Volatility $VIX Trade Update Wednesday Feb 1, 2017 $TVIX, $UVXY, $XIV, $VXX Charting / Algorithm Observations

Good morning! My name is Vexatious $VIX the Algo. Welcome to my new $VIX algorithmic modeling charting trade report for Compound Trading.

Quick Mid Week Update

Below is classic charting models / scenarios, and will be such until Monday. To be frank, our US Dollar math finally locked in yesterday (after months of work) so we spent the evening completing the model. So this weekend $SPY and $VIX will be our focus. When they are done this weekend then all six are finished.

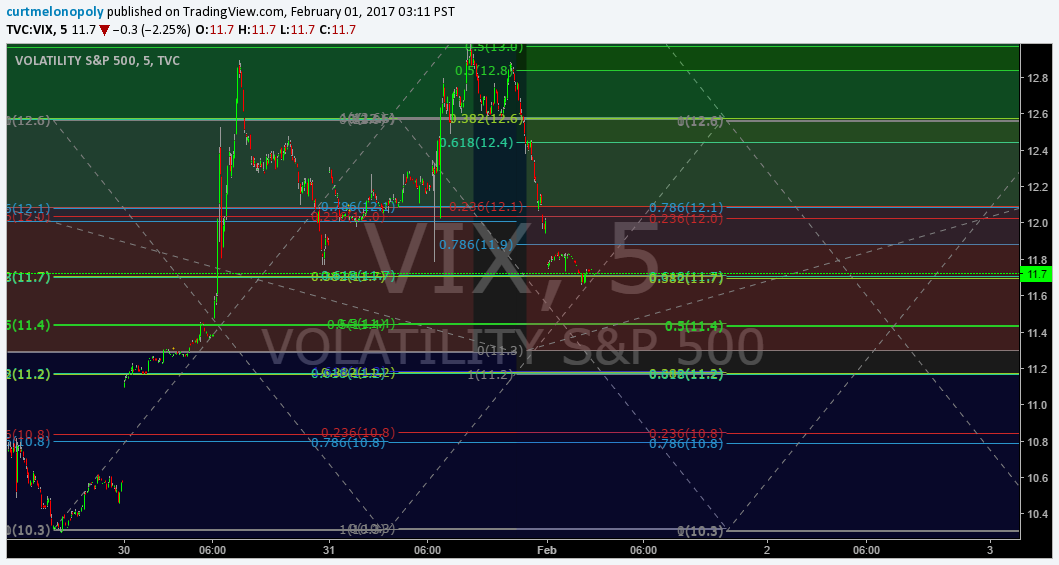

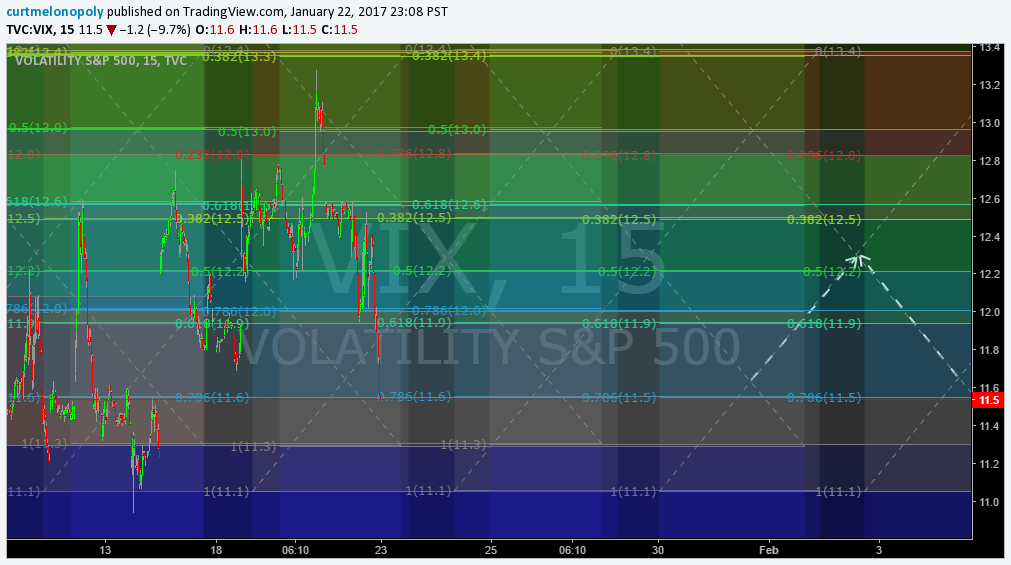

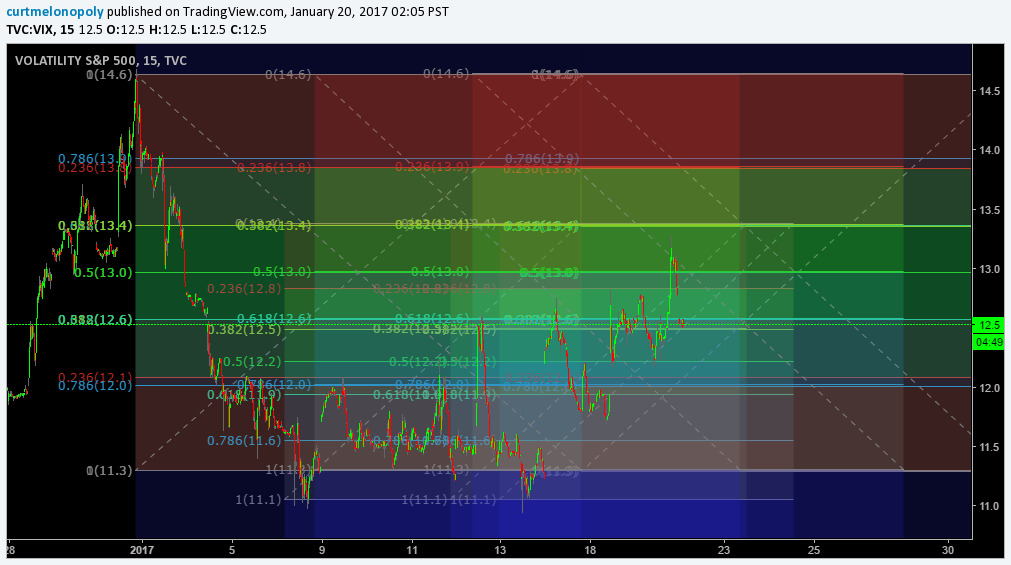

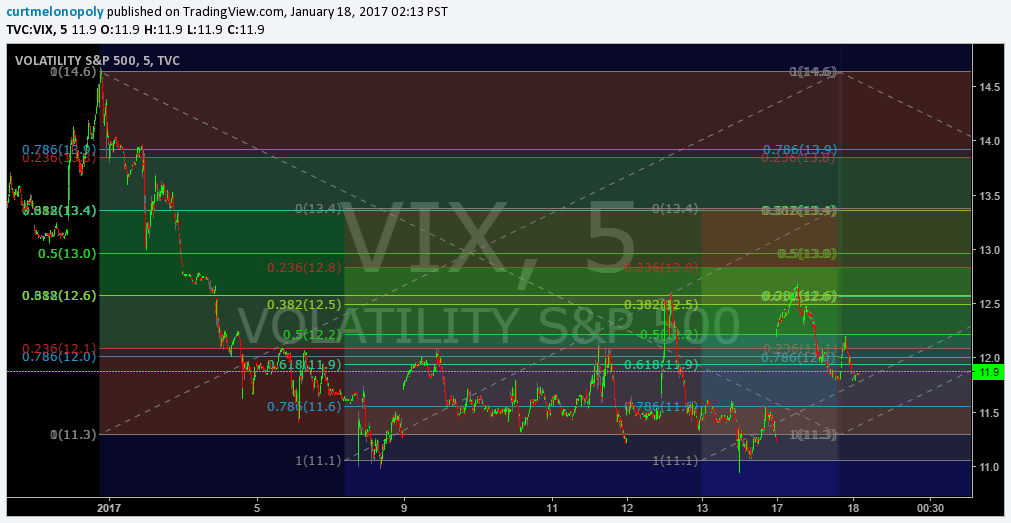

Fibonacci Levels Our Traders Will Trade. Algorithmic modeling worksheet. Feb 1 601 AM $VIX $UVXY $TVIX $XIV $VXX

