Compound Trading Tuesday May 2, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading, Videos and Live Stock Alerts. $ANGI, $ELED, $CNBX, $ETBI, $UWT – $PVCT, $LIGA, $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

If there was a day for a learning trader to gets some education from our trading room it was Monday. See video at link below.

Did more training in today’s session than I have for a long time. Hopefully the video turns out ok when published. Most of day:) #trading

Did more training in today's session than I have for a long time. Hopefully the video turns out ok when published. Most of day:) #trading

— Melonopoly (@curtmelonopoly) May 1, 2017

Notice: Our lead trader coaching schedule is fully booked and waiting list has started. Keep that in mind if enrolling or email in advance.

https://twitter.com/CompoundTrading/status/858970678342451200

Tuesday was day two of trading challenge.

We Want (Need) You! Apply to Nearest Recruiting Station. Part 4 “Freedom Traders” Series. https://compoundtrading.com/want-need-apply-nearest-recruiting-station-part-4-freedom-traders-series/ …

https://twitter.com/CompoundTrading/status/858581529727049730

Thanks for the replies to the Freedom Traders post on weekend! I’ll think through them and respond thru the week. Require thought! Peace:)

Thanks for the replies to the Freedom Traders post on weekend! I'll think through them and respond thru the week. Require thought! Peace:)

— Melonopoly (@curtmelonopoly) May 1, 2017

https://twitter.com/CompoundTrading/status/859351336336461824

Premarket Trading Plan Watch-list for this session can be found here (locked to respect members and unlocked to public about a week later for transparency):

https://twitter.com/CompoundTrading/status/859383936987914240

Most recent Premarket Chart Set-Up Video (most recent available to public – there may be other exclusive’s in member newsletters) Tuesday won’t be published (lacking content):

$OCN $BLPH $ASPS $IDXG $ARLP $TRCO $XXII $JIVE $MICT $FCEL $TWTR

https://twitter.com/CompoundTrading/status/859067029487321089

Most recent Market Open Momentum Stock Trades Video (most recent available to public – there may be others in member’s newsletters) Tuesday won’t be published – lacking content:

$OCN $YTEN $MTBC $CCCN $TWTR $AEZS

https://twitter.com/CompoundTrading/status/859098292231307264

Most recent Mid Day Chart Set-Up Review Video (most recent available to public – there may be others in member’s newsletters) Tuesday won’t be published (lacking content):

Midday Chart Setup Review: $OCN $CCCR $CYOU $BTSC $USLV $AG $ABBV $XRF $CMRE, $BLDV

https://twitter.com/CompoundTrading/status/859111267012882432

Most Recent Public Swing Trading Simple Charting can be found here: Swing Trading Simple Charts (Public) Apr 16 $SPY, $VIX, $USOIL $WTIC, $GLD, $GDX, $SLV, $DXY, $USDJPY, #GOLD, #SILVER

https://twitter.com/CompoundTrading/status/853551912599400448

Premarket Session:

Protected: PreMarket Trading Plan Tues May 2 $ANGI, $THC, $LMNX, $ALNY, $MOC

Protected: PreMarket Trading Plan Tues May 2 $ANGI, $THC, $LMNX, $ALNY, $MOC https://t.co/UyxS58mtcy

— Melonopoly (@curtmelonopoly) May 2, 2017

Member Reminder: Premarket chart set-up review in trading room 9:00! Charts. Live voice broadcast. https://compoundtrading.com #freedomtraders

Member Reminder: Premarket chart set-up review in trading room 9:00! Charts. Live voice broadcast. https://t.co/d1TrWCgBiP #freedomtraders

— Melonopoly (@curtmelonopoly) May 2, 2017

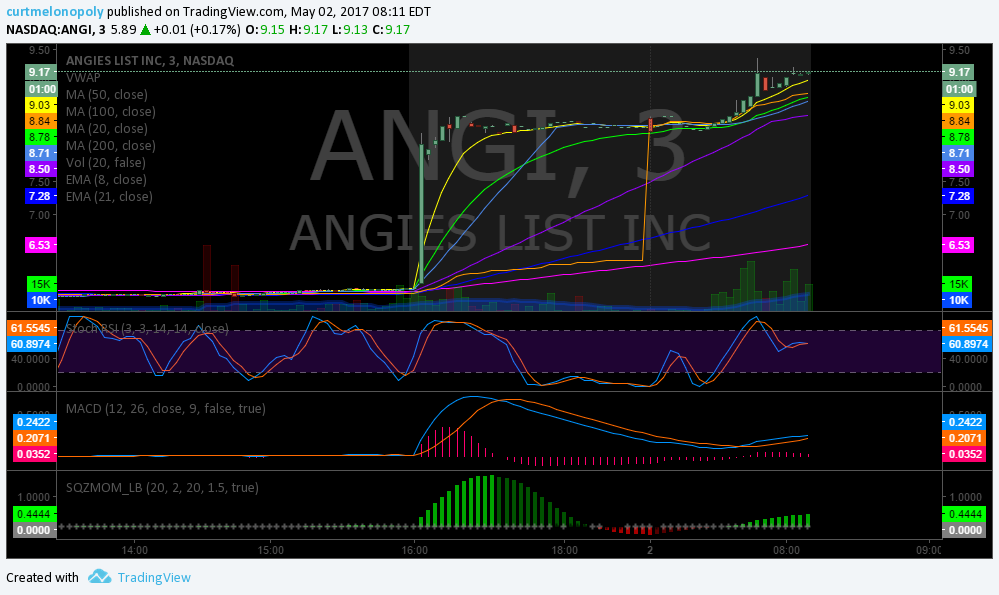

$ANGI Premarket up 56%

$ANGI Premarket up 56% pic.twitter.com/VSbOsuPQVR

— Melonopoly (@curtmelonopoly) May 2, 2017

Market Day, Chat Room Trades and Personal Trades:

$ANGI, $ELED, $CNBX, $ETBI, $UWT

So far on the two week trading challenge Monday I tool a trade in $MTBC and today in both for small wins and late Tuesday (in after market) I took a long position in $UWT (oil related). And I was in $ANGI for a paper cut loss.

Quarry Rock is rocking it! I need to do some catch up:)

Traders in our room were also in $CNBX and $ETBI.

Leaderboard: $ANGI 58.91% $SPAN 32.9% $THC 23.26% $CHGG 21.56% $CYH 19.43% $IAC 17.31% $PBI 16.39%

Leaderboard: $ANGI 58.91% $SPAN 32.9% $THC 23.26% $CHGG 21.56% $CYH 19.43% $IAC 17.31% $PBI 16.39%

— Melonopoly (@curtmelonopoly) May 2, 2017

In Play: $MTBC, $CGI, $SHOP, $CHGG, $NXTD, $OCN, $BDSI, $DGAZ High Uncertainty: $DBVT, $ANGI, $ALV

In Play: $MTBC, $CGI, $SHOP, $CHGG, $NXTD, $OCN, $BDSI, $DGAZ High Uncertainty: $DBVT, $ANGI, $ALV https://t.co/dTZmILEAPr

— Melonopoly (@curtmelonopoly) May 2, 2017

In to the close leader board: $ANGI 63%, $SPAN 33%, $CHGG 29%, $THC 21%, $RTNB, 19.4% $CYH 18.7%

In to the close leader board: $ANGI 63%, $SPAN 33%, $CHGG 29%, $THC 21%, $RTNB, 19.4% $CYH 18.7%

— Melonopoly (@curtmelonopoly) May 2, 2017

$ELED OTC Strong in to the close 34% today holding for now.

$ELED OTC Strong in to the close 34% today holding for now. pic.twitter.com/poSVoEKetB

— Melonopoly (@curtmelonopoly) May 2, 2017

$ETBI OTC Holding trend still up 8% on the day. #OTC 49M shares double normal.

$ETBI OTC Holding trend still up 8% on the day. #OTC 49M shares double normal. pic.twitter.com/tMjiedGZ59

— Melonopoly (@curtmelonopoly) May 2, 2017

$CNBX Closing near HOD also. Up 19% on the day. #pot #OTC

$CNBX Closing near HOD also. Up 19% on the day. #pot #OTC pic.twitter.com/Ja2jY3Fd4w

— Melonopoly (@curtmelonopoly) May 2, 2017

Learning How-to Trade Stocks, Chart Set-Ups, Lessons and Educational:

Looking for a trading home? What you can expect from the Compound Trading Lead Trader. #trading #mentoring #freedomtraders

https://twitter.com/CompoundTrading/status/857416340533018624

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size – under 5% of my daytrading acounts) – $ONTX, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI, $LIGA (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| ANGI | 9.51 | 61.46% | 26455500 | Top Gainers | |

| SPAN | 28.90 | 32.93% | 218253 | Top Gainers | |

| CHGG | 11.79 | 28.71% | 13036700 | Top Gainers | |

| BASI | 1.54 | 23.20% | 3013000 | Top Gainers | |

| THC | 18.66 | 21.56% | 16929409 | Top Gainers | |

| CYH | 10.32 | 19.72% | 14792503 | Top Gainers | |

| CHGG | 11.79 | 28.71% | 13036700 | New High | |

| SPAN | 28.90 | 32.93% | 218253 | New High | |

| IAC | 96.24 | 14.31% | 6211322 | New High | |

| SARA | 0.14 | 0.00% | 18874 | New High | |

| OHGI | 2.08 | 13.79% | 685533 | Overbought | |

| BCEI | 37.95 | -3.19% | 329200 | Overbought | |

| MOC | 2.83 | 12.30% | 1805695 | Unusual Volume | |

| ASBB | 40.50 | 15.71% | 257140 | Unusual Volume | |

| SPAN | 28.90 | 32.93% | 218253 | Unusual Volume | |

| SARA | 0.14 | 0.00% | 18874 | Unusual Volume | |

| BSBR | 8.87 | 3.38% | 4107200 | Upgrades | |

| ACRE | 13.42 | -4.76% | 242600 | Earnings Before | |

| MDSY | 0.73 | 4.29% | 40271 | Insider Buying |

Algorithm Charting News:

Every target predicted last week hit! Tues Wed Fri! Crude algo work sheet FX $USOIL $WTIC #OIL $CL_F CL $USO $UCO $SCO $UWT $DWT #OOTT

https://twitter.com/EPICtheAlgo/status/858952483720151040

Don’t miss this video. #algorithms #fibonacci

https://twitter.com/CompoundTrading/status/857297652765138944

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

For our swing trading platform users there is a new report out.

Protected: Weekly Swing Trading Updates Mon May 1 $IBB, $AGN, $CTSH, $TSLA, $SNAP, $VGX, $AAU, $NVO…

https://twitter.com/CompoundTrading/status/858989421021978625

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

USD/JPY bets ramp.

USD/JPY bets ramp. https://t.co/F0ZrCZ83tI

— Melonopoly (@curtmelonopoly) May 3, 2017

Gold $GLD, $XAUUSD, $GC_F :

NA

Gold Miner’s $GDX:

Biggest Gold Miner ETF Just Saw Largest Outflows on Record http://www.bloomberg.com/news/articles/2017-05-01/biggest-gold-miner-etf-just-saw-largest-outflows-on-record … ht @TN

Biggest Gold Miner ETF Just Saw Largest Outflows on Record https://t.co/IwJb5UA28Y ht @TN pic.twitter.com/AOJrqK4ouk

— Jesse Felder (@jessefelder) May 2, 2017

Silver $SLV:

Silver ETF falls for the 11th consecutive day, longest streak in its history (inception April 2006). $SLV

Silver ETF falls for the 11th consecutive day, longest streak in its history (inception April 2006). $SLV pic.twitter.com/ZkClWfspmX

— Charlie Bilello (@charliebilello) May 1, 2017

Crude Oil $USOIL $WTI:

Was it really that hard to predict ? Go long! ? Rising U.S. oil production knocks OPEC off course: Kemp http://reut.rs/2qpkGXt via @Reuters

Was it really that hard to predict 😂 Go long! 😂 Rising U.S. oil production knocks OPEC off course: Kemp https://t.co/cpVGQcMn4w via @Reuters

— Melonopoly (@curtmelonopoly) May 3, 2017

Energy Select Sector $XLE death cross.

Energy Select Sector $XLE death cross.

— Melonopoly (@curtmelonopoly) May 1, 2017

#OIL Recent highs – chart perspective – it will be interesting around the corner.

#OIL Recent highs – chart perspective – it will be interesting around the corner. https://t.co/PzrfVZJ2No

— Melonopoly (@curtmelonopoly) May 3, 2017

Volatility $VIX:

Low volatility and Crowded Trade Risk. One of my favs. #edge ?⤵

Low volatility and Crowded Trade Risk. One of my favs. #edge 🎯⤵ https://t.co/tMkjfheXUJ

— Melonopoly (@curtmelonopoly) May 3, 2017

‘Volatility markets are pricing in virtually zero risk in the near term.’

'Volatility markets are pricing in virtually zero risk in the near term.' https://t.co/gvDQGPAKgi

— Jesse Felder (@jessefelder) May 2, 2017

The time to worry about VXX is when volume (as % of total shares outstanding) dries up.

The time to worry about VXX is when volume (as % of total shares outstanding) dries up. pic.twitter.com/onjGHKP0ND

— Tom McClellan (@McClellanOsc) May 2, 2017

$VIX short exposure.

$VIX short exposure. https://t.co/lUugEVpuaf

— Melonopoly (@curtmelonopoly) May 3, 2017

$SPY S&P 500 / $SPX:

NEW Blog – “How Concerning Is The Underperformance Of The Equal Weight S&P 500?” https://www.seeitmarket.com/how-concerning-is-equal-weight-sp-500-underperformance-16824/ … by @CiovaccoCapital

$SPX $SPXEW

NEW Blog – "How Concerning Is The Underperformance Of The Equal Weight S&P 500?" https://t.co/i7gZjYAK9M by @CiovaccoCapital$SPX $SPXEW pic.twitter.com/QWomOsWXhJ

— See It Market (@seeitmarket) May 3, 2017

$SPX in only 7-point range Tuesday, ahead of FOMC. I’d say that low Average True Range (ATR) is marking a top, but it has not worked lately.

$SPX in only 7-point range Tuesday, ahead of FOMC. I'd say that low Average True Range (ATR) is marking a top, but it has not worked lately. pic.twitter.com/A28G6mDVAv

— Tom McClellan (@McClellanOsc) May 2, 2017

Surprisingly enough, YoY growth in margin debt has historically been a positive sign for the S&P

Surprisingly enough, YoY growth in margin debt has historically been a positive sign for the S&P https://t.co/GTxHRnDoYz pic.twitter.com/s3akBPKZ9c

— Adam Collins (@eversightwealth) May 2, 2017

$SPY $SPX play book should have plan B. ?⤵

$SPY $SPX play book should have plan B. 🎯⤵ https://t.co/RovBAyG6R5

— Melonopoly (@curtmelonopoly) May 3, 2017

.Looks like $SPX needs a Fed “no rate hike relief rally” to get to new highs.

https://twitter.com/NorthmanTrader/status/859431972220936192

$NG_F Natural Gas:

NA

Markets Looking Forward:

AM #earnings $S $GRPN $YUM $TAP $TWX $SO $GRMN $HUM $CLX $ADP $DLPH $NVO $EL $EMES $HFC $ICE $RAI $ACCO $SCMP $CDW

AM #earnings $S $GRPN $YUM $TAP $TWX $SO $GRMN $HUM $CLX $ADP $DLPH $NVO $EL $EMES $HFC $ICE $RAI $ACCO $SCMP $CDW https://t.co/L4OeNnTfSq

— Melonopoly (@curtmelonopoly) May 3, 2017

Small Caps Lagging

Small Caps Lagging pic.twitter.com/WmnSAb9dWE

— Alastair (@StockBoardAsset) May 2, 2017

#BIG6 ? $AAPL $GOOGL $MSFT $XOM $AMZN $FB

#BIG6 🔥 $AAPL $GOOGL $MSFT $XOM $AMZN $FB https://t.co/V2PCUakZDs

— Melonopoly (@curtmelonopoly) May 3, 2017

Tech leading all sectors YTD (+14%) and 1-year (+31.6%). New all-time high today in $XLK and $SPY (total return).

Tech leading all sectors YTD (+14%) and 1-year (+31.6%). New all-time high today in $XLK and $SPY (total return). pic.twitter.com/M7MYoIIYah

— Charlie Bilello (@charliebilello) May 3, 2017

Ratio of Consumer Discretionary to Consumer Staples hits an 18-month high. $XLY $XLP pic.twitter.com/KNOikcmHxV

— Charlie Bilello (@charliebilello) May 3, 2017

Ratio of Consumer Discretionary to Consumer Staples hits an 18-month high. $XLY $XLP

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix. Also, please note, sometimes pieces of the transcript are missing (also something we are working on). But the video is raw and complete.

If this post was of benefit to you, be kind and share on social media!

Curt M_1: Protected: PreMarket Trading Plan Tues May 2 $ANGI, $THC, $LMNX, $ALNY, $MOCLINK: https://compoundtrading.com/premarket-trading-plan-tues-may-2-angi-thc-lmnx-alny-moc/PASSWORD: 051217PRE

Curt M_1: Stock Trading Results Mon May 1 $MTBC, $OCN, $OCCR, $TWTR, $BLDV, $BTSChttps://compoundtrading.com/stock-trading-results-mon-may-1-mtbc-ocn-occr-twtr-bldv-btsc/

Curt M_1: Back at 9:05 for premarket review>>>>>>>>

Sartaj: Good morning, everyone

quarryrock: Hello Good am

Curt M_1: gm

Curt M_1: On mic in 1 min for premarket >>>>>>>>>

Curt M_1: pn mic>>>>>>>>>>>>>>>> 9:07

sfkrystal: If the buyout bit id 8.50, why would it go higher?

sfkrystal: http://www.marketwatch.com/story/angies-lists-buyout-bid-is-well-below-ipo-price-2017-05-02?siteid=yhoof2&yptr=yahoo

Sartaj: Thank you

sfkrystal: mtbc

sfkrystal: oops

sfkrystal: down p/m

sfkrystal: but gained yesterday

quarryrock: haha

quarryrock: ss $SHOP $79.90 pre

sfkrystal: yeah volume is already 2M, could be a squeeze

sfkrystal: lol

Spiegel: ELED

sfkrystal: OHGI?

Sartaj: Literally slept in

quarryrock: ss $SHOP $82.40 last add

mat: waht a crappy open. Thought AMD or X might give me a play, weak all around so far

Market Maven: On $DISH short

Market Maven: forgot to alert sory

Flash G: $SHOP small swing doing ok but others exc

lenny: wtf haha bad open

quarryrock: BTC $SHOP $80.34 gain +.81

quarryrock: whipsawed me

quarryrock: but ill take it

Sartaj: Terrible. And as Mat mentioned, couple of these sectors should have been up, if nothing else on geo factors

Sartaj: Yesterday was interesting in terms of the Korean Peninsula, then again May Day protests could still be wearing off

Curt M_1: 21,000 shares #ELED .0462 ish waiting on ticket

Curt M_1: $ELED OTC

quarryrock: wow right trade poor entry and exit for me folks on SHOP

sfkrystal: lol

Curt M_1: 9.63 800 long $ANGIE

sfkrystal: Tori Amos did a great cover too

mat: Semi’s down hard across the board not helping SPY

Curt M_1: $ELED Long add 175,999 shares .051

quarryrock: $AMD overdone on watch here

Curt M_1: $ANGI 9.28 closed loss

Sartaj_1: Oil algo is on its way to a direct target hit

Sartaj_1: A lot easier than watching bulls get trampled lol

Market Maven: $DISH all covered

quarryrock: STC $UVXY $13 Cs +.10 25%

Spiegel: GAHC?

quarryrock: BTO $TWLO $34 Cs .87 5/5

Carol: $ADHD b/o possiblr

Spiegel: Curtis , if ELED is a big winner it was all me. But if it’s a loser it’s all yours. OK?

Flash G: haha

Flash G: awesome

Curt M_1: ok

Spiegel: CNBX here

Flash G: $RTIX re – confirming on the swing

quarryrock: added $TWLO $34 Cs .77 5/5

sfkrystal: angie agreed at 8.5

Spiegel: I did the AMD calls when it was 11.06. Up 20% so far

Market Maven: Long $AMD 11.28 for a start

Spiegel: AMD now above VWAP

quarryrock: looking for Oprah to break down more

quarryrock: still in $21 WTW puts

quarryrock: STC 50% of $TWLO Calls .98 +27%

quarryrock: that was a nice one

Flash G: good stuff

Spiegel: So I got ELED, AMD calls, and CNBX. All winners so far.

lenny: nice

quarryrock: sweet!

Spiegel: AMLH nice reversal off lows today

Carol: watching that Apiegel

Carol: Spiegel

Carol: I’m long in it

Spiegel: nice! me too

Carol: I’m under water just barely now

Spiegel: You’ll get your chance to be above water soon. Just a matter of time

Carol: not far off now any sec

Market Maven: I have added to $AMD as it goes here

Market Maven: Cost average 11.272

Market Maven: $CNBX is a should ve

Spiegel: Glad to have the Maven seal of approval for my CNBX

Market Maven: Good play Spiegel – should have ugh

Spiegel: a guess the new car you buy today will have to be just a $20,000 Honda Civic

Spiegel: I

Market Maven: 🙂

Curt M_1: I’ll let er ride see ya guys at lunch

Spiegel: see ya

Spiegel: The Gambler has just left the building

Spiegel: CNBX 1.50

Market Maven: ha

Market Maven: Stop on $AMD at buy. Not acting great.

quarryrock: $PI back from the dead and ripping. still in swing

Market Maven: $CNBX 1.80 possible today even 2.00 if it really gets a squeeze

Spiegel: AS long as it hold VWAP I’m ok with it

Spiegel: but then again my entry is options when it was 11.06

Market Maven: Speaking of VWAP, Curt will close $ELED below VWAP and the 21 ema guaranteed FYI even if he’s out of office – he’ll hold through some pressure but not a complete wash out

quarryrock: wow $TWTR rip

sfkrystal: maven, which freq VWAP? 5 min?

Curt M_1: Leaderboard: $ANGI 58.91% $SPAN 32.9% $THC 23.26% $CHGG 21.56% $CYH 19.43% $IAC 17.31% $PBI 16.39%

Market Maven: I use 5 min on intra day trades normally yes

Market Maven: VWAP

sfkrystal: ty

Market Maven: np 🙂

Market Maven: specific to $ELED comments yes also 🙂

quarryrock: $TWLO should find $34 flat by the close if im reading the options chain correctly

quarryrock: waiting game now

Spiegel: There went my AMD profits. poof. out

Market Maven: ya thats why i closed earlier – it didn’t look good

lenny: agree

Spiegel: you were correct. What didn’t look good to you? MA’s curling down?

