Crude Oil Trade has been on a rally for some time. A retrace is in order, but how how far will oil retrace? What is my personal oil trading strategy? What is my bias – bullish or bearish in to time cycles?

To be clear, I am very bullish oil based on various geo-political set-ups or probabilities. That’s my fundamental bias – bullish oil, the reasons would take a book to explain and that’s not our focus here anyway. The focus here is to know the key areas of support and resistance on the primary time frames to trade oil this week for profit. So this post will focus on that and the regular EPIC oil algorithm report will be out soon.

Here’s my personal trading plan (strategy) for crude oil…

The recent run up in oil caught me off-guard, prior to the run-up I was on a multi-week winning streak. Where the change in streak for my trading occurred was when I changed time frames and algorithmic models – I was testing some machine trading models we are coding.

Anyway, that’s water under the bridge and I’m ready for the next.

Below is a break down of what I see coming in my personal oil trading strategy near term. First lets review a few crude oil charts on a few different time frames…

Crude oil weekly chart with key areas of support and resistance in trading box to watch.

The trading box on the weekly chart provides an upper resistance starting at around 75.30 and a lower support area starting at around 72.93.

The diagonal Fibonacci trend lines provide an up trend resistance at around 74.75 and down trend support nearing 73.50.

Neither is absolute (the trading box or Fib trend lines), but they are marks to watch. The way that crude oil trades is that every key decision is to be watched for a turn, you never know which will cause a turn so you make your move based on what has happened at each decision.

The weekly charting structure is a large structure and the trading box should be weighted significant in anyone’s trading plan.

Crude oil daily chart with key resistance and support areas of trade on watch.

On the daily chart the trading box offers support starting at around 73.26 and has a range of support to about 73.00 which puts it about 7 cents off where the weekly chart trading box support is at (starts). Intra-day in Sunday night futures FX USOIL WTI is trading 73.69 and hit a low of day in this session so far at 73.53.

If oil rally’s again, the daily chart says 79.09 area is the start of significant resistance in the trading box range. If you reference 79.00 ish on the weekly chart that brings trade to the upper region of the Weekly charting resistance also. The two time-frames do not concur exact, but they are similar.

Also of note, the 20 MA is at 71.96 intra-day (an indicator to consider).

Symmetry on this daily chart structure says 80.00 Nov 28 and 86.70 Jan 25 are in play if rally re-starts.

And yet another structure to consider… but only consider as it relates to symmetry possible. The channel may also be in play (white arrows). The rule of trade should be to EPIC’s oil algorithmic charting model, the charts included in this special report like this one are provided for consideration only.

Trade in crude oil near algorithm channel support or resistance in up channel or down channel is an obvious area to start entries.

The support and resistance areas of the trading channels on the EPIC algorithm are the most obvious areas to secure a turn in trade – these I will be respecting and trading with as serious of focus as I can muster going forward. The support and resistance areas of the channels work. Take your entry, keep your stop tight because you can always re-enter. When trade is near support or resistance simply use a 5 minute time frame and time in accordance to intra day trade and use a stop, keep it tight, and re-enter as needed. Five small scrapes for a trade that can move through the quad range is a small price to pay.

Last but not least there is significant range support near 72.53 on the crude oil algorithm model that I will respect in my trade plan.

So what’s the bottom line to my crude oil trading strategy going forward?

It doesn’t matter how many time-frames you chart oil on there is no way to get the various time-frames to concur, oil is just that way. Because oil trade is that way it is critical to use a rules based process for your trade execution.

The most predictable way that I have found is to use the algorithm model support and resistance at the channel signals. If you respect those areas of the algorithm and viciously respect tight stops understanding that you can always re-renter then you will do well. If you let fear or bias play with your mind you will fail. How do I know? Trust me, I’ve been trading the algorithm model since inception and I can tell you without a doubt that respecting its structure works and not respecting it causes embarrassing losses. A rigid system of trade works.

Anything I can do to help you with your trading let me know.

Thanks

Curt

October 8, 2018 6:54 AM Crude Oil Trading Strategy (Intra-day) Update

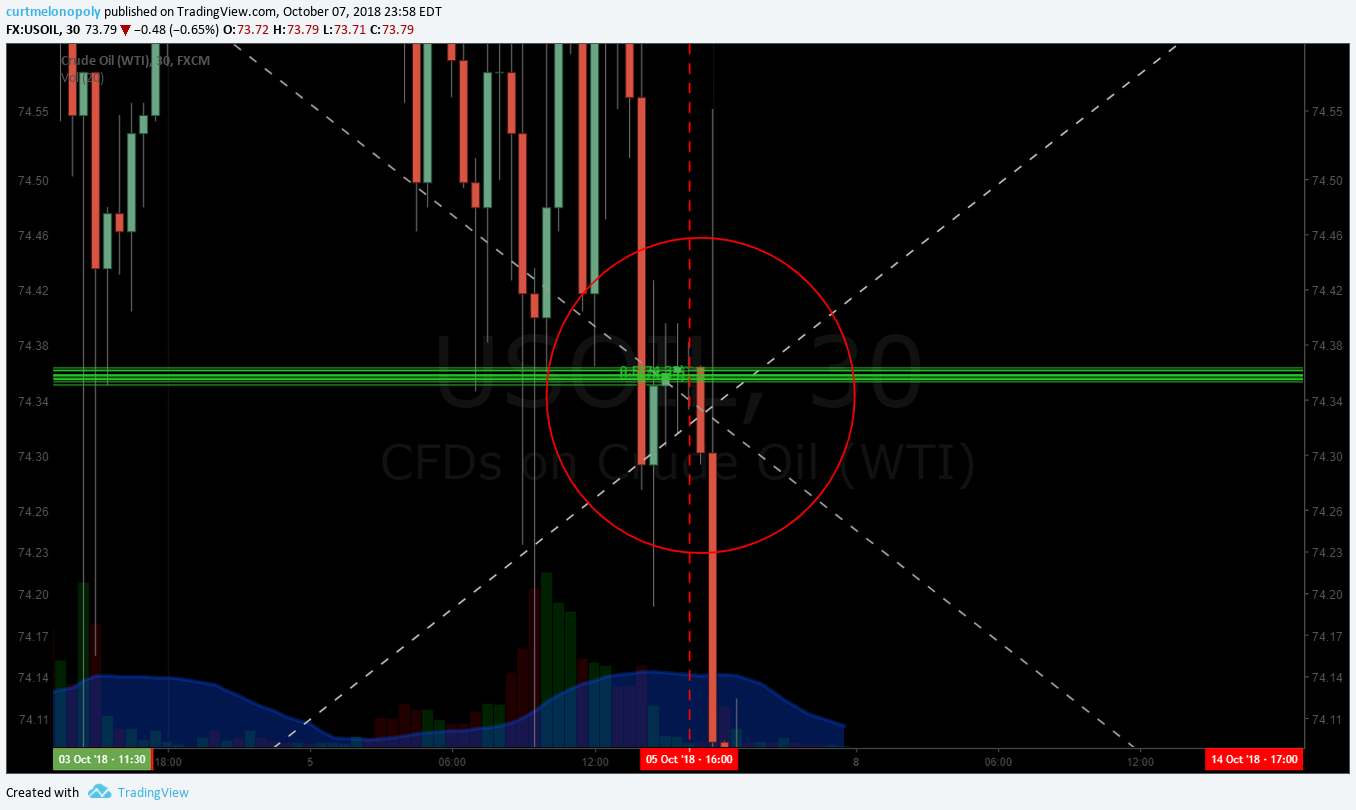

Below is an updated crude oil algorithmic chart update with the oil daytrading range I am monitoring. Also noted are the price targets expected.

Intra-day Oil Trading Strategy FX USOIL WTI CL_F USO #oil #trading #strategy https://www.tradingview.com/chart/USOIL/8JOAcTlF-Intra-day-Oil-Trading-Strategy/