Compound Trading Wednesday May 3, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading, Videos and Live Stock Alerts. $UWT, $TWLO, $PIRS – $PVCT, $LIGA, $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

If there was a day for a learning trader to gets some education from our trading room it was Monday. See video at twitter tweet link below.

Did more training in today’s session than I have for a long time. Hopefully the video turns out ok when published. Most of day:) #trading

Did more training in today's session than I have for a long time. Hopefully the video turns out ok when published. Most of day:) #trading

— Melonopoly (@curtmelonopoly) May 1, 2017

Notice: Our lead trader coaching schedule is fully booked and waiting list started. Keep that in mind if enrolling or email in advance.

https://twitter.com/CompoundTrading/status/858970678342451200

Tuesday was day three of trading challenge.

We Want (Need) You! Apply to Nearest Recruiting Station. Part 4 “Freedom Traders” Series. https://compoundtrading.com/want-need-apply-nearest-recruiting-station-part-4-freedom-traders-series/ …

https://twitter.com/CompoundTrading/status/858581529727049730

Thanks for the replies to the Freedom Traders post on weekend! I’ll think through them and respond thru the week. Require thought! Peace:)

Thanks for the replies to the Freedom Traders post on weekend! I'll think through them and respond thru the week. Require thought! Peace:)

— Melonopoly (@curtmelonopoly) May 1, 2017

Last market trading session Post Market Stock Trading Results can be found here: (Previous week Thurs, Fri, and Mon are coming soon).

https://twitter.com/CompoundTrading/status/859684603434418176

Premarket Trading Plan Watch-list for this session can be found here (locked to respect members and unlocked to public about a week later for transparency):

https://twitter.com/CompoundTrading/status/859745303020306436

Most recent Premarket Chart Set-Up Video (most recent available to public – there may be other exclusive’s in member newsletters) Tuesday won’t be published (lacking content) and Wednesday currently being processed:

$OCN $BLPH $ASPS $IDXG $ARLP $TRCO $XXII $JIVE $MICT $FCEL $TWTR

https://twitter.com/CompoundTrading/status/859067029487321089

Most recent Market Open Momentum Stock Trades Video (most recent available to public – there may be others in member’s newsletters) Tuesday won’t be published – lacking content and Wednesday currently being processed:

$OCN $YTEN $MTBC $CCCN $TWTR $AEZS

https://twitter.com/CompoundTrading/status/859098292231307264

Most recent Mid Day Chart Set-Up Review Video (most recent available to public – there may be others in member’s newsletters) Tuesday won’t be published (lacking content) and Wednesday currently being processed :

Midday Chart Setup Review: $OCN $CCCR $CYOU $BTSC $USLV $AG $ABBV $XRF $CMRE, $BLDV

https://twitter.com/CompoundTrading/status/859111267012882432

Most Recent Public Swing Trading K.I.S.S Simple Charting can be found here: Swing Trading Simple Charts (Public) Apr 16 $SPY, $VIX, $USOIL $WTIC, $GLD, $GDX, $SLV, $DXY, $USDJPY, #GOLD, #SILVER

https://twitter.com/CompoundTrading/status/853551912599400448

Premarket Session:

PreMarket Trading Plan Wed May 3 $PIRS, $PHMD, $ESES, $BLDV, $BVTK, $VRX, $TAN, $GSIT

PreMarket Trading Plan Wed May 3 $PIRS, $PHMD, $ESES, $BLDV, $BVTK, $VRX, $TAN, $GSIT https://t.co/cs59Cb1Q6h

