Wednesday Dec 14, 2016 EPIC the Oil Algo Oil Report (Member Edition). FX: $USOIL $WTIC ($USO, $UCO, $SCO, $CL_F, CL, $UWT, $DWT, $ERX, $ERY, $GUSH, $DRIP)

Welcome to my new FX: $USOIL $WTI oil trade report.

NOTICES:

IMPORTANT ALERT: We will try and do a better job not relying just on our broadcasting voice alerts in the room because there are folks that are on cell phones that can’t hear our audio alerts so we will do our best to type the details of a trade etc intraday in the room text box. It will be easier when our full time staff are in the room in the new year because a lot of that load will be taken of the shoulders of the traders. AND, if you get kicked off because you lose service on your phone and you sign back in and you lose track of conversation just tell us in the room and we’ll email you the text you missed while you were away from room (as long as we have time). And finally, we will have the text alerts going over next few days but they won’t be perfect until early Jan when our staff are with us.

NEW: There is a new feature blog post at this link, “Why our Stock Algorithms are Different than Most.” If you are using our algorithms it is a must read.

ETN’s: $UWTI and $DWTI have been resurrected by CitiGroup! $UWT and $DWT http://uk.reuters.com/article/usa-investment-etn-idUKL1N1E31ZB

LOCKED POSTS: Starting mid December the Member Editions will become available (be unlocked to general public) within days of original publication. Portions that include algorithmic calls and charting that are still in play will not be published until they expire.

MULTI-USERS: Institutional / commercial platform now available for multi-users – pricing and product information will be posted to website soon.

LIVE CHARTS: Live charting for members of my algorithmic modelling is now available on Trading View. Links are now emailed to members regularly.

PATENT PHASE: As I mentioned I am now in patent application phase. Stay tuned for agreements concerning disclosure and use coming to members.

24 HOUR TRADE ROOM: My charting transitions from FX $USOIL $WTI to 24hr crude oil futures early 2017. My sub service w incl 24 hr crude oil trade room.

PRICING: My proprietary services transitioned recently from free inaugural to subscriber only access. All rates for existing members for all service prices will be grandfathered in perpetuity (view website products page for conditions). Early 2017 when my 24 hour futures trading room opens along with 24 hour live charting I will have a rate increase but as with recent roll-over existing members will be grandfathered at locked-in current rates.

SOFTWARE: My algorithmic charting is going to developer coding phase early 2017 for our trader’s dashboard program. Please review my algorithm development process and about my oil algorithm story on our website www.compoundtrading.com and my oil algo charting posts on my Twitter feed.

HOW MY ALGORITHM WORKS: I am an algorithm in development. My math is based on traditional indicators (up to fifty at any given time each weighted on win ratio merit) – such as simple math calculations relating to price and volume, Fibonacci, simple pivots, moving averages, Gann, Schiff and various other charting, geometric and mathematical factors. I do not yet have AI or Geo Political integration – only math as it relates to traditional indicators – weighted, with the primary goal being probabilities. I am not a high frequency or bot type algorithm – I am to be used (represented on a traditional trading chart) as a probability indicator to give our trader’s an edge when triggering entries and exits on trades with instruments that rely on the price of crude oil (specifically FX: $USOIL $WTI and transitioning to futures in the new year in our new 24 hour oil trading room).

Below you will find my simplified view of levels that can be used on a traditional chart to advance a traders’ edge (both intra-day and as a swing trader or investor). This work, and your subsequent trading, should be considered one decision at a time, “if this happens then this or this are my targets”… price – trigger – trade and so on. If you need assistance email your questions to info@compoundtrading.com, message our lead trader on Twitter, or message a lead trader privately in the trade room.

FX: $USOIL $WTI Observations:

Today will not be a detailed report as data has not changed much from the last two days so you can use those and today’s report, the live charting link provided and the trade room as your guide as needed.

Here is the new : Live EPIC the Oil Algo Live Trading Chart Link

https://www.tradingview.com/chart/USOIL/ifp01Csh-MEMBER-ONLY-LIVE-OIL-CHART/

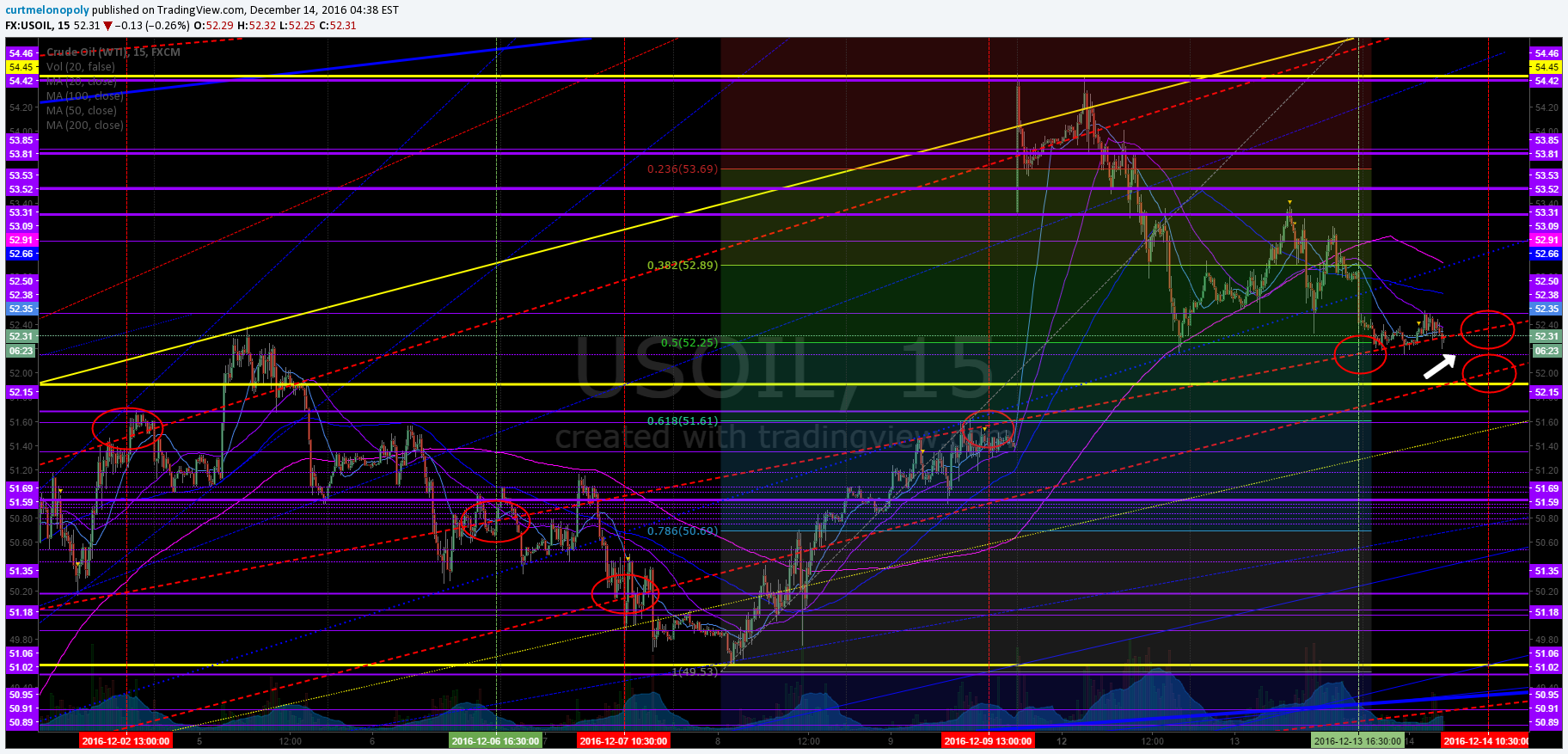

Price of crude trading in the range between the major support and resistance. Yesterdays market action had crude come off and HIT THE TARGET ZONE for the Tueday 4:30 time (not perfect but trade-able target for sure). Alpha algo targets are in site for Wednesday 10:30 AM now and Friday 1:00 PM (you will see them on chart).

Intra-day Crude Oil Trading Range: At time of writing FX $USOIL $WTI is trading at 52.34 (507 AM ET Dec 14, 2016). Some thoughts with respect to traditional charting that may help advance you trading edge:

Multi Week Trading Range / Swings:

Note: Be carfeul with the prices you see in the purple boxes on the right – they do not line up on chart for price action (they are for indicators).

For swings, trade between the yellow lines – they are your primary support and resistance. If price gets up over that upper yellow line at 54.49 the trade between that line as support for longs as long as it stays above and ratchet up your stops when it gets close to major resistance at 54.49, 55.17, 58.37 and 58.57. There are of course other support and resistance lines – but those are they big ones.

Also, pay attention to the upward trending channel – you can enter long and sell in between the channel yellow lines as it trends.

If price stays below the resistance at 54.49 then you trade the channel under that.

I have been waiting for an opportunity to take a long position at a yellow line support. I have been patient with that because the price of crude has been so aggresive I thought it would come off to those lower targets it hit yesterday and looks like it will hit today at 10:30 AM. So I will likely take a long position (not for sure) but if I do my stop will be fairly tight. Ideally you want a long position at supports way down at channel bottom. But we’ll see how it goes in the room.

If you have any questions email info@compoundtrading with direct questions for direct answers. Or ask in the trade room in a private message to the lead trader.

Diagonal Trend Lines:

Diagonal trend-lines (blue). Diagonal trend-lines are critical inflection points. Please review many of my recent posts so you can learn about how important these diagonal trend-lines are. If one is breached you can look to pull-back to next diagonal blue trend line about 90% of the time. Also pay attention to how thick the lines are – the thicker the line the more important because they represent extensions from previous time / price cycles.

There is one diagonal trendline above intra price and on two below (blue diagonal thin lines trending up). Look at the chart above – you will see where the diagonal trendlines are trending – WATCH THEM CLOSE. And remember you can come in to the chatroom to message the trader and REMEMBER I have posted a live chart link earlier in this blog so if you can’t see the lines well on this chart above you can go to the live chart link and watch for member live algo chart links through-out the day in your email inbox!

Price Action with 20, 50, 100, 200 MA

So here you have a conflict. On the 15 minute chart the price is trading under the 200 MA – which is a BEARISH SIGNAL intra-day. And below it is not on the 30 minute chart – the price is above. Watch this really close because price under the 200 MA on the 30 minute could send price down to lower targets on the chart for Friday. I marked on on the chart lower for Friday.

Fibonacci Levels:

I have left the Fib lines on this chart from yesterday because things haven’t changed. However, you can see tighter trading Fib lines in the trading room at times when I’m locking in on a trade or if you subscribe to Trading View you can set them yourself real quick. Watch these lines for support and resistance. I don’t use them as tradtional retracement levels with crude because the algo lines etc are more dominant. But the Fib lines are excellent indicators for intra-day trade support and resistance.

Horizontal Trend-Lines (purple):

Horizontal trend-lines are not as important as the other indicators reviewed above, however, they do serve as important resistance and support intra-day for tight trading and they are important if thick (in other words they come from previous time / price cycles). WE STARTED TO REPRESENT THE REALLY IMPORTANT LINES IN YELLOW FYI FOR EASE. Refer to chart for current applicable horizontal trend-lines.

Advanced Charting:

Respect support and resistance lines:

If you can be patient and take your long and short positions against these yellow lines for now that is your highest probability trading. With the recent geo political mess it makes the algo targets difficult because crude is not trading in its “natural” state that occurs when the geo political banter stops.

Crude oil is still bullish – but there is a high probability that crude oil either visits the bottom of the channel yellow lines (diagonal) either this Friday or early next week – the Fed speak may have some bearing on this too so stay tuned!

Oil Time / Price Cycles:

Time / price cycles are the single most important indicator I use as a trader and EPIC’s record with them is near 100% – and that’s since inception seven months ago. The reason they are so important is that I as a trader do not want to be holding a crude oil instrument at a termination of a time cycle if I am not absolutely sure if price will go up or down. I will however go really deep in advance of a time price cycle termination IF THERE IS A HIGH PROBABILITY OF A DIRECTION IN PRICE if we are trading at a really important pivot area. In other words, if we were trading at the bottom of the upward trending channel at a support (yellow lines) and I knew there was a significant time cycle about to terminate I would go really heavy with a long. The price really spikes or drops hard when these important time cycles terminate. Fantastic plays.

The problem with time / price cycle terminations is that they change from minute to minute (depending on where price is on the chart) so you have to be in the trade room to get the alert – now we will do everything we can in future to send these on SMS but I want to be careful because it can be difficult with so much going on in the room. The reason they change is because they are actually represented by or are geometric shapes in the chart – I know it sounds weird but we’ve hit them just shy of 100%. And the oil political guys know the same thing and they ALWAYS TIME THEIR BIG ANNOUNCEMENTS AROUND THESE TIME CYCLE TERMINATIONS. So if you can picture a triangle on the chart – and price is trading in the triangle – and price is going to come to the edge of the triangle and there is a significant support or resistance or an algo line terminating there too or a target (those type of things)… then we know there is a high probability of a time and price change. In other words, its where there are clusters of algorithm points that cross and when price is going to cross over that cluster is where they are. And these are represented on all the different time frames – the larger the time frame – the larger the time price cycle terminate – the larger the spike or downdraft. This is where we establish our intra-day qudrants from for sniping trades (which we will put in to the room soon because it looks like the geo political rhetoric is over for a while making them more predictable). Difficult to explain in short. So we will do our best to SMS alert these in future.

Also, the real large or important time / price cycle terminations we know far in advance and they can be put in these newsletters. Right now there are no large significant time cycles identified – there are smaller ones that affect intra-day price but no significant ones identified.

If you review EPIC’s Twitter feed, blog posts and his story on our website you will get a feel for how accurate these are.

Alpha Algo Trading Trend-Lines (Red dotted lines):

To determine which algo line is most alpha (or probable) intra day, it is the nearest line to price action. This can also help you determine the trend of trade. If the algo line is trending up the price will follow it up until price is tested at an algorithm indicator (the main tests are diagonal trendlines, horizontal trendlines, time / price cycles etc – as I have shared with you). This is why it is important to watch all the lines because they are all support and resistance. To keep it simple trade the range as I’ve mentioned but keep an eye on these indicators.

The alpha algo trendlines are on the chart above.

Current Alpha Algo Targets (Red circles):

I can report that the alpha algo primary probability target prediction from last week for Wednesday December 7 at 10:30 as a direct hit for that time / price cycle. And so did the Friday target at 1:00 PM as a direct hit! And yesterdays target was a hit! As I mentioned at the beginning of this post! Very trade-able calls – excellent!

So what is your most probable algo target for Wednesday at 10:30 EST and Friday 1:00 EST? Your closest target that crude is trending toward is always the most probable. Crude is currently trending toward a target (red circles on chart) Then, your second most probable is the one that is up or down trend depending on whether general price is in an upward or downtrend for the most recent week or so and what your other indicators look like (such as the MA’s I explained above).

The other way to determine which targets are in play is actually quite simple, you will notice that crude trades between the channel lines up and down and up and down and there are various support and resistance along the way. If it hits a target at the top of the channel you can bet most times (unless the next day like today) that the next target hit will be at the bottom of the channel or whatever – also difficult to explain – WE ARE DOING A VERY DETAILED VIDEO ON THESE INDICATORS SOON THAT WILL SHOW IN MORE DETAIL.

The targets for this week are represented on the chart above and for the ones above you will need to follow the algo lines. Again, refer to the live charting I send you for this also or be in the trading room.

Wait for the price to trend toward a target and take your position and watch as price gets closer and closer to the target. Remember, that the machines trade from decision to decision – or in other words from support to next resistance or resistance to next support or when the times come each week on Tuesday Wednesday and Friday they will trend toward the target that market price action determines they go to.

Our lead trader will explain more in the room and do not hesitate to ask our lead trader in the room by private message or on twitter to explain intra day decisions.

Also, please be sure to refer to the most recent post for your algo targets (there is an additional target as mentioned on the chart above now of course also).

Oil Intra-Day Algo Trading Quadrants:

Well we just got to a point where we were in a trading range and the quadrants were getting locked in last week and the geo political interference caused the break-out in crude oil price. So we need to wait now for Wednesday targets to expire and maybe Friday – but we’re getting to the point where we’ll be able to get aggressive with them soon because I am convinced the geo political catalysts will settle down for a while.

Indicator Methods:

As explained above, my algorithm is a consideration of up to fifty traditional indicators at any one time – each one given its own weight in accordance to its accuracy (win rate). This is how we establish the probability of specific targets hitting (we call them alpha algo targets).

Alpha Algo Targets, Algo Trend-lines, Algo Timing, Quadrants for Intra Snipes:

Algo targets are the red circles – they correspond with important times each week in oil reporting land. Tuesday 4:30 PM, Wednesday 10:30 AM and Friday at 1:00 PM. The red dotted diagonal lines are the algo trend-lines. And the vertical dotted (red or green) are marking the important times each week. You will find that the price of crude will hit one of the alpha algo targets about 90% of the time. In the absence of market direction the machines take price to the next algo line and/or target. Understanding how the price of crude reacts to the algos and how they move price from target to target is critical for intra-day and swing trading crude oil and associated instruments.

You will notice that price action of crude will use these algo trend-lines and act as support and resistance, and that price also often violently moves when an alpha algo line is breached either upward or downward.

We cover this in much more detail in the member updates, trading room. A review of my Twitter feed and previous blog posts will help you understand the relation of these indicators. We will start posting video blogs (for my subscribers) on YouTube (in addition to my daily blog posts) for swing traders that work during regular trading hours.

Also… we will cover how to establish algo trend-lines and price targets future forward (as you have seen me do on my Twitter feed for some time now).

Conclusion:

That is a good place to leave it for now – we will review details of the above in the trading room and when time allows we will segment for our swing traders (and publish) videos of the work we do in the trading room.

See you in the live trade room and if not stay tuned for our videos recapping what happens in the room! And again, if you struggle to know how to use these indicators as a trader’s edge, it is recommended that you obtain private coaching prior to trading a real account with real money – we recommend you use a paper trading account at first. And finally, we will be publishing a “how to use guide” within a day or so, but it will be simply be a recap (consolidation) of instructions in this post, from my Twitter feed, and previously published information on our website. You can also send specific questions to our email inbox at info@compoundtrading.com – if you do this be sure to ask a specific question so it can be answered specifically. When the 24 hour oil trading room opens you will have ample opportunity in that 24 hour room to ask questions also.

Watch my EPIC the Oil Algo Twitter feed for intra day notices and your email in box for member only material intra day also.

EPIC the Oil Algo

Article topics: EPIC the Oil Algo, Crude Oil FX: $USOIL $WTI, $UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT, $ERX, $ERY, $GUSH, $DRIP, Chart, Algorithm, Indicators, Trading Room, Trading Edge, Fibonacci, Indicators, Algo, Targets