How to Trade Facebook (FB) Earnings Wash-out. Technical Charting for Swing Trading and Day Trading. Member Edition of Report.

Facebook, Inc. (FB) plunged in after hours trade today falling from 218.62 high of day to 164.30 in a spectacular after hours trading session.

In this report are the technical charting details for trading Facebook in the coming days and weeks. The charts below will assist you on short time frame daytrading in premarket and market open tomorrow. Also included in this report are longer time frame daytrading levels and swing trading buy sell triggers for Facebook stock trade.

The reason for the sell-off is detailed in a Market Watch article from earlier today;

Facebook stock drops more than 20% after warning that revenue growth will take a hit

https://www.marketwatch.com/story/facebook-stock-crushed-after-revenue-user-growth-miss-2018-07-25

Facebook earnings include ‘nightmare guidance’ that lopped more than $100 billion off its market cap in after-hours trading.

“As I’ve said on past calls, we’re investing so much in security that it will significantly impact our profitability,” Zuckerberg said. “We’re starting to see that this quarter.”

The stock didn’t fall off a cliff until Chief Financial Officer David Wehner disclosed that the social-media giant expects the revenue-growth slowdown to continue.

“Our total revenue-growth rates will continue to decelerate in the second half of 2018, and we expect our revenue-growth rates to decline by high-single-digit percentages from prior quarters sequentially in both Q3 and Q4,” he said on the conference call. Wehner also said Facebook still expects expenses to grow 50% to 60% from last year.

The last time we traded a Facebook wash-out the trade was one of our biggest winners of 2018 (thus far). We nailed the bottom of the sell-off and we followed the trade through as it gained upside until today. We have been out of the trade for a few weeks now in anticipation for today’s earnings announcement.

Below is one of many alerts issued to members in the last Facebook sell-off, we were in nice and early and banked considerably as a result:

$FB Facebook long side trade from 153.40 Mar 28 buy side trigger now testing buy sell trigger 167.51. See chart notes. #swingtrading

https://twitter.com/SwingAlerts_CT/status/984194323192266752

You can find the April 11, 2018 Facebook trade article from our blog here:

$FB Facebook Long Set-Up Testing Buy Sell Trigger #swingtrading (Public Edition)

During the last Facebook sell-off swing trade price plunged in to the 150’s and the article link takes the trade step by step from the low 160’s.

When this first set-up I alerted it a number of times in different ways on different platforms – I even texted people and sent private messages. I was screaming this from the rooftops..

As time goes on in your trading life you learn over and over again how this particular type of set-up has profit written all over it. The secret however, is knowing where your trading chart structure is in advance of trade getting to that area of restructuring after the wash-out. Knowing that is key.

STEP 1: Getting in to the Facebook trade in premarket or at market open tomorrow morning (Thursday July 26, 2018).

The chart below will help you with short time-frame entries to get your positioning right, get on the right side of the trade so that you can then leg in to a sizeable swing trade if you want from there forward (pending trading action in the morning).

My trading plan for Facebook will be to do exactly that, daytrade it in premarket tomorrow with the objective of getting some profit side room in the trade so that I can leg in to a more significant swing trading position.

I should note that considering the company’s guidance on the earnings call today that I do not expect the same ROI as the last trade we started in April of 2018.

