Volatility $VIX Trade Update Monday Jan 9, 2017 $TVIX, $UVXY, $XIV Charting / Algorithm Observations

Good morning! My name is Vexatious $VIX the Algo. Welcome to my new $VIX trade report.

Notices:

Algorithmic Charting: Below you will find the first in a series of charting posts to come over 2017. Each post will bring more and more detailed indicators.

New Service Options: We now also offer a stand-alone trading room option now vs. bundle (incl. trading room, premarket newsletter, alerts). Plans from $1.22 per day w/ promo code.

How My Algorithm Works and Availability:

I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on individual merit) such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and other mathematical factors. I do not yet have AI or Geo integration – only math. I am not a high frequency or bot type algorithm – I am to be used (represented on a chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price movements of the volatility index (more specifically $VIX).

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader). This work, and your subsequent trading, should be considered as one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on.

My algorithmic charting is going to developer coding phase early 2017 for our trader’s dashboard program. Please review my algorithm development process and a recent post by my developer that explains more about “Why Our Algorithms are Different than Most”.

I Am In Very Early Stage Development

My algorithm is the sixth in the line of six that my developers are working with – which means I am in the very early stages. So you will find my charting below to be very simple (relative to say the first algo developed EPIC the Oil algo). So if you find that my initial charting does not assist you with an edge in your trading please let the office know by emal info@compoundtrading.com within 30 days of signing up so they can refund you. If you do chose that option, you can always check back as 2017 progresses when my algorithm processes / indicators for your trading edge will be very extensive (late Jan ish).

$VIX Trading Observations:

Live Chart Link: https://www.tradingview.com/chart/VIX/NagLpI9Y-Vexatious-VIX-Volatility-Algo-Algorithmic-Modeling-Jan-09-134-A/

Volatility is like no other algorithmic modeling we are working with (to date). The modeling as described above is in very, very early stages. Nonetheless, here are some considerations;

First, it seems volatility (based on probability calculations) is due for an increase – see red line on chart below for the most probable scenario short term.

Until volatility starts to rise this is the best we can do – provide the most probable scenario.

However, as soon as it starts to rise we can then provide historical averages / probabilities and indicators to move with the price action and trade in and out of volatility price action.

If you are shorting volatility, the trend-line in yellow has proven to be effective of the last number of months, however, we would caution relying on it.

So the bottom line with the $VIX as it is intra-day – our traders are waiting for the indicators to turn positive at which time we will be issuing posts relating to intra-day trading ranges – until then we wait.

Other considerations:

Demark exhaustion

$VIX Tom Demark exhaustion is at its 13th most in last 10 years. Average upside return at these levels is 97% within average thirty-five days on last twelve occasions.

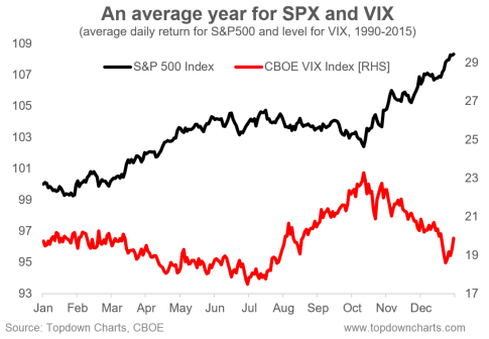

An Average Year for $SPX and $VIX

As of close Friday

$VIX 11.28 #Contango 13.62 %

$XIV gains 0.80% daily from contango

$VXX holds 35% VX1 and 65% VX2 futures

6 trading days to expiration

Volatility indexes finished the first week of the year mostly in the red $VIX $TYVIX pic.twitter.com/ZAEAs9v55X

— Cboe (@CBOE) January 7, 2017

New all-time record for $VIX

futures – avg. daily volume of 238,773 in 2016 (up 16%) https://t.co/9VBEbMGsDo volatility pic.twitter.com/vDfTYIyqrJ— Cboe (@CBOE) January 6, 2017

UVXY Reverse Split Ahead: How To Position When Volatility Spikes

Alpha Algo Trading Lines:

Over the coming days we will establish these based on indicators intra-day price action.

Alpha Algo Trading Targets:

Over the coming days we will establish these based on indicators intra-day price action.

Intra Day Algo Trading Quadrants:

Over the coming days we will establish these based on indicators intra-day price action.

Time / Price Cycle Change Forecast:

Over the coming days we will establish these based on indicators intra-day price action.

Conclusion:

Our indicators all point toward an increase in volatility very soon – days and weeks at most, at which time we will publish intra-day trading ranges for our members

Good luck with your trades and look forward to seeing you in the room!

Vexatious the $VIX Algo

Article Topics: Vexatious $VIX Algo, Volatility, Stocks, Wallstreet, Trading, Chatroom, Algorithms, $TVIX, $UVXY, $XIV