Swing Trading Report. In this Special Earnings Season (Member Edition) Sunday Aug 5, 2018: OIL $WTI $USOIL, SP500 $SPY, US Dollar $DXY, $SWIR, $GPRO, $NFLX, $GSIT, $AXP, $ABX, $TAN, $TWLO, $WYNN, $XLE, $XLF, $X, $RIG, $SLX and more.

What’s New!

- Interested in free swing trading setups? Click here to sign up for the Complimentary Swing Trading Report Mailing List.

- Now available for serious traders – Legacy All Access Membership.

Mid Day Trade Set-Ups Webinar Video:

IMPORTANT: This video gets in to detailed trading levels to watch in your swing trades and also had a number of how to use our charting explanations. Very important to review the video and not just the summary below.

Mid Day Member Webinar – Swing Trading Set-ups Summary (from Aug 3 mid day, published August 5, 2018):

Forward:

Swing Trading Special Earnings Season Report to cover trading the chart set-ups. Mid day review sessions will become the premise for our next major Q3 and Q4 positioning in the stock market.

We are reviewing all one hundred equities we have in coverage on our swing trading platform – all over the next ten days or so for earnings trading season.

Trade alerts are reviewed in this video that triggered today.

Be sure to actually watch this video as the summary below is only for reference and doesn’t give a whole picture for any of the trade set-ups listed.

All quoted support and resistance are approximate.

Published Aug 5, recorded Aug 3, 2018 Mid Day Swing Trading Review.

July 3 and July 10 Swing Trading Regular Reports are referenced in this special earnings report. Members can reference those two reports for charts you may need (or review the video) as all the charting is not included in the report below due to weekly reporting time constraints.

Tickers covered;

OIL $WTI $USOIL – expecting oil to settle in cradle at end of week. Video has quick review of model.

$DXY US Dollar – Up against resistance threatening to move in to its next bullish structure – long over 95.62, PT 96.70.

SP 500 $SPY – over 200 ma on 60 mi, support 278.60, resistance 283.77, that’s your range for Monday.

$SWIR Sierra Wireless – Momentum stock on the day reviewed on video (moving averages). Nearing 50 MA resistance on weekly chart.