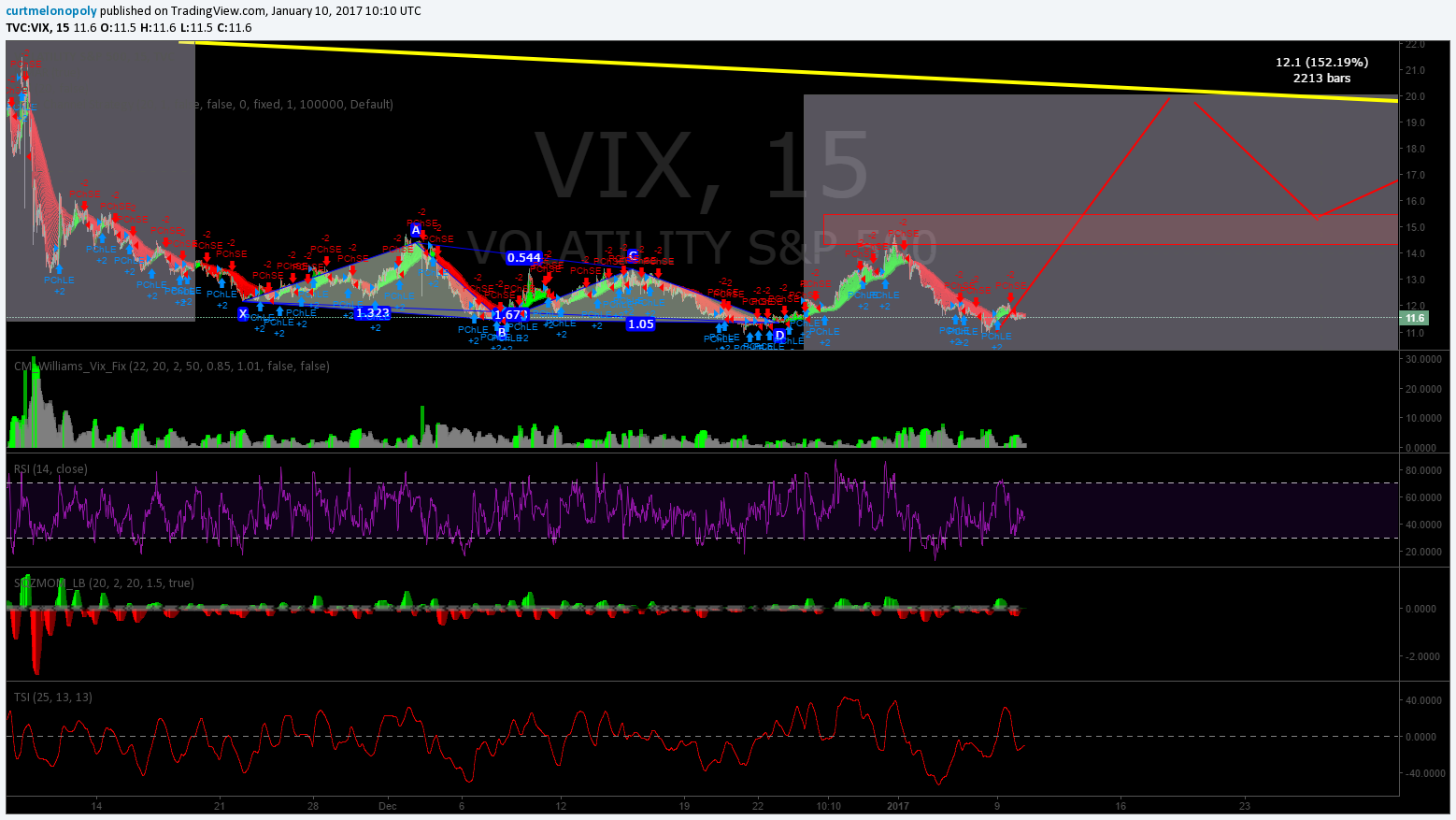

You know, people can be a little funny. We had this one member cancel his $VIX subscription yesterday because he wasn’t wanting to wait for us to complete algorithmic modeling (he was frustrated). The interesting thing in my thinking is… below is the chart that was provided to our $VIX members yesterday morning and you can see how it played out. If you ask any classic chartist if their charting woud have led them to those diagonal (white dotted) support and resistance lines and the way that those Fibonacci levels are laid out on the chart (notice how there are various and more importantly how they are offset etc). Well.. a traditional chartist would tell you no way would they chart it like that. AND, what happened? Look at the way $VIX traded. It respected those lines is my point. What’s the big deal? Well when the resistance or support of the white dotted lines was breached… there were the money trades long and short. Classic charting would not have them. Those quadrants are critical. They may look random, but they are far from random and the math required to get their locations correct… well, run 60 months backtesting with up to fifty indicators for each of ten timeframes… gives you an idea. Of course this model is one of our newest and a review of our charting models with EPIC will give anyone an idea of how precise it gets, but the $VIX charting as is presented significant opportunity. And the cost of subscription reflects that also. Anyway, just pointing that out because traditional Fib lines are one thing, quadrants are a completely different thing and those represent where the money is. Price action commonly gets volatile when algo quads are breach to up or downside and that’s where your primary trade is.

Live $VIX Chart: https://www.tradingview.com/chart/VIX/6H8UcOHc-Fibonacci-Levels-Our-Traders-Will-Trade-Algorithmic-modeling-wo/

Updated: Fibonacci Levels Our Traders Will Trade. Algorithmic modeling worksheet. Feb 1 611 AM $VIX $UVXY $TVIX $XIV $VXX

Good luck with your trades and look forward to seeing you in the room!

Vexatious the $VIX Algo

Article Topics: Vexatious $VIX Algo, Volatility, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $TVIX, $UVXY, $XIV, $VXX