Greg: yup

Market Maven: just trading action and price didn’t get lift I think it should have after VWAP – was a guess really

sfkrystal: $ANGI asc triangle, i’m so confused.

Spiegel: WEll, you were right and that’s what matters in the end

sfkrystal: i mean not that actual value has anything to do with trading or anything, but… still confused.

Market Maven: $ANGI will likely dump imo haha value who cares we trade anything

Greg: enjoying the swing trade side Curtis – good system

Market Maven: hes out till noon fyi

Market Maven: but he’ll like to hear that

Market Maven: Flash does well with it too

sfkrystal: in your opinion. lol

Spiegel: Maven, do you do the swing service too. And the oil?

Market Maven: Just Swing. But the Oil is crazy spectacular I know that.

quarryrock: im tempted to ss $HUBS into their ER tonite. but the smarter play is to wait for the report and then lean in – this stock is just insane

Market Maven: Swing is super simple 2 hours a week..

Market Maven: yup

Spiegel: I’m thinking of joining oil when it gets the 24 hour room but am worried about getting addicted to it and it killing my life. I might be in there all the time like a gambler or drug addict.

Flash G: I concur. The swing is about 3 hours a week for me and deceptively simple. the KISS method works.

Spiegel: I’m used to the KICC method – Keep It Complicated & Convoluted

lenny: The oil if you follow the signals you won’t lose. Maybe 3 – 5% of the time but small when you do. It’s tuned in. You should look at the reports from past. But yeh I get the addicted part.

lenny: EPIC is tight.

Spiegel: you in it Lenny?

lenny: Curt will be adding to $ELED soon haha

lenny: yes

Spiegel: And with EPIC , what of the many oil vehicles do you trade – WTI?

lenny: me Flash Maven Curt OILK been trading together for some time and Shafique and Sandra i Guess

lenny: i trade futures Curt trades ETN’s and OILK futures

lenny: Curts moving over to Futures

Spiegel: hmmm. and theres clear signals when to buy or what oil is heading towards

lenny: Exact signals – looks complicated but its simple

lenny: The algo account I think ROI is 1200% a year or so

Spiegel: Could you guess how much youre up this year with it or since you joined it, roughly?

Spiegel: WOW!!!

lenny: TThey’re publishing soon – they’re just waiting for legal I think – contracts for subs – its a big deal EPIC

Spiegel: you mean the 24 hour room?

lenny: it’s going to be YUGE ha

lenny: EPIC is being coded so it will go beyond a chart and its going to be a digital dashboard for traders

Spiegel: that does sound epic!

lenny: Intelligent Assistant they call it

lenny: its just a digital assistant – chart works the same

Spiegel: what will the digital assistant do then?

lenny: you should look through the calls – crazy calls – every ime oil is going to turn up or down EPIC hits it

lenny: digital interface that will signal for you the trades on different time frames

Spiegel: that is exactly what I would like

lenny: it will be very expensive

lenny: likely 10k plus a month

Spiegel: Well there goes that.

lenny: but the charts are the same

quarryrock: ss $COH $43.07

Spiegel: I’ll stuick to the email version then

lenny: its the same

Spiegel: But the EPIC emails are around $500 a month, right?

lenny: digital assistant is for after you’ve made a few million on the charts

lenny: no i think i pay les than 200 with the discount

Sartaj: The 24 hour room (EPIC bundle) is about 499 a month, yes

Sartaj: After the discount, the standalone EPIC newsletter is 122 per month

Spiegel: Not $10,000?

lenny: ahh there you go

Sartaj: Well, Lenny is one of those guys who likes shopping around. He was telling us about this algo group that was licensing out solutions starting at 100k

Sartaj: per month

lenny: newsletter alone is under 200 a month with coupon code

lenny: thats all you need spiegel

Sartaj: it stands to reason that at a certain point, we’ll go from that 500 per month price range with the 24 hour room, up to 10k per month after coding phase has entered a stable build

Sartaj: not right away, but just so you get an idea of what the ranges are… yeah, they definitely get up there

lenny: right now today everyone does well with the newsletter charting it works

Spiegel: and what is the eta for the 254 hour room?

Sartaj: Curt and I were thinking early-mid Q3

Sartaj: likely Q4

Spiegel: Ah ok, so I have time. I want to spend 2 months travelling this summer

quarryrock: STC remaining 50% $TWLO calls $1.08 +24%

lenny: last I heard was late fall

quarryrock: plus $2k total on TWLO trades.

lenny: nice Q

Sartaj: Yes, you have ample time. In terms of the standalone newsletter, it might be worthwhile, if for nothing else than to acquaint yourself with how it’s used etc

quarryrock: its got more in it! but i wanted to take profits here

Market Maven: good plays quarry

quarryrock: thanks guys! these ER names always have an implied bid under them

Market Maven: Curt’s gonna be anxious to catch you Quarry

quarryrock: haha

Market Maven: 🙂 It’s good for him.