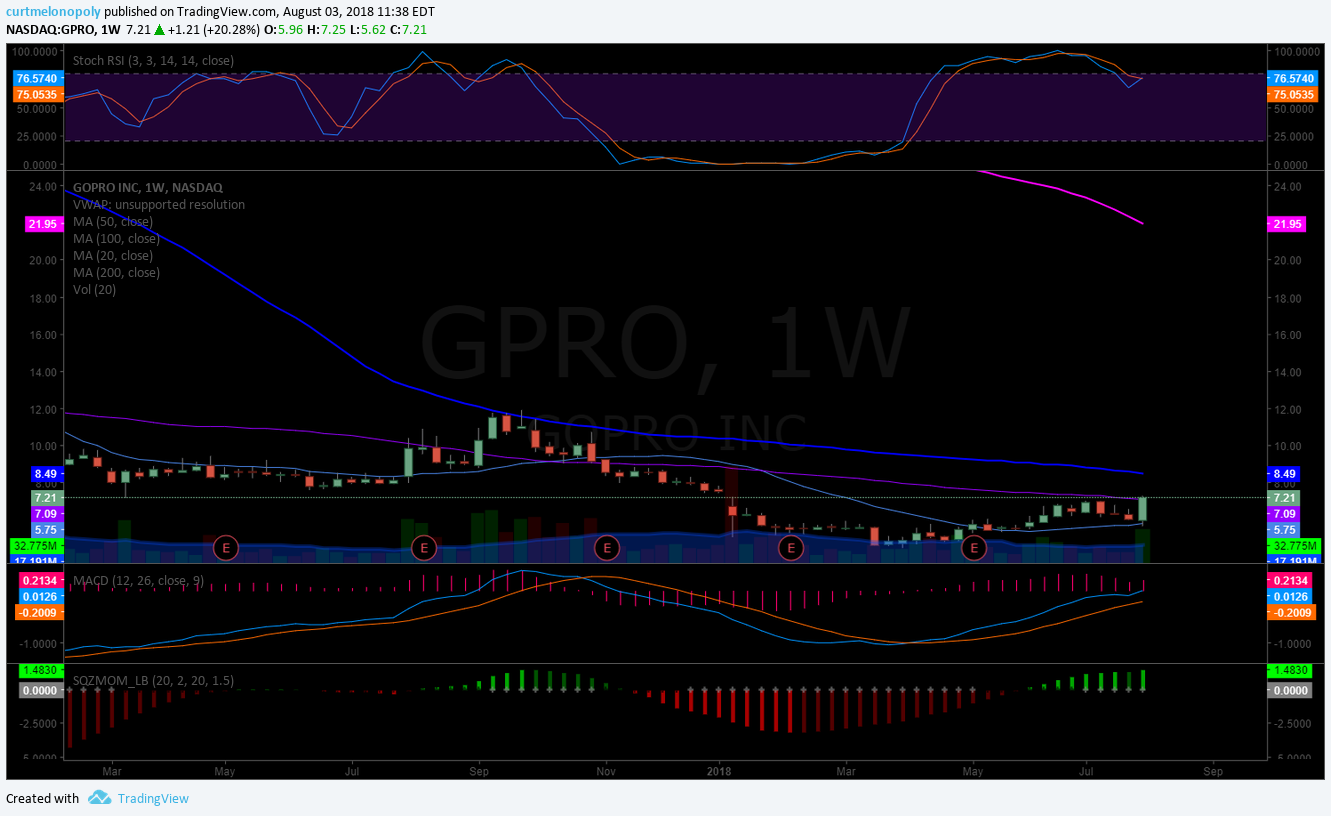

$GPRO GoPro – Testing 50 MA on weekly, up 20% on day, last time it used 100 MA for resistance.

Netflix $NFLX – 337.64 is main structural support. 421.70 is key resistance area. When it got the 200 MA on the hour previously is where we traded the buy sell triggers to the bullish side. 307.44 296.19 283.80 are supports and we’re looking for a long at end of retrace. At 309.70 I am interested in a long would prefer 284.18 could even sell in to 254.91 structural support. Detailed trendlines are discussed in video. Levels quoted will change on trend lines. 368.61 quad wall 377.20 200 MA 380.24 resistance area intra day. If I’m right we’ll get a bounce to the 379 area around 200 MA. Trading plan scenarios are discussed on video with various technical levels to watch.

GSI Technology $GSIT – Other side of earnings, has held previous lows, last report had indicators indecisive and it still is. Trade alert alarm set at 50 MA for a watch.

American Express $AXP – Was going to daytrade it and start sending out trade alerts on AXP but it keeps failing the break out I’m watching on the weekly chart. Indicators are flat and that’s a problem.

Barrick Gold $ABX – Main pivot has worked on charting alerted to members in the swing report. Likely sees the 8s before it bounces. Trading 11s.

Solar ETF $TAN – Same with this chart, the pivot has worked but there isn’t enough to make a bias decision.

TWILIO $TWLO – Daily chart, trending stock. Have to wait for earnings this week to make a decision.

$WYNN – Wash out territory on the daily. Sent out trade alerts on the $WYNN trade and we did okay but it is difficult to leg in to this trade. Set alarm to be alerted when Stochastic RSI turns.

Metals and Mining ETF $XME – Red line is a large structure weekly chart major pivot on the chart. Over 39.50 is a watch for a long side trade. Slight bullish bias.

Transocean $RIG – Not a clean set-up at this point. Support 11.76, 15.65 is resistance. 10.84, 9.71, 11.50, 7.84 in a sell-off.

Energy Sector Fund $XLE – Trading 75.05 Stochastic coming down on daily, over its previous highs it’s a long but it is really indecisive at this point.

Steel ETF $XLF – Daily SQZMOM on its way down but there is a pinch and coil on the 200 ma, slight edge to the bulls. The weekly chart looks better but it’s coiled around main pivot. It’s a decision area.

$SLX – MACD is coming down on weekly and indicators are indecisive at this point.

United States Steel Corp $X – Bear advantage. MACD on way down on weekly chart and has lost its 50 MA.

#swingtrading #earnings #tradealerts

Charts and Chart Links re: Member Version.

(Mailing list versions that may be made available from time to time may not include charting or chart links and may or may not be published in a timely rotation).

If you have any questions about this special earnings trading report message me anytime. If you do not know how to take advantage of algorithmic structured trading charts please consider basic trade coaching of at least 3 hours to get on the winning side of your trading – you will find details here.

Cheers!

Curt

I get a lot of Questions about How to Trade our models, this vid has 5 min explanation at 1:00 min-6:00 min. https://www.youtube.com/watch?v=QrXbE7lojAg&t=3s … – Fib Trendlines, Trading structure/quads, Price targets, Main support resistance (buy sell triggers), Time cycles, Moving averages, Trading trims/adds.

Promo Discounts End Aug 14!

Temporary Promo Discounts (for new members only).

Subscribe to Weekly Swing Trading Newsletter service here Reg 119.00. Promo Price 83.30 (30% off). Promo Code “30P”.

Or Real-Time Swing Trading Alerts Reg 99.00. Promo Price 69.37 (30% off). Promo Code “Deal30”.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform (Lead Trader).

Subscribe to Swing Trading Service:

Swing Trading Bundle (Swing Trading Newsletter and Live Swing Trading Alerts).

Swing Trading Newsletter (Weekly Newsletter Published for Traders).

Real-Time Swing Trading Alerts (Private Member only Twitter Feed).

One-on-One Trade Coaching (Via Skype or In-Person).

Free Mailing List(s):

Join Email List for Free Trade Charting Trade Set-ups, Deals, Podcasts and Public Webinars.

Free Swing Trading Periodical Contact Form (Complimentary Swing Trade Set-Ups to Email)

Public Chat:

Visit our Free Public Chat Room on Discord.

#swingtrading #tradealerts #trading #earnings

Follow Me: