Compound Trading Chat Room Stock Trading Plan for Tuesday April 11, 2017; $SALE, $TNXP, $STRM: $SPXS – $SPY, $DUST – $GLD, $GDX, $DWT – $USOIL, $WTIC — $ONTX, $DUST, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI – Gold $GLD, Gold Miners $GDX, Silver $SLV, Oil $USOIL $WTI, Natural Gas, US Dollar Index $USD/JPY $DXY, S&P 500 $SPY, Volatility $VIX… more.

Welcome to the morning Wall Street trading day session at Compound Trading!

Notes in red text below are new comments entered specifically today.

Notices:

Today’s Live Trading Room Link: https://compoundtrading.clickmeeting.com/livetrading

Notice: Our platform algorithmic chart modeling is entering phase 2 coding. Reports will be unlocked at longer intervals to general public.

Notice: Our platform algorithmic chart modeling is entering phase 2 coding. Reports will be unlocked at longer intervals to general public.

— Melonopoly (@curtmelonopoly) April 11, 2017

Blog post: When You Learn It – You Are Free (Part 1 of Freedom Traders). My Stock Trading Story.

https://twitter.com/CompoundTrading/status/848681468125745153

Yesterday’s Stock Trading Results

https://twitter.com/CompoundTrading/status/851716882709319680

The Quarterly Daytrading Performance Review P/L with Charting is Published.

https://twitter.com/CompoundTrading/status/846494014635429888

The Quarterly Swing Trading Performance Review P/L with Charting is Published. The Algorithms Quarterly Performance Reports are being compiled as I write and will be posted soon.

https://twitter.com/CompoundTrading/status/841078264537993218

Most recent Keep it Simple Swing trade Charting (MACD, MA, Stoch RSI, SQZMOM focus):

https://twitter.com/CompoundTrading/status/848756853169283073

Current Holds / Trading Plan:

Main watchlist in my trading plan today:

$SALE, $TNXP, $STRM are the morning momos so far.

$SPXS – $SPY (at resistance soon), $DUST – $GLD, $GDX (Gold at test resistance / support), $DWT – $USOIL, $WTIC (in upward channel) BUT is very near real significant resistance.

OTC on watch $USRM, $LIGA, $MMEX

Most holds are small to mid size holds in this order according to sizing – $DVN (larger holding), $PLUG, $ONTX, $DUST, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI.

Per recent;

$DUST I will close for a loss if Gold holds 1260 – sucks, but it was a relatively small position (to portfolio size) but I didn’t follow the golden rule… when a trade goes against your plan cut fast and I didn’t so I will likely pay the price. And I guess what has become the second golden rule… listen to the algos… they haven’t been wrong yet – so yes, I didn’t listen to my own invention ROSIE the Gold Algo (give Rosie a little plug there she deserves it lol). Embarrassing, especially because ROSIE nailed the bottom many weeks in advance of the bottom – all I had to do was listen and boom new house. Sad.

Market Outlook :

Per recent reports:

There are significant resistance clusters above recent highs in oil and the S&P so I will be very cautious to upside going forward until recent highs are taken out and confirmed. I see significant upside challenges in Oil and SPY with most recent highs being taken out.

Morning Momentum Stocks / News and Social Bits From Around the Internet:

Premarket momentum stocks to watch: $SALE, $TNXP, $STRM

Gap ups / momo on these plays: $TNXP $UVXY $AUPH $UGAZ $IDRA $MTL $AXON $TSLA $LEDS $AAOI $PUMP $NUGT $JNUG $SVU

News on these plays:

Chart Set-Ups: $BOFI, $GREK

Previous Day Momentum Stocks to watch:

6am

NFIB Small Business Optimism Index

8:55am

Redbook

10am

JOLTS

1:45pm

Neel Kashkari Speaks

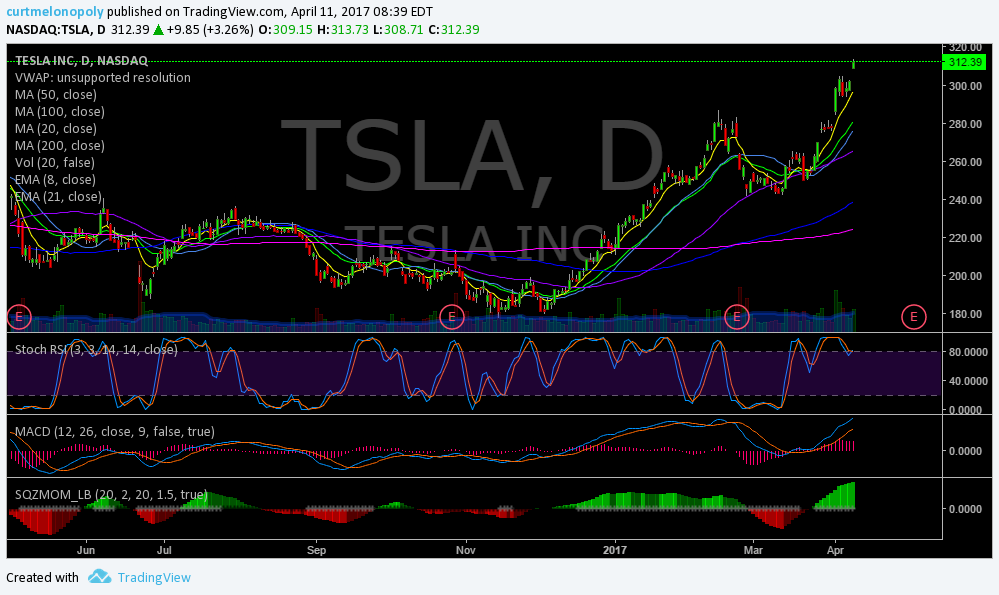

Carter Worth is lit tonight and makes a compelling case for $TSLA pic.twitter.com/q6W3TRMiK5

— CNBC's Fast Money (@CNBCFastMoney) April 10, 2017

This Week$JPM $C $WFC $FAST $DAL $TSM

Next Week | preview

M $NFLX

T $GS $BAC $ISRG

W $EBAY $BLK $CSX

T $MXIM $VZ $MAT $SHW

F $GE $HON $SLB pic.twitter.com/HtjHi2L0dw— Tom Wrigley (@WrigleyTom) April 9, 2017

If you are new to our trading service you should review recent blog posts, our YouTube Channel and at minimum our algorithm Twitter feeds because they do tell a story in terms of the market and how the inflections of the market determine our day to day trading. You will notice the algorithmic modelling has been undeniably accurate with many time-frames (intra-day, weeks and months out) so I myself have learned to respect their math (they have taken me from a 60% hit rate to 80% in my trading – all publicly posted live trades).

The algorithm Twitter feeds can be found here:$WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index). Our Swing Trading Twitter feed is found here: https://twitter.com/swingtrading_ct. Our lead trader Twitter feed is here @curtmelonopoly, lead tech developer @hundalSHS, and associate trader @quadzilla_jr.

Momentum Stocks (Market Open and Intra-Day):

I do trade morning momo stocks, but I do avoid risk – so often I avoid the first 30 minutes (gap and go) and trade momentum stocks later in the day after the wash-out looking for a snap-back. Just prior to open and shortly after open I post momentum stocks to the trade chat room (and Twitter and Stocktwits if I have time).

Some of my Favorite Set-Ups:

(1) Momentum Stock Wash-Outs for Snap Back, (2) Bad News Wash-outs on Stocks with High Institutional Ownership, (3) Getting on the Right Side of a Trend Change and scaling in my position and (4) Our Algorithm Set-Ups.

The momentum stocks (from previous days and morning trade) I continue to watch through the day for indicators that allow a trade.

Morning Stock Watch-Lists for my Favorite Set-Ups:

(1) Pre-Market Gainers Watch-List :$SALE 49%, $TNXP 39%, $STRM 21%, $MXWL $SDRL $IDRA $AUPH $AXON $MTL $PUMP $YELP $HMY $RIO $UVXY $WDC $NUGT $JNUG

I will update before market open or refer to chat room notices.

(2) Pre-market Decliners Watch-List: $JDST $XIV $SPY $NAKD $UAL $ON $DRYS I will update before market open or refer to chat room notices.

(3) Other Watch-List: Per above

(4) Regular Algo Charting Watch-List: Gold $GC_F $GLD, Miners $GDX ($NUGT, $DUST, $JDST, $JNUG), Silver $SLV $SI_F ($USLV, $DSLV), Crude Oil FX: $USOIL $WTI ($UWTI, $DWTI, $USO, $UCO, $CL_F, $UWT, $DWT), Natural Gas $NG_F ($UGAZ, $DGAZ), S & P 500 $SPY $ES_F ($SPXL, $SPXS), US Dollar Index $DXY ($UUP), Volatility $VIX ($TVIX, $UVXY, $XIV)

(5) Upgrades: $KNX $RSPP $AMT $PDS $TTI $RNG $YELP $BANC $ARCO $STX $TOL $WDC $SNY $NTRS $PDS as time allows I will update before market open or refer to chat room notices.

(6) Downgrades: $SUN $ABB $CYS $AGNC $WIX $ON $XCRA $AVGR $WMGI $UGP $HUBG $SCSS $TWO $CYS $CAFD $HCP $OMED $PCH $SALE $STT as time allows I will update before market open or refer to chat room notices.

Stay tuned in Stock Chat Room for more pre-market stocks on watch.

Study:

For new readers, a review of our unlocked posts on our blog would help you get in to the story we are following with the securities listed in this newsletter.

Free scanners to find momentum stocks that you can easily review charts of for indicators that bring probability of your trade being successful up considerably. These are not useful for first 30 minute market open gap and go type plays (you need a good momentum scanner, level 2, and best to have hot-keys for the first 30 mins of gap and go trading)… but are very useful for intra day scalping and swing trading (start with trending stocks and then look at indicators intra for simple set-ups – study scan study scan study scan).

http://finviz.com/

https://finance.yahoo.com/screener/predefined/ec5bebb9-b7b2-4474-9e5c-3e258b61cbe6

http://www.highshortinterest.com/

http://www.gurufocus.com/short-stocks.php

http://www.3xetf.com/all/

http://www.etf.com/channels/gold-etfs

GL!

Curtis

Article Topics: $SALE, $TNXP, $STRM: $SPXS – $SPY, $DUST – $GLD, $GDX, $DWT – $USOIL, $WTIC – $DVN, $MGTI, $NE, $XOM, $ONTX, $DUST, $ASM, $SSH, $LGCY, $TRCH, $ESEA, – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Stockmarket, Pre-Market, Trading Plan, Wall Street, Stocks, Day-trading, Watchlist, Chatroom, $GLD, $GOLD, $SILVER, $USD/JPY, $USOIL, $WTI, $VIX, $SPY, $NATGASUSD