Compound Trading Chat Room Stock Trading Plan for Friday April 21, 2017; $BEBE, $BLDV, $DGLD, $GLD, $XIV, $SPY, $SPXL — $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $MGTI – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

I will be traveling today – so right after mid day chart set-up review I will be out of room. I will be leaving the room on and Sartaj will be in the room. The chart that I leave on will be static but the chat will be as usual.

$AAU Example of when 20 MA gets upside of 200 MA with price above. KAPOW! Waiting for Stoch RSI to return to bottom curl up. #swingtrading

$AAU Example of when 20 MA gets upside of 200 MA with price above. KAPOW! Waiting for Stoch RSI to return to bottom curl up. #swingtrading pic.twitter.com/2dyBWP3v4Y

— Melonopoly (@curtmelonopoly) April 21, 2017

Learning traders. Master this trade set-up. Change your life. #freedomtraders

Learning traders. Master this trade set-up. Change your life. #freedomtraders https://t.co/5uloNEq7lZ

— Melonopoly (@curtmelonopoly) April 21, 2017

Reviewing these trading set-ups in room all week at lunch. Here’s some raw footage. #trading #setups #freedomtraders

Reviewing these trading set-ups in room all week at lunch. Here's some raw footage. #trading #setups #freedomtraders https://t.co/6SqOEquC5J

— Melonopoly (@curtmelonopoly) April 21, 2017

Today’s Live Trading Room Link: https://compoundtrading.clickmeeting.com/livetrading

Most recent lead trader blog posts:

Trading Checklist (Rules) I Follow Before Triggering. Part 2 of “Freedom Traders” Series.

https://twitter.com/CompoundTrading/status/853217228237422592

Now I’m Inspired! My Guarantee to Struggling Traders (and Yours). Part 3 “Freedom Traders” Series.

https://twitter.com/CompoundTrading/status/853764002584944640

The Quarterly Daytrading Performance Review P/L with Charting:

https://twitter.com/CompoundTrading/status/846494014635429888

Most recent Keep it Simple Swing trade Charting (MACD, MA, Stoch RSI, SQZMOM focus):

https://twitter.com/CompoundTrading/status/853551912599400448

Most recent Premarket Chart Set-Up Video (most recent available to public – there may be other exclusive’s in member newsletters):

https://twitter.com/CompoundTrading/status/854695312367243264

Most recent Market Open Momentum Stock Trades Video (most recent available to public – there may be others in member’s newsletters): Thursday market open is still in processing FYI.

https://twitter.com/CompoundTrading/status/854703199017725952

Most recent Mid Day Chart Set-Up Review Video (most recent available to public – there may be others in member’s newsletters): Thursday Mid Day chart review is still in processing FYI.

https://twitter.com/CompoundTrading/status/854761895269740544

Trading Plan (Buy, Hold, Sell):

Morning momentum stocks on watch so far: Quiet morning

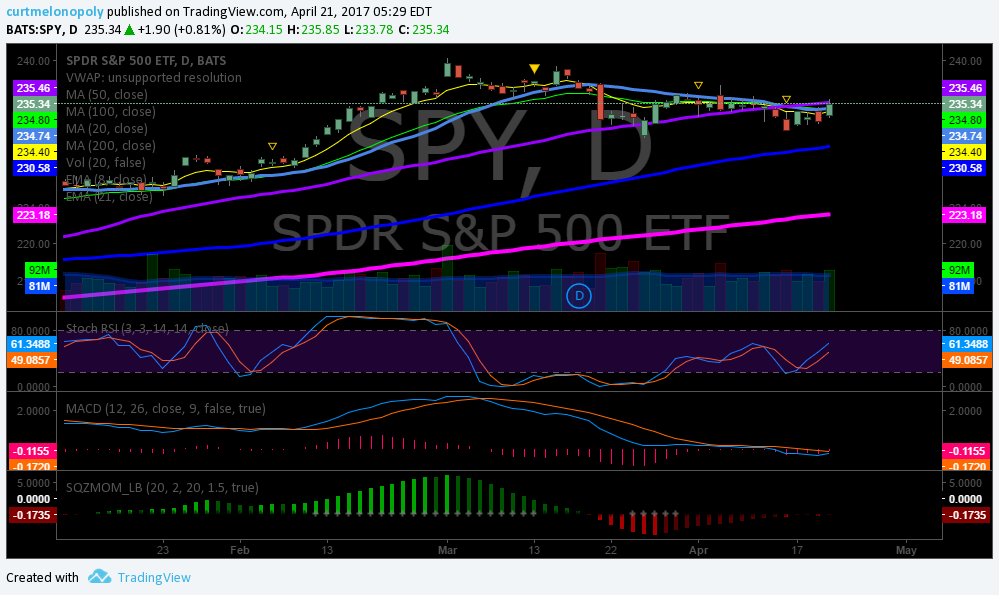

Markets: $SPY could break out here, $GLD, $GDX are both under pressure – we will see – thinking $DGLD, $USOIL, $WTIC tanked like EPIC said it would so we’ll see what range it gets next here.

OTC on watch: $BLDV, $UPZS, $OPMZ $LIGA $MMEX $AMLH $ACOL $BVTK $USRM

Gap ups:

News on these plays: $BEBE, $VRX, $ABBV,

Chart Set-Ups on Watch: $SNAP, $ROL, $XRT, $VFC, $CALA, $CELG, $GOOGL, $AMZN, $JUNO, $OAK, $BOFI

$SNAP responding to cross-overs on hourly 20 50 100 & 20 thru 200 MA? Stoch RSI revved need at bottom preferrably to trigger long. #trading

$SNAP responding to cross-overs on hourly 20 50 100 & 20 thru 200 MA? Stoch RSI revved need at bottom preferrably to trigger long. #trading pic.twitter.com/3K9Yzfp3r5

— Melonopoly (@curtmelonopoly) April 21, 2017

Live chart for those that have asked for me to share the indicators I use. Open, click share, click make it mine.

Live chart for those that have asked for me to share the indicators I use. Open, click share, click make it mine. https://t.co/t8aVfvjDXV

— Melonopoly (@curtmelonopoly) April 21, 2017

If you’re not sure how to get the chart indicators here’s a vid that explains

If you're not sure how to get the chart indicators here's a vid that explains https://t.co/uaVL4RSsXY

— Melonopoly (@curtmelonopoly) April 21, 2017

$SPY Price is above 20 MA, if it gets above 50 MA and 20 MA crosses up 50 MA you will see a good pop.

Previous Day Momentum Stocks to watch: $BVLD OTC, $IMNP, $NADL, $SCSS, $SXC

$BLDV up 300% intraday on news.

$BLDV up 300% intraday on news. pic.twitter.com/nxtbrWekaz

— Melonopoly (@curtmelonopoly) April 20, 2017

Most holds are small to mid size holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA

I liquidated some positions on the bag list that will be explained in post market trading results report that will come out on weekend.

Market Outlook :

Per recent reports:

There are significant resistance clusters above recent highs in oil and the S&P so I will be very cautious to upside going forward until recent highs are taken out and confirmed. I see significant upside challenges in Oil and SPY with most recent highs being taken out.

Market News and Social Bits From Around the Internet:

Futures up with focus on France https://seekingalpha.com/news/3258631-futures-focus-france?source=twitter_sa_factset … #premarket $SPY $QQQ $DIA $SH

S&P +0.11%.

10-yr +0.04%.

Euro -0.23% vs. dollar.

Crude -0.16% to $50.63.

Gold +0.09% to $1,285.00.

9:30am

Neel Kashkari Speaks

9:45am

PMI Composite Flash

10am

Existing Home Sales

1pm

Baker-Hughes Rig Count

GE 1Q INDUSTRIAL OPER + VERTICALS EPS 21C, EST. 17C

Gilead’s NASH candidate GS-0976 shows treatment effect in early-stage study https://seekingalpha.com/news/3258611-gileads-nash-candidate-gsminus-0976-shows-treatment-effect-early-stage-study?source=feed_f … #premarket $GILD

$BEBE up near 9 percent in premarket trading now … announces it will shutter all of its stores

AbbVie’s G/P achieves 95% cure rate after eight weeks of treatment in HCV-3 patients https://seekingalpha.com/news/3258625-abbvies-g-p-achieves-95-percent-cure-rate-eight-weeks-treatment-hcvminus-3-patients?source=feed_f … #premarket $ABBV

$VRX Announces Pricing For SILIQ At $3500/month As The Lowest Priced Injectable Biologic For Moderate-To-Severe Plaque Psoriasis

Honeywell shares gain premarket after profit and sales top estimates

Mattel shares plunge 8% premarket after sales disappoint

XBiotech slumps nearly 30% premarket on likely EMA rejection of cancer drug:

Schlumberger posts $279M #profit after previous quarter loss

Visa shares up 2.6% premarket

Skechers shares up 3.3% in premarket trade

XBiotech’s stock plummets after cancer treatment receives disappointing review panel vote

$SYRS prices $35m offering at $13.50/share

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List : Quiet morning I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: $XBIT $MAT $CBLI $FIZZ $JDST $APRI $STM $GPT $NVDA $BLUW $BUD $SYT $VRX I will update before market open or refer to chat room notices.

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $CSX $GIMO $BDN $WABC $FFIN $FTNT $ALDW $CFG $NS $NSH $DGX $SKX $CLB as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $VZ $MXIM $CP $HUM $ESNT $PRI $COG $VREX $PAGP $PAA $FIZZ $OMCL as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

In one of blogs posts I commented that Fintwit was a rule in trading. I have had more profitable trades come over DM randomly than anything.

— Melonopoly (@curtmelonopoly) April 21, 2017

Article Topics: $BEBE, $BLDV, $DGLD, $GLD, $XIV, $SPY, $SPXL – $LIGA, $MGTI, $ONTX, $SSH, $LGCY, $TRCH, $ESEA – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD