Trade Set Ups Video for Swing Trading Earnings Season Monday January 28, 2019.

Swing Trading Stock Signals in this Report: $AMZN, $MSFT, $FB, $BABA, $TSLA …

Email us at compoundtradingofficial@gmail.com anytime with questions about any of the swing trade set ups covered in this video. Market hours can be difficult to respond but we endeavor to get back to everyone after market each day.

Notices:

Welcome to a series of special reports during earnings season for our swing trading platform. There will be a significant number of these mini reports.

Until mid July 2018 we distributed one swing trading report (1 of 5 in rotation) with a mandate being one report per week (on average) cycling the five reports (that include over one hundred equities) every five weeks (approximately).

Commencing July 2018 we switched up our swing trading service rotation to also include reports for earnings season, special trade set-ups, themed reports and swing trade alerts direct to your email inbox.

After earnings season we will recommence the regular rotations.

When managing your trades with the weekly reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers. I was asked recently why we do not usually (although we do sometimes) include precise entry and exit points. The reason is simple, they don’t work – those services have terrible results.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case we rely heavily on the natural trading structure of the financial instrument; including the MACD on daily or weekly, Stochastic RSI, Moving Averages, trading boxes, quadrants, Fibonacci support and resistance, trend lines, trajectory / trend of trade, time-cycles and more.

Indicators we base trade entry and exits on are at times listed with each trade posted so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade (here again it is wise to have at least a basic understanding of trading structures because you need to be able to respond to your own trading rules based process).

It is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter / exit or add / trim as required.

If you need help with rules based swing trading technical analysis, a specific trading plan (entries, exits, adds or trims) or with a simple understanding of proper structured charting and/or trading structured set-ups you can book some trade coaching time and we will assist you with your trade planning as needed. You may find after a few hours of trade coaching that this is all you need to become a proficient profit side trader.

We can schedule private coaching online, you can attend a trading boot-camp (online or in person) or order the downloadable recordings of a recent trading boot-camp or master class series (each about 20 hours of training per event). For any of those options email us for details.

Below is a primer if you know none or very little about proper chart structures:

“I get a lot of Questions on How to Trade our Structured Chart Models, this video has 5 min starter explanation at 1:00 – 6:00 min”. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fibonacci Trend-lines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Intra-week you can DM myself on Twitter (@curtmelonopoly), visit me on Discord (http://discord.gg/2HRTk6n) and private message me or email me (info@compoundtrading.com) with specific questions regarding trades you are considering. You can also visit the main trading during the mid-day review and ask questions by text in the chat area of the room.

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with reporting deadlines or are in a trading session.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

Earnings Season Calendars.

Bloomberg Earnings Season Reporting Calendar List: https://www.bloomberg.com/markets/earnings-calendar/us

Economic Calendar – Top 5 Things This Week #swingtrading #earnings $AAPL $MSFT $AMZN, $BABA, $FB, $AMD, $EBAY, $BA, $TSLA, $MMM, $VZ, $SQ, $WYNN, $X, $MA, $CAT, $AKS… https://www.investing.com/news/economy-news/economic-calendar–top-5-things-to-watch-this-week-1758816

https://twitter.com/swingtrading_ct/status/1089542580696694784

Our Earnings Season Special Reports Thus Far:

Jan 24 – Protected: Swing Trading: Earnings Special Report | $AAPL, $AKS, $AMD, $AGN, $EXP

Jan 17 – Protected: Swing Trading Earnings | Video: Trade Set-Ups | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX, $SPY, $VIX

Jan 16 – Protected: Swing Trading Earnings | Feature Report | $MS, $AXP, $C, $SJR, $BAC, $DAL, $NFLX

Jan 14 – Protected: Swing Trading Earnings | Feature Report | $C, $SJR, $BAC, $DAL, NFLX

Swing Trading Set-Ups:

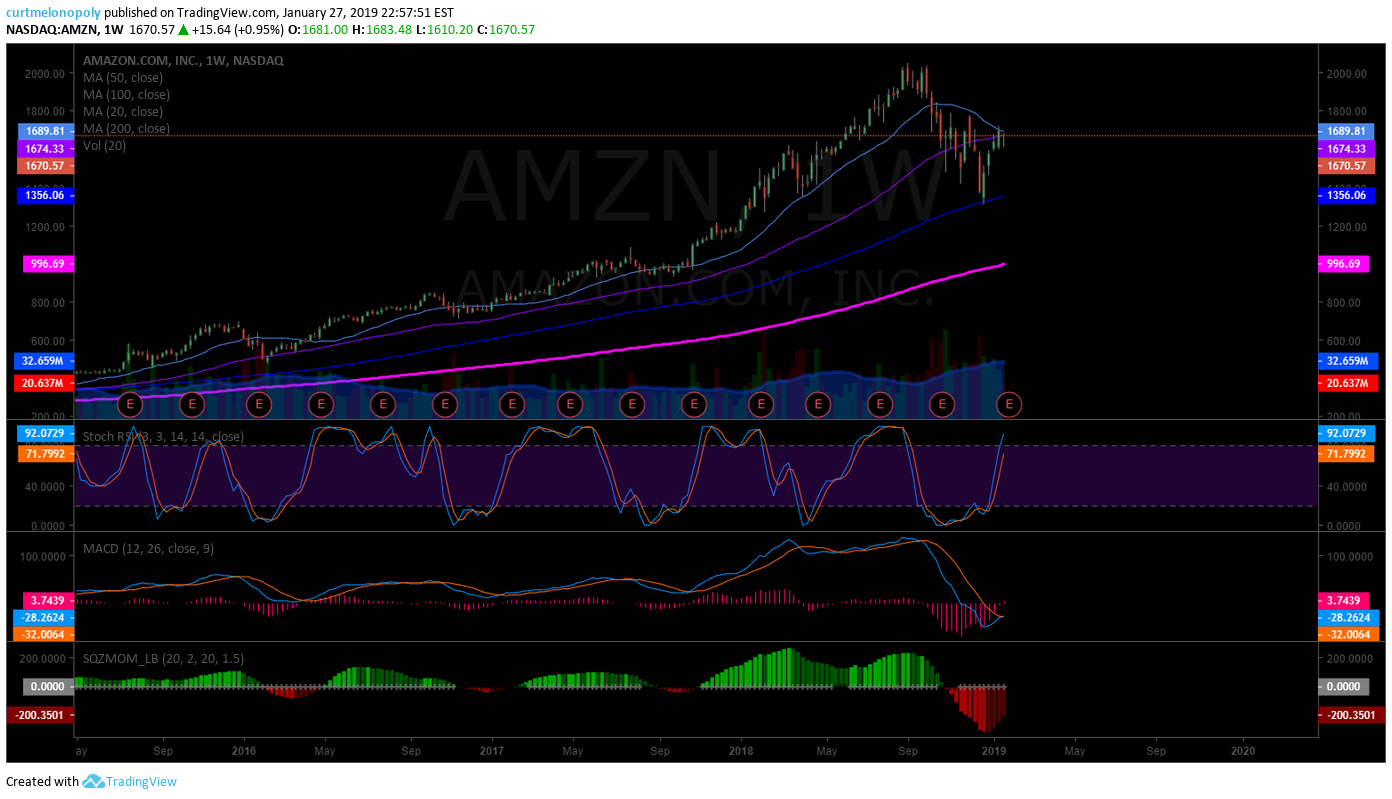

AMAZON (AMZN) Weekly chart says shorts better have it right in to earnings. MACD SQZMOM Price to MA’s say big move possible.

Jan 27 – The upside move here could be huge. Price on a launch pad right under 20 and 50 MA’s on weekly chart with SQZMOM and MACD supporting a possible move. Wouldn’t want to be short in to earnings. Risk reward very poor for shorts.

Amazon.com’s $4.5 Billion Retail Opportunity – 3,000 stores with 50% higher returns than conventional convenience stores. #swingtrading #earnings https://finance.yahoo.com/news/amazon-com-apos-4-5-220000638.html?soc_src=social-sh&soc_trk=tw

My Trading Plan for Amazon Earnings:

It’s simple, if price breaches the 20 and 50 MA it’s a long to test previous highs (the pivot of around 1950.00). And if previous highs are taken out, look for an equal extension to upside of previous highs (price target around 2200.00). If Amazon sells off, look to 200 MA (near) test and bounce.

AMAZON (AMZN) Earnings swing trade price targets for upside move or sell – off. $AMZN #swingtrading #earnings

MICROSOFT (MSFT) Similar to AMZN but I don’t like it as much. Retrace didn’t touch 100 MA and RR not the same imo. $MSFT #earnings #swingtrade

The set-up is very similar to Amazon, but the 20 and 50 MA’s aren’t pinching like on Amazon chart and price didn’t pull back enough. Also, the fundamental picture isn’t as strong. The Amazon chart trajectory holds much higher risk reward for the bullish trade bias.

However, if it sells-off I wouldn’t expect as much of pull back as with Amazon.

So it depends if you are considering a trade position in to earnings or not. I will wait until after earnings are announced for both, And likely not trade Microsoft. Yet to be seen.

Trading Plan for Microsoft Earnings:

In a bullish run you can expect previous highs, however, I wouldn’t expect much more near term.

In a sell-off I would target a touch to 100 MA (near to). Unlikely imo.

Forget IBM. Microsoft Is a Better Dividend Growth Stock $MSFT #swingtrading #earnings https://finance.yahoo.com/news/forget-ibm-microsoft-better-dividend-231200981.html?soc_src=social-sh&soc_trk=tw

FACEBOOK (FB) Price targets on 240 minute trading chart. $FB #earnings

We have used this model a number of times for win side trading on Facebook.

We will wait for earnings and then trade the price targets pending direction.

Facebook earnings: After a year of scandals, record profit still expected #swingtrading $FB https://on.mktw.net/2B2j9uw.

FACEBOOK (FB) Weekly chart. In a bullish move I will target 168.00 region for 50 MA test. In a sell-off there’s no saying. $FB

ALIBABA (BABA) I like the setup for the long side to 206.00 price target. Will wait for earning trade to confirm. $BABA.

TESLA (TSLA) My bias is down to 231.00 price target. Will wait for earnings, but that is my bias. $TSLA #earnings

Tesla’s first downgrade of the year comes down to this #swingtrading $TSLA #earnings https://on.mktw.net/2DteGCX

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member on Twitter Feed and more recently by way of Email).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Article Topics; Compound Trading, Swing, Trading, Stocks, Signals, Earnings, $AMZN, $MSFT, $FB, $BABA, $TSLA