Flash G: Looks like Spiegel, Quarry and Krystal are a good fit if you ask me.

Spiegel: So what extra do you get currently with the EPIC bundle over just the EPIC newsletter?

Flash G: My two bits.

Sartaj: Nothing in particular, but you do reserve your pricing at the inaugural rate

Spiegel: lol.

Spiegel: Will the pricing go up over the summer and early fall before it’s released?

Spiegel: the 24 hour I mean

Market Maven: $ELED going to be a runner maybe.

Sartaj: I will get back to you on that. Our development process is agile; hard for me to say yes or no right now

Spiegel: Will you at lest give us notice before you do so I could lock in at the current price?

Sartaj: but we have you on a reserved list, in any case, so yes

sfkrystal: ya i’m liking the handle $ELED

Sartaj: of course

Spiegel: gret!

Market Maven: It’s looking serious.

Market Maven: Waiting patiently.

Market Maven: For confirmation

Spiegel: ELED just took a little spill. Hope its temporary

Spiegel: was humming along nicely and then ploop

sfkrystal: lol that was my fault for saying i liked it

Market Maven: It’s holding up in down time of day. That’s what I like.

Market Maven: There’s no panic at all.

Spiegel: AMD sure ain’t holding up. Looks like is cracking 11

Flash G: I like the swings and my after lunch scotch. And watching you bucks stress all day.

lenny: $AQB halt!

Curt M_1: On mic 12:05 for mid day chart review>>>>>>>>>>>>>

Spiegel: Only thing I don’t like about ELED here is the spread. about 4%

Spiegel: it just narrowed as I typed that

Spiegel: bid is back up

sfkrystal: $ANGI has held it’s gains too lol

Hedgehog Trader: hey all

Sartaj: “robots” lol

Sartaj: Hey hedge

Spiegel: ELED chart a work of beauty. Look at 5 min. Every day it has a quick peak, then levels out to slightly lower,…next day another peak then levels out. day after day

Spiegel: this is day 7 of that

Sartaj: Wow

sfkrystal: yes looks like a perfect pump imo

Spiegel: can’t deny that

Curt M_1: need 2 mins finishing a call

quarryrock: oprah fade!

Sartaj: Japan declared BTC a legal currency today

sfkrystal: nice!

Spiegel: need a bitcoin algo now

Sartaj: Very nice, until they find a way to tax it 😀

sfkrystal: hah true

Spiegel: 24 hour room

Curt M_1: Bank of Japan also invests in derivitives bahahaha

Spiegel: I’ll sleep when I’m dead

Sartaj: Yeah I guess they are masters of air

Curt M_1: ok on in 1 min>>>>>

Curt M_1: on mic 12:13>>>>>>>>>>>

quarryrock: $PI parabolic

Spiegel: link

Sartaj: https://compoundtrading.com/development-processhttps://compoundtrading.com/epics-story

Spiegel: Thanks Sartaj. And glad to here you’ll do more OTC’s in the future Curtis

Spiegel: It’sll make your room very popular but also attract some yahoos

Sartaj: Crowd-sourcing aspect

Spiegel: Just hope I measure up

Sartaj: Understatement

Sartaj: That was ridiculous

Sartaj: Try Opera, Curt

sfkrystal: lol

Hedgehog Trader: Mercury in Retrograde

Sartaj: I should have exited at resistance

Sartaj: Becoming a swing

Sartaj: OPEC didn’t haev good news

Sartaj: have*

Spiegel: I am

Spiegel: ttheres not much time left for it to hit that circle now after todays dip. so will it still head towards it on move towards price in that final circle now?

Sartaj: We have seen more often than not, as Curt said, that price will spike directly into the target zone, sometimes at the very last minute

Spiegel: or move

Sartaj: Or within a very tight time-frame

Hedgehog Trader: nice Sartaj

Sartaj: Even Gary was tripping out

Sartaj: and he’s been around

Spiegel: fascinating. i have to be a part of this.

Spiegel: ROX

Hedgehog Trader: $LACDF

Hedgehog Trader: hah

Spiegel: ROX is a swing for me. Not usually huge moves any day

Hedgehog Trader: i am very bullish on lithium which has been very strong – and has some great catalysts

Hedgehog Trader: TSLA is going to build 4 new gigafactories this year

Hedgehog Trader: and China is opening several battery factories in the next couple of months

Hedgehog Trader: India is going full electric by 2030- lithium is a great short and long term sector

Hedgehog Trader: 3 insiders bought $440k worth of LACDF shares since April 11

Hedgehog Trader: and i am also seeing multiple lithium stocks with insider buying

Leanne: Have a great afternoon everyone, gotta run. Thanks Curtis.

quarryrock: sold $PI swing +$1.19

Spiegel: $ROX also please. Although too extended for a buy here. I’ve been in it awhile.

Hedgehog Trader: Spiegel – I like $ROX too

Spiegel: 🙂 Not just great technically but fundamentally also

Hedgehog Trader: i agree

Hedgehog Trader: amazing strength and lack of volatility in $NAK during the latest gold and silver correction

Spiegel: ROX is ginger beer

Spiegel: which I hate

sfkrystal: lol, i’m just a confused newbie

quarryrock: hi

quarryrock: im up about $4500 on the day – left alot of money on the table with TWLO

quarryrock: only have 3 positions open now SLW undewater a little and WTW , COH ss

Carol: $BOMT on the move

sfkrystal: $BONT 😉

Flash G: $VRX NHOD

Spiegel: CNBX rockin it

Spiegel: 1.60 now

Spiegel: has had a horrible time of it on the daily. appears ready to bounce decently for hopefully more than a day

Spiegel: I use ema’s so the 20 has crossed the 200 using that (as of today)

Spiegel: Gotta go. Everyone enjoy the rest of your day!

Flash G: BYE

Curt M_1: CYA

Market Maven: bye spiegel

quarryrock: $WTW is a case where ss via the stock a better plan than puts.

Curt M_1: $CHGG break out see if it confirms

sfkrystal: $ELED broke vwap

lenny: whay do u say that quarry?

quarryrock: the delta on the premium doesnt move much relative to the underlying stock price

quarryrock: stock is down 2.2% and premium on the $21 Ps hasnt moved much at all

lenny: hope you do a blog piece about your trades in this chalenge – would like to learn about it

quarryrock: absolutley happy to share

quarryrock: now TWLO is exact opposite. the premium is hair triggered to the stock – Implied Volatility is high

Carol: $VNCE downed over 60% on that halt

quarryrock: went right to $34 bucks as advertised earlier. unfortunately i wasnt patient enough

quarryrock: BTO weekly QQQ $137 Ps .41

Curt M_1: OIL TANK

Curt M_1: AM #earnings $S $GRPN $YUM $TAP $TWX $SO $GRMN $HUM $CLX $ADP $DLPH $NVO $EL $EMES $HFC $ICE $RAI $ACCO $SCMP $CDW

lenny: zzzzz

Carol: yup

quarryrock: BTO $GRPN $4 C’s .32 this is a small casino trade. unlikely to hedge this implied move is 15% tomorrow. small size

sfkrystal: so now that vwap has gone up and the price has remained essentially the same, would curt get out of $ELED?

sfkrystal: if either price comes down or vwap/ma goes up for a cross either way

quarryrock: this tankage in AMD is shocking

sfkrystal: $CHGG nhod

Curt M_1: reboot

Carol: $TWTR a champ but I think I will close my swing now.

Flash G: wise

Curt M_1: Would be nice to see $ELED break out here for EOD run:)

Curt M_1: Volume in that candle $ELED

Market Maven: You still hold $ELED Kyrstal?

Curt M_1: In to the close leader board: $ANGI 63%, $SPAN 33%, $CHGG 29%, $THC 21%, $RTNB, 19.4% $CYH 18.7%

Curt M_1: There we go!

quarryrock_1: BTC ss $COH loss of $55

quarryrock_1: waste of time trade oh well

Flash G: win some lose some

Market Maven: win more than you lose!

quarryrock_1: yep!

Curt M_1: Hey Krystal I have a guy in UK that wants info on trading US stocks from UK – could you chat with him on Twitter or no?

Curt M_1: I had to chi out there over the last 6 mins Closed

Curt M_1: $ELED Average 5294 completely out

lenny: Looks like Krystal is gone

Sartaj: See everyone tomorrow, peace

quarryrock_1: STC $WTW loss of .16 10%

Curt M_1: wow look at that candle lol

quarryrock_1: wasnt going to risk the Puts position

Curt M_1: cya Sartaj!

Curt M_1: Thanks for coming out Quarry!

Curt M_1: and kicking my ass lol!

Curt M_1: “I’ll be back”

quarryrock_1: cheers ! great day and AH next!!

Market Maven: c ya

Follow our lead trader on Twitter:

Article Topics: $ANGI, $ELED, $CNBX, $ETBI, $UWT – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500