— Melonopoly (@curtmelonopoly) May 3, 2017

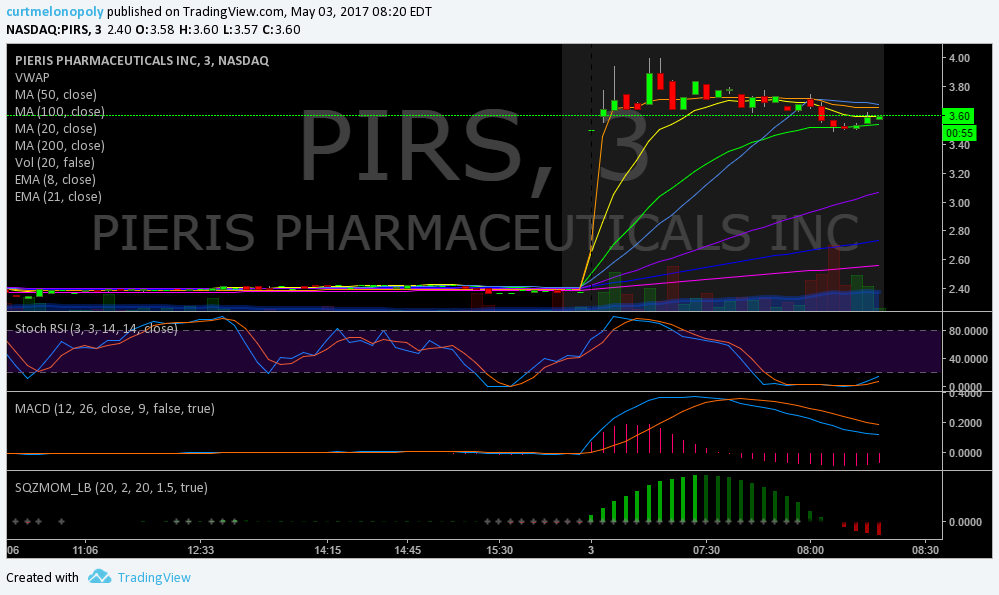

$PIRS Premarket up 49%.

$PIRS Premarket up 49%. pic.twitter.com/TK22oY7cGF

— Melonopoly (@curtmelonopoly) May 3, 2017

Market Day, Chat Room Trades and Personal Trades:

Today I traded $TWLO wash-out snap-back for a win and closed my overnight $UWT $USOIL $WTI related trade right before #EIA report for a win.

Closed $UWT right near early high this morning. @EPICtheAlgo got me out right on time live in room. Video out later.

Closed $UWT right near early high this morning. @EPICtheAlgo got me out right on time live in room. Video out later. https://t.co/ZoPF924ERH

— Melonopoly (@curtmelonopoly) May 3, 2017

Learning How-to Trade Stocks, Chart Set-Ups, Lessons and Educational:

Here’s quick email interaction from today re: $TWLO:

Member:

Hi guys

I hate to bother you with stuff but in today’s live action early in the am Curt pointed out that twlo under 25 had another dollar and when the trade was made he mentioned that he will close above 26. Pretty impressive. I just wanted to know what was the method used there to determine a) that twlo was going to go up and not down again like the night before and how did targets get determined?

Thanks in advance.

Nasir

Curtis:

Hey no problem message me on Twitter DM anytime to if you like or tag me in a tweet – whatever’s easier for you

Ummm… the answer is long on that… it’s the indicators the MA’s and how they were set up… the mid day review videos on our You Tube will kind of explain.

I’ll try and do a post specific to your questions soon if time allows:)

Looking for a trading home? What you can expect from the Compound Trading Lead Trader. #trading #mentoring #freedomtraders

https://twitter.com/CompoundTrading/status/857416340533018624

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size – under 5% of my daytrading acounts) – $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| PIRS | 3.67 | 52.92% | 27739800 | Top Gainers | |

| ESES | 1.40 | 34.62% | 8055300 | Top Gainers | |

| STRP | 155.20 | 23.35% | 1257738 | Top Gainers | |

| BPI | 15.01 | 21.93% | 500400 | Top Gainers | |

| MYGN | 22.50 | 20.45% | 4540100 | Top Gainers | |

| XENT | 24.10 | 20.20% | 1742400 | Top Gainers | |

| BGMD | 0.07 | 30.54% | 20003 | New High | |

| PIRS | 3.67 | 52.92% | 27739800 | New High | |

| BPI | 15.01 | 21.93% | 500400 | New High | |

| XENT | 24.10 | 20.20% | 1742400 | New High | |

| IAC | 96.02 | -0.23% | 1622700 | Overbought | |

| OHGI | 2.03 | -2.40% | 162646 | Overbought | |

| PIRS | 3.67 | 52.92% | 27739800 | Unusual Volume | |

| HJPX | 26.23 | -0.08% | 14370 | Unusual Volume | |

| OB | 18.24 | 16.18% | 4656300 | Unusual Volume | |

| FNBC | 0.25 | 164.48% | 37490437 | Unusual Volume | |

| AMED | 57.63 | 2.75% | 961600 | Upgrades | |

| AAWW | 53.35 | -7.70% | 541700 | Earnings Before | |

| MLVF | 21.85 | 0.00% | 600 | Insider Buying |

Algorithm Charting News:

Every target predicted last week hit! Tues Wed Fri! Crude algo work sheet FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/858952483720151040

Don’t miss this video. #algorithms #fibonacci

https://twitter.com/CompoundTrading/status/857297652765138944

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

For our swing trading platform users there is a new report out.

Protected: Weekly Swing Trading Stocks Wed May 3 $BA, $NFLX, $AXP, $GSIT, $TAN, $VRX, $WYNN, $BABA … #swingtrading

Protected: Weekly Swing Trading Stocks Wed May 3 $BA, $NFLX, $AXP, $GSIT, $TAN, $VRX, $WYNN, $BABA … #swingtrading https://t.co/3ZdlMpvFTq

— Swing Trading (@swingtrading_ct) May 3, 2017

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

USD/JPY bets ramp.

USD/JPY bets ramp. https://t.co/F0ZrCZ83tI

— Melonopoly (@curtmelonopoly) May 3, 2017

Gold $GLD, $XAUUSD, $GC_F :

Gold pic.twitter.com/sMN38LZGGM

— Melonopoly (@curtmelonopoly) May 4, 2017

Gold Miner’s $GDX:

Biggest Gold Miner ETF Just Saw Largest Outflows on Record http://www.bloomberg.com/news/articles/2017-05-01/biggest-gold-miner-etf-just-saw-largest-outflows-on-record … ht @TN

Biggest Gold Miner ETF Just Saw Largest Outflows on Record https://t.co/IwJb5UA28Y ht @TN pic.twitter.com/AOJrqK4ouk

— Jesse Felder (@jessefelder) May 2, 2017

Silver $SLV:

Silver ETF falls for the 11th consecutive day, longest streak in its history (inception April 2006). $SLV

Silver ETF falls for the 11th consecutive day, longest streak in its history (inception April 2006). $SLV pic.twitter.com/ZkClWfspmX

— Charlie Bilello (@charliebilello) May 1, 2017

Crude Oil $USOIL $WTI:

Was it really that hard to predict ? Go long! ? Rising U.S. oil production knocks OPEC off course: Kemp http://reut.rs/2qpkGXt via @Reuters

Was it really that hard to predict 😂 Go long! 😂 Rising U.S. oil production knocks OPEC off course: Kemp https://t.co/cpVGQcMn4w via @Reuters

— Melonopoly (@curtmelonopoly) May 3, 2017

Energy Select Sector $XLE death cross.

Energy Select Sector $XLE death cross.

— Melonopoly (@curtmelonopoly) May 1, 2017

Volatility $VIX:

Low volatility and Crowded Trade Risk. One of my favs. #edge ?⤵

Low volatility and Crowded Trade Risk. One of my favs. #edge 🎯⤵ https://t.co/tMkjfheXUJ

— Melonopoly (@curtmelonopoly) May 3, 2017

‘Volatility markets are pricing in virtually zero risk in the near term.’

'Volatility markets are pricing in virtually zero risk in the near term.' https://t.co/gvDQGPAKgi

— Jesse Felder (@jessefelder) May 2, 2017

The time to worry about VXX is when volume (as % of total shares outstanding) dries up.

The time to worry about VXX is when volume (as % of total shares outstanding) dries up. pic.twitter.com/onjGHKP0ND

— Tom McClellan (@McClellanOsc) May 2, 2017

$VIX short exposure.

$VIX short exposure. https://t.co/lUugEVpuaf

— Melonopoly (@curtmelonopoly) May 3, 2017

$SPY S&P 500 / $SPX:

NEW Blog – “How Concerning Is The Underperformance Of The Equal Weight S&P 500?” https://www.seeitmarket.com/how-concerning-is-equal-weight-sp-500-underperformance-16824/ … by @CiovaccoCapital

$SPX $SPXEW

NEW Blog – "How Concerning Is The Underperformance Of The Equal Weight S&P 500?" https://t.co/i7gZjYAK9M by @CiovaccoCapital$SPX $SPXEW pic.twitter.com/QWomOsWXhJ

— See It Market (@seeitmarket) May 3, 2017

$SPX in only 7-point range Tuesday, ahead of FOMC. I’d say that low Average True Range (ATR) is marking a top, but it has not worked lately.

$SPX in only 7-point range Tuesday, ahead of FOMC. I'd say that low Average True Range (ATR) is marking a top, but it has not worked lately. pic.twitter.com/A28G6mDVAv

— Tom McClellan (@McClellanOsc) May 2, 2017

Surprisingly enough, YoY growth in margin debt has historically been a positive sign for the S&P

Surprisingly enough, YoY growth in margin debt has historically been a positive sign for the S&P https://t.co/GTxHRnDoYz pic.twitter.com/s3akBPKZ9c

— Adam Collins (@eversightwealth) May 2, 2017

$NG_F Natural Gas:

NA

Markets Looking Forward:

Commodities pic.twitter.com/Imm7o9Oo51

— Melonopoly (@curtmelonopoly) May 4, 2017

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix. Also, please note, sometimes pieces of the transcript are missing (also something we are working on). But the video is raw and complete.

Curt M_1: On mic at 9:05 for Premarket Review

Sartaj: Good morning, everyone

Curt M_1: Morning Sartaj – won’t be on mic until 9:10 watching a few stocks here

Curt M_1: On mic for premarket review 9:10

quarryrock: good am all

Flash G: gm

Sartaj: 15.79

Spiegel: 15.85?

Sartaj: Spiegel wins

Spiegel: I WIN!!!

Spiegel: Send me my prize.

sfkrystal: anyone else getting regular drops from this room?

Sartaj: No, everything sounds fine on my end

Sartaj: haven’t been kicked, either

sbrasel: thoughts on twlo?

sbrasel: below ipo and heavy short interest

sbrasel: not sure

sbrasel: they blamed it on uber

sfkrystal: $PIRS down to 3.23 ask

Market Maven: $TWLO Ilike that idea thanks!

quarryrock: took a bath on my GRPN casino play

sbrasel: 35 % short interst

Flash G: Long $TWLO 24.65 small start

Lenny: I need a bath

Lenny: In $TWLO with ya Flash

Lenny: panny moregoing t oplay the range to res

quarryrock: AMD nice DCB

Spiegel: hot crappy low priced stock today with lots of twitter buz is budz

Spiegel: BUDZ

Spiegel: terrible daily but like CNBX due for a bounce

Market Maven: A lot of short opps at open.

sfkrystal: like that $PIRS held 3.08

Spiegel: PIRS turning up nicely

sfkrystal: in from 3.20 $PIRS

quarryrock: STC $QQQ .52 +27%

Lenny: $PIRS snap back could get huge

Spiegel: good one krystal. Was looking to get in and I looked away at something else and it took off without me

Sammy T: yep nice

Flash G: $GILD bottom on watch

Sammy T: $FNCX 19%

Spiegel: Did you remember to reboot your computer before open today?

Curt M_1: ha ya

quarryrock: $FSLR on the loose !

Sammy T: $MTBC pressure

Sammy T: Long $DUST starter

Curt M_1: $TWLO res tes

Curt M_1: res test

quarryrock: BTO $CRM 86.5 Ps .42 5/5

Sartaj: Putin and Erdogan press conference in Sochi

Spiegel: BUDZ 1.42 now

Spiegel: 1.48 now. Think it was 1.32 when I first mentioned it

Spiegel: You need a gaming laptop

sfkrystal: $PIRS nhod

Spiegel: AMLH moving

Sartaj: 5 minutes to #EIA

Curt M_1: Close $UWT 16.16 1200 shares small win from last night swing

Sartaj: Spiegel hasn’t seen this in real-time before

Sartaj: Quite a few people in here who haven’t

sfkrystal: whoah

Sartaj: SEE?!

Sartaj: WE’RE NOT CRAZY

sfkrystal: that’s… insane

Sartaj: Managed markets

Spiegel: So was EPIC calling for it to drop there?

Sartaj: Intersect the span of the quadrant, with a high probability of dropping through its lower supports

Sartaj: But if you want to be specific, an algorithm calls one output; in this case, a price/time. So we knew it would hit 47.83 at 10:30 am exactly

Sammy T: EPIC

Sammy T: good name

Spiegel: You weren’t holding any positions though when that oil report came out though, right?

sfkrystal: brilliant

Spiegel: I’ve decided I’m definitely joining the EPIC bundle on June 1 for 6 months.

quarryrock: $X woodshedded

Lenny: super cool stuff

Sartaj: Not much more to say. Now you all know where the frustration comes from when everyone’s bullish (TV, fintwit, etc.), and EPIC is calling these turns literally weeks in advance. The latest top, for example – called six weeks in advance

Sartaj: And then, when the turn was happening, people are still sending DM’s “oh hard to say where oil will go…”

quarryrock: STC $CRM Ps +.11 26% hitting singles

Sartaj: I’ll get a highlight video up later today

Spiegel: I wouldn’t let it bother me. Youre making big money and you have the satisfaction of always being right

quarryrock: all the large QQQ names choppy

Curt M_1: $TWLO having hard time with 200 MA on the 3

Curt M_1: I literally never lose in oil plays – when room is open I’ll trade intra day too like mad – that chart you see is a 30 min – but those are available on all time frames for tight trade or wide trade

Spiegel: When am I supposed to sleep?

Curt M_1: I don’t now you know why

sfkrystal: lol

Spiegel: there must be a dead hour or two between different sessions

Curt M_1: I haven’t slept since EPIC was invented

Spiegel: Oh wow!

Curt M_1: hardly lo

Sartaj: Coding phase will alleviate some of that pressure, but you get even less sleep during software development

Sartaj: so.

Spiegel: Guess I’ll just have to develop a coke habit combined with Monster energy drinks in order to stay awake and trade EPIC

Curt M_1: and we have the algos now for other things like Gold etc so we’re puped about the future

Curt M_1: coke would help ya

quarryrock: BTO $146 $AAPL Ps .76

Spiegel: LOL – great. And I’ll be able to afford it too!

Spiegel: kidding of course

Sartaj: pays for itself

Curt M_1: Long $TWLO 24.98 800 shares

quarryrock: STC $APPL P’s quick scalp .11 $500

Spiegel: AMLH finally broke a penny.

ny75: snap 20 cross 200 on 3 min coming up

quarryrock: AAPL may go find that $145 again

Curt M_1: Going for coffee – will be back for lunch hour review. Will watch $TWLO while gone and dump it if it loses much more than VWAP

ny75: what is the target for twlo?

Curt M_1: I don’t have one – just a daytrade snipe

ny75: ok thanks

quarryrock: BTO $SLW $19.50 Cs .27 5/5

quarryrock: miners are waking up

Hedgehog Trader: $EXK beasting (silver miner)

Sartaj: Midday Chart Review starts at 12:05

Curt M_1: On mic>>>>>>>>>>>

ny75: $shop

Spiegel: JNUG

mat: Old fave ASM trying to base off of a sloppy looking double bottom at 1.4/1.41. Im in a few looking for another run

Spiegel: MAybe AMLH

Hedgehog Trader: Mat- look at $EXK

Hedgehog Trader: it’s one the best performers today for great fundies

mat: Will do. TAHO was a crazy earnings beat. I think they are backloading a lot of their costs to the rest of the year or something

mat: EXK looks good. PPP puting in a similar move after nice earnings as well. PPP had a large strike going at it’s major mine so the rest of the year should rock

Hedgehog Trader: and Mat- $NAK

Hedgehog Trader: been strong during downdraft

mat: NAK is on my DNT list lol

ny75: shop

Hedgehog Trader: ha 🙂

Hedgehog Trader: $SINO always strong

Hedgehog Trader: i’m looking for shippers to rally hard into mid-May

Hedgehog Trader: my signals indicate a very large magnitude move in next 15 days for $EXK

Hedgehog Trader: makes sens if you believe miners will break out

Hedgehog Trader: of their slump and run

mat: Silver is oversold hard and GDX has been acting better. Put in its low last week while silver/gold continue to be weak so that tells em miners want to rally if the base metals cooperate

mat: gdxj/gld ratio is also in the gutter

Hedgehog Trader: gold usually bottoms after miners

mat: Yepp, usually miners front run the metals. I’m looking for this week and next weeks earnings to be the catalyst to get things moving north

Hedgehog Trader: Mat i get we’re likely to see them run to at least May 16th

sfkrystal: $PIRS might be setting up

will: pulm?

Hedgehog Trader: Opa!

ny75: question: are you in snap in your swing side port?

Hedgehog Trader: that’s okay Curt, can’t get em all. besides, you can make bank on LACDF

Hedgehog Trader: tremendous fundies behind lithium right now

Spiegel: I’m just worried about them defaulting.

Hedgehog Trader: some of these had long consolidations

Hedgehog Trader: like $ESEA and investors aren’t always sure when to jump in

Hedgehog Trader: LACDF also had $440k of insider buying since Apr 11

Spiegel: TWLO making at bit of a comeback

Spiegel: When market gets soft, are you set to do bearish 3X ETFs?

Curt M_1: yes sir

Curt M_1: and it may not get soft

Spiegel: Great!

Sartaj: brb

Spiegel: I’ve got TWLO options expiring Friday

will: cbli pulling back today

Spiegel: My TWLO options up 53% if I sell at the ask

Curt M_1: $VWR halt

Spiegel: TWLO continues to impress

Spiegel: Only $1 from target

Spiegel: Even Wikipedia has all you need to know

Spiegel: Sorry, that ws for someone else I was chatting with

Spiegel: TWLO 25.99!

Spiegel: $even the even $26 didn’t slow it down too much

Sartaj: It’s actually going, but the MACD is about to peak

Spiegel: Selling my options

Sartaj: Nice

Spiegel: out

Sartaj: Just in time

Sartaj: Hello, Bernard

sfkrystal: $VWR should go to at least 40% on the day

Curt M_1: You’ll like it Spiegel

Spiegel: In at .65. Endured some pain and almost sold. Sold for 1.25 for 92%

Spiegel: Peaked at 1.50 ask

Curt M_1: nice

sfkrystal: which was that spiegel?

Spiegel: TWLO call options

Spiegel: May 5, $25s

sfkrystal: ah, ok options ic

Spiegel: very risky since so short term

Spiegel: If TWLO stayed under $25 by Friday I’s lose everything. So I didn’t bet big.

sfkrystal: $PIRS has trouble with 3.72

Spiegel: Getting out of TWLO was great timing. If I had to sell now bid on the option is only .75 so just 15% profit. cents profit

sfkrystal: back in $PIRS from 3.72

Market Maven: $PIRS could break out here for sure

Spiegel: Agree Maven. Right at the breakout level now

Spiegel: 3rd times a charm

Curt M_1: $HIL halt

Spiegel: I want back in to TWLO options but my history has always been when I go back for seconds I lose. Should just be happy with what I’ve made

Flash G: yes

Spiegel: Lets just mark the stock here 25.85 and see how it wouldve worked out for me.

Spiegel: I’m not buying

Spiegel: watch, this will be the time it wouldve realy worked out

Spiegel: $26.75 here we come!

Spiegel: JNUG almost $17!

Sammy T: Miners are frisky with FOMC for sure

Curt M_1: Fed unchanged

Spiegel: as expected

Flash G: $GOOGL has legs under it.

Hedgehog Trader: $ASM chart now looking good

Spiegel: maybe not for long if gold keeps going down. I can’t believe rates unchanged is making it fall. It should be making it rise.

Flash G: Fairly quiet post FOMC – should pick up after oil closes at 2:30

Curt M_1: $TWLO out 25.59

Spiegel: So glad I didn’t rebuy the options. Old Spiegel would have

Curt M_1: Should have bailed when resistance was tested

Curt M_1: haha

Curt M_1: 24.98 buy 800 shares out 25.59 was originally going to close at 26.30 ish ugh

Sammy T: Long $PIRS 3.90 for a test on break-out

Flash G: Russell didn’t hear what it wanted that’s for sure

Sammy T: Would be nice to get a power hour

Hedgehog Trader: instead of a powder hour

Hedgehog Trader: or a chowder hour

Market Maven: yup

Spiegel: FNBC looking good

Hedgehog Trader: btw for miners have a look at $GPL, Mat

Hedgehog Trader: https://twitter.com/HedgehogTrader/status/859846780288200704

Sammy T: Have a good one all! See you tomorrow.

Bernard: Hi Sartaj

Bernard: I haven’t been watching much today. lol

Market Maven: You too!

Sartaj: Just as well. In any case, looks like there was some interesting stuff going on with oil today. Did you go short?

Bernard: Unfortunately, I didn’t.

quarryrock: interesting behavior on AAPL all day

Sartaj: Nice to hear from you, in any case. We usually don’t hear too much from the newsletter people haha

Sartaj: Nice to hear from you, in any case. We usually don’t hear too much from the newsletter people haha

Lenny: Night all

Bernard: haha. yeah. I’m waiting for oil to bottom out and ride it back up

Curt M_1: Night golks

Bernard: If I’m reading chart correctly, the bottom should be 47.30 unless it breaks support, right?

Sartaj: Can you send that again over email, please? We are about to shut down the room

Bernard: sure

Sartaj: Thanks

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $UWT, $TWLO, $PIRS – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500