January 3, 2018 Crude Oil Trading Strategies from mid day review in the oil trading room with lead trader.

Voice starts at 3:58 on video. My apologies for the construction workers in background, there are a couple short intermissions in video to discuss noise with renovators 🙂

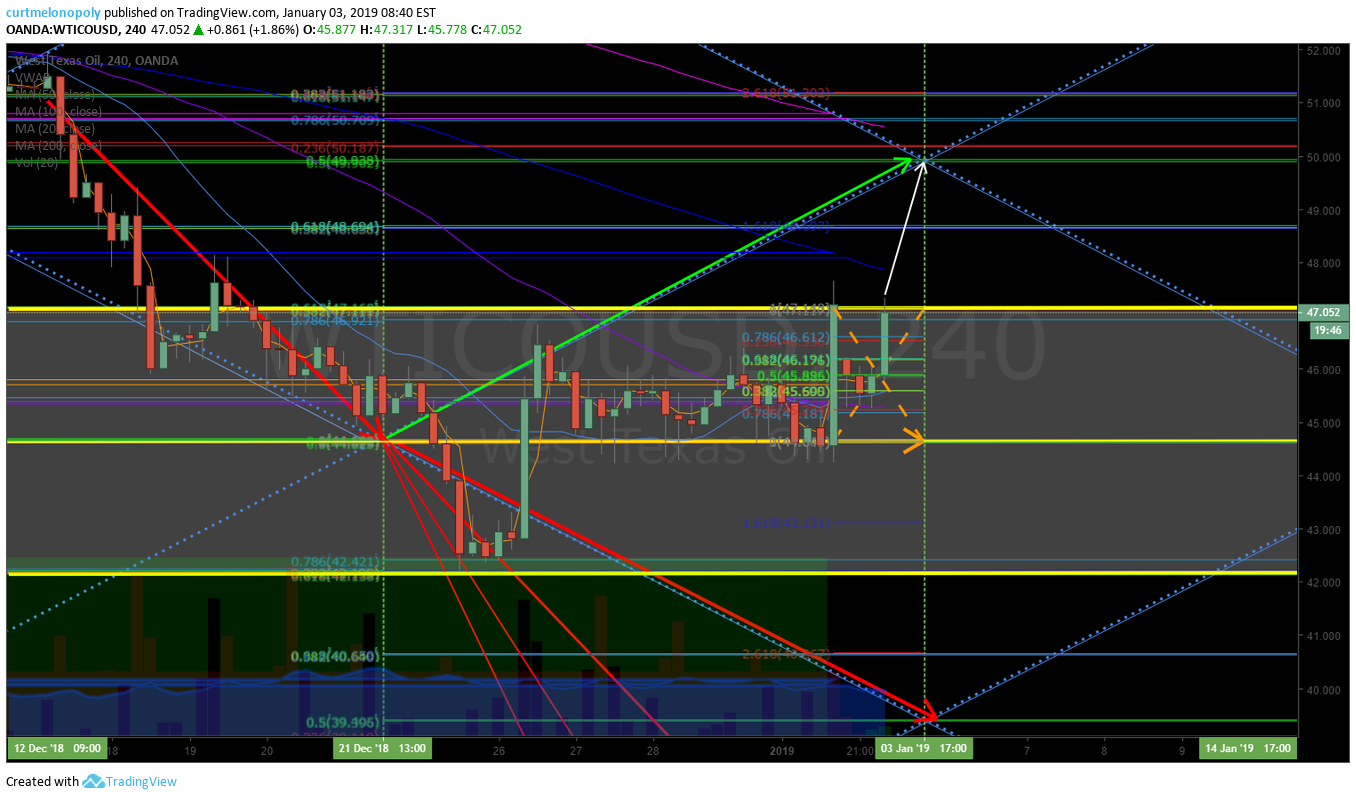

Crude oil trading strategies reviewed in our oil trading room from today. Crude oil trade set-ups on oil charting for Jan 3, 2019.

We don’t expect trade to normalize until next week in crude oil.

Sideways trade since December 20th 2018. Price of crude sold off near 41.00 price target.

On 240 Minute oil chart trading box (trading range) 47.14 resistance 42.18 support (FX USOIL WTI). Simplified EPIC Oil Algorithm model for sizing in swing trades. Time cycle conclusion today on the charting.

Bullish price target 50.00 in time frame, bearish price target unlikely mid quad 44.63 and lower most bearish 42.20 area 39.45 area lower quad support. EIA tomorrow these will be main levels to watch.

Machine trading protocol reviewed at 7:30 reviewed on video. Timing, structure, price on model, order flow etc explained. Order flow is still missing from holiday trade and we don’t expect the machine trade to be active until next week – explained on video. Also explained on video are the large block order flows in crude oil trade that triggers the machine trading oil trade alerts. We expect alerts to be 5 – 10 x in January of what was alerted in Dec for example. All explained on video.

EPIC Oil Algorithm model discussed at 9:00 on video – how structure etc is sloppy through holiday trade.

15:30 machine trade sizing spigot chart reviewed, sloppy holiday trade or consolidation – possible retrace bottom.

Weekly trendline oil chart 16:20 is reviewed and support is discussed. Also the retrace fib targets are discussed.

At 17:00 on daily oil chart are discussed. A bit on structured charting is also discussed. Daily chart price targets in to future reviewed on video.

At 20:00 minutes on video the primary resistance and support areas are discussed for intra day trade, futures and EIA tomorrow.

#Crudeoil #Trading #Strategies