Using the S&P500 to Confirm Momentum Correlates: $SPY/$BZUN Model Structures

In this video, we cover the following topics:

- Using volume and price action on the S&P500 to determine sentiment

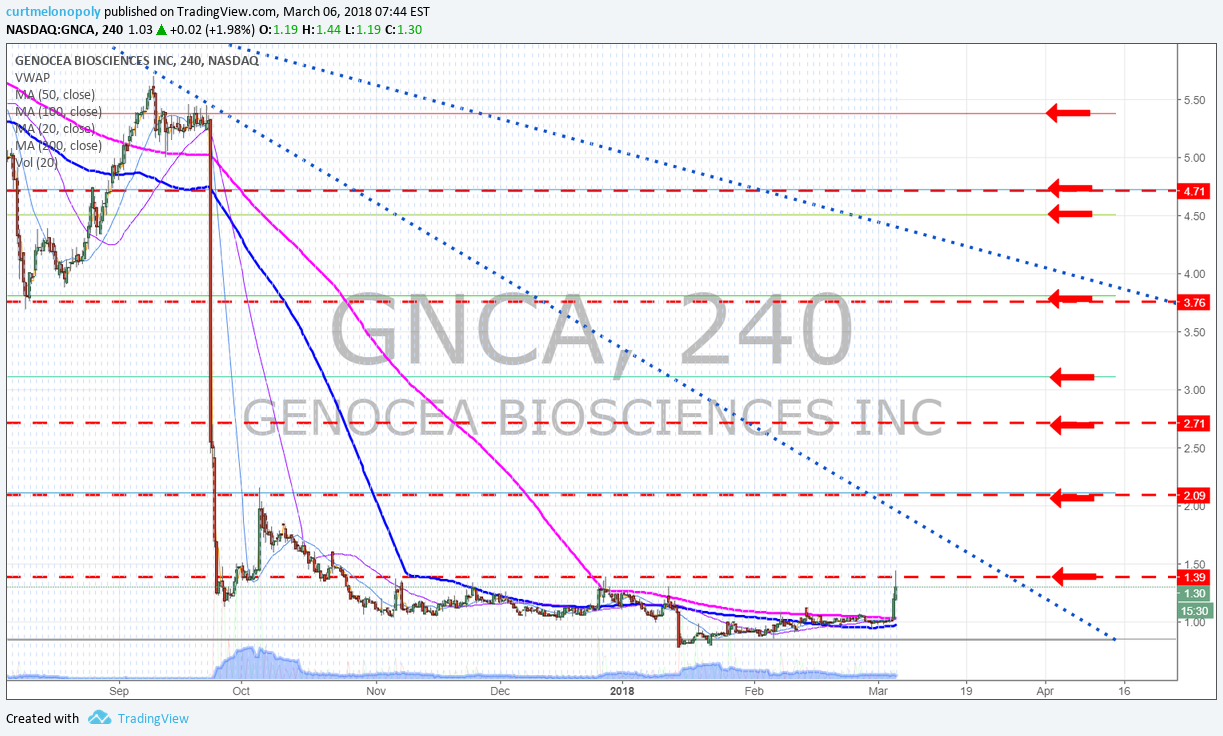

- Geometric chart setups and major algorithmic support/resistance lines as buy and sell triggers

- How to trade [morning] momentum stocks using chart setup triggers on the $SPY to confirm trade entry confirmations

- Creating on-the-fly technical/algorithmic models and correlating price action in that equity against the market

Note that the above example runs into some problems with low-float stocks, with regards to the liquidity of some equity x. With highly liquid stocks, bullish/bearish correlates against the $SPY back-test well with @FREEDOMtheAlgo.

—

Join our swing newsletter mailing list for complimentary trade setups and technical analysis like in the video above: https://compoundtrading.com/swing-trading-periodical-contact