How to Trade Pure Storage (PSTG) Earnings in Six Days.

Pure Storage technical swing trade chart set-up with buy / sell triggers and price targets.

May 16, 2018

What’s New

- Now available for serious traders, information here for our exclusive Legacy All Access Membership.

- 24 Hour Crypto Trading Desk opens mid May 2018 along with our Coding Algorithm Models for Machine Trading. This team is also responsible for alerting trades on the live Twitter alert feeds for all models. Formal announcements to follow.

PSTG Earnings Date

Earnings announcement* for PSTG: May 21, 2018

https://www.nasdaq.com/earnings/report/pstg

Below is the link for the real-time Pure Storage chart with all buy sell triggers and price targets;

The Pure Storage Swing Trade Set-Up

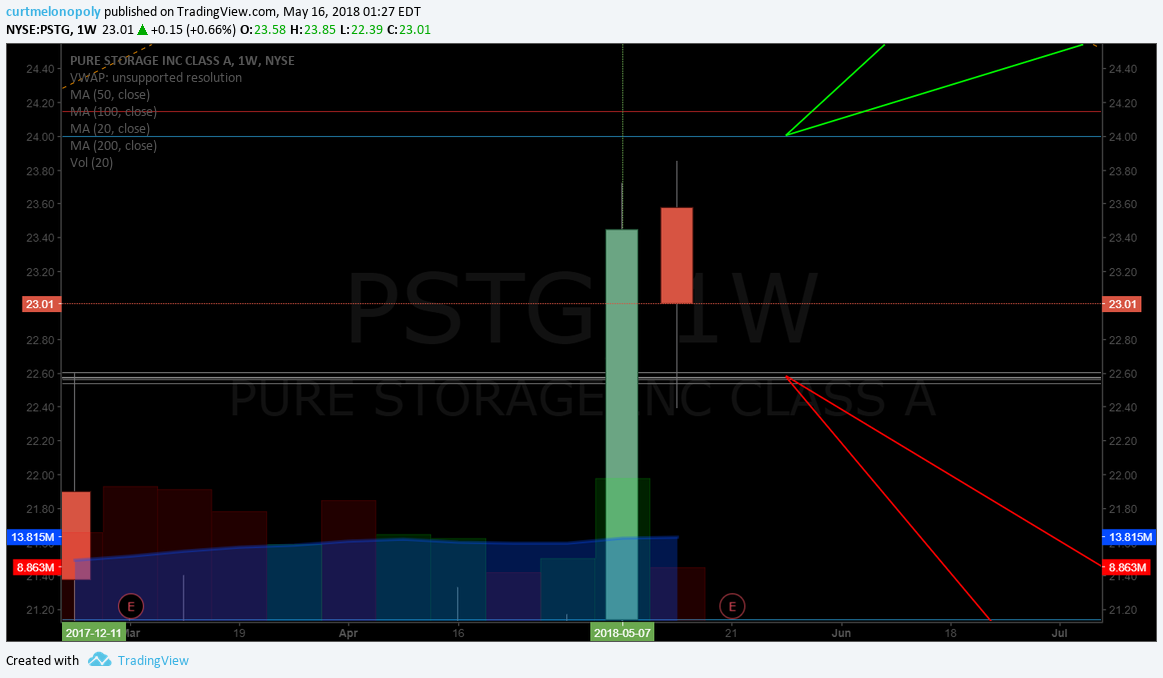

PSTG closed 23.01 Tuesday with earnings in six days.

Important trade support is at 22.50 area (gray horizontal line) also marked with a white arrow.

White arrows are the most important buy sell triggers on the chart.

Above 22.50 (give it some room) it is a long to next resistance 24.00 area (horizontal lines on chart are resistance / support lines depending on what side of the line trade is on). Next on upside is 24.14 and then 25.12, then 25.44 and 25.91 area.

Under 22.50 area it targets support at 21.14 and then 21.00 then 20.03 and 19.71.

Price targets on model to bullish side are 25.91 and really bullish 29.19 Oct 1 2018. Trade toward target with price action using support and resistance points.

Downside scenario has 19.23 and 15.92 (most bearish) price targets Oct 1 2018.

How to Trade Pure Storage Earnings in 6 days $PSTG #swingtrading by curtmelonopoly on TradingView.com

May 14 Article:

Pure Storage Clears Data Bottlenecks On Road To Artificial Intelligence https://www.investors.com/research/the-new-america/pure-storage-artificial-intelligence/?src=A00220&yptr=yahoo

In Closing:

A few hours of trade coaching or study on exactly how to trim in to resistance and how to add to your positions on winners and how to cut losses properly and quickly will return huge dividends.

You can subscribe to our Weekly Swing Trading Newsletter service here, use temporary Promo Code “30P” for 30% off Reg 119.00 Sale Price 83.30.

Or click here to subscribe and get 30% off Real-Time Swing Trading Alerts Reg 99.00 Sale Price 69.37 use temporary Promo Code “Deal30” for 30% off.

I personally guarantee our swing trading service is one of the best in the business and it’s very reasonably priced considering the technical expertise invested in the platform.

Any questions feel welcome to contact me anytime.

Good luck with your $PTSG Pure Storage earnings trade and if you need any help message me anytime!

Best,

Curt

If you are not already on our Free Swing Trading Periodical email list follow the link here to get on it to receive trading set-ups in the future. Unsubscribe anytime.

Connect:

Register to free email list for trade set-ups, webinars, special events: https://compoundtrading.com/contact/

Website: https://compoundtrading.com

Free chat room: https://discord.gg/2HRTk6n

Subscribe: https://compoundtrading.com/overview-…

Twitter: https://twitter.com/CompoundTrading

Lead Trader: https://twitter.com/curtmelonopoly

Tradingview: https://www.tradingview.com/u/curtmel…

Facebook: https://www.facebook.com/compoundtrad…

StockTwits: https://stocktwits.com/compoundtrading

Email: https://info@compoundtrading.com

Compound Trading Platform: Algorithm model charting for $SPY, $VIX, #OIL, #GOLD, #SILVER, #Crypto ($BTC Bitcoin, $ETH, $LTC, $XRP,) $DXY US Dollar and Swing Trading Newsletter. Live trading rooms for daytrading and oil traders. Private coaching and live alerts.