Welcome to the Compound Trading Swing Trade Report Monday Mar 5, 2017. $TAN, $WYNN, $NFLX, $AXP, $TWLO, $VRX, $GSIT. $ABX, $XME, $URRE, $RIG, $XLE, $SLX, $X.

Notices:

Good morning!

This swing trading report is one of five in rotation.

The reports are in the process of upgrades to include buy and sell triggers identified on charting of select instruments that are nearing trade set-ups. The triggers (price and / or other indicators) will also be set to alarm on our charting for attendees to the live trading room and alerts will flash on screen during live trading broadcast. Additionally, the triggers will be buy / sell points for our traders to use as part of the alerts members may receive.

If you need help with a specific trade and the specific trading plan for your swing trade set-up let me know and as I have time I can help you formulate.

When managing your trades with the reports keep in mind that you will have to invest an hour or two a week to check the indicators mentioned for buy and sell triggers.

Swing trading success, even with a service, does require “some” maintenance on the part of the user, although the new live alert service will take much of that burden off the user as we know many of our users have busy lives. It is the indicators lining up that signal a trade long entry or an exit. In our case rely heavily on MACD on daily or weekly (or Stoch RSI and Moving averages) but indicators we are basing our trade entry and exits on are listed with each trade so any user that does even moderate trade management will know when the indicator(s) have turn with or against the trade.

Intra-week you can always DM myself on Twitter or email with specific questions regarding trades you are considering for assistance. But it is critical that you attend to the maintenance of your signals at least once a week if not twice and set stops and preferably alarms so that intra-week you can enter or exit. If nothing else you can always book some coaching time and I’ll assist also (although we are at a point of waiting list for the coaching, at minimum you can get on list or for immediate help as I said please DM or email).

IF WE DON’T GET BACK TO YOU RIGHT AWAY it is usually because we are pressured with deadlines or are trading.

As live charts are made available below, click on link and open viewer. Then to use chart yourself click on share button at bottom right (near thumbs up) and then click “make it mine”.

To remove the indicators at bottom of chart screen (MACD, Stochastic RSI, Squeeze Momentum) double click on chart body to remove indicators from chart – and same to return the indicators.

If you receive a report and you are not subscribed to the specific service it is a complimentary issue provided to you.

Our apologies if you receive more than one copy – it means you are on more than one subscription list. We are working to resolve this issue.

Newer updates below in red for ease.

Recent Compound Trading Videos for Swing Traders / Charting Set-Ups:

See You Tube for other recent video posts.

Swing trading setups Jan 18 $FB, $SPY, $CNTF, $CTIC, $RIOT, $AES ….

Swing trade stock setups Jan 19 $SPY, $GSUM, $DXY, $MIND, $XPO, $ICPT…

Swing trade / daytrade set-ups for wk of Jan 22 $SPY, $FB, $ROKU, $DXY, $JUNO, $BTC.X, $FATE …

CRITICAL time cycle decisions SP500 $SPY, Gold $GLD, Oil $WTI, USD $DXY, Bitcoin $BTC.X and more…

Swing trading ideas & how I am managing $SPY $SPXL trade, structural trading $XNET, $SQ, $GDX …

Technical charting lessons here at market open $HMNY, $XNET, $SPY, $SEII, $INSY, $SLCA

Jan 9 Swing trading set-ups $XNET mid trade technical review, $GSUM, $SLCA, $SPY, $TESS….

Live $XNET trade $4267.00 gain. Swing trade entry and chart set-up at 40:00 – 54:00 min on video.

Jan 8 Swing Trading Set-Ups $AYI, $SPY, $SQ, $VRX, $AXON, $BTC.X….

Market Open Jan 8 Live Chart Model “On the Fly” $VRX, $SPY, $BTC, $LITD, $MYSZ, $INSY

Jan 3 Swing Trading Set Ups $SPY, $SPXL, $LTCUSD, $GLD, $APRI, $MNKD, $INSY, $TEUM, $NTEC, $LEDS …

Jan 2 Swing Trading Set-Ups $BTC.X, $SPY, $GDX, $XOMA, $JP, $INSY, $MNKD, $NTEC, $SKT, $RENN …

Dec 28 Swing Trade Set-Ups; $SPY, $SPXL, $NATGAS, $SRNE, $ZKIN, $WPRT

Dec 27 Swing trade set-up review $SPY, Gold, $BTC.X, $BVXV, $XXII, $VRX, $EKSO…

Email us at info@compoundtrading.com anytime with any questions about any of the swing trades listed below. Or, if we get bogged down private message Curtis in trade room or direct message him on Twitter. Market hours are tough but we endeavor to get back to everyone after market each day.

Stock Pick Coverage:

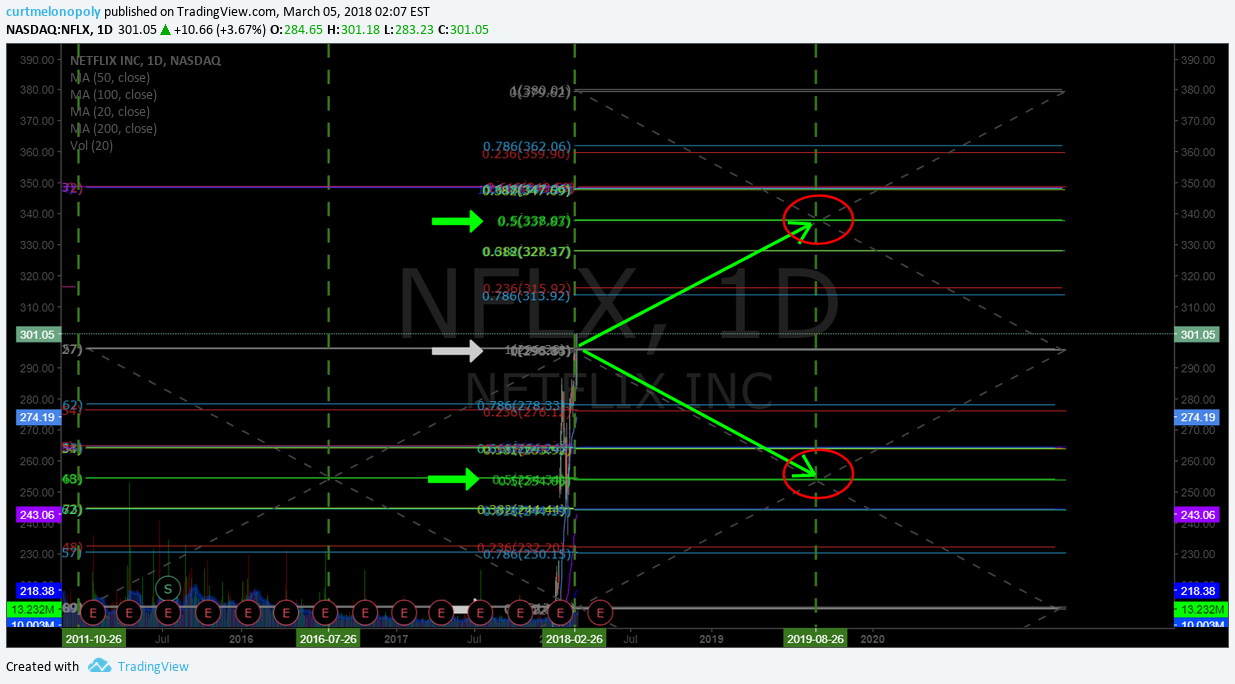

$NFLX – Netflix

Mar 5 – $NFLX How to trade the move with price targets #swingtrading – see feature post link below for complete trade set-up details.

Feb 26 – Feature Post https://compoundtrading.com/trade-momo-move-2/

Jan 23 – $NFLX trading 248.07 in premarket post ER trade extended way above MA’s on daily. Wait for MA bounce structure to setup.

Dec 15 – $NFLX trading 188.30 premarket under 20 and 50 MA with MACD that could turn up.

When price above 20 and 50 MA’s and MACD turns up this likely becomes a long trade. Will post buy/sell triggers as a trade nears. On high watch here.

Nov 21 – $NFLX trading 194.70 with MACD Stochastic RSI and SQZMOM trending down. Waiting for MACD turn to assess long.

Oct 31 – Trading 198.10 with MACD turned down above all MA’s on daily. On watch for MACD turn up and decision.

Sept 13 – Trading 185.40 bounced off 50 MA on daily since last report. MACD is now up, SQZMOM up but Stoch RSI peaking. Will assess when Stoch RSI bottoms and turns again.

Aug 18 – Trading 166.10. Indicators all pointing down and sitting on natural support. Waiting for indicators to turn.

Aug 7 – Trading 180.46 after its post earning’s break out. MACD turned down and will wait for it and other indicators to turn up before considering an entry.

July 24 – Closed premarket 188.40 from 158.20. Will watch for a re-enter pending some ER considerations early this week. Sentiment is pensive imo. Could go either way in market – generally speaking.

July 12 – Trading 158.20. Will watch here over its 50 ma and if 20 ma is about to breach 50 with price above and other indicators line up I will alert an add.

July 5 – Trading 146.17. Long from 159.35 200 shares on the 26th of June. Unfortunately thats where it turned down and now MACD is near bottom. 200 MA however is at 135.35 and that is possible. Understand that when I take an entry it is normally no more than 1/5 sizing until a trade proves itself out so I can usually take the down draft if required.

June 26 – Trading 158.33.

$NFLX pull back may be over MACD could cross up with SQZMOM and Stoch RSI trend up.On watch and I may take a long entry in premarket today.

$GSIT

Mar 5 – $GSIT Trading 7.91 with indecisive indicators.

Jan 23 – $GSIT Trading 8.38 with indecisive indicators up decent from mid Aug 2017 lows. Watching.

Dec 15 – $GSIT Trading 7.18 with MACD trending down. Will wait for a MACD turn for swing trade. Last report I stated that although the technical indicators appeared bullish that caution was warranted – the warning proved to be important as price did come under pressure. Now it’s a matter of allowing the chart to set-up for a long.

$AXP – American Express

Mar 5 – $AXP Trading 95.74 with indications trending down. Looking for 200 MA test.

Jan 23 – $AXP 50 MA support test with Stoch RSI near bottom and MACD trending down. Watching.

Dec 15 – $AXP trading 97.10 with indicators pointing down – watching for test and bounce of MA’s.

Nov 21 – $AXP American Express trading 93.95 Stoch RSI at bottom turn up MACD turned down SQZMOM turned down under 20 MA trending.

Wait for the MACD to curl back up and assess indicators for a long at that time.

$ABX – Barrick Gold

Mar 5 – $ABX Trading 11.54 with poor indicators. Watching.

Jan 23 – $ABX trading 14.51 over 50 MA under 20 100 200 MAs. Stoch RSI near bottom. Watching.

Dec 15 – $ABX trading 14.20 with indecisive indicators on daily chart but this could be close to bottom (IMO).

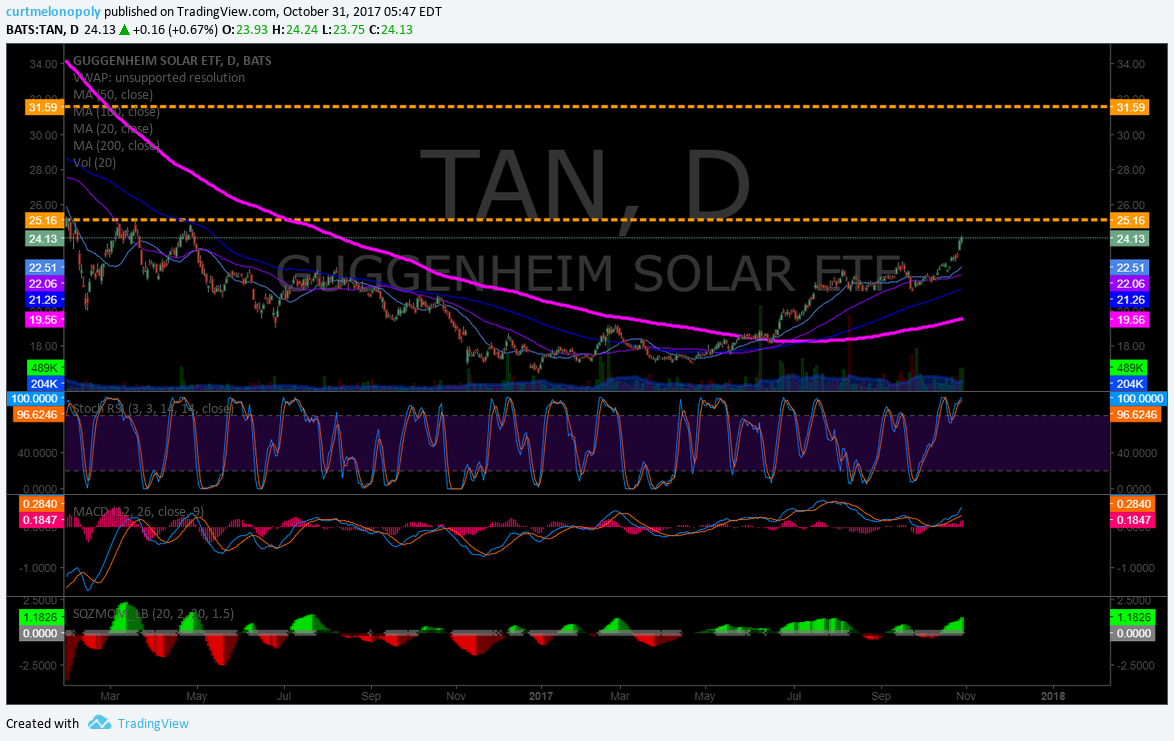

$TAN

Mar 5 – $TAN trading 24.31 with indecisive indicators on the daily chart. Watching.

Jan 23 – $TAN Solar ETF trending 20 MA test with Stoch RSI near bottom and MACD turned down. Watching.

Dec 15 – $TAN trading 24.48 with MACD about to turn up. Likely swing trade this one soon long. On high watch here.

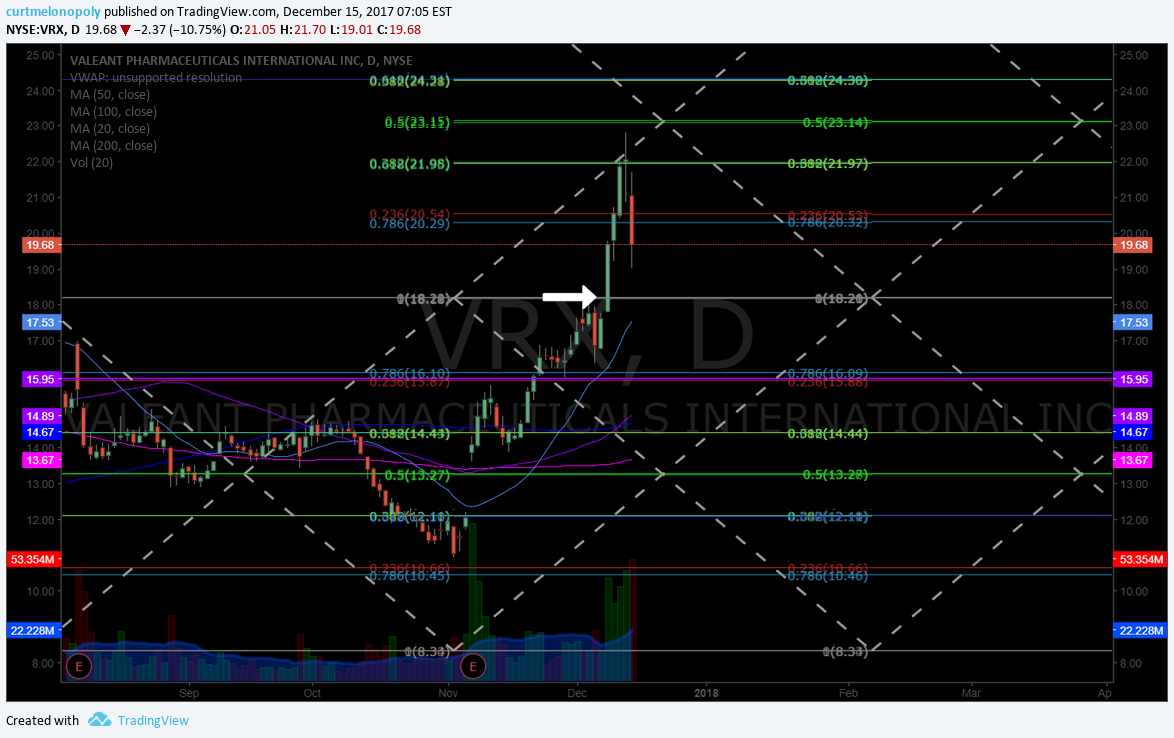

$VRX

Mar 5 – $VRX Trading 14.88 under 200 MA with all indicators trending down. Bearish.

Jan 23 – $VRX trading 22.03 with Stoch RSI near bottom but MACD is turned down. Will wait for MACD to curl up. #swingtrading

Dec 15 – $VRX is on the turn and the mid quad horizontal lines are excellent entries and trim profits as you go. #swingtrading

Quad wall resistance recently hit and price came off – so pay attention to the quads (diagonal Fib trend lines)

18.20, 23.15 and so on.

$TWLO

Mar 5 – $TWLO Trading 36.84 very bullish on weekly chart – waiting for pull back. Last report bullish bias was spot on.

Jan 23 – $TWLO Trading 26.24 with Stoch RSI turned back up, MACD trend up, SQSMOM up and price over 20 50 MAs under 100 200 MAs.

This is actually not a bad set-up…. so I will watch.

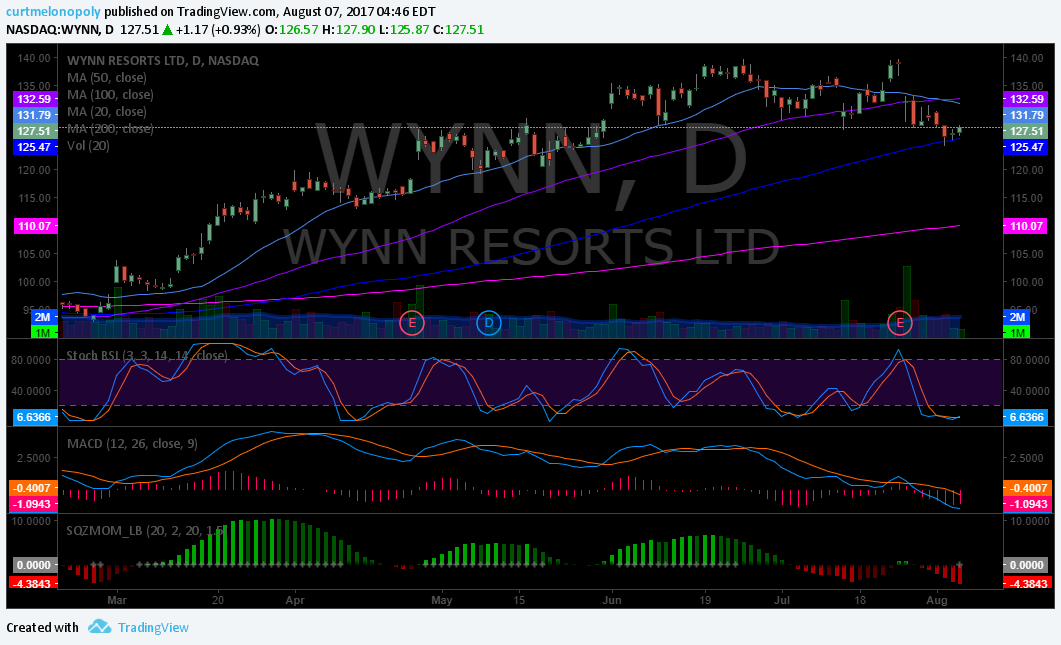

$WYNN

Mar 5 – $WYNN Weekly chart says caution long as MACD is turned down even though Stoch RSI says short term pop.

Jan 23 – $WYNN trading 195.23 on weekly chart Stoch RSI turned back up with earnings in 2 days.

Oct 31 – Trading 141.21 under 20 and 50 MA and about to retest 100 MA. It bounced at 100 MA previous so this is on high watch now also for a bounce. Post earnings with surprise upside.

$XME

Mar 5 – $XME weekly chart says wait for confirmation on Stoch RSI for long bias.

Jan 23 – $XME Weekly chart with price above 200 MA challenging historical resistance. Above the resistance area a possible long trade is possible pending set-up at that time. On watch here.

$WWR – Westwater Resources (Previously known as $URRE)

Mar 5 – $WWR Trading .79 with indecisive trade action and indicators. Caution.

Jan 23 – Trading 1.51 with flat indicators. Watching.

Oct 31 – Trading .81 and all indicators tanking.

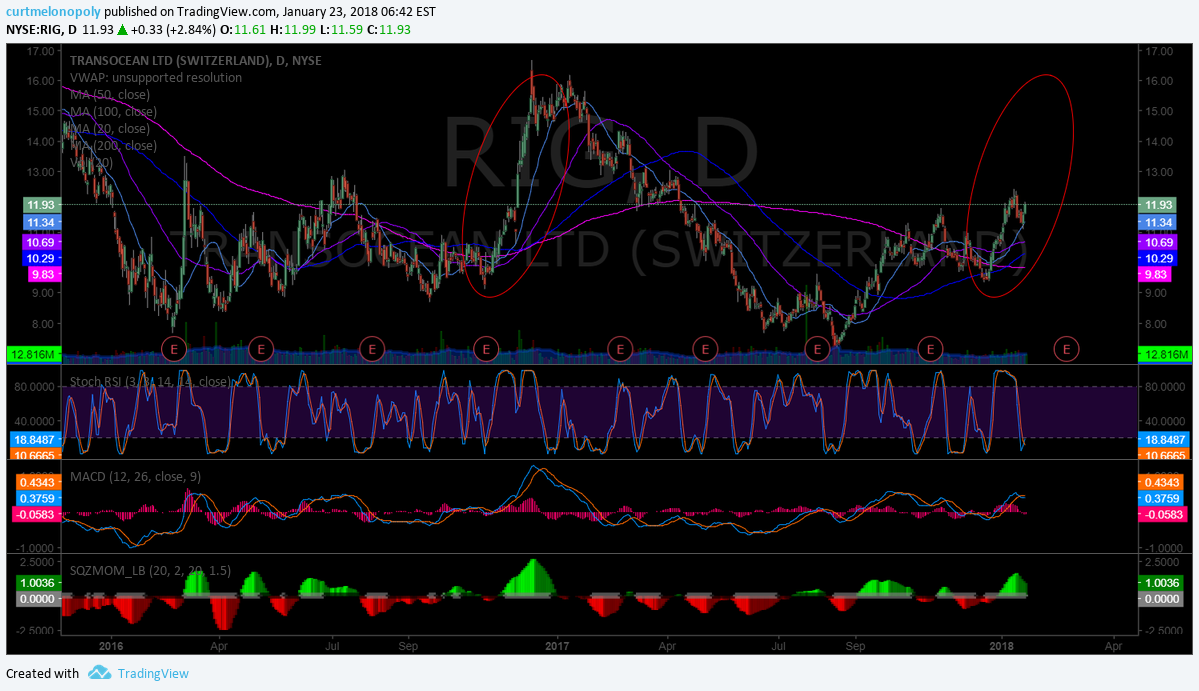

$RIG

Mar 5 – $RIG Trading 9.45 with indecisive indicators under 200 MA.

Jan 23 – $RIG trading 12.02 premarket with historical symmetry setting up intra-day that may be a good trade. #swingtrading

$XLE

Mar 5 – $XLE trading 66.44 with indecisive to bearish indicators under 200 MA. Caution.

Jan 23 – $XLE trading 78.03 near previous high break-out. On close watch now. #swingtrading

Oct 31 – $XLE Trading 67.69 and like $RIG and testing underside of 200 ma and it may get going again. Watching for MACD turn up.

$SLX – Vaneck Vectors Steel

Mar 5 – $SLX trending on dailing with indicators indecisive – waiting for a 200 MA test

Jan 23 – $SLX Steel ETF testing previous highs. On watch here now.

$X – United States Steel Corp.

Mar 5 – Trading 45.39 and exactly the same set-up / indicator scenario as $SLX. Watching.

Sept 23 – $X near historical resistance and previous high break out. On watch now.

Email or DM me on Twitter anytime with thoughts or questions!

Cheers!

Curtis

Article Topics; $TAN, $WYNN, $NFLX, $AXP, $TWLO, $VRX, $GSIT. $ABX, $XME, $URRE, $RIG, $XLE, $SLX, $X, Compound Trading, Swing, Trading, Stock, Picks