Review of Compound Trading Chat Room Stock Trading, Algorithm Charting Calls and Live Stock Alerts for Thursday March 9, 2017; $DRYS, $SPXL, $SPY, $USO, $USOIL, $WTIC, $BLKG, $ELF, $MDGS – $NE, $XOM, $BSTG, $ONTX, $DUST, $MGTI, $TRCH, $LGCY, $SSH, $ASM etc …

Intro:

Time stamped entries (in permanent archive) copied to this blog in italics (below) are direct live log chat from chat trade room as they occurred (random chat from myself not applicable or other misc chat deleted). Chat trade room is also video recorded daily for trade archive.

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators I am looking for in and out off each trade) and has live chart screen sharing right from my monitor to the room with all indicators I am looking at.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

https://twitter.com/CompoundTrading/status/839372151274647552

Per previous;

We’re in middle of editing and uploading a swath of educational videos (may take a few days on that).

Also, the ability for members to access transcripts on demand we are working on – should have that done soon.

The Compound Trading YouTube Channel now has the daily trading chat room full length video uploaded daily with all stock trades for the day.

Members are reporting that they like the mobile service ability of YouTube Live better than Webinato but members need to know that they need to have a Google+ / Gmail account and sign in to YouTube and activate a channel to use the service. We have had many not understand that so if you aren’t sure about procedure let us know and we will assist.

And lastly, the live charts we share, to make them live you need to open the chart and click on the share button at bottom right of any of the charts and then click “make it mine”. This will enable the live chart in your browser in TradingView whether a member or or not of TradingView.

Overview Perspective & Review of Markets, Chat Room, Algo Calls, Trades and Alerts:

Wednesday at end of day I tweeted out that I expected the shippers to run Thursday, and they came alive.

Looks like we might ship it tomorrow.

— Melonopoly (@curtmelonopoly) March 8, 2017

In play today in chat room; $DRYS, $SPXL, $SPY, $USO, $USOIL, $WTIC, $BLKG, $ELF, $MDGS

Premarket started with $MDGS news and it was traded up significantly but I didn’t take a trade.

$MDGS Trading up 25% in Premarket pic.twitter.com/eWleDpZAvU

— Melonopoly (@curtmelonopoly) March 9, 2017

$ELF – A number of traders in our room did well on this momentum play, I didn’t take a trade.

This tweet has a string of trades I took and various discussions if you click on it.

Premarket Leaderboard: $APRI $VVUS, $ELF, $XTLB $HSGX $OCRX $SMTC $XTNT $PIP $ERJ $DWT Streaming Live Open House: https://t.co/mOTRdItXEH

— Melonopoly (@curtmelonopoly) March 9, 2017

$DRYS – My day started with a premarket entry in $DRYS (the night prior I took an initial entry in $DRYS right before the bell EOD). I ended up closing two portions later today (25% each) when $DRYS was knocking on 2.00 and I am holding 50%. So it is a decent swing for sure so far.

$SNAP – I took a small momo trade and stopped out quick for a small loss.

$SPXL – The crude oil sell off I assumed would stop early in the day (with crude at a critical algorithm support level) but it didn’t and so my two entries in $SPXL (which is a long 3x leveraged $SPY product) took a bit of pain but recovered near end of market session and after market $SPY was looking better.

$BLKG – Took an entry in $BLKG literally one minute before it spiked. It’s a small OTC play.

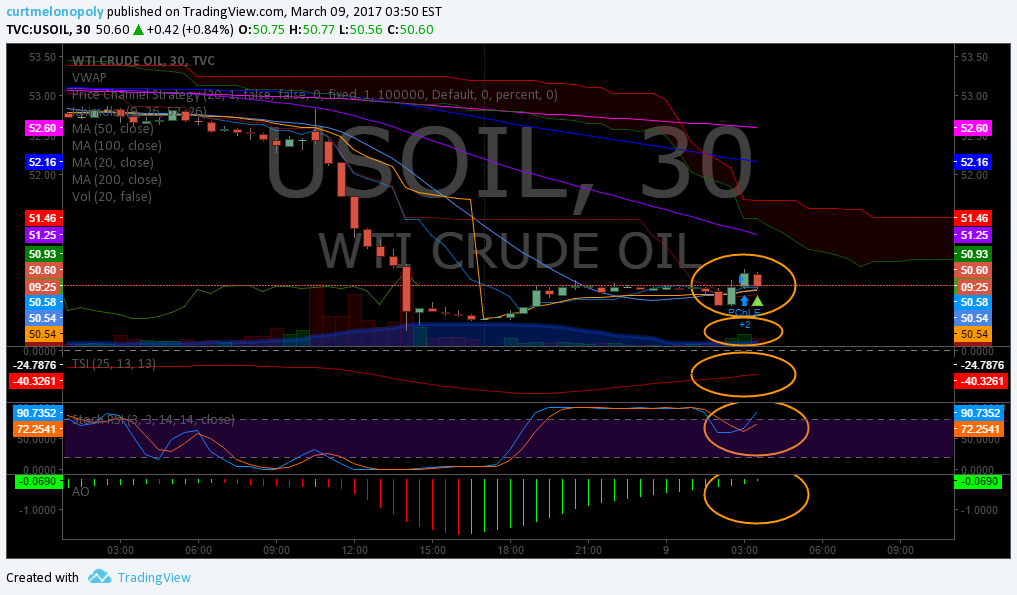

FX: $USOIL $WTI related position in $USO I took a small loss on (.7 cents) because a key support level in our algorithm was breached and I wasn’t comfortable with a possible continuation in sell-off. Our algorithm updates will allow me to trade the new trend range soon when published so I just cut bait early. I also took the trade because in overnight commodities trading there were chart signals of a bullish divergence also. So the trade was well thought out, but catching a knife isn’t easy – especially in a commodity that is selling off.

FX: $USOIL $WTI Being tested right now – trading 49.57 $CL_F $USO $UWT $DWT $UCO $USO This is the test right here. https://t.co/HUWqSVsAHX

— Melonopoly (@curtmelonopoly) March 9, 2017

FX: $USOIL $WTI Crude oil stopped is carnage right before the 200 MA so I thought I was safe also. So the algorithm support, Fibonacci support and classic simple charting all agreed… but…

FX $USOIL $WTI Carnage stopped right at 200 MA. Will it hold? $CL_F $WTIC $USO $UCO $UWT $DWT pic.twitter.com/Bj1OqCCTkl

— Melonopoly (@curtmelonopoly) March 9, 2017

This Periscope video explains my $USO trade set-up (Oil related ETF).

Trade setup in $USO long 2000 at 10.57 FX $USOIL $WTI $CL_F https://t.co/6vDdmbvrXJ

— Melonopoly (@curtmelonopoly) March 9, 2017

Momentum / Note-able Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| OCRX | 1.89 | 71.82% | 49616180 | Top Gainers | |

| CMTL | 13.78 | 23.81% | 3116100 | Top Gainers | |

| CRIS | 3.08 | 20.78% | 3160600 | Top Gainers | |

| MXPT | 5.51 | 20.31% | 345700 | Top Gainers | |

| CBAY | 4.09 | 20.29% | 1168820 | Top Gainers | |

| CUR | 5.30 | 19.64% | 692900 | Top Gainers | |

| QBAK | 6.85 | 14.36% | 213246 | New High | |

| PIRS | 2.85 | 10.47% | 1257700 | New High | |

| AUPH | 7.78 | 8.66% | 27412997 | New High | |

| STRL | 9.43 | 2.61% | 545700 | New High | |

| MASI | 94.79 | 0.65% | 1160600 | Overbought | |

| AUPH | 7.78 | 8.66% | 27412997 | Overbought | |

| SRET | 14.35 | -0.07% | 1337900 | Unusual Volume | |

| MLPX | 14.42 | -0.28% | 5430100 | Unusual Volume | |

| SYG | 68.22 | -0.19% | 44900 | Unusual Volume | |

| OCRX | 1.89 | 71.82% | 49616180 | Unusual Volume | |

| ABM | 42.35 | -0.35% | 665000 | Upgrades | |

| ABEV | 5.37 | -0.56% | 31270087 | Earnings Before | |

| CAPN | 0.72 | -6.94% | 94192 | Insider Buying |

Stocks, ETN’s, ETF’s I am Holding:

I am holding (in order of sizing – all moderate size to micro sizing) – $SPXL, $DUST, $ONTX, $XOM, $NE, $BLKG, $DRYS, $USRM, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio):

Trading and The Markets Looking Forward:

As above crude oil tanked hard. Gold, Miner’s and Silver are off and on watch. US Dollar threatening a break-out. $SPY calm and $VIX calm.

Recent notes in post market reports that still apply,

Per recent, “Our swing trading side continues to outperform all my expectations for 2017 (you can find the most recent unlocked swing trading newsletter on our blog) – I had a feeling it was going to do well, just didn’t quite expect a grandslam. We’re in the middle of compiling our next set of stock picks for the swing trading members and will have them out over next few days – hopefully that batch will bring the same type of returns as the new year batch did and continue to in most instances.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

The US Dollar is threatening important upside levels on the algorithmic model charting – we’ll see.

Gold $GLD $XAUUSD / Gold Miner’s $GDX:

Our algorithm was right about the upside extensions and Gold came off right where Rosie the Gold Algo warned. It continues under pressure. Rosie’s new updates will be interesting.

#GOLD Under 200 MA 20 MA Lost 50 MA and 100 MA taking out fibs on way down. $GLD $GC_F $NUGT $DUST $JDST $JNUG pic.twitter.com/vs2QANML4x

— Melonopoly (@curtmelonopoly) March 9, 2017

Silver $SLV:

As above with Gold, watching now. Awaiting new SuperNova Silver Algo charting (expected this weekend).

Crude Oil $USOIL $WTI:

As above, tanked hard Wednesday and some Thursday and watching now. Awaiting EPIC the oil Algo updates.

Volatility $VIX:

$VIX has been flat for some time, however, our algorithmic modeling suggests a possible time / price cycle coming due soon. It is possible the oil sell off was the time-price cycle of note. Here again will await weekend algo charting updates before I do much.

— Melonopoly (@curtmelonopoly) March 6, 2017

Oh yes, finally a possible sign of life in the algo signals.🔥 @VexatiousVIX https://t.co/mC5a0eDzMV

— Melonopoly (@curtmelonopoly) March 6, 2017

$SPY S&P 500:

$SPY has been trading perfectly within our model and see no divergence yet, however, we are watching the time /price cycle in our $VIX model very close here now.

Natural Gas:

NA – watching. I could have nailed that bottom as our test algo (not one of the six formally released charting algos) was near spot on with the recent bottom call but I didn’t take the trade.

Momentum Trades for the Day:

As above I traded $DRYS on overnight swing, $USO, $BLKG, and $SPXL. I missed the $OCRX momo play later in the day – I was on it, but didn’t take a trade.

Swing Trading:

My $GOOGL play from the swing trading side of our business is doing very well.

$GOOGL Swing is on fire. #SwingTrading pic.twitter.com/AK0fZN20dq

— Melonopoly (@curtmelonopoly) March 9, 2017

And $DUST swing trade continues to do well.

$DUST Swing trade is on fire. $GDX #Gold #SwingTrading pic.twitter.com/xUSbFUTYvT

— Melonopoly (@curtmelonopoly) March 9, 2017

As above near all of our swing trades in 2017 have been home runs.

The Swing Trading Twitter feed can be found here: https://twitter.com/swingtrading_ct.

Algorithmic Chart Models:

As noted above, these are doing exceptionally well also.

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Live Trading Chat Room Transcript: (on YouTube Live)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Also, times are Central Mountain below (we’re working on the fix now), so for New York ET time add two hours to all times. Also, most days at market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so you can correlate time with transcript with video feed when reviewing trades).

5:09 AM MarketMaven M morning:)

5:09 AM Flash G hey Maven

5:10 AM Flash G Just talked to Curt, he won’t be broadcasting till market open fyi

5:10 AM MarketMaven M cool

5:11 AM MarketMaven M If crude breaks that 200 omg lol

5:11 AM MarketMaven M Flash… Curt’s still short Gold correct $DUST?

5:11 AM Flash Gy es

5:12 AM Curtis Melonopoly Catch u guys at market open.

5:15 AM MarketMaven M This is a lot better on my phone than Webinato was

5:15 AM Flash G yepp

5:17 AM MarketMaven M crudes gonna lose that 200 MA imo

5:17 AM MarketMaven M oil on its way to 10 imo ?

5:17 AM Flash G ha

5:18 AM MarketMaven M grabbing coffe – catchya when action picks up

5:45 AM Curtis Melonopoly ECB decision on deck

5:45 AM Curtis Melonopoly ECB unchanged

5:48 AM Curtis Melonopoly $VVS Up premarket

5:49 AM Curtis Melonopoly $VVUS

5:53 AM Curtis Melonopoly $OCRX up again premarket

6:00 AM Curtis Melonopoly Upgrades $TEF $GEF $XOG $CPE $AMFW $ABM $OA $TECD $HIMX $FPO

6:01 AM Curtis Melonopoly Downgrades $TYPT $GILD $EXPR $DSW $FINL $TLRD $CVRR $AERI $GES $BRSS $ARA $ASND

6:05 AM Curtis Melonopoly $CVM Direct Offering. 15M shares at $0.10/share

6:08 AM Curtis Melonopoly $ELF up 20% premarket

6:47 AM MarketMaven M $MDGS First MUSE procedure completed in China; Medigus up 25% premarket

6:49 AM MarketMaven M Premarket movers: $APRI $MDGS $ELF $VVUS $IFON $XTLB $DCTH $OCRX $GLBS $DRYS

7:03 AM

Compound Trading PreMarket Trading Plan Mar 9 $APRI $MDGS $ELF $VVUS LINK: https://compoundtrading.com/premarket… PREMARKET030917PR

7:04 AM MarketMaven M Gainers: $APRI $VVUS, $ELF, $XTLB $HSGX $OCRX $SMTC $XTNT $PIP $ERJ $DWT $KERX $RAD $AUPH $HIMX $SCO $RUSS

7:22 AM MarketMaven M $SSYS Stock Drops -6.43% Premarket Despite 4Q Beat

7:24 AM Curtis Melonopoly long $USO 1/5 starter 10.57 avg 2000

7:28 AM MarketMaven M With ya on $USO small 300 starter

7:30 AM Flash G $RNVA on watch

7:31 AM Curtis Melonopoly $SNAP long 23.49 small

7:32 AM Curtis Melonopoly 300 shares

7:32 AM MarketMaven M stopped small loss

7:33 AM Curtis Melonopoly $SNAP long 600 23.20

7:34 AM Flash G Long $ELF some

7:34 AM Curtis Melonopoly stopped 23.08

7:34 AM Curtis Melonopoly $SNAP

7:35 AM Flash G $MRNS starter here also

7:38 AM MarketMaven M re-entry on $USO here 300 shares

7:42 AM Flash G $INAP action

7:44 AM Mathew w Call me crazy but giving miners a chance here. Small JNUG tester against LOD

7:44 AM Mathew w High r/r set up entry 5.66 with stop about 20 cents lower

7:46 AM Flash G I think you’re right Mathew

7:48 AM MarketMaven M ya ya flash ok maybe lol bad open though again!

7:50 AMMarketMaven Mawesomely voodoo again

7:50 AM MarketMaven M u and those algos:)

7:50 AM MarketMaven M ok I am starting a pos in $NUGT small

7:50 AM Flash G haha

7:52 AM Curtis Melonopoly FX $USOIL $WTI hit 49.59 area and bounced to 49.80 fast – we’ll see if that area holds – holding for now $USO 1/5 size

7:53 AM MarketMaven M $XTLB nHOD dilution play

7:54 AM Mathew w Pretty boring open. Thought we might see some action but not much happening outside of nattyg finally keeping some momentum. As soon as I say that it’ll probably reverse though lol

7:59 AM MarketMaven M yuck

7:59 AM MarketMaven M I missed $OCRX

8:00 AM MarketMaven M up YUGE

8:00 AM MarketMaven M $AUPH nHOD’s also

8:00 AM MarketMaven M at least oil holding ?

8:00 AM Mathew w JNUG add same stop

8:07 AM Curtis Melonopoly starter in $SPXL 300 127.41

8:10 AM MarketMaven My ou’re a nut imo – both plays curt they seem contrary llllolol

8:10 AM wintonresearch did you guys notice uranium stock outperformance vs oil the last 2 days

8:11 AM wintonresearch oil down 5% and UEC up 6%

8:11 AM wintonresearch morning all, btw ?

8:13 AM wintonresearch i like your choice of SPXL

8:13 AM wintonresearch everyone else is bearish

8:14 AM wintonresearch watching for heavily oversold copper to begin to turn back up, as copper rise would confirm SPY rally

8:14 AM Curtis Melonopoly hey nicholas

8:14 AM Flash G ya morning nich!

8:16 AM wintonresearch btw potential free money alert

8:16 AM wintonresearch Sprott is looking to buy Central Fund $CEF

8:17 AM wintonresearch and CEF is trading at 5-6% discount to NAV

8:17 AM wintonresearch $CEF is a fund backed by real gold and silver, audited

8:17 AM Curtis Melonopoly nice

8:18 AM MarketMaven M thanks mr nicholas!

8:18 AM wintonresearch If Sprott’s offer is accepted holders will have option to take delivery of said bullion

8:18 AM wintonresearch so a yes vote is very likely ?

8:19 AM wintonresearc hthat’s why CEF went up 3% yest while gold was down yesterday

8:19 AM Curtis Melonopoly interesting info nich

8:21 AM wintonresearch17.88 is NAV on CEF

8:21 AM wintonresearch trading now 16.80 ish

8:21 AM MarketMaven M I;m in $MDGS sorry didn’t alert was watching oil

8:22 AM wintonresearch Sprott made a similar offer and succeeded previously

8:22 AM wintonresearch anyway just putting it out there

8:24 AM MarketMaven M thanks nicholas

8:25 AM MarketMaven M closed $MDGS small gain .10 cents on 3000

8:27 AM Curtis Melonopoly $USO closed for .07 loss

8:29 AM MarketMaven M I’m holding – my position is a tiny one

8:33 AM wintonresearch silver stocks look to be hammering out a bottom if you see the SIL:SLV ratio

8:33 AM wintonresearch maybe a bit more chop

8:33 AM MarketMaven M good timing on $MDGS close

8:34 AM MarketMaven M I was just looking at the Silver charts and Gold

8:37 AM Flash G looks like PPT Yellen is juicing $SPY now

8:38 AM Curtis Melonopoly lol could be

8:39 AM Curtis Melonopoly I’m going to give it room

8:40 AM MarketMaven M a lot of $BMY chatter

8:41 AM Curtis Melonopoly $CATB holding VWAP so far…. on watch

8:47 AM Curtis Melonopoly $MDGS holding VWAP so far

8:59 AM Curtis Melonopoly my $GOOGLE swing rocking ?

9:05 AM Curtis Melonopoly sorry left ya for a second there… Internet spike

9:05 AM wintonresearch btw y’all keep eyes on $FNMA

9:05 AM wintonresearch i think it’s going to be a huge winner

9:06 AM Curtis Melonopoly long 1/5 add $SPXL 1271.19

9:07 AM Curtis Melonopoly 127.19

9:11 AM MarketMaven M Whats with $YELP

9:11 AM MarketMaven M $FNMA been watching close

9:15 AM Flash G $HIG blocks

9:28 AM Curtis Melonopoly $CATB HOD on deck

9:33 AM MarketMaven M $CATB is respecting VWAP curt

9:35 AM Mathew w Added to SWN swing this morning. This should really pick up in natty consolidates or heads higher. Lagging hard currently

9:38 AM Flash G lunch time

9:54 AM Mathew wzzzzzzzzz

9:54 AM Mathew w Playing the miners a bit back and forth through $JNUG but not much action here. Trying to base as GDX comes into some support fibs

9:58 AM MarketMaven M lunch for me back soon

10:18 AM Flash G.your $CELG rocking curt

10:19 AM Curtis Melonopoly yup

10:30 AM Curtis Melonopoly $CAT B/O

10:35 AM MarketMaven M.Just waiting for liquidity in $CATB to go poof here lol

10:40 AM MarketMaven M there it is poof

10:40 AM Flash G lol

11:31 AM Curtis Melonopoly going for lunch

11:31 AM Flash G.k

12:00 PM Curtis Melonopoly great pop on $OCRX

12:05 PM wintonresearch wild move on OCRX

12:05 PM Curtis Melonopoly $RXII Highs

12:11 PM Curtis Melonopoly my $DRYS overnight swing got some juice

12:23 PM Curtis Melonopoly closed 1/4 $DRYS overnight swing 1.79

12:24 PM Curtis Melonopoly 2000

12:25 PM wintonresearch Curtis fwiw i think DRYS could go on a huge rampage

12:25 PM Curtis Melonopoly ya

12:26 PM wintonresearch one of my clients got in on the original DRYS run from $4-5

12:26 PM wintonresearch he sold at $7 and was pretty happy- then it went nuts to $140 (if we count premkt) lol

12:27 PM wintonresearch i think we could see the back end of that original crazy shippers rally very soon

12:27 PM wintonresearch because i think the market is going to melt up again

12:28 PM wintonresearch and we are in +ve seasonal trend for shippers

12:29 PM Curtis Melonopoly dry index spike too

12:29 PM wintonresearch and because i think we’re going to see commodities reverse and rise strongly- hey need to be shipped

12:40 PM Curtis Melonopoly $BLKG .0026 OTC long 300k .. all part of my 3% of portfolio casino allotment

12:41 PM Curtis Melonopoly 3% of my portfolio are casino plays

12:42 PM Curtis Melonopoly that’s my personal percentage limit

12:42 PM Flash G nice

12:42 PM MarketMaven M seems you do ok with them

12:43 PM MarketMaven M holy shit it just went from .0025 to .0035 CURT!!!

12:43 PM MarketMaven M WTF lol

12:43 PM Flash G haha

12:44 PM Curtis Melonopoly and back down to 30

1:03 PM Curtis Melonopoly Closing 1/4 $DRYS o/n swing 2000 @ 1.92 holding 2/4

1:09 PM MarketMaven M Curt that 2 $DRYS mark is gonna pop and your $ESEA good to go then too I bet

1:09 PM Flash G long $DRYS couldnt handle t

1:10 PM MarketMaven M haha

1:10 PM MarketMaven M last night I though wtf is curt doing lol

1:11 PM MarketMaven M and this morning when i got the premarket alert on sms i thought he’s gone mad

1:11 PM Mathew w DRYS goes ex div today or soon right?

1:11 PM Curtis Melonopoly lol not sure

1:13 PM

Compound Trading https://www.smarteranalyst.com/2017/0… $DRYS

1:16 PM MarketMaven M Gold tank

1:17 PM Curtis Melonopoly $SPY and $SPXL starting to come back to life

1:17 PM MarketMaven M oil too

1:18 PM Flash Gwas thinking maybe time for $UWTIF long?

1:18 PM Curtis Melonopoly might be time

1:23 PM MarketMaven M $XLE green guys

1:24 PM MarketMaven M $KITE stilling rolling along – fing missed it

1:24 PM MarketMaven M ya know that $BLKG 32M shares averages 3M

1:25 PM MarketMaven M what’s up?

1:28 PM Curtis Melonopoly FX $USOIL $WTI at 49.59 resistance

1:29 PM Curtis Melonopoly no idea what’s up with $BLKG maven

1:34 PM MarketMaven M $SFUN blocks

1:35 PM Curtis Melonopoly crude oil struggling with that area I been on about

1:40 PM MarketMaven M wow $MRO highs

1:41 PM Flash G earnings MM

1:44 PM Flash G Long $UWTIF here for some starter placement on swng overnight at least

1:45 PM MarketMaven M thinking the same flash

1:49 PM MarketMaven M lol $BLKG 120%

1:49 PM Mathew w Added some $TRCH and $CRK here to go with my SWN swing. CRK and swn natty so oil movement doesn’t matter much there long run

1:50 PM MarketMaven M interesting

1:50 PM MarketMaven M i think curt long $TRCH no? $CRK i think i will follow

1:51 PM Curtis Melonopoly Yes maven to $TRCH

1:51 PM Mathew w Ive been waiting on TRCH, it should see at least a bounce if nothing else

1:52 PM Flash G looks like bulls back out to play

1:53 PM Curtis Melonopoly $BLKG sell off EOD

1:54 PM Curtis Melonopoly ah maybe not lol

1:58 PM Curtis Melonopoly $SPY green you gotta love free markets??

1:59 PM Curtis Melonopoly $BLKG closing HOD EOD 43M shares traded

2:00 PM MarketMaven M good night Curt Mathew and Flashy

2:01 PM Flash G lol bye bye

2:01 PM Mathew w have a good night all

2:01 PM Curtis Melonopoly see ya guys

Be safe out there!

Follow our lead trader on Twitter:

Article Topics: $DRYS, $SPXL, $SPY, $USO, $USOIL, $WTIC, $BLKG, $ELF, $MDGS – $XOM, $NE, $ONTX, $DUST, $VRX, $TRCH, $LGCY, $SSH, $ASM, $DRYS – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Trading Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500