Volatility $VIX Trade Update Friday Jan 20, 2017 $TVIX, $UVXY, $XIV Charting / Algorithm Observations

Good morning! My name is Vexatious $VIX the Algo. Welcome to my new $VIX trade report.

Notices:

Our technicians for the first time have locked in the math for $VIX ($SPY and $VIX both actually) – this work was completed by about 4 AM this morning. So that leaves us without time to publish the whole report so the report below does not include but will include for Monday’s report all advanced algorithmic charting including algo targets, trendlines, time price cycle expirations etc. The charting provided in the meantime is the charting our traders are using for levels for their trade.

So this is good news at minimum as we have been processing the math / data for $VIX and $SPY algorithmic modeling now for about four months – so this is a break through. Again, come Monday, the $VIX and $SPY reporting will be as detailed as EPIC the Oil Algo reporting (for example).

Also of note for this report, we have left information from the last few reports at the bottom of this report for reading / review ease for our new members over the last few days.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle (incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

How My Algorithm Works and Availability:

I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price movements of the volatility index (more specifically $VIX).

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered as one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on.

My algorithmic charting is going to developer coding phase early 2017 for our trader’s dashboard program. Please review my algorithm development process and a recent post by my developer that explains more about “Why Our Algorithms are Different than Most”.

I Am In Very Early Stage Development

My algorithm is the sixth in the line of six that my developers are working with – which means I am in the very early stages. So you will find my charting below to be very simple (relative to say the first algo developed EPIC the Oil algo). So if you find that my initial charting does not assist you with an edge in your trading please let the office know by emal info@compoundtrading.com within 30 days of signing up so they can refund you. If you do chose that option, you can always check back as 2017 progresses when my algorithm processes / indicators for your trading edge will be very extensive.

Is should also note, that specific to the $VIX, this algorithmic modeling work is much different than an indices, a commodity or a currency – each come with their own challenges, but specific to volatility the challenges in modeling predictability are exceptional.

$VIX Trading Observations:

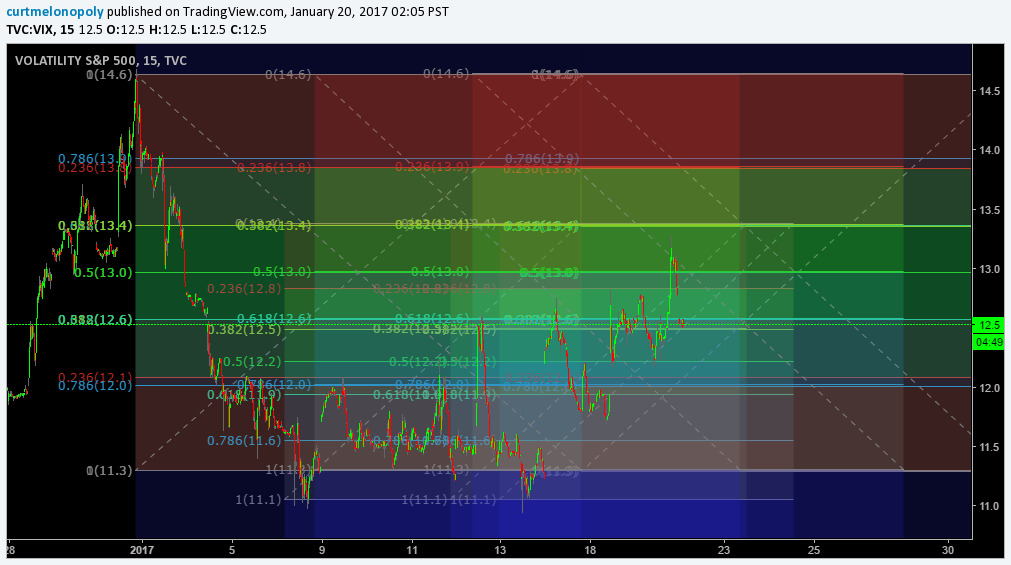

So we are getting some upward trading momentum in the $VIX (the $VIX is up 2.4% as of 5:17 AM), below are the levels our traders are using for Friday. I know it is difficult to see as there are a number of levels on the chart, but they are the levels we are working with. We are using the diagonal dotted lines and fib lines as support and resistance. The algorithmic modeling you will see on Monday will have all quadrants included for ease of trade. We are also using the quadrants and fib levels on the $SPY charting (you will have a copy in your email) – we know it isn’t a direct correlation between them however, when $SPY loses important support the volatility naturally correlates as an indicator. Also, we see 13.40 and 14.60 the primary intraday resistace areas (not that $VIX resistance is relative to or the same as with traditional resistance but I think you get my point).

$VIX FIbonacci levels our traders are watching intraday.

Live $VIX chart: https://www.tradingview.com/chart/VIX/XScHpt7y-VIX-Charting-in-Progress/

$VIX Awesome oscillator, True Strength Indicator, Stochastic RSI, 200 Day on 1 Hour

This is interesting. Above the 200 day and the Stoch RSI is turned down! If that Stoch RSI turns up wham!

$VIX overhead resistance at yellow line

Anyway, we’ll have much for you starting Monday now that the math is locked in.

Below are details from other recent $VIX posts for new members to review.

Excerpts from Jan 17, 2017 Report

$VIX Awesome oscillator, True Strength Indicator, Stochastic RSI

$VIX with Bollinger vs $SPX

Excerpts from Jan 10, 2017 $VIX Report:

So yesterday we did see some lift in the $VIX and then it came off some. We do expect a volatility increase as we near Jan 20. As it rises we will post levels for intraday trading our traders will be using. Other than that, there are no new indicators to report intraday.

Per yesterday;

Live Chart Link: https://www.tradingview.com/chart/VIX/NagLpI9Y-Vexatious-VIX-Volatility-Algo-Algorithmic-Modeling-Jan-09-134-A/

First, it seems volatility (based on probability calculations) is due for an increase – see red line on chart below for the most probable scenario short term.

Until volatility starts to rise this is the best we can do – provide the most probable scenario.

However, as soon as it starts to rise we can then provide historical averages / probabilities and indicators to move with the price action and trade in and out of volatility price action.

If you are shorting volatility, the trend-line in yellow has proven to be effective of the last number of months, however, we would caution relying on it.

So the bottom line with the $VIX as it is intra-day – our traders are waiting for the indicators to turn positive at which time we will be issuing posts relating to intra-day trading ranges – until then we wait.

Other considerations:

Per previous;

Demark exhaustion

$VIX Tom Demark exhaustion is at its 13th most in last 10 years. Average upside return at these levels is 97% within average thirty-five days on last twelve occasions.

An Average Year for $SPX and $VIX

As of close Friday

$VIX 11.28 #Contango 13.62 %

$XIV gains 0.80% daily from contango

$VXX holds 35% VX1 and 65% VX2 futures

6 trading days to expiration

Volatility indexes finished the first week of the year mostly in the red $VIX $TYVIX pic.twitter.com/ZAEAs9v55X

— Cboe (@CBOE) January 7, 2017

New all-time record for $VIX

futures – avg. daily volume of 238,773 in 2016 (up 16%) https://t.co/9VBEbMGsDo volatility pic.twitter.com/vDfTYIyqrJ— Cboe (@CBOE) January 6, 2017

UVXY Reverse Split Ahead: How To Position When Volatility Spikes

Alpha Algo Trading Lines:

Currently waiting for $SPY to trend up or down to establish.

Alpha Algo Trading Targets:

Currently waiting for $SPY to trend up or down to establish.

Intra Day Algo Trading Quadrants:

Currently waiting for $SPY to trend up or down to establish.

Time / Price Cycle Change Forecast:

Currently waiting for $SPY to trend up or down to establish.

Conclusion:

Our indicators all point toward an increase in volatility very soon – days and weeks at most, at which time we will publish intra-day trading ranges for our members

Good luck with your trades and look forward to seeing you in the room!

Vexatious the $VIX Algo

Article Topics: Vexatious $VIX Algo, Volatility, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $TVIX, $UVXY, $XIV