Webinar Recorded Sunday May 20, 2018: How to Swing Trade the US Dollar Index Move $DXY $UUP

Feature post includes video, charting and summary of the webinar.

Video of How to Trade US Dollar Webinar:

Click here for a direct link to the How to Trade US Dollar Index $DXY Video.

Summary of Video:

When the dollar lost the 200 MA on daily it dumped in to Feb of the year and went sideways.

We sat quiet through the sideways period since because it was divergent to our algorithmic model.

As price started to get closer to 200 MA from underside again and MACD turned we started to alert clients and share some alerts on social media.

There is a pivot at 92.61 area on the daily chart where the set-up triggered a long side trade for us.

If trade loses that pivot all bets are off long side bias. Not stated on the video.

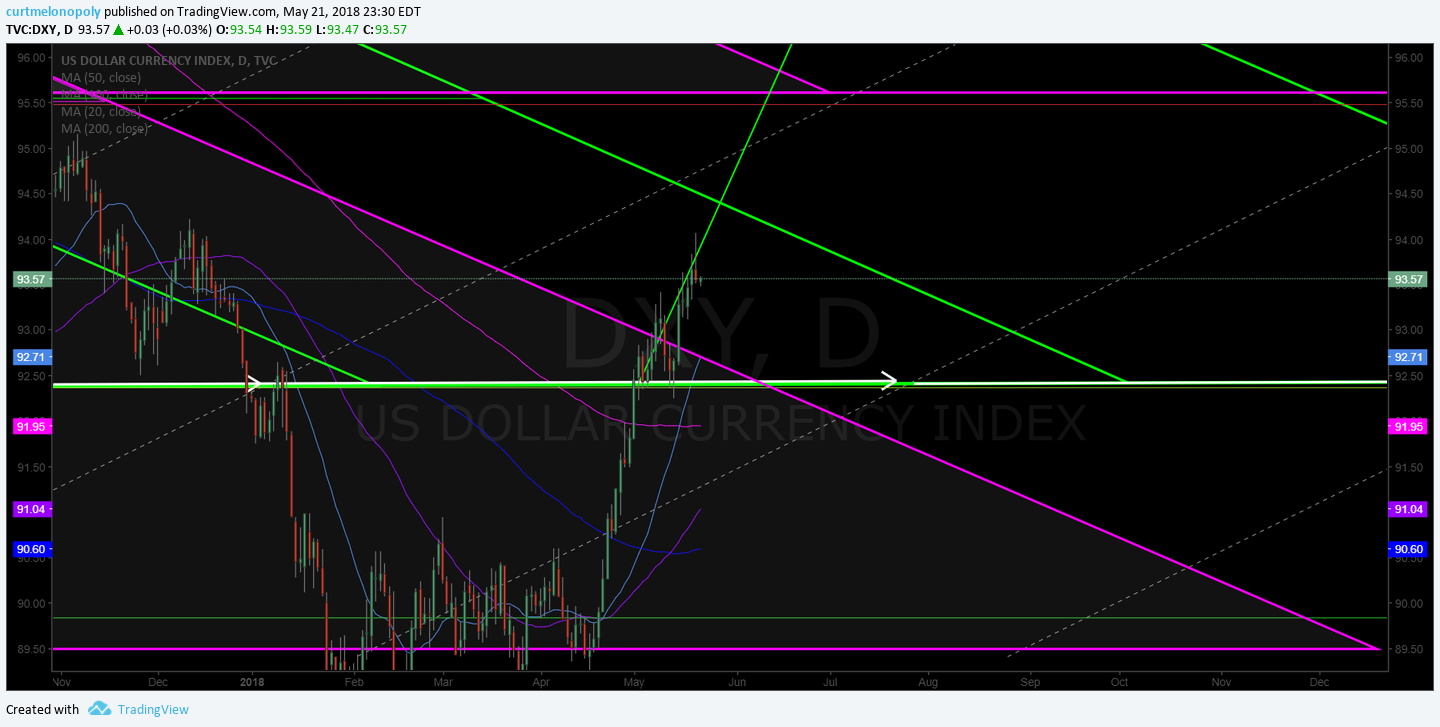

On the geometric charting (broad structure) there are some key areas of trade to watch for;

The video explains the chart structure to watch for.

The primary trendline to watch in the structure is shown on the video.

Important resistance 94.38 in 8 days 28th of May, 97.78 July 10, 100.5 – 100.76 Aug 20 (primary resistance), trading 93.78 intra,

Intraday on the hourly over 200 MA is a long and to trim I move to 15 min chart and when price loses the 20 MA, 50, 100, 200 MA I move out and wait for price to gain the 200 MA again on the hourly and I scale long again.

There is a part two to this video in progress, for a copy register to our mailing list.

Close up image of US dollar Index $DXY algorithmic chart shown in webinar video. #HowtoTrade #USD #Dollar #Algorithm

US Dollar Index Daily Chart MACD flat, price above main pivot (red line) over 200 MA. $DXY $UUP

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Subscribe to our Weekly $DXY US Dollar Index Newsletter Here

Website: https://compoundtrading.com

Blog: https://compoundtrading.com/blog/

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://[email protected]

Curtis Melonopoly (@curtmelonopoly) is rated Top 250 Stock exchanges authority, covering also Mathematical finance and Economy of the United States.

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.