Compound Trading Chat Room Stock Trading Plan and Watch List Friday Oct 6, 2017 $SWCH, $SHOP, $VERI, $ROKU Gold, Oil, $WTI, $XTBUSD – BITCOIN, $BTCUSD, Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notices:

Notes in red text below are new comments entered specifically today.

Today’s Live Trading Room Link:

http://compoundtrading1.clickmeeting.com/livetrading

Live Alerts for Oil, Gold, Swing Trading, Day Trading, Bitcoin are now available by following specific alert Twitter feeds.

Disclaimer / disclosure: Every subscriber must read this disclaimer.

Private Capital Fund / Personal Trading Going Forward:

We are now also trading for the private capital fund which will bring some slight changes.

The financing or our business build-out was planned to occur by way of either retail memberships, institutional memberships or private fund trading. The retail market is still early and slow on the uptake of the requirement toward #IA intelligent assisted trade (within six years our estimation is that most retails traders will all need it, but until then we’re not waiting and we’ll just be ready on the other side of that awareness curve). The institutional membership growth has been strong and to be sure we meet our growth trajectory goals (development completion timeline targets for launch of digital “intelligent assistance” #AI algorithm models) we are engaging the implementation of a private capital fund.

A few things of consideration:

- Following my trades is never condoned. Trade alerts are for the purpose of alerting awareness to something important occurring so that a member can form a thesis of trade and they are also for the purpose of learning when I win and win I fail. This (following trades) will be more difficult going forward because my frequency of trade will considerably increase.

- Trade Alerts. The trade alerts (swing and day) are not guaranteed at any time (in and/or out) however, it is important to note that with a much higher frequency of trade I will be alerting only those trades I expect to last a few hours or longer. If you ask me for targets or thesis type questions on the alert feeds or otherwise it is unlikely you will receive a response. Trade review videos will be posted for that purpose as required.

- Type of Trades. We will be trading the algorithm models (the seven we have), day trading and swing trading for the fund.

- Trade Sizing. When I alert to the trading room or on a feed I will be alerting the size only specific to the membership base trading. In other words, the size of trade for our private fund will not be disclosed.

- ROI Objective. We are trading under the goal / target of returning 100% per month. 50% would be very good and 25% is the minimum goal. So at minimum we are looking for 25% ROI per month compounded over 24 months. The fund size and/ or members will not be disclosed.

- Term of Project. The term is 24 months (as mentioned above). It is a personal & stakeholder legacy fund / goal retirement project. Others we train as we progress will continue the legacy fund thereafter (as will they continue with our trading services at large).

- Trading Platform on Screen. You will see at times (when I am trading my small daytrading account) my actual IB trading platform on the screen. When I trade my accounts (any of them) they may or may not be connected to various other private fund accounts (at different percentages etc).

- Sizing Considerations. Because we are also trading for the private fund, there will be trades we cannot take that I may otherwise take because the fund trade size will make it difficult for me to chip in and out of and other related liquidity issues.

Reporting and Next Gen Algorithms:

EPIC Oil $USOIL $WTI algorithm is now considered complete and ready for coding phase, Rosie Gold $GLD $GDX algorithm model is complete Gen 3 and has entered Generation 4 modeling (that is EPIC the Oil Algo level), $SPY, $SILVER and $DXY Generation 2 models and $VIX Gen 1 are delivered. $Bitcoin $BTCUSD #crypto was released Sept 1.

Master Class Charting Series Webinars:

All members received a copy in their email inbox as we progress. Full series will be posted to website at a cost of 2999.99. Early adopter members receive it free.

Attendees to next Master Classes being held in Dominican, Columbia and Panama attendees will receive 50% credit to off-set travel costs. Limited space FYI. Looks like a master class will happen in Columbia Jan 2018 – will advise.

Connect with me on Discord.

https://twitter.com/CompoundTrading/status/880670140454637569

Recent lead trader blog / video / social posts:

How to Use EPIC Oil Algorithm: $USOIL, $WTI, $CL_F, $USO, $UCO, $SCO, $UWT, $DWT, #OIL, #OOTT: http://youtu.be/hawVV31G9bg?a via @YouTube

https://twitter.com/CompoundTrading/status/889148655785177088

How to Use ROSIE Gold Algorithm: #GOLD, $GLD, $XAUUSD, $GDX, $GDXJ, $NUGT, $DUST, $JNUG, $JDST

https://twitter.com/CompoundTrading/status/889147527278333952

Recent Mid Day Chart / Trade Set-Ups:

See You Tube for other recent video posts.

Sept 19 Trade Set Ups $ARRY, $AAOI, $HMNY, $VERI, $SPY, $EPZM, $XBTUSD, $BTC https://www.youtube.com/watch?v=ZvtMmsETa70&t=3913s … #trading #premarket #rulesbasedtrading

Sept 19 Trade Set Ups $ARRY, $AAOI, $HMNY, $VERI, $SPY, $EPZM, $XBTUSD, $BTC https://t.co/QOfRSxeFzP #trading #premarket #rulesbasedtrading

— Melonopoly (@curtmelonopoly) September 21, 2017

Sept 15 Trade Set-Ups $PI, $SNAP, $ARRY, $VERI, $TTOO, $MRTX, $HMNY…

Sept 14 Trade Set-ups Review $NATGAS, $HTZ, $FENG, $WTI, $JKS, $VERI…

Sept 12 Trade Set-ups Review $CVS, $PI, $XXII, $TTOO, $ARWR, $HCN, $SHOP, $ABEO …

Unlisted

Sept 6 Trade Setup Review $ATHX, $GIII, $LFVN, $NDLS, $ZKIN, $SPY, $VIX, $USOIL, $WTI and more…

Q2 2017 Swing Trading Results are available here: P/L Realized Gains: $99,452.00 Percentage Portfolio Gain 105.74% (~35% per month)

https://twitter.com/CompoundTrading/status/896897288798392320

Trading Plan (Buy, Hold, Sell) and Watch Lists.

Morning Momentum / Gap / News / PR Stocks on Watch: $SWCH, $SHOP, $VERI, $ROKU

$SWCH IPO, $SHOP wash out bounce, $VERI wash-out bounce and $ROKU for break out after wash out.

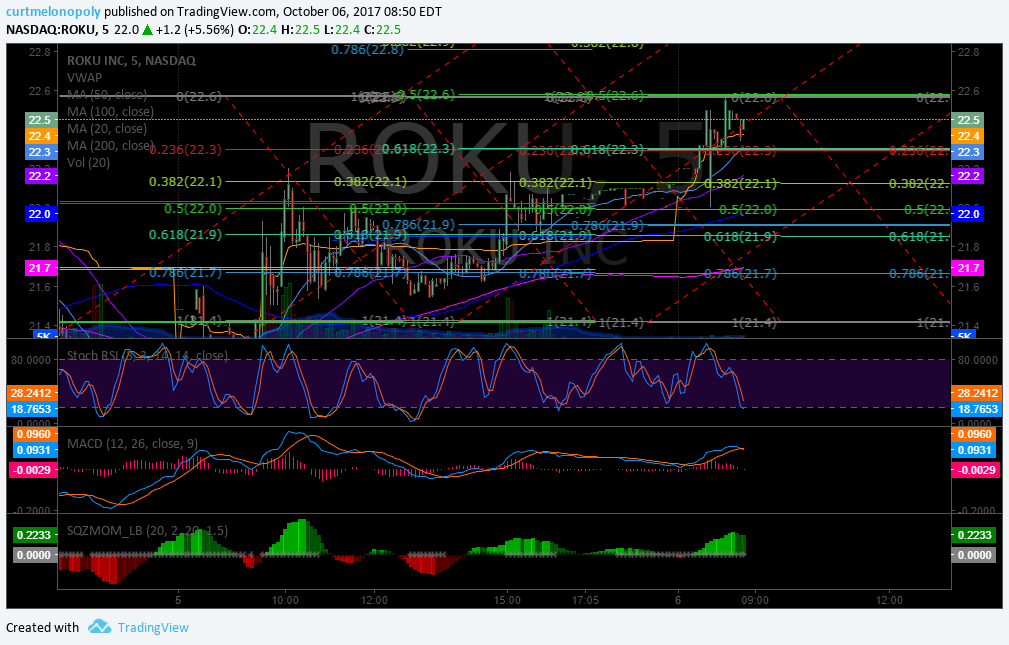

$ROKU Premarket Trading 22.45 up 3% in bullish formation.

$ROKU Premarket Trading 22.45 up 3% in bullish formation. pic.twitter.com/TBjH4gUQaz

— Melonopoly (@curtmelonopoly) October 6, 2017

Market observation / on watch:

US Dollar $DXY flat / up overnight but in uptrend turn perhaps. Oil $USOIL $WTI continues under pressure – I alerted EPIC members at recent high that I was short bias going fwd a number of days, Gold / Silver are moderate in overnight session (I continue to warn that Gold especially is vulnerable and recently advised I am short bias), $SPY continues moderately in bull form, $BTCUSD $XBTUSD has been making a trend turn after recent consolidation after its run up post Jamie Dimon – we have been hitting every turn lately with the team and our returns have been outstanding, and $VIX under continued pressure at 9.5 (and yes as I have been saying since before the election – this time could be different).

I again sent out recent trading triggers to members on Gold, Oil and Bitcoin.

Recent Momentum Stocks to Watch:

OTC on watch:

Recent SEC Filings to Watch:

Some Earnings On Deck:

Recent / Current Holds, Open and Closed Trades:

My $ROKU play looks very strong in premarket – I have been warning shorts publicly and in room very specifically told members a number of times Friday could be very active to upside. I continue to hold $AAOI and it may be a loser that I will cut if it fails 200 MA on daily.

Previous recent notes:

Yesterday I closed $ATEC flatish after scalping a win previous day and $VERI I closed at a loss. Still holding $SNAP, $AAOI and tiny $OMVS position.

First quarter was easy set-up trading, second quarter got a tad tighter and by third quarter many if not most charts were extended and now the rotation is like wack a mole so I am consolidating a master list of the best most predictable structurally sound charts and will just trade them until market sorts itself.

Recently closed off $ARRY decent and entered $ATEC and $VERI yesterday. Still holding $SNAP, $AAOI, and a tiny $OMVS position.

A tad concerned about $AAOI as Applied Optoelectronics $AAOI Stock Rose, Cardinal Capital Management Lowered Its Stake by $2.73 Million …

Yesterday was good. Re entered $ARRY and it looks good. Added to $AAOI and took some off later in day for a profit. Lots of plays in and out of now – market is in much better shape.

I trimmed some positions yesterday and added some ($CUR, $ARRY, $VERI, $AAOI) and I’m active in Bitcoin $XBTUSD right now and looking at oil bias short and Gold trading soon (and miners). Review video when posted for details.

Last week on the Bitcoin dump we entered the Bitcoin fray with a buy of Bitcoin, since then on Monday I entered $XBTUSD (am looking for a move up and adds over time – it has an area of resistance to work through – but the MACD on the daily may be about to turn up here and that would be big – $GBTC on OTC play I am considering with China scenario) and trimmed some $ARRY. Still holding $ARRY and $SNAP and have some very small other positions.

Friday was an excellent trading day. Accounts all up on the day about 5%.

Review on $WTI, $SNAP, $ARRY and $TVIX trade in Mon and Tues mid day videos. Last night I took a quick oil scalp small and got a paper cut in a Gold short.

Friday I went long $ARRY $SNAP and hedged with $TVIX (which is getting hammered premarket). Also in Oil in overnight trade with the smaller position accts flat at time of post and large account positions a tad underwater on it. But the chart is on my side (risk – reward).

Closed that $AMBA trade for a small loss and the most recent oil trade from last report for a win.

Thursday no trades other than closing $MSFT overnight for small profit.

Yesterday was choppy and I nailed an oil scalp in overnight trading. In $MSFT yesterday on daytrade and swing side, in $CUR on daytrade side still and holding $UUP on swing trading side still.

Yesterday I had wins intra in $XIV and shorting $TVIX. also had an overnight hold in $CUR that is yet to be determined.

$XIV, $ARWR, $PETS wins on Thursday. On Wednesday oil $WTI big win and $PETS and $AMD on daytrade small account build yesterday.

Yesterday I closed $UWT daytrade for small win, large oil trade for win, small Gold trade for win and small loss in $TVIX. Recently $XIV I closed in premarket for small gain, still holding some position from previous, $UGLD (closed in premarket July 31 small gain), $FEYE (closed for nice gain), $SRG (closed for nice gain), $NFLX (closed for huge gain), $IPXL (closed for gain), $AKCA (closed nice gain), $MCRB (closed small gain), $WMT (closed excellent gains), $UUP (closed small loss), $BWA (closed tiny loss), Holding: $XIV and new entry $AMMJ. All other holds are small size (less than 4% of day trading account on total) holds in this order according to sizing: $ONTX, $SSH, $LGCY, $TRCH, $ESEA, $LIGA (all not including select swing trading or algorithm charting trades).

Recent Chart Set-ups on Watch:

The member letter that went out this morning explains our status on reporting. The Q4 swings will be the first of the reporting storm out this week (swing reports and mid day trade set up videos).

Per recent; Adding $BBRY to list on ER and 200 MA trending. $GBTC, $AAOI, $FIT, $FSLR, $JKS, $FEYE $LACDF, $CTSH, $NVO, $TSLA, and $AAMJ. $NLNK and $PI are recent chart set ups – $GPRO for possible break out on chart and recent new includes $SNAP and $ARRY – $ARWR, $CDNA, $XXII, $NAK, $SHOP, $ITCI, $SENS, $HCN, $GTHX, $EXTR, $EDIT, $IPI, $XOMO, $MBRX, $PDLI, $LPSN and more that can be reviewed on You Tube videos or on weekly Swing Trading reports.

https://twitter.com/reedshermanator/status/916234405991116801

Crypto trade overnight session 100 x leveraged Bitcoin🔥🎯🚀👊 $XBTUSD $BTC #CryptoLove ♜♛♚♜ pic.twitter.com/xYvHVniR2I

— Melonopoly (@curtmelonopoly) October 6, 2017

KABOOM! $XBTUSD $BTC #Bitcoin 100 x leveraged love machine overnight session pic.twitter.com/pqNLs6HTq9

— Melonopoly (@curtmelonopoly) October 6, 2017

I did tell ya here this week;

Regains 4350.00 and go long young man / gal. $XBTUSD $BTC #Bitcoin

Regains 4350.00 and go long young man / gal. $XBTUSD $BTC #Bitcoin pic.twitter.com/6xUPUJQ89C

— Melonopoly (@curtmelonopoly) October 3, 2017

100 x leveraged injection of love filled cash alpha ?????✌ $XBTUSD $BTC #Bitcoin #crypto #premarket #jamiedimon

100 x leveraged injection of love filled cash alpha 🎯💯🚀🔥👊✌ $XBTUSD $BTC #Bitcoin #crypto #premarket #jamiedimon pic.twitter.com/zDjygsYEkh

— Melonopoly (@curtmelonopoly) October 5, 2017

Oil trade ?? $USOIL $WTI $CL_F #OIL #Alerts

Oil trade 🎯🔥 $USOIL $WTI $CL_F #OIL #Alerts pic.twitter.com/XIRAzdkA7a

— Melonopoly (@curtmelonopoly) October 4, 2017

Tues 430 PM Target Hit to Penny and Second. Oct 4 518 AM EPIC Oil Algorithm Chart FX $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT #Algo

Tues 430 PM Target Hit to Penny and Second. Oct 4 518 AM EPIC Oil Algorithm Chart FX $USOIL $WTI #OIL $USO $UWT $DWT $CL_F #OOTT #Algo pic.twitter.com/bSmTCbQMOm

— Melonopoly (@curtmelonopoly) October 4, 2017

$XBTUSD 4468.1 50% and 4691.4 full ext, watch red TL, in channel from daily quad exterior. $BTC Bitcoin

See other mid day charting trade set-up reviews on You Tube. I am extremely disappointed in the number of members that review those videos. The set-ups are key to success if you’re swing trading (even daytrading). So if I get a tear in the bear DM from folks that will be the first thing I’ll ask you… #fairwarning 🙂 All in love.

We are working on these (if listed) and others in Mid Day Review in trading room. If you can’t be in there you can catch the review on the raw video feed we post to You Tube of each trading day. Many of the mid day reviews are published “private” for members only so be sure to watch your email inbox for these among other member only videos.

Market Outlook:

Bullish.

https://twitter.com/Quarry_Rock/status/916129683988733952

Market News and Social Bits From Around the Internet:

8:30a

NFP

9:15a

Fed Bostic Speaks

10a

Wholesale Trade

12:15p

Fed Dudley Speaks

12:45p

Fed Kaplan speaks

1p

BH Rig #

1:50p

Fed Bullard

$SIEN Supports Reconstructive Breast Patients with Launch of Full Circle™ Grant Program and Revolutionary Portfolio of Tissue Expanders

$PLUG Craig-Hallum analyst Eric Stine raised his price target on Buy-rated Plug Power to $4

BREAKING: September's nonfarm payrolls report that showed loss of 33,000 jobs is first decline since Sept. 2010 https://t.co/LJEShjujLb

— CNBC Now (@CNBCnow) October 6, 2017

If you are new to our trading service you should review recent blog posts, the Compound Trading YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80%+ in my trading – all publicly posted live trades).

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Intra-day Trading Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List: $GIGA, $SNCR, $XXII $AVEO $DELT $APHB $MNKD $PSDV $ODP $GSAT $APVO $DWT $BTI $GSM $HMNY $SCO $EWP $SBGL

(2) Pre-market Decliners Watch-List : $COST $ECYT $ABBV $VERI $WLL $WYNN $ITEK $CLSN $VZ $BUD $RAD $MGM

(3) Other Watch-List:

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV), $BTCUSD Bitcoin.

(5) Recent Upgrades: $APC $KHC $LQ

(6) Recent Downgrades: $ALB $SAFM $DAR $CREE $VLO $HFC $TBK $OGE $SYF $WBA $GSBC $SAVE

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly and lead tech developer @hundalSHS.

Article Topics: $SWCH, $SHOP, $VERI, $ROKU, Gold, Oil, $WTI, Bitcoin, $XTBUSD, $BTC, Premarket, Watchlist, Stocks, Trading, Plan, $BTCUSD, BITCOIN, $XBTUSD, #Gold, $GLD, #OIL, $USOIL, $WTI, $DXY, US Dollar, $SILVER, $VIX, $SPY