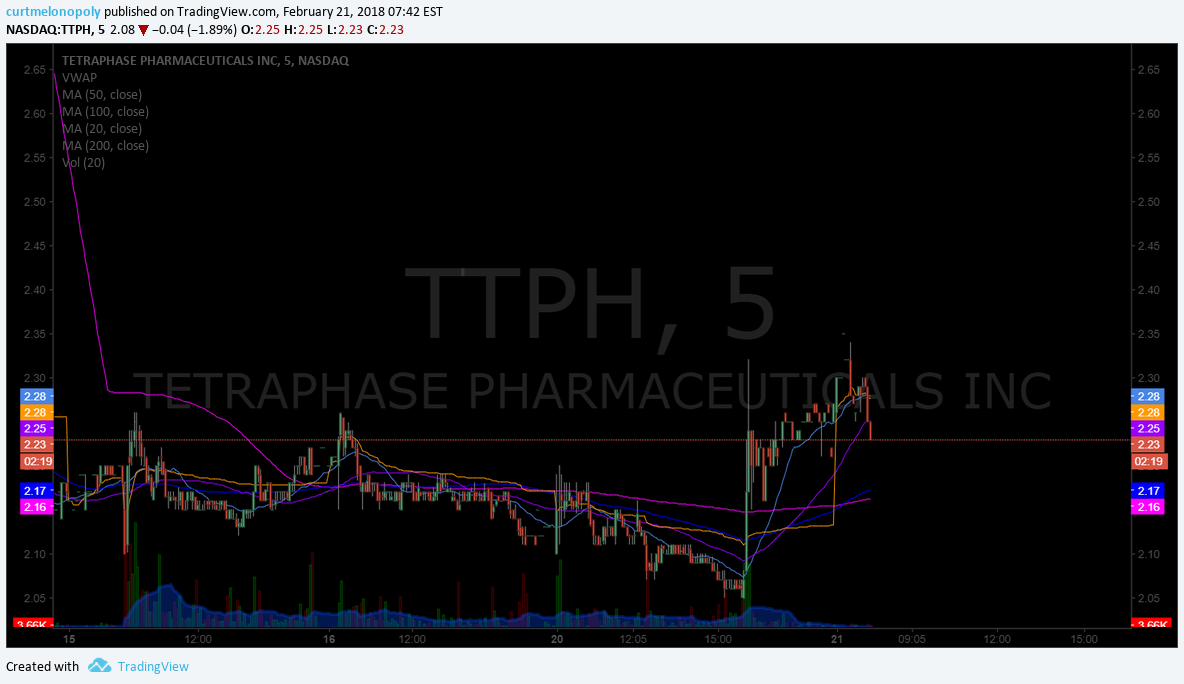

$TTPH premarket trading up 7.21% 2.23 on deal announced in asia. #stocks #premarket https://finance.yahoo.com/news/tetraphase-pharmaceuticals-enters-exclusive-development-210100562.html?.tsrc=rss

Market Observation:

US Dollar $DXY trading 89.79, Oil FX $USOIL ($WTI) trading 61.47, Gold $GLD trading 1329.16, Silver $SLV trading 16.42, $SPY trading 271.40 last, Bitcoin $BTC.X $BTCUSD $XBTUSD trading 11044.00, and $VIX trading 20.4.

Recent Momentum Stocks to Watch:

News:

Tetraphase Pharma up 12% premarket on eravacycline deal in Asia https://seekingalpha.com/news/3332647-tetraphase-pharma-12-percent-premarket-eravacycline-deal-asia?source=feed_f … #premarket $TTPH

https://seekingalpha.com/news/3332647-tetraphase-pharma-12-percent-premarket-eravacycline-deal-asia

$CYCC *DJ Cyclacel Announces Notice of Grant of New European Patent Covering Sapacitabine Pharmaceutical Formulations

(Dow Jones 02/21 04:00:26)

$ABBV

*ABBVIE REPORTS POSITIVE TOPLINE RESULTS FROM PHASE 3 STUDY EVAL

*ABBVIE REPORTS PHASE 3 ELAGOLIX STUDY MET PRIMARY ENDPOINT

Google launches machine learning-backed ad unit https://seekingalpha.com/news/3332685-google-launches-machine-learning-backed-ad-unit?source=feed_f … #premarket $GOOG $GOOGL

Recent SEC Filings:

Recent IPO’s:

Some Earnings On Deck:

#earnings for the week

$WMT $HD $ROKU $DPZ $CHK $OLED $AAOI $MGM $MDT $UCTT $FSLR $TTD $DUK $EXAS $SIX $P $STMP $TREE $CBRL $AAP $RIG $CTB $WLL $NBL $LNG $HLX $WLK $TPH $WAB $W $OC $APA $DVN $GRMN $HFC $GPC $SO $EGN $HSIC $LC $ECL $MOS $SLCA $DLPH $CAR

#earnings for the week$WMT $HD $ROKU $DPZ $CHK $OLED $AAOI $MGM $MDT $UCTT $FSLR $TTD $DUK $EXAS $SIX $P $STMP $TREE $CBRL $AAP $RIG $CTB $WLL $NBL $LNG $HLX $WLK $TPH $WAB $W $OC $APA $DVN $GRMN $HFC $GPC $SO $EGN $HSIC $LC $ECL $MOS $SLCA $DLPH $CARhttps://t.co/r57QUKKDXL https://t.co/5WENUDJCMO

— Melonopoly (@curtmelonopoly) February 20, 2018

Recent / Current Holds, Open and Closed Trades

This will re-commence under a new format when Curtis returns from holiday. “With new alert protocol buy / sell signals will be posted here as trade signals trigger along with specific thesis and chart set-ups”.

Per recent;

Yesterday the first oil trade went very well and with EIA I missed a large short opportunity, newer position $XNET 1/10 size long from Monday. Holding $XIV 1.5/10 sizing (event closing this derivative), $SPXL 1/10 size, small sizing holds include $WKHS, $GE, $XBTUSD $BTC Bitcoin 9700.00 1/40 size, $DUST 1/20 size recently close 50% for win, $ROKU, $GSUM (recently closed 1/3 at highs hold 2/3), $JP, $SLCA, $INSY (all small size) and very small sizing $AAOI, $SPPI and micro size $OMVS. On short side I am 1/10 Gold short.

Charts and Chart Set-ups on Watch:

$TTPH premarket trading up 7.21% 2.23 on deal announced in Asia.

$FSLR First Solar stock chart had MACD turned and under 50 MA in to earnings. #stock #chart

Bitcoin hit buy sell trigger support 5895 early (green arrow) then mid trigger early (gray) and 13790 in sight Feb 22. $BTC $XBTUSD

Per previous;

$SPY MACD may turn here. 200 MA hit, working thru moving averages.. MACD daily predictable directional swing trade indicator.. Feb 20 726 AM $SPXL $SPXS

Really decent action for those the held or added / bought the dip. Excellent trading opportunity in $SPY on the last wash-out.

Oil Resistance Check Feb 19. 50% Fibonacci, mid quad on monthly chart.. $USOIL $WTI $CL_F #OIL #OOTT $USO $UWT $DWT

$SODA pop #premarket trading 82.15 +4.5% on earnings. Daily chart looks good too. A main watch for me today. #trading https://www.marketwatch.com/story/sodastream-shares-jump-after-earnings-and-revenue-beat-2018-02-14?siteid=yhoof2&yptr=yahoo …

$NVDA Premarket up 9.96% trading 239.20 on cryptocurrency gaming demand and forward guidance.

$VIX over upper bollinger band creates excellent short side risk-reward. Use additional MACD signal. $TVIX $UVXY $XIV #volatility

Don’t look now but MACD turning up on $DXY US Dollar Index $UUP #swingtrading

$GDX in dangerous territory on 200 MA on Daily with MACD and SQMOM turned down. Bearish. $NUGT $DUST $JDST $JNUG

$ARRY Weekly chart suggests long term structure needs price over 14.89 on weekly now thru after June 3 time cycle. If so, it is up. #swingtrading https://www.tradingview.com/chart/ARRY/EZbQb5F4-ARRY-Weekly-chart-suggests-long-term-structure-needs-price-over/ …

$ARRY Weekly chart suggests long term structure needs price over 14.89 on weekly now thru after June 3 time cycle. If so, it is up. #swingtrading https://t.co/CA9E9zdGU0 pic.twitter.com/fkUJzMFe9Q

— Melonopoly (@curtmelonopoly) February 1, 2018

$AAOI The stock is trading 64% below last summer’s 52-week highs with earnings in 21 days I will be looking for a bounce. #earnings #trading

Buy sell trading triggers on simple $SNAP chart model have worked well. #swingtrading #charting https://www.tradingview.com/chart/SNAP/qJ0gRCyt-Buy-sell-trading-triggers-on-simple-SNAP-chart-model-have-worke/ …

Market Outlook, Market News and Social Bits From Around the Internet:

Dollar up and stocks down before key Fed meeting minutes

#5Things

-Treasuries

-Fed minutes

-U.K. jobs

-Latvia vs. Russia

-Another Mueller plea

https://bloom.bg/2sK5TJf

#5Things

-Treasuries

-Fed minutes

-U.K. jobs

-Latvia vs. Russia

-Another Mueller pleahttps://t.co/xkxUVYl1Zq pic.twitter.com/2K501eUKax— Bloomberg Markets (@markets) February 21, 2018

Economic Data Scheduled For Wednesday

Economic Data Scheduled For Wednesday pic.twitter.com/U8bpNN7u1M

— Benzinga (@Benzinga) February 21, 2018

50 names to avoid as rates rise – JPMorgan –

50 names to avoid as rates rise – JPMorgan – https://t.co/4KMHHSYy3O

— Investing.com Stocks (@InvestingStockz) February 21, 2018

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid much of the day trading risk (preferring to daytrade only what is structurally set-up also on the swing trade side and to my advantage in the algorithmic model charting). I often avoid the first 30 minutes (gap and go) and trade momentum stocks or structured (per explanation in previous sentence) stocks later in day after a wash-out looking for a snap-back trade that can possibly also become a strong swing or longer term trade that I can leg in to. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Charting Model Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $TTPH, $ANTH, $ASA $CYCC $ICON $LPSN $YINN $PDFS $OAKS $SBGL $ROKU $AAP $MOS $LYG $FXI $DGAZ $HMNY $MDXG $DB $P

(2) Pre-market Decliners Watch-List :

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $NFLX, $NBL, $CRM, $NBIX, $SIX

$ESPR PT raised to $94 from $81 at Needham

$AMZN Amazon price target raised to $1,750 on potential to grow competitive advantage

Esperion Therapeutics $ESPR PT Raised to $65 at JPMorgan http://streetinsider.com/r/13843275

Boenning & Scattergood Upgrades Sunstone Hotel Investors $SHO to Outperform

Old Dominion Freight Line $ODFL PT Raised to $150 at Morgan Stanley

JPMorgan sees favorable setup for Sarepta, boosts price target to $75 $SRPT http://dlvr.it/QHDcHw

US Steel $X PT Raised to $52 at Argus http://streetinsider.com/r/13843424

Wabtec $WAB PT Raised to $85 at Deutsche Bank

http://salesforce.com $CRM: Raising PT In Anticipation of A Strong Q4 Report – Citi

Oppenheimer Starts Quotient Technology $QUOT at Outperform

Mosaic +2.5% as J.P. Morgan upgrades on positive phosphate price outlook https://seekingalpha.com/news/3332691-mosaic-plus-2_5-percent-j-p-morgan-upgrades-positive-phosphate-price-outlook?source=feed_f … #premarket $MOS

Six Flags Entertainment $SIX PT Raised to $70 at KeyBanc http://streetinsider.com/r/13843694

Infinity Property & Casualty $IPCC PT Raised to $123 at Raymond James

(6) Recent Downgrades: $MTCH, $VERI, $RARE

Travelport Worldwide Limited $TVPT PT Lowered to $14.50 at Morgan Stanley

Allstate $ALL PT Lowered to $105 at Morgan Stanley

Helix Energy Solutions Group, Inc. $HLX PT Lowered to $11 at Credit Suisse

Henry Schein $HSIC PT Lowered to $75 at Leerink Partners, ‘Decent Quarter, with Good Dental …

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $BTC (@CryptotheAlgo) $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: Premarket, Watchlist, Stocks, Trading, Plan, Fed, $AMZN, $NFLX, $ESPR, $TTPH, Raising Rates, $GSUM, $WKHS, $ROKU, $JP, $SLCA, $INSY, $SPXL, $SPY, $BTC.X, Bitcoin, Gold, $DUST, $WTI, OIL, $VIX