Daytrading Stocks Isn’t Easy, But You Can Increase Your Win Rate When Trading Momentum Stocks Using Technical Analysis Along With A Catalyst Thesis.

In this post I use the market open trade in $ROKU as an example (live raw trading room footage is below) to teach you how to daytrade stocks that have a catalyst (in this case an upgrade in ROKU by a well known market analyst that morning) and using technical analysis to structure the trade (long trade entry point on chart, where to trim the position and where to close the position at key resistance).

My trade was clean, without stress, I alerted the trade live on the live trade alerts feed and traded it live in the trading room. When I alerted the trade I also gave our members a price target for closing the trade.

Hopefully my experience in using technical analysis while daytrading stocks will help you win more and lose less when you lose.

Live Trading Room Raw Video and Transcript Highlights Detailing Trade Entry, Price Target, Trims and Closing Trade.

The video below is the raw live trading room video feed that includes review of various trade set-ups in premarket and market open. The summary of the ROKU trade is below the video with points of reference on timing on video for easy reference.

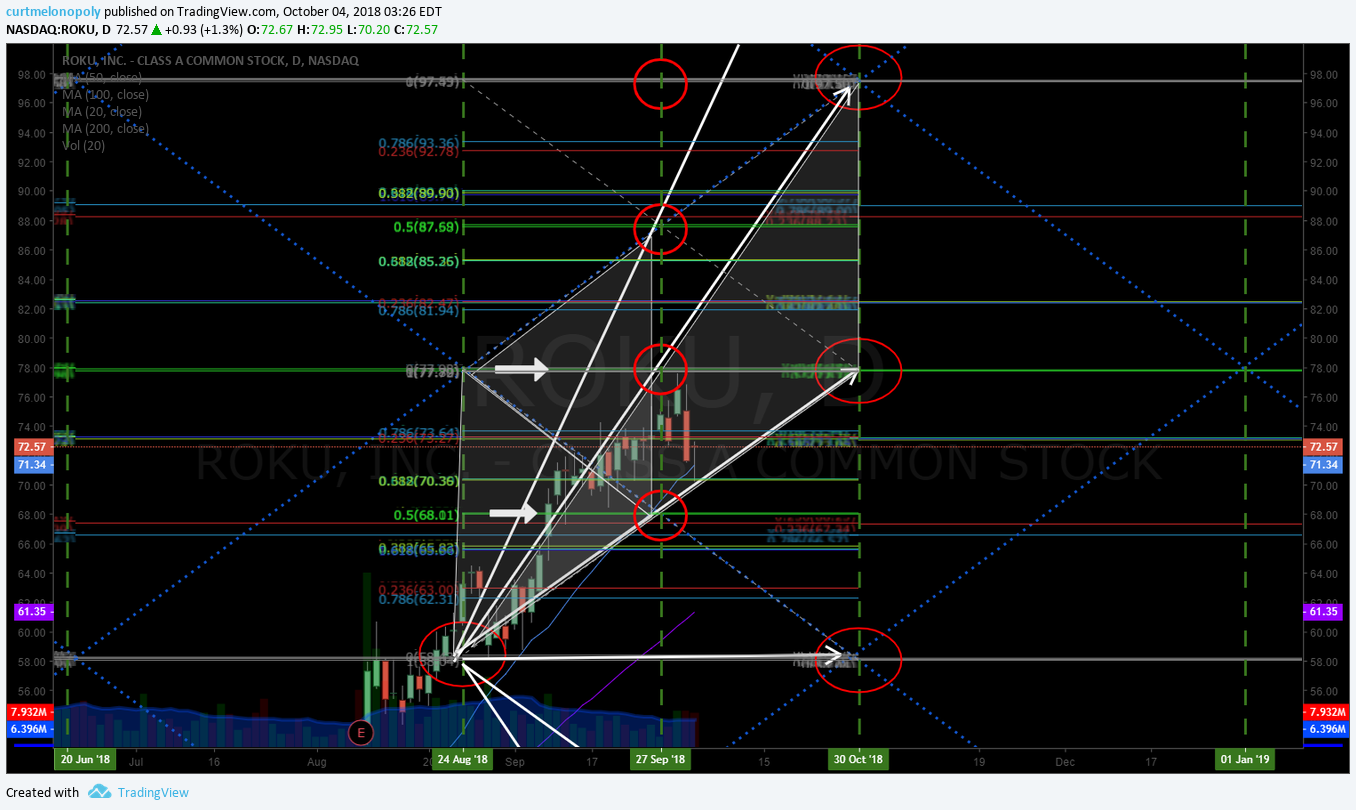

At 5:55 on video: In premarket I explain to the trading room that ROKU is my primary watch (the others I also reviewed on the video) on the day on the analyst upgrade. ROKU trading up 2% at 74.63 premarket. Over 77.62 is an add (to those already in the swing trade). For the longer term than daytrading 93.93 is a possible price target in a bullish scenario and 87.58 is more likely and 78.00 most likely for the target date on the chart at the time cycle peak.

The points of support and resistance on the charting that I reference follow a process of technical analysis that we use on all of our algorithmic charting.

ROKU trade is following trajectory. Be sure to trim trade positioning in the resistance areas on the chart and add above (or alternatively add at pull backs).

I also how 5 minutes in to open is an important area to watch and how I am cautious Monday mornings, but on this Monday premarket trading was bullish.

At 9:12 on video: Market open at 9:30 Eastern time. ROKU trading 74.72 at open, over 77.62 is a buy / add to any existing swing trade position. Support on ROKU intra day is at 73.15 – 73.20. Buy side coming in at this point and 3 – 4 dollar day trade range possible prior to resistance over head.

At 13:44 on video: Watching the market open first 5 minute candle conclusion. Over high of day (HOD) ROKU could run in to 77.70 price target. At this point in the trading session I explain that I may run the trade with the market to the price target. Trading 75.65 intra-day looking for 76.00 for a long entry for daytrade now.

At 14:41 on video: At this point I alert that I am long ROKU at 76.00 with a tight stop bias with price target for ROKU daytrade of 77.50. I would trim heavy in to that price target and possibly add above.

At 17:28 on video: Just about triggered an add to my long position in ROKU at 75.82, probably should have. Watch next 5 minute candle completion.

At 18:40 on video: ROKU is strong in to 5 minute candle switch. Now I have a stop at entry 76.00. If it dumps (sells-off) beyond my entry price at 76.00 I may re-enter.

At 21:01 on video: Trimming my position at 50% size at 76.69. Decent little day trade. It’s strong. Nice buys there.

At 25:15 on video: We’re getting pretty close to my price target.

At 25:50 on video: Trimming 25% of position 77.16 – likely early but….

At 27:10 on video: This is going to be an important candle turn. If a daytrade is going to soften (fade) it is likely to do that in to 10:00 AM, so I am watching the 10 minute point candle prior to the turn at the top of the hour at 10:00 AM.

At 28:28 on video: In to the candle turn I am watching the bottom of the candle body close. At candle turn watch for bullish or bearish trade action for a clue of how the next candle is going to trade. At this point ROKU is trading bullish trading near high of day. Looking for trade in next candle to hold the top of the body of the previous candle.

At 29:38 on video: Getting close to price target now it trade 77.29 there. 77.16 closed last 25% of the daytrade in ROKU.

The Catalyst: Analyst Upgrade on ROKU:

“Shares of Roku Inc (NASDAQ:ROKU) gapped up prior to trading on Monday after Needham & Company LLC raised their price target on the stock from $60.00 to $85.00. The stock had previously closed at $71.24, but opened at $73.03. Needham & Company LLC currently has a buy rating on the stock. Roku shares last traded at $76.48, with a volume of 8448678 shares”.

Article Here: Shares of ROKU Gap Up After Analyst Upgrade.

The Original Alert That Put ROKU on Watch for a Trade for our Members:

Below is a screen shot of the original trade alert posted on the swing trading alert feed (a copy was also posted to our daytrading alert feed on Twitter) that ROKU was on watch with a time cycle peak nearing (if you need to learn how to chart and/or trade time cycles reach out for some trade coaching, get access to trade coaching boot camp videos or spend some time in our live trading room).

It is important to note here that with the alert we also posted the link to the live chart on Trading View. This is important when you are harnessing your trade thesis in technical analysis, our members do not have to do the charting on their own, we provide that service as part of the platform.

Another important note is that when we are alerting day trades or swing trades for equities or commodity, crypto or currency trades… in most instances our members already have the technical charting models from previous analysis done for members in previous trade alerts or newsletters etc.

ROKU (ROKU) near short term time cycle, on watch for a daytrade and possibly swing long in to timing $ROKU #daytrading #tradealerts

https://twitter.com/SwingAlerts_CT/status/1044978728110100481

Day Trading Alert Feed.

Below are the screen shots for the actual trade entry, trimming the trade, where the stop on my trade was set and the price target for the trade on the day.

Day Trading Chat Room

And below is the screen shot of the trade alert in the daytrading chat room on Discord.

If you have any questions about the trade alert detailed in this article reach out! You can get me on email [email protected] or private message me on any of my social media accounts.

Trade safe and cut losers fast!

Curt

Subscribe:

Need help learning to trade set-ups like the one included in this post? Visit our trade coaching page.

If you are serious about learning in depth technical analysis and algorithmic charting and how to trade with that knowledge for a much higher win rate we have a master class video series that is approximately 20 hours of in depth teaching by our lead trader that retails for 1499.00. The master class trade coaching series is only available at this point by request by emailing our office at [email protected]. The unedited raw master class videos are now available and the most recent trade coaching event videos are included as an added bonus (usually another twenty hours or so of teaching).

Interested in our live trading room, swing trading newsletters or trade alerts? Visit our menu of trading services.

Subscribe to Live Trading Room.

Subscribe to Live Day Trading Alerts.

Subscribe to Swing Trading Alerts.

Article Topics: daytrading, learn to trade, momentum, stocks, technical analysis, ROKU, trade alerts, catalyst