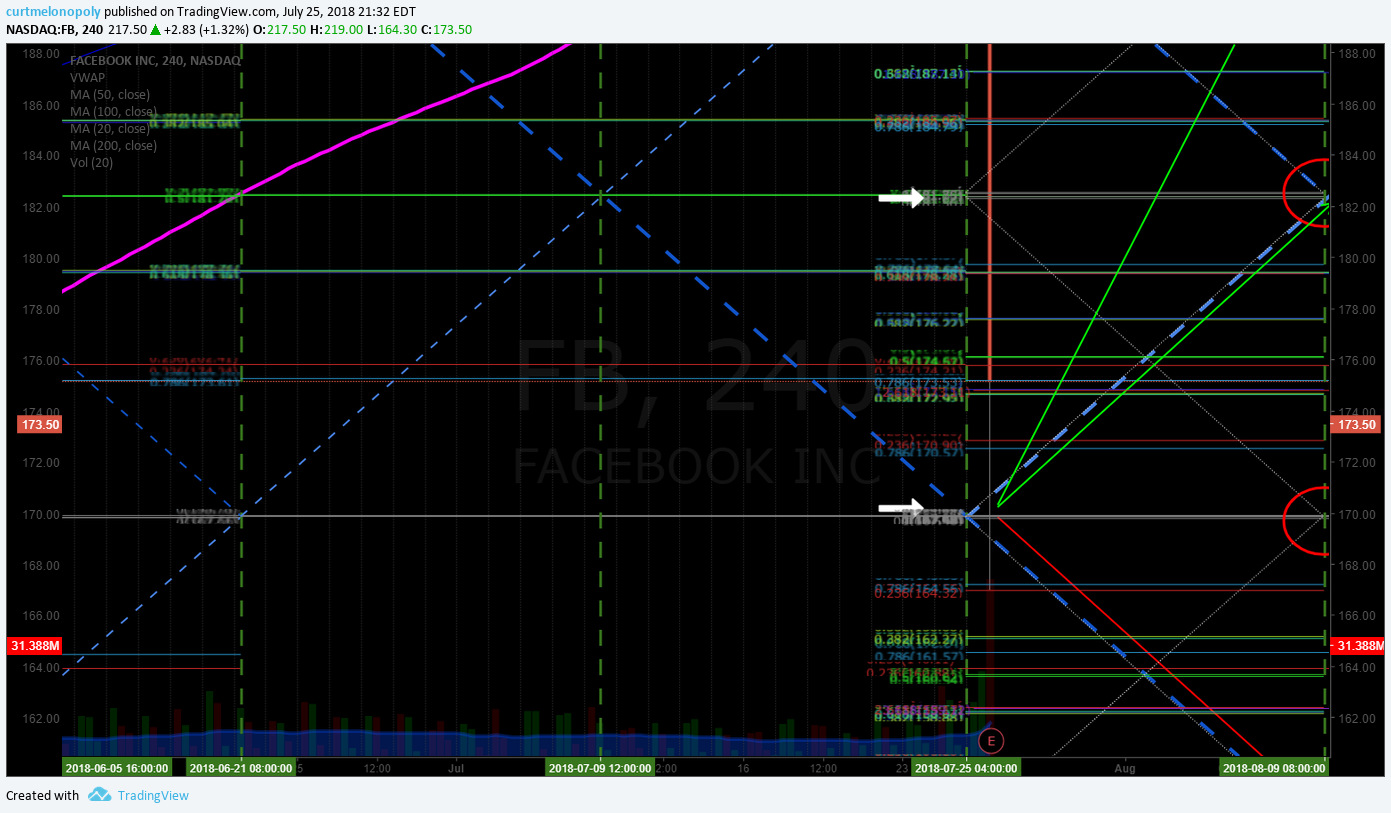

Facebook (FB) “On the Fly” Facebook Daytrading Chart with buy sell triggers for premarket Thursday. $FB #facebook #chart

Member version of this report includes (in addition to a static chart) a link below to a live interactive Facebook daytrading chart on Trading View (with all technical levels).

Buy / sell triggers on the short time frame per chart (intended for short term daytrading):

164.55

169.36

174.12

178.90

Trading at close of after hours market 173.50.

The 167.50 notation on the chart above is in reference to a series of tweets I published on my personal Twitter feed when the earnings sell off was in motion as follows;

Watching $FB close now

Watching $FB close now

— Melonopoly (@curtmelonopoly) July 25, 2018

167.50 would be nice $FB

167.50 would be nice $FB

— Melonopoly (@curtmelonopoly) July 25, 2018

next magic

next magic

— Melonopoly (@curtmelonopoly) July 25, 2018

167.50 hit $FB

167.50 hit $FB

— Melonopoly (@curtmelonopoly) July 25, 2018

magic show restructure in progress $FB

magic show restructure in progress $FB pic.twitter.com/jOUbPr12IE

— Melonopoly (@curtmelonopoly) July 25, 2018

STEP 2: Long Daytrade and Swingtrading Time Frames.

FACEBOOK (FB) Trading Facebook wash-out on earnings. Trading levels for daytrading and swingtrading. $FB #daytrade #swingtrade #chart

Member version of this charting includes (in addition to a static chart) a link below to a live interactive Facebook daytrading / swingtrading chart on Trading View (with all technical levels including buy/sell triggers, MA’s, quad walls, Fibonacci support and resistance, price targets and more).

Trade toward price target trajectory between the Fibonacci resistance and support levels (paying attention to quad walls – Fib diagonal trendlines). Trim heavy at buy sell triggers and add above or below depending on your trending direction of trade.

Cheers!

Curt

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me: