Swing Trading Report. In this detailed Special Earnings Season (Member Edition) Aug 3, 2018: $TSLA, $FB, $HIIQ, $GTHX, $PSTG, $FIT, $ATHM, $FEYE, $RCL, $SPY, OIL and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from Aug 2 mid day, published August 3, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review session from August 2, 2018 that will become the premise for our next major entries for Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

Notices are reviewed in the first 5 mins of video FYI.

All quoted support and resistance are approximate.

Swing trades reviewed on this video: $TSLA, $FB, $HIIQ, OIL, $GTHX, $PSTG, $SPY, $FIT, $ATHM, $FEYE …

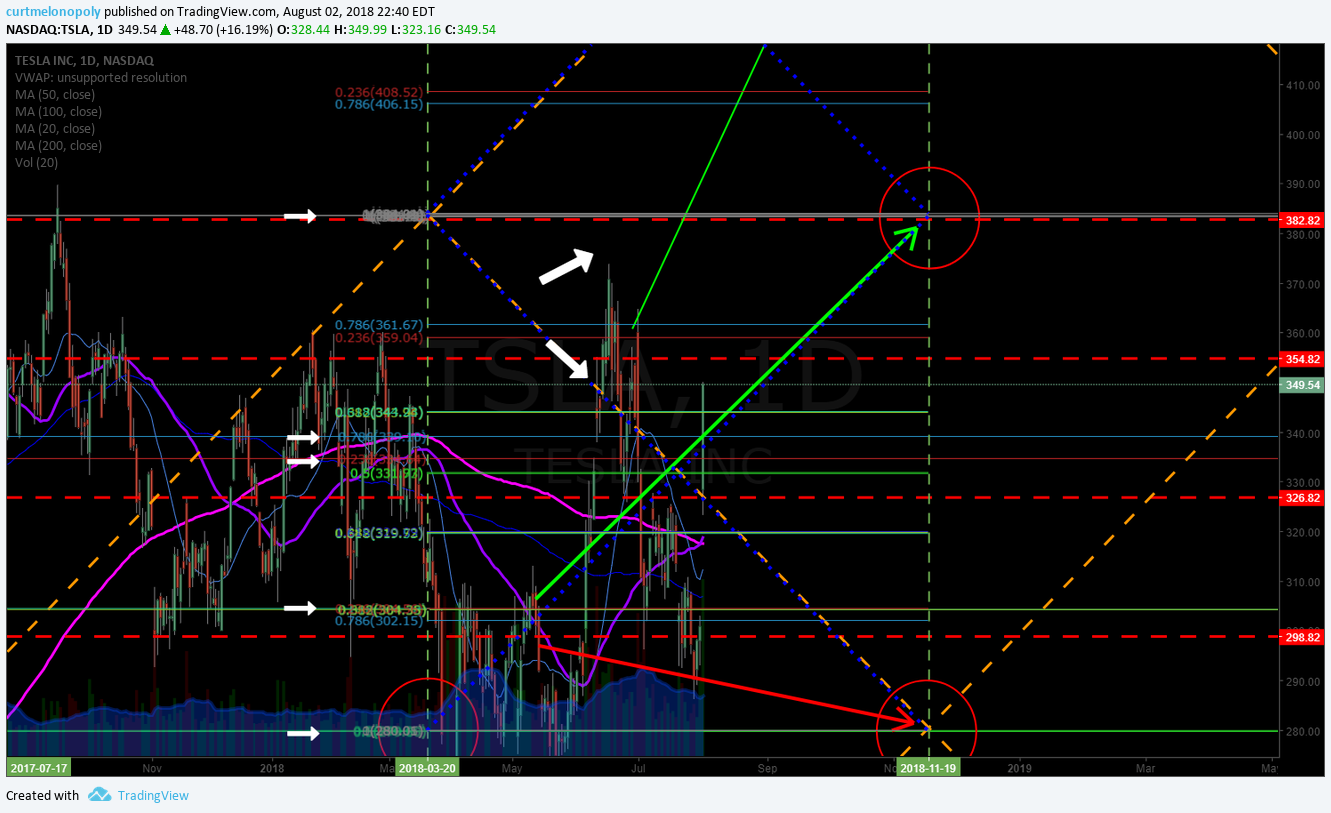

TESLA $TSLA – A review of the Tesla chart structure on video. Elon Musk fired up bulls on earnings conference call.

384.00 resistance and 435.38. Sell-off support 280.00 and 176.23 (main structural supports). But now at important resistance test area.

Nov 20 price target, upside trajectory 383.40. Trading range structure for trading TESLA with trims and adds is drawn by lead trader highlighted on video.

Significant resistance is shown on video at various points (Fibonacci quad walls – trendlines etc).

Recent Special TESLA Report is here: How to Trade the Tesla Move | Price Targets | Buy Sell Triggers | Time Cycles. https://compoundtrading.com/how-to-trade-the-tesla-move-price-targets-buy-sell-triggers-time-cycles-tsla-swingtrading-daytrading/

TESLA (TSLA) Closed 349.54 in regular trading Aug 2 in bullish formation here now. $TSLA #swingtrading

Live chart link for Tesla (shows all buy sell triggers and various other levels to watch for trade):

An example of our trading alerts feed on Twitter:

TESLA (TSLA) trading 351.55 on quad TL diagonal support, near key range resistance 383.42 today, over 354.91 targets 383.42 Nov 14 $TSLA #tradealerts

TESLA (TSLA) Tesla shares surge as investors embrace cash comments, Musk apology $TSLA #swingtrading https://finance.yahoo.com/news/tesla-shares-jump-cash-burn-144334101.html?soc_src=social-sh&soc_trk=tw

TESLA (TSLA) Tesla shares surge as investors embrace cash comments, Musk apology $TSLA #swingtrading https://t.co/hLrDQl4ceT

— Swing Trading (@swingtrading_ct) August 3, 2018

Health Insurance Innovations $HIIQ – Trading 42.75 price target 44.50 trade alert to trim went out today, next target 49.10 then 54.80 (divergent above channel), 40.20 support. Careful with trajectory noted on video.

Predictable charting trade structure. Channel is outlined. Symmetry shown in price targets hit. Trade alert entry long discussed. Trade trajectory is also discussed.

Health Innovations (HIIQ) Trade has hit our bullish price target early, trim longs here $HIIQ chart. #swingtrade #earnings

Live chart link for $HIIQ trade:https://www.tradingview.com/chart/HIIQ/zHy7T51l-Health-Innovations-HIIQ-Trade-has-hit-our-bullish-price-target/

Health Innovations (HIIQ) Health Insurers Fly As Trump Takes New Ax To ObamaCare $HIIQ #swingtrading https://www.investors.com/news/health-insurers-stocks-earnings-trump-rule-health-plans/

Health Innovations (HIIQ) Health Insurers Fly As Trump Takes New Ax To ObamaCare $HIIQ #swingtrading https://t.co/Ahqj7I0uRl

— Swing Trading (@swingtrading_ct) August 3, 2018

FITBIT $FIT – Buy sell triggers on our swing trading charts reviewed here. Recent special FITBIT swing trading report reviewed here on video.

FITBIT INC CLASS A (NYSE: FIT). How to Trade FitBit for 40% Gain (Member Exclusive) $FIT https://compoundtrading.com/fitbit-inc-class-a-nyse-fit-how-to-trade-fitbit-for-40-gain-member-exclusive-fit-swingtrading-daytrading-chart/

50 MA used as resistance on last sell off. Trading 5.48 down 7.5% today on other side of earnings. Likely over sold soon. Next time cycle completes Aug 14, 2018. Upside 5.60 6.67 7.72 are upside targets. Get ready for a turn. On watch here.

FITBIT (FIT) On close watch for an oversold bounce and trend reversal post earnings. $FIT

Live chart link with buy sell price targets and trade triggers for FITBIT https://www.tradingview.com/chart/FIT/Ni1fxuz4-FITBIT-FIT-On-close-watch-for-an-oversold-bounce-and-trend-rev/

FITBIT (FIT) The Versa Is Driving Fitbit’s Turnaround $FIT #swingtrading https://finance.yahoo.com/news/versa-driving-fitbit-apos-turnaround-213400971.html?soc_src=social-sh&soc_trk=tw

FITBIT (FIT) The Versa Is Driving Fitbit's Turnaround $FIT #swingtrading https://t.co/mEbX05UUJx

— Swing Trading (@swingtrading_ct) August 3, 2018

FIREEYE Inc. $FEYE – trading 15.09 on other side of earnings, downside 13.14 Sept 17 target, upside 16.24 19.29 Sept 17. Likely oversold soon also. Probability is for a turn. On watch closely for a trade. Main resistance 16.26.

Time cycles, machine trading liquidity, rule-set coding machine trading strategies and financial instrument chart trading structures on our algorithmic charting is discussed in detail here on the video. This explains how our win rate is so high.

FIREEYE (FEYE) Fireeye likely oversold soon also. Probability is for a turn. On watch closely for a trade. #swingtrade $FEYE

FIREYE (FEYE) FireEye Beats on New Customer Additions, Subscription Growth $FEYE #swingtrading https://finance.yahoo.com/news/fireeye-beats-customer-additions-subscription-000200148.html?soc_src=social-sh&soc_trk=tw

FIREYE (FEYE) FireEye Beats on New Customer Additions, Subscription Growth $FEYE #swingtrading https://t.co/Mz11yFLIjR

— Swing Trading (@swingtrading_ct) August 3, 2018

AutoHome $ATHM – Weekly chart, price target hit, mid quad support, earnings in 6 days, on high watch, 127.75 Apr 1 2019, large chart structure, Upside move target scenarios 110.87 , 128.70, 146.00.

AUTOHOME (ATHM) Weekly chart, price target hit, mid quad support, earnings in 6 days, on high watch $ATHM #swingtrading

Also discussed on the video is how to visualize the algorithmic charting horizontal instead of vertical and algorithmic charting channels.

Autohome (ATHM) Autohome Inc. to Announce Second Quarter 2018 Financial Results on August 8, 2018 $ATHM #swingtrading #earnings https://finance.yahoo.com/news/autohome-inc-announce-second-quarter-110000348.html?soc_src=social-sh&soc_trk=tw

Autohome (ATHM) Autohome Inc. to Announce Second Quarter 2018 Financial Results on August 8, 2018 $ATHM #swingtrading #earnings https://t.co/OAoa51LtmW

— Swing Trading (@swingtrading_ct) August 3, 2018

Facebook $FB – FaceBook has been an awesome trading instrument for our trading team and members this year.

How to check Wall Street calls is discussed.

While Facebook was in sell-off panic I was posting live on my Twitter feed where price would stop and rebuild in the chart structure.

Earlier in the year our Facebook trade in that sell-ff washout trade was one of our largest wins this year.

Review these recent special reports on swing trading Facebook (it will put the current trade set up in to perspective):

Protected: Trading Facebook (FB) Earnings Part 2 – Opportunity Knocks (Member Edition) $FB #trading #earnings

https://compoundtrading.com/trading-facebook-fb-earnings-part-2-opportunity-knocks-member-edition-fb-trading-earnings/

Protected: Trading Facebook (FB) Earnings Wash-out on Revenue Growth Warning (Member Edition) $FB #trading

https://compoundtrading.com/trading-facebook-fb-earnings-wash-out-on-revenue-growth-warning-member-edition-fb-trading/

$FB Facebook Long Set-Up Testing Buy Sell Trigger #swingtrading (Public Edition)

https://compoundtrading.com/fb-facebook-long-set-testing-buy-sell-trigger-swingtrading-public-edition/

Buy sell triggers are discussed. Chart shows our structure that we have known for months.

Now trade in Facebook is following the trajectory in the charting send to members.

181.68 167.53 174.76 are buy sell triggers. 181.50 Sept 8 target and more above.

Review other recent reports for the larger view of chart structure in Facebook.

160.60 and 153.58 in a sell-off. The previous time we traded this in the year it did go one more floor down before it took off bullish.

FACEBOOK (FB) trade following trajectory in chart sent to members 181.68 167.53 174.76 buy sell triggers. $FB #swingtrade #chart

Example of what our trade alerts look like on our trading alert Twitter feed:

https://twitter.com/SwingAlerts_CT/status/1024658448942870528

FACEBOOK (FB) Facebook’s Faceplant a Buying Opportunity $FB #swingtrading https://www.barrons.com/articles/facebooks-faceplant-a-buying-opportunity-1533240359

FACEBOOK (FB) Facebook’s Faceplant a Buying Opportunity $FB #swingtrading https://t.co/LoLnAsx1zG

— Swing Trading (@swingtrading_ct) August 3, 2018

G1 Therapeutics $GTHX – Earnings in 6 days, wonderful swing trade in progress here, 58.14 upside price target (most bullish), this trades with large intra-day swings, also a good daytrading instrument, 58.21 resistance. Trims today at quad wall resistance.

A review of our trade alerts feed on Twitter is at this point in the video.

G1 THERAPEUTICS (GTHX) Trims today at quad wall resistance worked well.

Pure Storage $PSTG – trade alert triggered while doing video, closed just above key support last Friday – important time of week for a stock to trade just above key support level. Trading 22.53 earnings in 24 days, trading right at decision, price target Oct 1 25.78 29.20 (bullish). Downside 19.19 15.90 in event of sell-off.

A recent special report we published on trading Pure Storage:

How to Trade Pure Storage (PSTG) Earnings in Six Days (Member Edition) $PSTG

https://compoundtrading.com/how-to-trade-pure-storage-earnings-in-six-days-member-edition-pstg/

Royal Caribbean $RCL – up over its mid quad resistance, 200 MA is right above and up against a quad wall, not a buy until over 188.70 because it has a number of decisions.

Price increases going in to the fall are discussed.

$SPY SP500 – Trading 281.74, followed quad wall down, 200 MA under price where price bounced, 283.68 resistance, price target 299 Aug 2 (not happening), Aug 13 time cycle price targets 283.82 and bullish 294.20 support for a sell-off 278.56, 273.67 in sell off 267.88 and 262.00.

SP500 (SPY) Chart – Closed at intra resistance with mid quad resistance next. $SPY

OIL FX $USOIL $WTI – Price hit the Tues 4:30 target and Wed 10:30 AM EIA price target on the EPIC Algorithm model. Got a a serious bull side move off bottom channel support earlier today (the team was traveling so we missed it). Various levels discussed on video.

Charts and Chart Links for Member Version Only

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

If you have any questions about this special earnings trading report message me anytime.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

Follow Me: