Welcome to the second day’s review of our two-week trading challenge, where our lead trader’s aim is to double his large account. My name’s Sartaj, a software engineer at Compound Trading. Following our original format, the first part of this series is a chart review. Our lead trader’s record for January 10 was 6 wins, 2 small losses, and 1 hold from a previous swing trade.

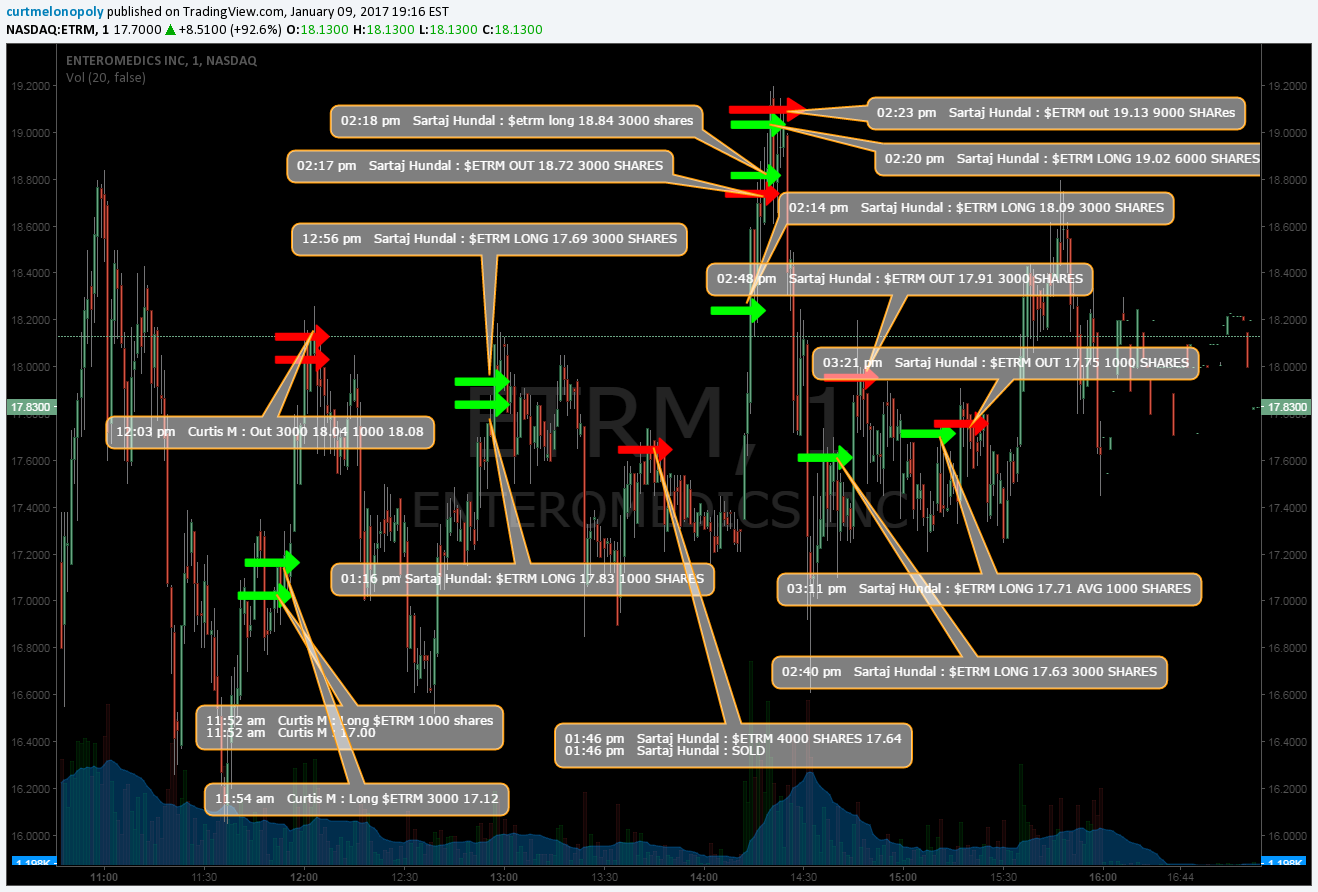

Overall, the general sentiment of the market has been relatively flat pending Donald Trump’s inauguration. Much of the chatter since Monday has indeed been about medical-related fields, and $ETRM showed itself to be a scalper’s paradise today. More on this later.

Hence, the focus was largely on biopharma stocks, with one hold in oil based on the results of our oil algorithm.

The first play was in $GNVC, which leveraged morning momentum one minute after the opening bell. Entry was at 9:31 am going long at 8.23, 1000 shares. Exit was one minute later. The original plan was to hold in the 8.70 area after the initial momo pike, but there was a pull back after price moved to 10. Price action came off a bit faster than it should have after the initial spike, in our lead trader’s estimation. This validated his concern with respect to pulling out very early.

This example also highlights the importance of seeing indicators line up. While the stochastic oscillator and Osmond

metrics were lining up well, there were not enough checkmarks to justify a hold.

Moving on, we see that $ETRM continued to be a scalper’s paradise, following Monday’s trends. We made one play at 10:22 am, with entry at 19.04, and exit 4 minutes later out 3000 shares at 19.59. As we can see, an extended hold until lunch time may have worked out in retrospect, but our lead trader worked off his plan and exited before the downdraft between 10:30 am and 10:40 am.

The next stock we looked at was $SGNL. This was technically interesting, as the volume has been low here for quite some time. Most of our wins were came from this stock, leveraging gap-ups. The orange arrows highlights a halt, which we had pinned down right to the minute. Note that there pops in price nearly every time a halt came in.

The first loss of the day came near end-of-day in $BIOC. While the entry was sound, leveraging a reversal at 2:42, there was not enough price action during the pop at 3:28.

Our second loss came from $XGTI, a technology company. Similar to the previous loss, there was an expectation of a pivot where the exit point was, building price action at a previous resistance level. However, after the reversal at 3:09 pm, the downdraft continued. A better play may have been to exit right before the reversal, although the price action here was quite dramatic.

Finally, our lead trader entered one hold. Further to these momentum and scalping plays, our flagship algorithm, EPIC, had the following observations: On January 9, price fell out of its lower resistance, which we represent as a “lower width” in terms of our algorithmic charting. It was posited around a 50% probability that price would reach 53.16.

Using $UWT as a primary trading instrument against $USOIL (where we represent our algorithm), our lead trader went long at 24.10, 1000 shares. There was slight lift over the support width, with evidence of a price action moving towards one of the primary algo targets in the afternoon.

Oil output being cut, a couple of trade and environmental agreements in the works. General sentiment is to wait until the US presidential inauguration. Not really anything impressive in terms of price actions, but algo targets are still on mark pending re-calculations.

Given these geo-indicators, our lead trader entered a hold.