Special Earnings Season Swing Trading Report and Video for July 24, 2018 (Mailing list version).

In this Edition: $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

The Mid Day Trade Set-Ups Video:

Trade set-ups on this video; $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW and more.

Mid Day Chart Swing Trading Set-ups July 23, 2018 Summary:

Swing Trading Special Earnings Season Reports that will become the premise for our next major entries.

SORRY ABOUT THE ALLERGIES / COUGHS – I sincerely apologize.

You will want follow along with this special series of videos because our alerts in the first part of the year were huge and you can verify by reviewing the feed and we plan to kill the second part of the year!

Stocks reviewed on this video: $SPY, OIL, $VIX, $DXY, $GOOGL, $HCLP, $ARRY, $ARWR, $CDNA, $XXII, $SSW

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

The video is slow because the models need to load and alarms along with swing trading plan has to be reviewed for each chart.

The audio is poor on this specific video – hopefully we have that solved for Tuesday video.

$SPY – 60 Min Chart, support 278.60, trading 279.99, upside 281.00 resistance, downside 276.17 downside support. 283.80 24th 9 am 178.60 same day is bearish scenario.

$VIX Volatility – Stoch RSI starting a pinch up, MACD is starting a bottom, time cycle completion this week. Possible inflection point to Dec 24 time cycle completion. If we don’t see one then the Dec 24 time completion is a very high probability. Oct 8 min 20s price target.

US Dollar $DXY – Hit resistance on current structure (at light blue downtrend line). Testing 20 MA support and resistance (light blue MA on chart). Over main structure resistance has PT 97.76 Sept 14 if it gets up over.

Oil $WTI $USOIL – Upside momentum starting on the day.

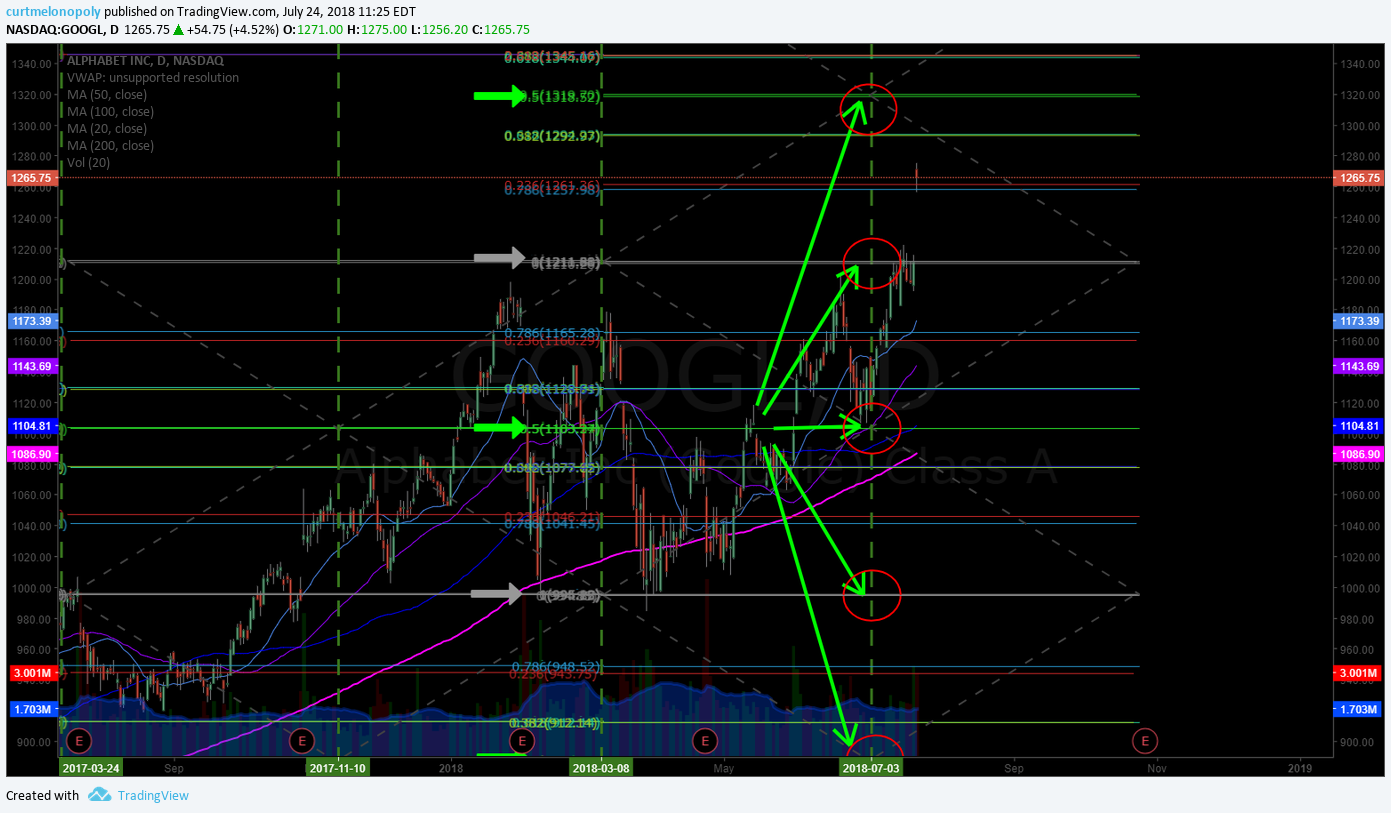

$GOOGL – Hit 1210.85 1256.83 – 1261.50 is first upside resistance then 1284.53 area. 1320.00 is largest structure resistance for long side swing trading. 1150.00 – 1164.62 next support with 1103.02 is primary structure support for downside risk.

$HCLP – High Crush watching close on monthly for potential big move. 17.05 resistance, 16.50 to 17.05. Previous highs 21 – 22 possible. Double extension also possible if it got bullish to 25s. It could easily double its extension. If a pull back happens when price is above 20 and 50 MA and 20 MA breaches the 50 (with price above) that is a serious bullish set up. Don’t ignore this set up.

$ARRY – Indecisive. Earnings in 18 days.Gen 1 algorithm chart reviewed.

Learn to trade to win – Structured trading is reviewed at this point in the video starting at 16:00 mins. Trading quadrants, Fibonacci support and resistance, trading by numbers, time frames, quadrant trend line support and resistance, buy sell triggers for swing trades, how to and where to follow trends, natural trading structure etc.

$ARWR – Reports in 13 days, if it gets bullish it can get serious. The structure is aggressive. Some trade coaching / complaining rants here too.16.45 Nov 23 sideways PT, 32.87 Nov PT healthy side target, should continue to trend. Paint by numbers trading in the structure. 19.73 Aug 15 is most likely scenario pending earnings of course. All decisions are on the chart.

$CDNA – No model charting, but the pivot we identified worked well after the alert.

$XXII – more trading structure knowledge if you need to get from red to green with your trading. Upside and downside buy sell triggers discussed on video.

Oil Trade – the price target for 3:30 on Monday did hit per the video and a leg in long would have worked well, we did not execute but the trading plan reviewed on the video would have been an excellent trade.

$SHOP – testing previous highs 173.21 trading intra, great trade last session in dump long and it was fantastic. Entry points on a break out squeeze and a pull back are discussed. Earnings in 8 days.

$SSW – has been a fantastic chart structure for our trading. 5.16 buy sell trigger, 8.51, 11.94 for example – they are explained on the weekly chart for SSW. Chart structure is explained.

$ITCI – we nailed this trade on this structure and it was one of our best the year to date. In a social search of that time we were the only ones alerting it and talking about it. Huge win. ITCI hit price targets perfect. Trade set up reviewed on video.

$SENS – 240 Min chart MACD crossing up, SQZMOM trending up, buys coming in, bounced off 100 MA hit quad wall perfect, don’t ignore this one, it has serious return when it gets going, it is getting set up. Over 4.28 and quad wall this has horsepower for a great return 5.47 PT then 5.82.

Charting and chart models are only included in the swing trading member reports. This is a free mailing list report and video only.

Cheers!

Curt

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me: