Compound Trading Tuesday April 18, 2017 Review of; Chat Room Stock Day Trading, Swing Trading, Algorithm Chart Trading and Live Stock Alerts. $IDXG , $GNC, $DWT, $DUST, $USOIL, $WTIC, $GDX – $DWT, $DUST, $LIGA, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI etc …

Intro:

Compound Trading is a trading group active in day trading, swing trading and algorithmic model charting (black box).

Time stamped entries (in permanent archive) copied to this blog are direct live log chat from chat trade room as they occurred (random chat not applicable is deleted from transcript below but raw video footage is as it occurred – uncut). Chat trade room is recorded daily for trade archive (embedded below and available on our YouTube channel).

In addition to chat, this trade-room has live voice broadcast (that covers in detail what indicators we are looking for in and out off each trade. Typically at market open and for chart review during lunch hour at minimum) and has live chart screen sharing right from our monitors. At times guest traders and associate traders will screen share charting and/or voice broadcast.

EVERY CALL WE MAKE, EVERY PUBLIC INTERACTION, REPRESENTATION OF TRADE (ON EVERY VENUE) IS VIDEO RECORDED (TRADING ROOM), ON SOCIAL MEDIA OR ON BLOG / WEBSITE TIME-STAMPED FOR PERMANENT RECORD AND ABSOLUTE TRANSPARENCY. PLEASE ALSO REFER TO OUR PUBLIC DISCLOSURE https://compoundtrading.com/disclosure-disclaimer/ .

Notices:

Most recent lead trader blog posts:

Now I’m Inspired! My Guarantee to Struggling Traders (and Yours). Part 3 “Freedom Traders” Series.

https://twitter.com/CompoundTrading/status/853764002584944640

Last market trading session Post Market Stock Trading Results can be found here:

https://twitter.com/CompoundTrading/status/854275760139509760

Premarket Trading Plan Watch-list for this session can be found here (locked to respect members and unlocked to public about a week later for transparency):

https://twitter.com/CompoundTrading/status/854309310171664384

Most recent Premarket Chart Set-Up Video (most recent available to public – there may be other exclusive’s in member newsletters):

https://twitter.com/CompoundTrading/status/854338981147820033

Most recent Market Open Momentum Stock Trades Video (most recent available to public – there may be others in member’s newsletters):

https://twitter.com/CompoundTrading/status/854339253974646784

Most recent Mid Day Chart Set-Up Review Video (most recent available to public – there may be others in member’s newsletters):

https://twitter.com/CompoundTrading/status/854390838608117760

Most Recent Public Swing Trading Simple Charting can be found here: Swing Trading Simple Charts (Public) Apr 16 $SPY, $VIX, $USOIL $WTIC, $GLD, $GDX, $SLV, $DXY, $USDJPY, #GOLD, #SILVER

https://twitter.com/CompoundTrading/status/853551912599400448

Premarket Session:

Premarket momo.

Don’t forget we’re doing premarket chart set-up reviews for members! Get in there and get ready for the day!

Member Reminder: Premarket chart set-up review in trading room 9:00! Charts. Live voice broadcast. https://t.co/d1TrWCgBiP #freedomtraders

— Melonopoly (@curtmelonopoly) April 18, 2017

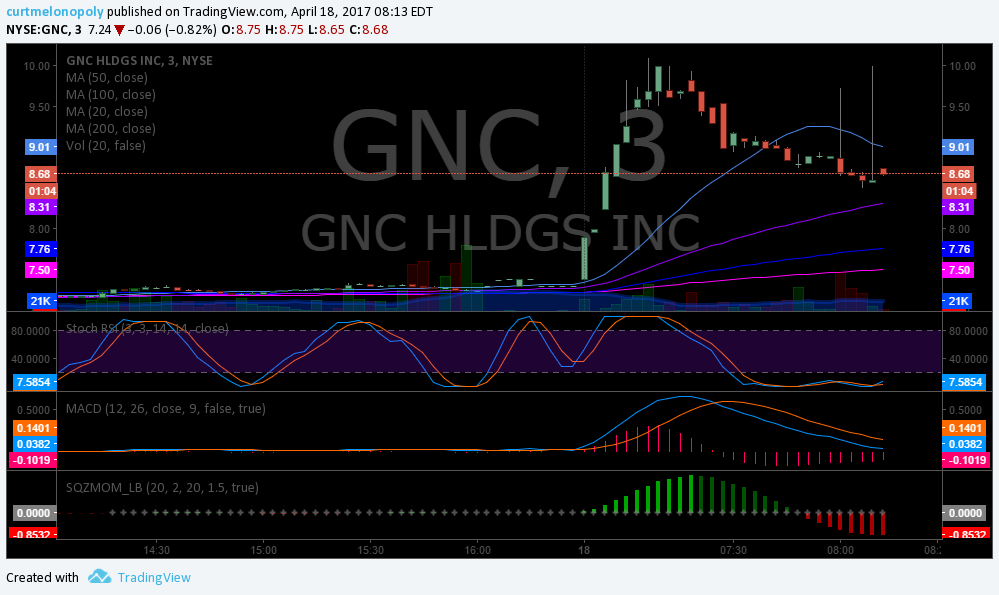

$GNC Premarket up 20% on earnings.

$GNC Premarket up 20% on earnings. pic.twitter.com/f10GNTSzSq

— Melonopoly (@curtmelonopoly) April 18, 2017

Premarket Leaderboard $IDXG $GNC $BIOC $XOMA $QTNT $RIGL $NVAX $CAB $PLX $AKTX $VSI

Premarket Leaderboard $IDXG $GNC $BIOC $XOMA $QTNT $RIGL $NVAX $CAB $PLX $AKTX $VSI

— Melonopoly (@curtmelonopoly) April 18, 2017

In play today in chat room and on markets: $IDXG , $GNC $DWT, $DUST, $USOIL, $WTIC, $GDX

Got a decent momentum play first thing in the morning on $IDXG for about a 600.00 win and then later played it again only to have an intra-day 8-K offering slam it. So I was red on day by about 1200.00. One of my bigger losses on year so far. I got so used to winning I forgot what it was like to take a loss. Now, on my accounts very small relative but still sucks. A good reminder to always set stops, even on smaller entries. But this does highlight the need to keep your risk management and sizing in check.

Curt M: Long 3.56 1000 shares $IDXG

Curt M: Stop 3.60

Curt M: Add 4.07 1000

Curt M: Stop 3.88

Curt M: Out 4.13 2000

Still holding miscellaneous small bags that constitute less than 5% of portfolio (which is typical for me) and holding my $DWT (at 1/5 size) and $DUST at 2/5 size.

The opening video today with the $IDXG momentum trade was an awesome training / learn how-to trade stocks type video on technical set-ups and indicators on gap and go momentum stocks for new and even some more advanced traders (I had a few message me about it and I was surprised it was valuable for them too).

Wow that was awesome market open! $IDXG – boom time again for members. Caught on vid too. Anyway off mic til noon chart setup review. Peace.

Wow that was awesome market open! $IDXG – boom time again for members. Caught on vid too. Anyway off mic til noon chart setup review. Peace.

— Melonopoly (@curtmelonopoly) April 18, 2017

Popular: $GS, $GNC, $GWW, $AYX, $CAH, $WB, $MITK, $HRB, $XOMA, $BIDU, $AFL, $UL, $CMI, $CF

Popular: $GS, $GNC, $GWW, $AYX, $CAH, $WB, $MITK, $HRB, $XOMA, $BIDU, $AFL, $UL, $CMI, $CF https://t.co/yemGJwsYXB

— Melonopoly (@curtmelonopoly) April 18, 2017

Had one of my worst wash-outs YTD today in $IDXG – really small position but it caught me without a stop. Ugh. See rules then trade.

Had one of my worst wash-outs YTD today in $IDXG – really small position but it caught me without a stop. Ugh. See rules then trade.

— Melonopoly (@curtmelonopoly) April 18, 2017

Leaderboard $IDXG 35%, $GNC 25% $MTFB 15%, $DXR 14%, $AKTX 14%, $MVIS 14% Losers: $PSIX -29%, $CBLI – 27%, $CUDA -16%, $SPU -16% #trading

Leaderboard $IDXG 35%, $GNC 25% $MTFB 15%, $DXR 14%, $AKTX 14%, $MVIS 14% Losers: $PSIX -29%, $CBLI – 27%, $CUDA -16%, $SPU -16% #trading

— Melonopoly (@curtmelonopoly) April 18, 2017

Holding $DWT because of course EPIC the Algo has been rocking the show and not missing a beat.

EPIC the Algo on fire?Hasn’t missed a turn since inception. All documented on http://compountrading.com . $USOIL $WTI $CL_F #OIL#trading #OOTT

EPIC the Algo on fire🔥Hasn't missed a turn since inception. All documented on https://t.co/1UiJPavLNe. $USOIL $WTI $CL_F #OIL#trading #OOTT pic.twitter.com/ALMOUuybCs

— Melonopoly (@curtmelonopoly) April 18, 2017

How-to Trade Stocks, Lessons and Educational:

Trading gap go break out market open covered in detail. W $IDXG indicators as price confirms. At 15:00 min on vid.

Trading gap go break out market open covered in detail. W $IDXG indicators as price confirms. At 15:00 min on vid. https://t.co/LI9D5HDUTq

— Melonopoly (@curtmelonopoly) April 18, 2017

Watch video in blog post. Then study charts. Find moving averages that lineup on time-frame suitable #freedomtraders

Stocks, ETN’s, ETF’s I am holding:

I am holding (in order of sizing – all moderately small size to micro sizing except $DUST) – $DUST, $DWT, $XIV, $ONTX, $XOM, $NE, $ASM, $SSH, $LGCY, $TRCH, $ESEA, $MGTI (this is the daytrading portfolio and does not represent swing trading service portfolio): Looking at moving out of all these small positions over the next month or so.

Note-able Momentum Stocks Today (via FinViz):

| Ticker | Last | Change | Volume | Signal | |

| IDXG | 2.76 | 28.37% | 56777353 | Top Gainers | |

| GNC | 9.03 | 24.72% | 26630527 | Top Gainers | |

| TWI | 9.94 | 14.25% | 1406318 | Top Gainers | |

| MVIS | 2.34 | 14.15% | 2667471 | Top Gainers | |

| XOMA | 7.41 | 14.00% | 1192447 | Top Gainers | |

| CORE | 34.87 | 13.36% | 776862 | Top Gainers | |

| HPJ | 5.60 | 8.74% | 507599 | New High | |

| DY | 103.15 | 5.77% | 1641915 | New High | |

| TTS | 21.00 | 8.25% | 1996037 | New High | |

| FDEF | 52.23 | -0.50% | 68335 | New High | |

| STRP | 113.60 | 0.99% | 945719 | Overbought | |

| FIZZ | 89.07 | 1.41% | 302862 | Overbought | |

| IDXG | 2.76 | 28.37% | 56777353 | Unusual Volume | |

| AGZ | 113.76 | 0.17% | 1314394 | Unusual Volume | |

| LTRE | 2.45 | 8.89% | 49178 | Unusual Volume | |

| NURO | 0.71 | 16.70% | 2730885 | Unusual Volume | |

| AFL | 73.88 | 0.48% | 2689896 | Upgrades | |

| ASRV | 3.90 | -1.27% | 101235 | Earnings Before | |

| MDVX | 1.28 | -7.25% | 183119 | Insider Buying |

Algorithm Charting News:

⤵ That tweat cause our $SPY algorithm warned us /members TWO WEEKS before last high we’d not return to high for some time?? @FREEDOMtheAlgo

⤵ That tweat cause our $SPY algorithm warned us /members TWO WEEKS before last high we'd not return to high for some time🎯🔥 @FREEDOMtheAlgo https://t.co/cfxBXmcOKB

— Melonopoly (@curtmelonopoly) April 14, 2017

We notified members in most recent trading range over last week that our algorithm identified a divergence and to expect an interimn top.

— Freedom $SPY Algo (@FREEDOMtheAlgo) March 21, 2017

⤵Epic nailed the top when the world was screaming this. @EPICtheAlgo

Bulls can end up on a plate too though… Oil Markets Turn Bullish Amid Spiking Geopolitical Risk https://t.co/0IzL7HxI0Q #oilprice

— Melonopoly (@curtmelonopoly) April 11, 2017

I wouldn’t get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

I wouldn't get too excited long $SPY $ES_F $USOIL $WTI etc. until most recent highs are taken out and confirmed.

— Melonopoly (@curtmelonopoly) March 30, 2017

The Charting Algorithm Twitter feeds can be found here: $WTI (@EPICtheAlgo), $VIX (@VexatiousVIX), $SPY (@FREEDOMtheAlgo), $GLD (@ROSIEtheAlgo), $SLV (@SuperNovaAlgo), $DXY (@DXYUSD_Index).

Swing Trading Notes / News:

When I started talking leaning in to oil related short 5 days ago LOT of people, well you know. EPIC the Oil Algo ?? $USOIL $WTI $CL_F #OIL

When I started talking leaning in to oil related short 4 days ago LOT of people, well you know. EPIC the Oil Algo 🎯🔥 $USOIL $WTI $CL_F #OIL pic.twitter.com/c8RXMY65HD

— Melonopoly (@curtmelonopoly) April 14, 2017

The Swing Trading Twitter feed is here: https://twitter.com/swingtrading_ct.

US Dollar $DXY $USDJPY $UUP & Currencies of Note:

NA

Gold $GLD, $XAUUSD, $GC_F :

Gold. Sometimes simple charts better. #Gold $GC_F $GLD $XAUUSD $NUGT $DUST #Commodities

Gold. Sometimes simple charts better. #Gold $GC_F $GLD $XAUUSD $NUGT $DUST #Commodities pic.twitter.com/gPQwwWhhWf

— Melonopoly (@curtmelonopoly) April 19, 2017

Gold Miner’s $GDX:

For those buying GDX on war concerns. Gold production tends to collapse during wars. Resources diverted to war efforts.

https://twitter.com/PolemicTMM/status/853374500083294208

Silver $SLV:

NA

Crude Oil $USOIL $WTI:

Crude Oil. Simple charts. #Oil $CL_F $USOIL $WTI $USO $UWT $DWT #OOTT

Crude Oil. Simple charts. #Oil $CL_F $USOIL $WTI $USO $UWT $DWT #OOTT pic.twitter.com/ztbRd7Vq2u

— Melonopoly (@curtmelonopoly) April 19, 2017

Seasonality. Crude oil. $USOIL $WTI $CL_F #Crude #Oil

Seasonality. Crude oil. $USOIL $WTI $CL_F #Crude #Oil https://t.co/ct6jIXfsM6

— Melonopoly (@curtmelonopoly) April 14, 2017

Volatility $VIX:

$VIX Market Bottoms ? …. Is A Market Bottom Near? Watch For A VIX Spike Reversal – blog by @hedgopia

$SPY $VIX $VXX

$VIX Market Bottoms 🎯 …. Is A Market Bottom Near? Watch For A VIX Spike Reversal – blog by @hedgopia $SPY $VIX $VXX https://t.co/JELaLXDTdV

— Melonopoly (@curtmelonopoly) April 14, 2017

Stat Of The Day>Record $VIX Term Structure Skew: 1Mo/3Mo (VIX/VXV) @ Extreme High;8-Day/1MO (VXST/VIX) @ Extreme Low

Stat Of The Day>Record $VIX Term Structure Skew: 1Mo/3Mo (VIX/VXV) @ Extreme High;8-Day/1MO (VXST/VIX) @ Extreme Low pic.twitter.com/lVqwCHTak0

— Dana Lyons (@JLyonsFundMgmt) April 14, 2017

$SPY S&P 500 / $SPX:

A number of notable short-term extremes suggest $SPX is near a point of reversal higher.

A number of notable short-term extremes suggest $SPX is near a point of reversal higher. New from the Fat Pitch https://t.co/x8JPdGMjNP pic.twitter.com/R0PW6hghrq

— Urban Carmel (@ukarlewitz) April 14, 2017

$NG_F Natural Gas:

NA

Markets Looking Forward:

#earnings $BAC $NFLX $GS $UNH $JNJ $IBM $GE $QCOM $VZ $SCHW $MS $CUDA $BX $PGR $V $MTB $HOG $ABT $UAL $CMA $RF $USB http://eps.sh/cal

#earnings $BAC $NFLX $GS $UNH $JNJ $IBM $GE $QCOM $VZ $SCHW $MS $CUDA $BX $PGR $V $MTB $HOG $ABT $UAL $CMA $RF $USB https://t.co/r57QUKt2zb https://t.co/5HsPVsjNGU

— Melonopoly (@curtmelonopoly) April 19, 2017

Live Trading Chat Room Video Raw Footage and Transcript:

Two Part video (Part 1 embed is below and go to Compound Trading Youtube channel for Part 2 of live feed from day and other charting from the day)

Compound Trading Stock Chat-room Transcript:

Please note: Miscellaneous chatter removed from transcript and some discussions I will add notes with information I’ve gleaned in discussions online with traders on DM etc also for further explanation (noted with *). Most days at 9:30 ET market open there is moderator live broadcast explaining trades and at times during the day there is also live broadcast market updates and trade set-up explanations (so you have to scroll through video feed to market open etc to catch live broadcast portions – in future we will note in in transcript when we are on the mic so viewers can correlate time with transcript with video feed when reviewing trades).

Note: We are testing a new trading room. This particular room does not list a time stamp with each chat entry – we are working on a fix. Also, please note, sometimes pieces of the transcript are missing (also something we are working on). But the video is raw and complete.

MarketMaven: hey looking good today

Flash G: up 50k from yesterday would look good any day ha nice work MM

Sammy T: mornin

lenny: hey sam

Sartaj: Good morning

OILK: Nice play on oil. Epic.

Curt M: morn

OILK: wow oil stopped right at res EPIC email alert this morning uncanny

MarketMaven: Housing Permits beat 1.260MM, Exp. 1.255MM

Curt M: Premarket Leaderboard $IDXG $GNC $BIOC $XOMA $QTNT $RIGL $NVAX $CAB $PLX $AKTX $VSI

Curt M: On mic at 9:05 for premarket chart set up review >>>>>>>>>>>>>>>>>

Curt M: A couuple stragglers have asked for 5 mins

optionsavvy: gm

Sartaj: Hey, Savvy

optionsavvy: BPMX has some buyers pre

Curt M: gm

optionsavvy: NADL light vol to upside as well

optionsavvy: BAC setup for a nice options trade on a back to 24 res basis

optionsavvy: 23.5 Cs for this week could play well if it goes

optionsavvy: need to let the IV flatten a bit after open imo

Flash G: Like the BAC idea

Curt M: On mic for premarket >>>>>>>>>>>>>>

Curt Melonopoly: http://finance.yahoo.com/news/gnc-holdings-gnc-beats-q1-122112257.html?.tsrc=rss

Curt M: Pff mic premarket chart review >>>>>>> 9:26 $IDXG $GNC $GOLD $GLD $GDX $DUST $USDJPY $USOIL $WTIC

Curt M: On mic in 2 mins for open $IDXG $GNX morning momo watch >>>>>>>>>>>>>>>>>>>>>

Curt M: on mic>>>>>>>>>>>>

Curt M: Long 3.56 1000 shares $IDXG

MarketMaven: yup

optionsavvy: mkts looking like chop day

Curt M: Stop 3.60

Curt M: Add 4.07 1000

Curt M: Stop 3.88

optionsavvy: LBIX has vol and looks like a breakout near

optionsavvy: OHRP has been SICK since .60

Curt M: Out 4.13 2000

Spiegel: Now that I’ve sen you in action youre incredible

Sartaj: Tell your friends, Spiegel

Sartaj: We’ve been screaming from rooftops

optionsavvy: mkts hitting support here buyers need to close the deal

Leanne: I”m on a 3 month challenge of wall climbing with you guys.

lenny: ahhahaha

Spiegel: I’m taking a trial with another trade room and they didn’t even start buying IDXG until 4.06

Leanne: GM, sorry, super busy Easter wknd, still recovering

Spiegel: $50K ?!?! That’s insane!

Leanne: Oh Spiegel, leave that other room, Curtis is all you need

Spiegel: I can see that now

mat: Curt dropping a master class in here this morning. This should be an instructional video for sure

Leanne: Thanks Curtis

Curt M: hey no probs 🙂

Sartaj: That was epic

Curt M: off mic morning momentum >>>>>>>>>>>>>>>>>>>>>>

Curt M: EPIC I love little epic

Sartaj: That was, as mat said, a master class. Shows the importance of watching your technicals

Curt M: Oil got pop

Curt M: intra resistance on oil FYI

Curt M: on Mic re: Oil quicl>>>>>>>>>>>>

optionsavvy: I dont trade sub 1s but that ARGS chart is pretty

Spiegel: I can’t believe I signed up yesterday for this room for just $36.50 and just got to see a trade like that. And the money some people are making is more than I ever imagined.

Sartaj: 🙂

Sartaj: Wait until we start coding these babies

Curt M: Off mic on Oil Review FX: $USOIL $WTI Crude Oil >>>>>>>>>>>>>>> 10:30 AM

Flash G: Spiegel -just you wait! 🙂 you’ll be over the wall with us

Curt M: Sartaj…. you can publish that oil chart review also?

Sartaj: Yes

Sartaj: I recorded it

MarketMaven: Replay of yesterday $IDXG on deck peeps! KABOOM later

MarketMaven: Adding now.

Sammy T: with ya

Curt M: thanks Sartaj

Curt M: Should be quiet now for an hour and a half or so

Sartaj: And Spiegel, glad we could clear the air yesterday. There is definitely a certain ethic involved with this room, as you’ve touched on, and given the price and everything, we want to make sure it’s the right fit for everyone involved.

Sammy T: $XGTI tape bullish guys

Curt M: Going to watch for confirmation or break down – if it breaks down I’ll come back in later likely

Curt M: Off mic until it goes (if it does)

Spiegel: Of course Sartaj! I don’t believe in people just jumping into a room and shouting “Give me the picks” so they can just treat things like a chimp pushing buttons. There has to be some understanding and learning involved.

Curt M: Will watch it – holding – may hit it hard when Stoch RSI at bottom pending price aaction

Sammy T: When Stoch RSI turns up I’ll be in full throttle myself fwiw

Spiegel: So it’s turned up. I got in. Anyone else get in or add there?

Sammy T: Me, len , market maven for sure lol

Spiegel: of course now that I’m in its crossed back down.

Spiegel: there we go!

Sammy T: yepp

Sammy T: it may berak HOD real early here

Sammy T: Stoch RSI is near top though so there is a chance it will continue to consolidate though

MarketMaven: Everyone doesn’t want to miss the afternoon move thats why its so bullish early IMO

MarketMaven: Hpoefully nothing in market Fs it up before it goes

Curt M: SQZMOM just turned green.

Spiegel: Whoa!

Curt M: Whoa nice wash out stops wacked

lenny: holding

lenny: thats what ya get for time of day lol perfect example

lenny: ah well, it’ll repair over lunch and go

Spiegel: and now its halted which is never a good thing when it’s been going way down

MarketMaven: It’s repair

MarketMaven: ya Curt’s got it right thats support – if it doesn’t hold that off halt then theres a problem lol

MarketMaven: Still above my cost avg too so I’m good

Spiegel: Apparently they did a $2.20 convertible note. So it’s going to get killed when it reopens. What a terrible first trade I’m trapped in.

MarketMaven: Checking

Flash G: Seems odd intra day

Spiegel: its open

Flash G: Confirmed. The nes isn’t good. But the traders may trade it up.

MarketMaven: Perspective is your cost avg Spiegel – never take your learning trades at slow time of day lol and get a stop on your trades young man! in future.

MarketMaven: They’re shorting the pops now

MarketMaven: has to hold 3

lenny: 40 MM shares wow

Curt M: I can’t get a confirm on the $IDXG news

Flash G: I got it from other traders I guess I should’t of spoke so fast.

Curt M: An offering mid day seems so wierd.

Curt M: Lots of chatter no confirmation though

Curt M: amended exchange from prior agreement is seems – panic maybe? anyone confirmed?

Sammy T: searching

Sartaj: brb

Curt M: Oil holding that lower support so far

Sartaj: Midday review at noon EST, curt, or 12:30 EST?

Curt M: 12:10 yes – sorry working on $IDXG confirm

Curt M: Looks like 1.6MM shares convertible at 2.20 which is nothing

Curt M: But that could be old news

Curt M: Confirmed 2.20 Swnior Convertible Notes

Curt M: Have the 9-K

Curt M: 3,547,775.00 2.20 Dated March 23

Curt M: 8-K sorry not 9

Curt M: Closing of Agreement April 18, 2017

Curt M: It’s a small offering though. but still.

Curt M: Matures June 23 2018 for 125% of face value.

Curt M: Iinteresting FORM 8-K. Should bounce but don’t count on it.

Curt M: If it loses 2.95 I’ll cut for a loss. Dirt bags intra day. Wow.

MarketMaven: Never seen that before.

Flash G: I have but rare.

Curt M: I’ve never seen this scenario.

Spiegel: What are the odds it would happen my very first trade here? Nobodies fault. Couldn’t be predicted or even expected. And yes I should have had a stop in (even if Curt didn’t).

Curt M: Similar I’ve seen but the FORM 9-K makes it original

MarketMaven: Ya low of day is my cut point to…. 2.94.

MarketMaven: But its holding up.

Spiegel: Sadly I wasn’t in on the big rise earlier. Was just observing. So this hurts.

lenny: Who the hell does a mid day offering?

rom: cup and handle pattern on the 1 minute?

lenny: Anyway, I’ll likely cut 2.94 or add at break of current resistance for a quick trade.

Curt M: On mic in 3 min for mid day review >>>>>>>>>>>>

Curt M: On mic 12:08 >>>>>>>>>>>>>>>>>>>

Leanne: Spiegel, I’m new too, you are not alone here.

Spiegel: Nice to know I’m not alone Leanne

Spiegel: I’m not too upset. Just going to lose what I made yesterday.

Spiegel: And next time, set STOPS, STOPS, STOPS!

Leanne: Spiegel, this is an awesome group with Curtis as the leader and I have learned a lot. Highly recommend watching all Curtis’ youtube vids. We’ll do this together.

Spiegel: Great!

Spiegel: I notice all those rules are from the book Market Wizards. Interviews with top traders.

Spiegel: froze all of a sudden. Just me?

Sartaj: For a second, it’s back for me

Spiegel: me too

Sartaj: Our lab has been eating more bandwidth than usual lately

Curt M: $IDXG stopped 2.93 for a loss 200 shares

Spiegel: IDXG in at 4.15. Stopped at 3.05. $1100 loss. Glad to get the worst luck of the year out of the way at the beginning.

Sartaj: Did we mention our office has been busy? Curt will be back in a second

rom: sb

rom: chart

Spiegel: If USDYEN falls as you expect won’t that make gold fall and hurt your DUST position? Or am I wrong about your thoughts on USDJPY

Leanne: Thanks Curtis, love the lessons

Leanne: I hear ya! wish I was focussed on trading more. in time,

rom: you are the best!

rom: thank you so much

Curt M: No prob!

Curt M: Back in 10 and lets get some plays set for afternoon.

Curt M: off mic >>>>>>>>>>> 1:05 PM

Flash G: fgoing to get coffee too

Leanne: me too, actually going to find a new baker… might be a while!

MarketMaven: baker… she’s a baker master !

MarketMaven: love baking

Flash G: hungry

Flash G: red market days…. hmmmm…

Flash G: Oil all about oil right now

lenny: A message from Sunrise Trader …. Risk off, flight to safety type market right now. Less is more no need to be part of the chop/chop. Market gives opportunity to the prepared

lenny: Love it

If this post was of benefit to you, be kind and share on social media!

Follow our lead trader on Twitter:

Article Topics: $IDXG , $GNC, $DWT, $DUST, $USOIL, $WTIC, $GDX, $GLD – $UGAZ, $DGAZ, $NUGT, $DUST, $USLV, $DSLV, $UWT, $DWT, $JNUG, $JDST, Compound Trading, Learning, How To, Trade, Trading, Educational, Lessons, Results, Wall Street, Stocks, Day Trading, Swing Trading, Investing, Chat Room, Trading Results, $GLD, $GDX, $USOIL, $WTIC, $USD/JPY, $SPY, $DXY, $VIX, $GC_F, $USO, $UCO, $SCO, $CL_F, S&P 500

2 thoughts on “Post-Market Tues Apr 18 $IDXG , $GNC, $DWT, $DUST, $USOIL, $WTIC, $GDX, $GLD”

Comments are closed.